OGJ Newsletter

Hilcorp San Juan to buy ConocoPhillips' assets

Hilcorp San Juan LP, a partnership of Houston-based Hilcorp Energy Co. and Washington DC-based private equity firm The Carlyle Group, has agreed to acquire ConocoPhillips' interests in the San Juan basin of northwestern New Mexico and southwestern Colorado for up to $3 billion.

Full-year 2016 production from the assets was 124,000 boe/d, of which 80% was natural gas, with cash from operating activities for the year totaling $200 million. Full-year 2017 estimated production is 115,000 boe/d, consisting of 80% natural gas and 20% NGLs. Yearend 2016 proved reserves were 600 million boe.

"The San Juan basin acquisition fits the profile of the established, conventional assets Hilcorp typically aims to secure and enhance," commented Jason Rebrook, Hilcorp president and chief development officer.

The purchase price comprises $2.7 billion in cash and a contingent payment of up to $300 million that's effective beginning Jan. 1, 2018, and has a term of 6 years. The deal is expected to close in the third quarter.

As of Dec. 31, 2016, the net book value of the assets was $5.9 billion, which includes $2.8 billion of step-up basis associated with ConocoPhillips' acquisition of Burlington Resources Inc. in 2006. ConocoPhillips expects to record a noncash impairment on the assets in the second quarter.

"Including our recently announced Canadian asset sales, we have line of sight to more than $16 billion of total considerations in 2017," said Ryan Lance, ConocoPhillips chairman and chief executive officer. "These transactions will materially reduce our exposure to North American gas and achieve an immediate step change improvement in our balance sheet and cash margins."

ConocoPhillips last month agreed to sell its 50% interest in the Foster Creek Christina Lake oil sands partnership and the majority of its Deep basin conventional assets in Alberta and British Columbia to Cenovus Energy Inc. for $13.3 billion.

Repsol acquires Vietnamese block interest

Spain's Repsol Exploracion SA has agreed to acquire the 5% interest in Vietnamese Block 07/03 owned by Pan Pacific Petroleum NL, Sydney, for $5 million.

Repsol bought all the shares in Pan Pacific subsidiary Pan Pacific (Vietnam) Pty. Ltd., which holds the interest in the block in the Nam Con basin in the South China Sea.

The deal is subject to Pan Pacific shareholder approval.

A successful deal completion will leave Pan Pacific with no debt and assets valuing $20 million, including $16 million in cash.

Executive Director Grant Worner says Pan Pacific will have the freedom to deploy its capital in a range of investment opportunities rather than committing to and relying on a single investment that is larger than the company's existing funding capabilities.

The Vietnamese sale follows on the heels of Pan Pacific's sale of its 15% interest in Tui oil field offshore New Zealand to Malaysian company Tamarind Classic Resources (OGJ Online, Feb. 15, 2017).

Brooks named CEO, president of Energy XXI Gulf Coast

Douglas E. Brooks has been named chief executive officer and president of Energy XXI Gulf Coast Inc., Houston.

Brooks has more than 34 years of experience in the energy industry. Most recently he served as CEO for Yates Petroleum Corp. from April 2015 until its merger with EOG Resources Inc. in October 2016. He served as CEO of Aurora Oil & Gas Ltd. from October 2012 until June 2014, and as a senior vice-president at Forest Oil Corp. during April-October 2012.

Brooks spent 24 years with Marathon Oil Co. in roles of increasing responsibility, lastly as the director of upstream mergers and acquisitions and business development for the Americas. He has also built two private equity-sponsored firms focused on unconventional resource projects in the western US.

Michael S. Reddin had served as interim CEO and president since February after the departure of John D. Schiller from his roles as director, CEO, and president. Scott M. Heck also in February joined Energy XXI Gulf Coast as COO, succeeding Antonio de Pinho. Heck has more than 36 years of experience in upstream engineering and leadership roles with Tenneco Oil Co., Hess E&P, and Bennu Oil & Gas LLC.

