New exploration play expands Colombia's Llanos basin oil production

Tayvis Dunnahoe

Exploration Editor

Latin American exploration and development has been ignored in the recent years as operators focused more on North American shale opportunities. "However, the region has an immense hydrocarbon resource potential and a lot of opportunity," GeoPark CEO Jim Park said. The operator entered Chile in late 2002, and after 15 years in the region now holds acreage in Colombia, Peru, Brazil, Chile, and Argentina and plans to enter Mexico's onshore plays.

GeoPark has targeted its growth on big proven underexplored and underdeveloped mature onshore hydrocarbon basins across the region. Only a handful of independent companies operate in Latin America, resulting in little competition for attractive assets. Historically, most exploration and development has been dominated by major operators and national oil companies.

The company increased production growth 36%/yr from 2006 to 2016, reaching more than 25,000 boe/d (45,000 boe/d operated) with 143 MMboe of 2P reserves (as of December 2016), 80% of which is oil. "We have an asset platform across the region with more than 30 blocks and a diverse risk-balanced project portfolio," Park said.

Llanos basin

GeoPark is a partner in one of Brazil's largest producing gas fields and is carrying out new oil exploration drilling this year in both Brazil and Argentina, as well as gas development drilling in Chile. But it's in exploring and producing the Llanos Basin in Colombia that the operator has made its biggest strides.

"Many believed there was nothing left to find but very small, quickly-declining fields," said Park regarding the Llanos basin, which has been drilled and developed for 70 years. GeoPark entered Colombia in 2012 and, after purchasing two small independents, has become the third largest independent operator in Colombia.

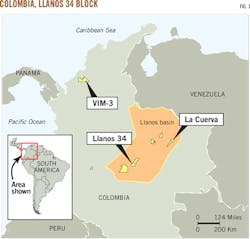

The company pioneered a new play type combining structural and stratigraphic traps, targeting the downthrown side of the faults in Llanos 34 Block (Fig. 1). "The block has three principal fault trends, and we have found accumulations on the first two and will explore the third fault trend this year," Park said.

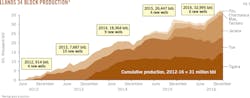

The operator has drilled more than 40 wells in Llanos 34 Block since 2012. The block now produces more than 43,000 b/d from nine discovered oilfields. Cumulative 2012-16 production for the block is 35 million bbl (Fig. 2). GeoPark will drill 15-20 additional wells on Llanos 34 Block in 2017, including development, appraisal, and exploration wells.

New Llanos oil play

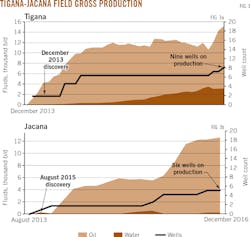

GeoPark holds interests in a total of nine Colombian blocks covering more than 1 million acres in both the Llanos and Magdalena basins (see Table). "The Tigana-Jacana field is a 180-million-bbl accumulation or greater with its boundaries not yet fully defined," he says.

The Tigana-Jacana field is producing most of the oil from Llanos 34 Block, which the company operates with a 45% interest (Fig. 3). "Several wells have already produced more than 2 million bbls each," Park said. "This block is proving up to be one of the biggest and most economically-attractive plays in Colombia in recent years."

In February, GeoPark drilled Chricoca 1 to a total depth of 11,966 ft, testing the Mirador and Guadalupe formations. The Mirador production test yielded 1,000 b/d of 34° gravity oil, with 9% water cut, through a 33⁄64-mm choke at 34 psi. The deeper Guadalupe formation was also tested, producing water with traces of heavy oil. A second well, Tigana Sur 6, was drilled to a depth of 11,645 ft, and tested in the lower Guadalupe formation. The well produced 1,600 b/d of 15° gravity oil, with 8% water cut, through a 52⁄64-mm choke at 70 psi (OGJ Online, Feb. 2, 2017).

Tigana Sur 6 well has a 57 ft net pay in the lower Guadalupe, a 60% thickening of the average net pay in other Tigana oil field wells producing from Guadalupe.

Reservoir qualities for the play feature permeabilities up to 2 darcies and porosities of 25-30% with little decline or water encroachment. Drilling costs run $3 million/well and average drilling depths are 11,000-12,000 ft. Wells are providing payback in 6 months. According to GeoPark, infrastructure and oil transportation is expanding and improving in the region.

GeoPark drilled and completed the Jacana 11 appraisal well to a TD of 11,618 ft in March 2017. The well produced 2,100 b/d of 18.7° gravity oil through a 33⁄64-mm. choke with a wellhead pressure of 98 psi and less than a 1% water cut.

Jacana 11 reached a bottom-hole location 2,500 m southwest of Jacana 6 without encountering the oil-water contact, extending the Tigana-Jacana oil play towards the southwest limits of the Llanos 34 Block.

Long-term development

GeoPark will drill 30-35 wells in South America in 2017, where it holds interest in 6 million acres.

In December 2016, Peruvian state-owned Petroleos del Peru SA (Petroperu) awarded GeoPark operatorship of the Morona Block with a 75% working interest. The block covers 1.9 million acres in Maranon basin in northwest Peru. Exploration in the region started 40 years ago and includes extensive geophysical surveys. The basin has already produced 1 billion bbl of oil and is considered to be one of the most prolific in South America.

The Morona block contains the Situche Central oil field, which has been delineated by two wells with short-term tests of roughly 2,400 and 5,200 b/d of 35-36° gravity oil. GeoPark says the block's certified 3P reserves exceed 80 million bbl with a field potential of up to 200 million bbl. Its near term plans are to bring the existing wells onto production and then further develop the field. "The development of Morona fits well with the timing of the production development of our Llanos 34 fields and its exploration will come into play over the next several years," Park said.