OGJ Newsletter

GENERAL INTEREST — Quick Takes

Trump urged to make bipartisan FERC picks

US Senate Democrats called on President Donald J. Trump to fill vacancies at the Federal Energy Regulatory Commission with Democrats and Republicans. FERC has not had a quorum since Feb. 3, when the resignation of former Chairman Norman Bay became effective after Trump replaced him in that post.

"FERC has a long tradition of bipartisanship; most votes within the commission are unanimous. In 2016, less than 2% of the orders issued included a dissenting opinion," Energy and Natural Resources Committee Ranking Minority Member Maria E. Cantwell (D-Wash.) and 15 other Senate Democrats said.

In addition to the three vacant commission seats, a fourth that is currently held by Colette Honorable is scheduled to expire on June 30. By law, not more than three members of FERC may be members of the same political party, the senators noted. Historically, both Republican and Democratic presidents have nominated people recommended by the Senate leader of the party that does not hold the presidency, they said.

"We hope that your nominees will be prepared to continue this tradition, and we intend to review them through that lens during the confirmation process," the Senate Democrats told the president in their Mar. 8 letter.

US crude stocks climb in 9th straight weekly rise

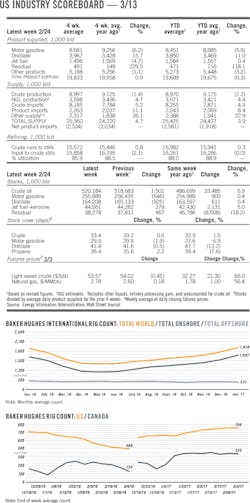

US commercial crude oil inventories, excluding those in the Strategic Petroleum Reserve, increased 8.2 million bbl during the week ended Mar. 3 compared with the previous week's total, according to the US Energy Information Administration's Petroleum Status Report.

At 528.4 million bbl, US crude inventories are above the upper limit of the average range for this time of year. Stockpiles have now risen in 9 consecutive weeks.

Analysts and traders surveyed by the Wall Street Journal expected a 1.7 million-bbl increase. The American Petroleum Institute's preliminary estimate, meanwhile, indicated inventories jumped 11.6 million bbl.

EIA reported total motor gasoline inventories dropped 6.6 million bbl last week but are near the upper limit of the average range. Both finished gasoline inventories and blending components inventories decreased.

US crude refinery inputs during the week ended Mar. 3 averaged 15.5 million b/d, down 172,000 b/d from the previous week's average. Refineries operated at 85.9% of their operable capacity.

Both gasoline production and distillate fuel production increased to 9.8 million b/d and 4.8 million b/d, respectively.

US crude imports averaged 8.2 million b/d, up 561,000 b/d from the previous week's average. Over the last 4 weeks, crude imports averaged 7.9 million b/d, down 1.7% from the same 4-week period last year.

UKCS decommissioning taxation due study

The UK government will study changes sought by the offshore oil and gas industry to tax rules affecting sales of offshore equipment in late years of operation. The spring budget, published Mar. 8, cited the need to "ensure support for the transfer of late-life assets."

It said the government will publish a formal discussion paper "on the case for allowing transfers of tax history between buyers and sellers." It also will establish an advisory panel "to ensure appropriate scrutiny of the options," reporting at the time of the autumn budget this year.

Deirdre Michie, chief executive officer of Oil & Gas UK, welcomed move. "The current tax treatment of decommissioning makes it harder for existing owners to sell mature assets and leads to lengthy, complicated deals which slow down activity in the basin," she said. "Recent deals highlight the opportunities in the basin, but more transactions could be achieved if this issue is resolved."

She said the discussion paper is due Mar. 20.

Exploration & Development — Quick Takes

India describes new open-acreage licensing

The government of India will use revenue-sharing in an open-acreage, exploration and production licensing scheme for which details are beginning to emerge.