Energy XXI Gulf Coast completed its financial restructuring and emerged from Chapter 11 at yearend 2016 after eliminating more than $3.6 billion of debt. The firm was previously known as Energy XXI Ltd.

CNOOC offers 22 blocks off southern China

China National Offshore Oil Corp. is seeking international bids on 22 blocks covering 47,270 sq km offshore southern China.

Sixteen of the blocks are in the eastern Pearl River Mouth basin, two are in the western Pearl River Mouth basin, and four are in Beibuwan Bay.

Water depths range from 20 m in Beibuwan Bay to 3,000 m in the eastern Pearl River Mouth basin.

CNOOC will close the offering's data room on June 15.

Husky plans two Pearl River Mouth wells

Husky Energy Inc., Calgary, expects to drill two exploratory wells next year on Block 16/25 in the Pearl River Mouth basin 150 km southeast of Hong Kong.

A subsidiary of the company signed a production sharing contract for the block with CNOOC Ltd. of China.

Water depth of the 44-sq-km block is 100 m.

Husky will be operator and hold a 100% working interest during exploration. CNOOC can assume a participating interest of as much as 51% for development and production.

Husky also plans two exploration wells on nearby Block 15/33.

USGS sees big Bossier, Haynesville potential

The Upper Jurassic Bossier and Haynesville formations along the US Gulf Coast together represent a mean undiscovered, technically recoverable natural gas resource of 304.4 tcf, according to the US Geological Survey.

The new estimate is "the largest continuous natural gas assessment USGS has yet conducted," the agency said.

The formations onshore and in state waters also represent mean undiscovered, technically recoverable resources of 4 billion bbl of oil and 1.9 billion bbl of NGL, USGS said.

The assessment covered potential in conventional and continuous reservoirs.

USGS estimated mean Bossier resources at 108.6 tcf of gas, 2.9 billion bbl of oil, and 1 billion bbl of NGL.

It estimated mean Haynesville resources at 195.8 tcf of gas, 1.1 billion bbl of oil, and 900 million bbl of NGL.

In a 2010 assessment of Jurassic and Cretaceous potential on the Gulf Coast, USGS estimated gas resources at 9 tcf in the Bossier and 61.4 tcf in the Haynesville.

"Since the 2010 assessment, we've gotten updated geologic maps, expanded production history, and have a greater understanding of how these reservoirs evolved," said USGS scientist Stan Paxton, author of the assessment.

Drilling & Production — Quick TakesEIA: Permian, Eagle Ford oil output to continue rising

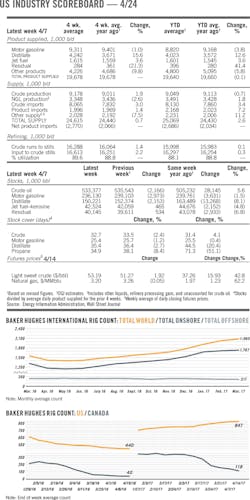

The seven major onshore producing regions in the US are expected to collectively increase oil output by 124,000 b/d month-over-month in May to average 5.193 million b/d, according to the US Energy Information Administration's latest Drilling Productivity Report.

The monthly DPR tracks the total number of active drilling rigs, productivity, and estimated changes in production from existing oil and gas wells in the Bakken, Eagle Ford, Haynesville, Marcellus, Niobrara, Permian, and Utica. The seven regions accounted for 92% of US oil production growth and all US gas production growth during 2011-14.

The regions' production rebound has been gaining steam each month this year, led by an industrywide focus on the Permian basin, where oil output is expected to increase 76,000 b/d month-over-month in May to 2.362 million b/d. The neighboring Eagle Ford, the site of a more recent resurgence, is forecast to rise 39,000 b/d to 1.216 million b/d.

Baker Hughes Inc.'s most recent data indicate the Permian has added 205 rigs since May 13, 2016, and now totals 339 (OGJ Online, Apr. 13, 2017). The Eagle Ford has added 44 units since Oct. 14, 2016, and now totals 75. Drilled but uncompleted (DUC) wells have multiplied in the two regions. The Permian gained 90 DUC wells month-over-month in January and now totals 1,864, while the Eagle Ford rose by 26 during the month and now has 1,285.

