Asia Pacific development increases with lower sanctioned volumes

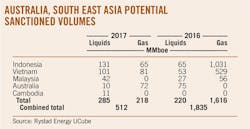

Rystad Energy believes projects in Australia and South East Asia will develop 512 MMboe in recoverable liquids and natural gas resources in 2017, a 75% drop from 2016.

The study concludes 2017 sanctioned projects in the region contain more liquids (58%) compared to 2016, which contained primarily gas (88%). Leading countries include Indonesia and Vietnam, which account for almost 75% of potential financial approvals in 2017 (see Table).

In 2016, projects equaling 1,835 MMboe were sanctioned in the region. But this trend is skewed by two major projects, BP PLC's Tangguh expansion at Bintuni Bay, West Papua, Indonesia, and PetroVietnam's Block B-O Mon project offshore Vietnam (OGJ Online, June 17, 2015, and Sept. 14, 2016). According to Rystad, the two projects accounted for 75% of the gas volume in projects that reached final investment decision (FID) in 2016.

Managing expectations

Despite lower sanctioned volumes in 2017, the count of potential projects is higher than 2016, Rystad said.

Australia and South East Asia have not "gone into a slumber following the price slump," said Rystad senior analyst Readul Islam. The Rystad 2017 forecast balances operator and industry expectations versus recent project news flow to assess candidate projects' chances of attaining FID. "The upside and downside risks to the forecast mean all stakeholders will be eagerly following 2017 approvals in these regions," Islam said.

Projects, delays

The Ande-Ande Lumut (AAL) project in northwest Natuna Sea offshore Indonesia holds 107 MMboe and could comprise 20% of the 2017 sanctioned volumes in the Asia Pacific region, according to Rystad.

AWE Ltd., Sydney, a 50% partner in the project with operator Santos Ltd., has delayed FID due to the low-price environment. But the company also cited low prices as offering the potential to save development costs as suppliers and service companies compete for reduced exploration and development opportunities.

Indonesian oil production is on course to decline to 2020, but sanction of the AAL project could mitigate production losses.

Repsol SA's Ca Rong Do (CRD) floating production, storage, and offloading (FPSO) project in Vietnam has also been delayed. The CRD oil and gas field, discovered in June 2009, is in Block 07/03 on the southern border of the Nam Con Son basin, 420 km offshore Vietnam. WoodMackenzie Ltd. has said an FID is expected in second-half 2017 on CRD development. CRD is roughly half the size of AAL and accounts for 12% of 2017 FID volumes from the region, Rystad said.

Cambodia's Block A, home to the Apsara oil field, covers 4,709 sq km in the Gulf of Thailand over the Khmer basin, roughly 150 km offshore Cambodia in 50-80 m of water.

Kris Energy Ltd. is developing the Apsara oil field, Cambodia's first, and timing could have been affected by the operator's recent debt restructuring. The operator has since described Apsara as one of its net-present value-positive investment priorities.

Development outcome

Projects such as AAL and CRD could already have been approved had prices not declined. Rystad's 2017 forecast acknowledges the possibility of FIDs sliding into 2018, responding to market turbulence, Islam said.

Development volumes in Australia and South East Asia also have an upside, many of the projects expecting 2017 FIDs are being risked into 2018. AWE's final investment decision for its Waitsia Phase 2 onshore gas scheme, in Western Australia, has been risked into first-quarter 2018 against the operator's year-end 2017 goal. Positive appraisal results and increased momentum in gas sales agreements, however, could tip project sanctioning into 2017.