Long under development, the Hydrocarbon Exploration and Licensing Policy (HELP) is to replace the New Exploration Licensing Policy in use since 1999 (OGJ Online, Aug. 28, 2012).

It will open all of India's sedimentary-basin acreage for domestic and foreign investment. Companies will identify blocks of interest to be included in biannual bid rounds.

The government offered revenue-sharing instead of profit-sharing in a recent auction of development licenses for small oil and gas fields.

At CERAWeek by IHS Markit in Houston, a delegation led by Minister of State for Petroleum and Natural Gas Dharmendra Pradhan identified these other features of the new system, inclduing a single, uniform license covering exploration and extraction for all hydrocarbon prospects; full marketing freedom and free pricing of crude oil and gas; ability to explore through the entire contract period; no royalty for 7 years for deepwater and ultradeepwater blocks; equal weighting to work program and fiscal bid parameters; no oil tax; and exemption from custom duty.

Region-wide US Gulf Lease Sale 249 slated for August

The US Department of the Interior will offer 73 million acres offshore Texas, Louisiana, Mississippi, Alabama, and Florida for oil and gas exploration and development in Lease Sale 249, scheduled for Aug. 16.

The proposed region-wide lease sale would include all available unleased areas in the western, central, and eastern planning areas of the Gulf of Mexico, encompassing about 13,725 unleased blocks 3-230 miles offshore in 9-11,115 ft of water.

Proposed Lease Sale 249 will be the first offshore sale under the new Outer Continental Shelf Oil and Gas Leasing Program for 2017-22. Under the new 5-year program, 10 region-wide lease sales are scheduled for the gulf. Two gulf lease sales will be held each year and include all available blocks in the combined western, central, and eastern gulf planning areas.

The US Bureau of Ocean Energy Management estimates that the US OCS contains about 90 billion bbl of undiscovered technically recoverable oil and 327 tcf of undiscovered technically recoverable gas. The gulf OCS, covering about 160 million acres, has technically recoverable resources of 48.46 billion bbl of oil and 141.76 tcf of gas.

BOEM says production from all OCS leases provided 550 million bbl of oil and 1.25 tcf of natural gas in fiscal-year 2016, accounting for 72% of the oil and 27% of the natural gas produced on federal lands.

Cairn appraises SNE field offshore Senegal

Cairn Energy PLC, Edinburgh, is furthering its SNE field appraisal off Senegal after confirming gross oil intervals of 18½ m and 8½ m in its SNE-5 well (OGJ Online, Nov. 28, 2016).

SNE-5 targeted two units within an oil leg in the fields upper reservoirs. In two separate drill stem tests, the 18-m interval flowed 4,500 bo/d on a 60⁄64-in. choke. Two main flows of 24-hr each produced 2,500 bo/d on a 40⁄64-in. choke and 3,000 bo/d on a 56⁄64-in. choke. The second drill stem test in the 8½-m zone flowed 3,900 bo/d on a 1-in. choke.

The SNE-5 well has been plugged and abandoned and the Stena DrillMAX drillship is moving about 5 km west of the SNE-1 discovery where it will commence drilling the Vega-Regulus (VR-1) well. VR-1 will explore an Aptian Carbonate target and will serve as appraisal well in SNE field, Cairn said. The company also said Aptian Carbonates underlying the SNE field have a prospective resource of 100 million bbl.

VR-1 results will further narrow the range of SNE field volumes and allow the JV partners to integrate the SNE-5 results before moving on to its planned SNE-6 appraisal well.

Work starts on Leviathan field's first phase

Wood Group has begun detailed engineering for the 30,000-ton fixed platform to be installed offshore Israel to handle production from deepwater Leviathan natural gas field (OGJ Online, Feb. 23, 2017).

Operator Noble Energy Inc. has drilled two of the four wells to be completed subsea in about 5,200 ft of water during the first development phase. Each will be able to produce more than 300 MMcfd of gas.

Twin 73-mile, 18-in. flowlines will carry production to the platform, which will be set in 270 ft of water 6 miles from shore.