The Niobrara is projected to climb 8,000 b/d during May to 456,000 b/d, continuing a steady-but-shrinking increase. Its DUC well count dropped by 15 month-over-month in January to 623. The Bakken's slide is expected to shrink to 1,000 b/d, bringing the region's output to 1.023 million b/d. Its DUC well count rose by 4 in January to 809.

Gas production from the seven regions is forecast to gain 501 MMcfd month-over-month in May to 50.089 bcfd. The Permian is expected to rise 159 MMcfd to 8.135 bcfd, while the Eagle Ford is projected to increase 84 MMcfd to 5.936 bcfd.

The Haynesville, which also partially encompasses Texas, is expected to jump 138 MMcfd in May to 6.375 bcfd. Its DUC well count increased by 13 in January to 182.

Phase starts to boost South Pars gas flow

Production from giant South Pars natural gas field offshore Iran will increase to 730 million cu m/day next March from 575 million cu m/day at present following the recent or imminent start-ups of five development phases, according to Iranian Minister of Petroleum Bijan Zangeneh.

The government also said production from the South Pars oil layer has reached its plateau rate of 35,000 b/d from seven wells. Oil flow into the Cyrus floating production, storage, and offloading vessel began Mar. 20.

South Pars Phases 17 and 18, which the Shana news agency described as "ready for official inauguration," comprise four platforms, 44 wells, and two 34-in. pipelines to purpose-built processing facilities onshore.

Target production rates for Phases 17 and 18 are 50 million cu m/day of gas, 80 b/d of condensate, and 400 tons/day of sulfur.

With four platforms near the maritime border with Qatar, Phase 19 has total design capacities of 56 million cu m/day of sour gas, 50 million cu m/day of sweet gas, 550 tons/day of ethane, 2,000 tons/day of propane, 12,000 tons/day of butane, 80,000 b/d of gas condensate, and 400 tons/day of sulfur.

Phases 20 and 21 have a platform each with capacities totaling 56.6 million cu m/day of rich gas, 75,000 b/d of condensate, 400 tons/day of sulfur, 1.05 million tons/year of LPG, and 1 million tons/year of ethane.

BPTT starts up Trinidad onshore compression project

BP Trinidad & Tobago LLC (BPTT) reported the start-up of the Trinidad onshore compression (TROC) project. Full start-up will occur over the next few months, BPTT said, when TROC will have the potential to deliver 200 MMscfd of gas.

The facility is expected to improve production capacity by increasing production from low-pressure wells in BPTT's existing acreage in the Columbus basin using an additional inlet compressor at the Point Fortin Atlantic LNG plant.

Atlantic LNG Co. of Trinidad & Tobago will serve as TROC's operator. The project was sanctioned in July 2016 following agreements between ALNG shareholders, National Gas Co. of Trinidad & Tobago, and other directly impacted upstream operators.

TROC is one of seven major upstream projects BP expects to bring online this year.

Wintershall starts production from Ravn oil field

Wintershall Noordzee BV has started oil production from its first own-operated Danish oil field. Ravn field, on Block 5/06, produces oil from 4,000 m via a newly constructed production platform in the Danish North Sea, 300 km north of the Dutch town of Den Helder. The produced crude oil is transported via a subsea pipeline to Wintershall Noordzee's A6-A processing platform about 18 km from the Ravn platform, where it is fed into the existing export network to the Netherlands.

Wintershall Noordzee is developing Ravn field in a phased manner using an "appraisal through development" concept. This concept will enable the company to continuously gather performance data on well productivity and the lateral extent of the reservoir. Analysis of these data will provide the basis for and contribute to further field development options.

Wintershall Noordzee owns a 63.64% share in Ravn field. Danish state-owned oil and gas company Nordsofonden holds the remaining 36.36% as licensing partner.