With a deck weight of 22,000 tons, the platform will have three processing trains with capacities of 450 MMscfd each.

Processed gas will flow into the Israel Natural Gas Lines Ltd. onshore transportation grid at Dor in northern Israel.

Noble estimates gross capital costs for first-phase development at $3.75 billion and gross reserves related to the investment at 9.4 tcf of gas. Leviathan holds gross recoverable resources of 22 tcf.

Production from the first phase is to start by the end of 2019 at 1 bcfd. Noble expects all production wells to be completed next year. A second development phase would add 900 MMcfd of Leviathan production capacity from four new wells, two processing trains, four compression trains of 300 MMcfd each, and a third tie-back flowline.

Drilling & Production — Quick Takes

Chevron unit starts Mafumeira Sul production off Angola

Chevron Corp. said its subsidiary Cabinda Gulf Oil Co. Ltd. (Cabgoc), has started oil and natural gas production from its main Mafumeira Sul platform offshore Angola. Early production from the second-stage development started in October 2016 using a temporary production system.

Mafumeira Sul is 15 miles off Cabinda province in 200 ft of water on Block O (OGJ Online, Feb. 6, 2013). Mafumeria Sul is the second-stage development of Mafumeria field. The first phase was Mafumeira Norte, which started production in 2009.

Mafumeira Sul infrastructure includes a central processing facility, two wellhead platforms, 75 miles of subsea pipelines, 34 producing wells, and 16 water injection wells. Its design capacity is 150,000 b/d of liquids and 350 MMcfd of natural gas.

Chevron said that Mafumeira Sul production will be gradually ramped up to full capacity through 2018.

Cabgoc is the operator and holds a 39.2% interest in Mafumeira Sul. Partners are Sonangol EP 41%, Total SA 10%, and Eni SPA 9.8%.

SNEPCo halts Bonga production for turnaround work

Royal Dutch Shell PLC's Nigerian unit has halted production from its Bonga deepwater oil and natural gas field for turnaround maintenance that involves inspections, recertification, and any needed equipment repairs.

Bonga, 75 miles offshore Nigeria, began production in November 2005 (OGJ Online, Dec. 1, 2005). It has capacity to produce 225,000 b/d of oil and 150 MMscfd of gas.

Shell Nigeria Exploration & Production Co. Ltd. spokesman Bamidele Odugbesan said production was stopped Mar. 4 and is expected to resume sometime in April. No specific date was cited.

SNEPCo operates the Bonga project as contractor with 55% interest under a production-sharing contract with Nigerian National Petroleum Co., which holds the lease for OML 118 where Bonga field is located.

Output up at Yamal Peninsula's biggest field

Natural gas production from Bovanenkovskoye field in northwestern Siberia reached a record-high 264 million cu m/day last year with the addition of two wells and two booster compressor stations, reports Gazprom, the operator. Two of the field's production facilities are operational, which Gazprom describes as the largest of 32 fields in the Yamal Peninsula.

Bovanenkovskoye production began in 2012. The company plans to bring another compressor station online this year. A third production facility is under construction. It will allow production to reach design capacity of 115 billion cu m/year.

Gazprom is twinning a 1,260 km, 1.42-m OD pipeline between the field and Ukhta and a 970-km, 1.42-m OD pipeline between Ukhta and connections with existing systems at Torzhok.

Aramco planning 'long term' for drilling JVs

Saudi Aramco reported that two joint ventures with drilling firms will become "fully operational" within a few months.

Aramco will have 50% ownership in both JVs that will own, operate, and manage rigs. One is for onshore drilling with Nabors Industries Ltd. and one is for offshore drilling with Rowan Cos. PLC (OGJ Online, Oct. 31, 2016; Nov. 21, 2016).

In the short term, the JV rigs will operate in Saudi Arabia. "And in the long term, we can begin to see these two companies as regional and international drilling companies that make Saudi Arabia a hub for energy services," said AbdulHameed A. Al Rushaid, executive director of drilling and workover.