PROCESSING — Quick TakesKuwait, Oman finalize partnership for Duqm refinery

Kuwait Petroleum Corp. subsidiary Kuwait Petroleum International Ltd. (KPI) has finalized an agreement with Oman Oil Co. (OOC) to jointly develop Duqm Refinery & Petrochemical Industries Co. LLC's (DRPIC) grassroots 230,000-b/d refinery and petrochemical complex to be built in the Duqm Special Economic Zone (SEZAD) in Duqm, Al Wusta Governate, Oman (OGJ Online, Nov. 14, 2016).

As part of the Apr. 10 agreement, KPI will invest an undisclosed amount in the proposed refining and petrochemical project that, once completed, will produce transportation fuels and petrochemicals to meet rising demand in Oman and abroad, the companies said.

The agreement follows DRPIC's goal of attracting investors to help complete the proposed complex following IPIC's conclusion in early 2016 that the new direction of project to include petrochemicals did not fit its investment strategy.

In 2015, DRPIC said it planned to award a total of two EPC contracts for the project by yearend 2016, including a larger package for all equipment and structures required for main crude oil processing units, as well as a second package to cover all supporting installations, utilities, tankage, and buildings (OGJ Online, Jan. 25, 2016).

According to OOC's website, the project is still awaiting award of the EPC tender before construction begins.

The company previously awarded a contract to Galfar Engineering & Contracting SAOG, Muscat, to provide site preparation work for the project, for which leveling and laying of foundations for refinery construction has now been completed, OOC said.

Primarily designed to produce and recover naphtha, jet fuel, diesel, and LPG, the refinery will include units for hydrocracking, hydrotreating, delayed coking, sulfur recovery, hydrogen generation, and Merox treating.

HPCL revives plans for Rajasthan refinery

State-owned Hindustan Petroleum Corp. Ltd., Mumbai, has revived plans for a 180,000-b/d refinery and petrochemical complex in the Barmer region of Rajasthan.

Company directors approved resumption of the project and the signing of a revised memorandum of understanding with the Rajasthan government.

The original project was a joint venture with HPCL holding a 74% interest and the state government 26%.

Half the crude feedstock was to have come from Cairn India Ltd.'s Barmer Block fields. The other half was to be a mix of Arab crudes.

The project stalled in 2014 in a political dispute over financing. India's Ministry of Petroleum and Natural Gas in November requested a new detailed feasibility report from Engineers India Ltd.

Cairn India and partners produce about 157,000 b/d from their Rajasthan block, mostly from Mangala, Bhagyam, and Aishwariya fields with additional production from Raageshwari and Saraswati fields.

Firms select site for proposed USGC petchem project

Saudi Arabian Basic Industries Corp. (SABIC) ExxonMobil Chemical Co. have selected a site in San Patricio County, Tex., as the possible location for a jointly owned petrochemical complex the companies hope to build along the US Gulf Coast (OGJ Online, July 25, 2016).

Still under study, the complex would house a 1.8 million-tonne/year ethane cracker and derivative units, including a monoethylene glycol unit as well as two polyethylene units, ExxonMobil and SABIC said.

Without disclosing further details regarding the specific site selected for the project, with that process now completed, the companies said they will apply to the Texas Commission on Environmental Quality (TCEQ) for necessary air and wastewater permits.

ExxonMobil and SABIC independently plan to reach final investment decisions on the proposed multibillion-dollar project after receiving all required TCEQ permits.

While the companies did not indicate a definitive timeline for the complex or its estimated cost, ExxonMobil did confirm it is one of 11 proposed projects included as part of its 10-year, $20-billion Growing the Gulf expansion initiative announced earlier this year (OGJ Online, Mar. 9, 2017).

Siting of the complex at the US Gulf Coast would allow ExxonMobil and SABIC to take advantage of the region's existing infrastructure to capture competitive pricing for US natural gas feedstock as well as access to rising demand for ethylene-based products in overseas export markets.