Aramco said it is promoting "local content" by creating demand for new drilling rigs built in Saudi Arabia by Aramco's manufacturing JVs.

Output rising, costs falling on the UKCS

Rising production and falling costs mask lingering problems for oil and gas operators on the UK Continental Shelf (UKCS).

Oil and gas production offshore the UK will rise to 1.8-1.9 million boe/d by 2018, predicts Oil & Gas UK in its Business Outlook Report 2017.

Production fell for 15 years before turning up in 2015 after bottoming at 1.5 million boe/d. Helping recovery were government tax incentives and a collaborative industry effort to lower costs and improve efficiency.

Production rose by 5% in 2016 to 1.73 million boe/d.

In the past 2 years, Oil & Gas UK reports, average unit operating costs have fallen to $15.30/bbl from $29.70/bbl.

Cost reduction and investment constraints have lowered development costs for new projects by more than 50% since 2013.

According to the report, operators have brought 34 new fields onto production since 2013 and improved productivity of existing fields.

This year, output will begin at 13-18 fields.

Investment in UKCS projects continues to fall. The industry expects total spending of almost £17 billion in the UK this year, down from last year by about 3%.

And exploration remains at record lows, the report notes.

Oil & Gas UK Chief Executive Deirdre Michie welcomed a slow return of industry confidence in the UKCS but noted the hazards.

"The revival is led chiefly by exploration and production companies which may collectively see a return to positive cash flow for the first time since 2013 provided costs are kept under control and commodity prices hold," she said. "However, this is unlikely to translate immediately into reinvestment or increased activity. The challenges for the basin ahead, particularly for companies in the supply chain, are still considerable."

Her group has asked the government to extend an investment allowance "to operational activities that are focused on maximizing economic recovery."

PROCESSING — Quick Takes

Shell, Aramco advance split up Motiva refining JV

Saudi Aramco and Royal Dutch Shell PLC have agreed to move forward on a previously announced plan to divide up assets, liabilities, and businesses of their US-based refining and marketing joint venture Motiva Enterprises LLC, which operates three refineries at the US Gulf Coast.

Aramco subsidiary Saudi Refining Inc. (SRI) and Shell's US downstream affiliate SOPC Holdings East LLC signed binding definitive agreements to end the partnership on Mar. 6, Motiva and Shell said in separate statements.

Scheduled to close during this year's second quarter, the deal includes a $2.2-billion balancing payment from Shell to Aramco that, subject to adjustments including for working capital, will be satisfied by a combination of SRI assuming more than its 50% share of Motiva's net debt as well as a planned $1.5-billion cash payment for the remaining balance, Shell said.

To reduce the cash portion of the balancing payment, however, Shell said it will assume $100 million of Motiva's total net debt, which as of yearend 2016 stood at $3.2 billion.

As part of the revised agreement, SRI will retain the Motiva name, assume 100% ownership of the 600,000-b/d Port Arthur, Tex., refinery, retain 24 distribution terminals, as well as maintain an exclusive, long-term license to use the Shell brand for gasoline and diesel sales in Georgia, North Carolina, South Carolina, Virginia, Maryland, Washington, DC, the eastern half of Texas, and most of Florida.

In exchange, Shell will assume sole ownership of the 235,000-b/d Norco refinery-where subsidiary Shell Chemical LP already operates a petrochemical plant-and the 242,250-b/d Convent refinery, which Motiva previously announced will be integrated to create the Louisiana Refining System.

Shell also will retain 11 distribution terminals as well as Shell-branded markets in Alabama, Mississippi, Tennessee, Louisiana, a portion of the Florida panhandle, and the US Northeast.

Neste lets contract for Porvoo refinery

Neste Corp. has let a contract to Neste Jacobs Oy to provide advanced process automation technology for the fluid catalytic cracking (FCC) and FCC gas recovery units at its refinery in the Kilpilahti industrial area of Porvoo, Finland.