TRANSPORTATION — Quick TakesBlackstone to buy EagleClaw MV for $2 billion

Blackstone Energy Partners and Blackstone Capital Partners have agreed to buy EagleClaw Midstream Ventures LLC, a portfolio company of EnCap Flatrock Midstream, for $2 billion. The all-cash deal is expected to close by the end of July and includes $1.25 billion in stapled debt financing.

EagleClaw's assets are in Reeves, Ward, and Culberson counties in Texas, part of the Permian's Delaware basin, and include more than 375 miles of natural gas gathering pipelines and 320 MMcfd of processing capacity with an additional 400 MMcfd under construction. Included in the deal are the Toyah and Pecos systems.

The Toyah system includes more than 185 miles of gas gathering pipeline; five field compressor stations with 33,000 hp in low-pressure compression; and the 60-MMcfd Toyah I and 200-MMcfd Toyah II cryogenic processing plants at the East Toyah gas processing complex.

The Pecos system was acquired by EagleClaw in its August 2016 purchase of PennTex Permian LLC. It includes a 60-MMcfd cryogenic processing plant, 100 miles of gathering pipeline, and four field compressor stations. EagleClaw has purchased and begun design on the 200-MMcfd Pecos II cryogenic processing plant, which is expected in service later this year.

EagleClaw's customers have long-term dedications of gas volumes from more than 220,000 acres. Those producers target stacked pay zones including the Upper and Middle Wolfcamp, Bone Spring, and Avalon shale formations.

EagleClaw will retain its name and operate as a Blackstone portfolio company. Its leadership team and the majority of the company's employees will remain in their current roles and are investing alongside Blackstone in the deal.

Pence's Alaska stop includes LNG project discussion

US Vice-President Mike Pence met with Alaska Gov. Bill Walker and Alaska Gasline Development Corp. Pres. Keith Meyer in Anchorage on Apr. 15 en route to Asia. "We had an excellent discussion with [him] about the Alaska LNG project," Meyer said following the meeting.

The Alaska LNG Project will include an 800-mile pipeline that will transport an average 3.1 bcf of natural gas from Alaska's North Slope to a liquefaction plant and export terminal for sale in the Asia-Pacific region. It also will have multiple interconnections along the pipeline for in-state gas distribution.

The project is expected to create 9,000-12,000 engineering and construction jobs and another 700-1,000 long-term operations positions. It aims to monetize the largest US concentration of proved, conventional, and thus-far stranded gas.

"Our meeting was a perfect precursor to the vice-president's trip to Asia," said Meyer, adding that Pence was scheduled to meet with leaders in South Korea and Japan-two primary markets for Alaska LNG.

Pence was the latest of several high-profile officials to express interest in the project, Meyer said. Chinese President Xi Jinping, returning to Beijing after meeting with US President Donald Trump, visited Anchorage on Apr. 7 where he met with Walker and Meyer, the AGDC official said. The three leaders discussed the project and how Alaska and China are well positioned for a long-term LNG trading relationship, he said.

Saipem unit lets marine contract for Tangguh LNG plant

PT Saipem Indonesia let a marine construction contract to McConnell Dowell Corp. Ltd. for work on the BP PLC-operated Tangguh LNG plant extension in Indonesian New Guinea.

The contract includes construction of two finger piers and work at the bulk offloading facility along with design, supply, installation, construction, testing, and commissioning on the LNG and condensate loading jetty No. 2 at the site.

The two-train Tangguh project first came on stream in 2009 and has delivered in excess of 700 LNG cargos since that time.

The final investment decision for a third LNG train was made in July 2016. This will increase the capacity of the plant by 3.8 million tonnes/year of LNG bringing the total capacity to 11.4 million tpy.

As well as the new bulk offshore loading facility and the second LNG and condensate loading jetty, the overall development includes new pipelines, new wellhead platforms and redevelopment of the existing onshore Tangguh brownfield site with additional boil of gas recovery, flares and other support infrastructure.

McConnell Dowell's contract work is to begin immediately with completion expected in early 2019. The third LNG train is scheduled to be brought on stream in 2020.