Neste Jacobs Oy's scope of work under the contract includes delivery of its proprietary NAPCON simulators to Porvoo's FCC and FCC gas recovery units as part of Neste's plan to ensure safe, reliable, and cost-efficient ongoing operation of the two units, the operator and service provider said.

This latest order follows previous installations of NAPCON simulators at the Porvoo refinery, which Neste has subsequently integrated into the plant's continuous maintenance program, according to Neste Jacobs Oy.

A value of the technology contract was not disclosed.

Separately, Neste said on Feb. 7 that it continues to finalize works related to its previously announced €500-million project to integrate the 3 million-tonne/year Naantali refinery with the 10.5 million-tpy Porvoo refinery so that the sites will operate as a single Finnish refining system.

While work on an associated €200-million solvent deasphalting (SDA) feedstock pretreatment unit and asphaltene pelletizer in the area of PL4 at Porvoo also remains under way, the project is still on schedule for mechanical completion and startup by second-half 2017, the operator confirmed.

Designed to enable Porvoo to increase production of higher-quality fuels such as diesel by decreasing the content of asphaltenes present in crude feedstock processed at the site, the SDA unit also will help the refinery to reduce output of heavy fuel oil.

Vitol to buy OMV Turkish distribution unit

A unit of Vitol Investment Partnership Ltd. has agreed to buy OMV AG's wholly owned fuel-distribution subsidiary in Turkey for €1.368 billion. Market-leading OMV Petrol Ofisi Holding AS has more than 1,700 service stations and a fuel storage and logistics business with total capacity exceeding 1 million cu m. It is a major distributor of lubricants and jet fuel.

The buyer is VIP Turkey Enerji AS.

TRANSPORTATION — Quick Takes

White House: Keystone XL will not use US steel

TransCanada Corp.'s Keystone XL crude oil pipeline will not be built with US-produced steel pipe, according to the administration of President Donald J. Trump.

White House Principal Deputy Press Secretary Sarah Sanders said the executive order declaring that all pipelines built in the US would use pipe and steel produced in the US was "specific to new pipelines or those that are being repaired. And since [Keystone XL] is already currently under construction, the steel is already literally sitting there, it would be hard to go back. But I know that everything moving forward would fall under that executive order."

TransCanada had previously indicated that about 50% of the pipe it intended to use on Keystone XL had been manufactured in the US, but that much of even that portion was likely made using foreign-sourced steel (OGJ, Mar. 6, 2017, p. 32).

The memorandum signed by the president invited TransCanada Pipeline Ltd. to resubmit its application for Keystone XL and directed the departments of State and the Interior and the secretary of the Army to make a permitting decision within 60 days. TransCanada resubmitted its application Jan. 26, 2017.

The company filed a separate application Feb. 16, 2017, with Nebraska's Public Service Commission for route approval through the state, proposing three possible paths. TransCanada expects the state's review to conclude this year.

Pipeline steel team forms after Trump memo

Four national oil and gas associations have formed a pipeline steel team in response to US President Donald J. Trump's Jan. 24 Executive Memorandum specifying that US-manufactured materials will be used in all new construction as well as repairs, retrofits, and expansions to the maximum extent possible.

The memorandum directed the US Secretary of Commerce to consult with relevant executive agencies to develop a plan and submit it to the president within 180 days of its publication in the Federal Register.

Representatives from the American Petroleum Institute, the American Gas Association, the Association of Oil Pipe Lines, and the Interstate Natural Gas Association of America met in mid-February after member companies expressed concern about potential challenges for constructing new projects and repairing existing systems in complying with the memo.

They formed the pipeline steel team with member company representatives to analyze the memo's potential effects, develop policy recommendations, and reach out to the Trump administration and others.

No specific issues have been identified or possible steps proposed because the process has just got under way, AOPL and INGAA representatives separately told OGJ.