North American upstream spending to soar in 2017

Following an unprecedented 2 years of double-digit percentage declines, upstream capital expenditures in North America will rebound strongly this year, according to Oil & Gas Journal's annual spending outlook.

The willingness of members of the Organization of Petroleum Exporting Countries' to cut production has placed a floor under crude oil prices.

The US Energy Information Administration has forecast Brent crude oil prices to average $55/bbl this year and $57/bbl in 2018 in its latest Short-Term Energy Outlook.

West Texas Intermediate crude prices are forecast to average about $1/bbl less than Brent prices in 2017. These forecasts compare with an average of $43/bbl for both Brent and WTI in 2016.

Currently the futures curve for crude has lost all of its contango in this year's second half, and has instead demonstrated backwardation.

Based on various companies' capex announcements, OGJ projects that total US upstream spending will surge 37.8% this year to $120 billion. This follows a 40% plunge in spending in 2016.

The 2016 US refining market proved to be a challenging environment. Many of the refining dynamics may continue to play in 2017. Meanwhile, US petrochemical investments will maintain a positive outlook this year.

OGJ finds that oil and gas capital budgets for exploration and production in Canada will climb 40% this year. Oil sands spending, however, will continue to decline.

International upstream spending outside North America is expected to increase 2% in 2017, following a decline of 18% in 2016, according to the latest Barclays E&P survey. Growth is expected in almost every region except Europe. Offshore spending will continue to decline this year.

US upstream spending

US upstream spending will be weighted heavily towards the development of oil and liquids-rich shales, while improved US natural gas prices also have resulted in more gas-targeted rigs coming back online.

The overall US rig count during the week ended Feb. 24 totaled 754, up 350 units since a modern era nadir of 404 touched during the week of May 27, 2016. US oil-directed rigs totaled 602, up 286 units since their May 27, 2016, bottom. Rigs targeting gas reached 151, up 70 since Aug. 26, 2016.

The increase in US upstream spending is being driven by both increased drilling activity and rising oil field services costs. According to Barclays' online survey, more than 79% of E&P companies expect an increase in oil field service costs this year, though the large majority expect only a modest 0-10% pricing increase.

Offshore spending for projects in the Gulf of Mexico will continue to decline this year. According to estimates of Wood Mackenzie Ltd., gulf capital expenditures in 2017 will fall another $1.5 billion from the previous year.

One component of US upstream spending is the total of bonus payments that the US Bureau of Ocean Energy Management collects from lease sales for tracts on the Outer Continental Shelf.

Activities in last year's gulf lease sales were down markedly compared with those from previous year's. Despite conducting three lease sales in the gulf in 2016-Lease Sales 226, 241, and 248-BOEM received a total of just $178 million in apparent high bids. In 2015, BOEM conducted two gulf lease sales, 235 and 246, and received bids totaling $561 million.

BOEM has three lease sales slated for 2017: Lease Sale 244 in Alaska's Cook Inlet, and Lease Sales 247 and 249 in the gulf. OGJ estimates that a total of $200 million will be generated by these three sales.

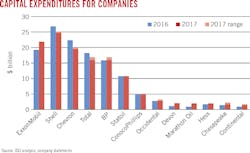

US firm's spending plans

Many US E&P companies' 2017 capital budgets, as they have announced, were 50-70% higher than their 2016 budgets. Although international oil companies are still restraining their spending plans, they universally increased their spending for US onshore drilling.

ExxonMobil anticipates an investment level of $22 billion in 2017, up from $19.3 billion in 2016. More than one quarter of the company's planned spending this year will be made in short-cycle opportunities-those expected to generate positive cash flow in less than 3 years after initial investment-including in the Permian and Bakken.

In January, ExxonMobil announced an acquisition that will more than double its Permian basin resource potential to 6 billion boe.

Chevron announced a $19.8-billion capital and exploratory investment program for 2017, representing a reduction of 42% from 2015 outlays and at least 15% lower than projected 2016 capital investments. Despite a lower capital budget for 2017, Chevron's investment in US upstream will increase by $1 billion from a year ago to $5.7 billion. About $2.5 billion is allocated to shale and tight plays, the majority of which is slated for Permian basin developments in Texas and New Mexico.

ConocoPhillips reported capital spending plans totaling $5 billion for 2017, slightly higher than the $4.9 billion budgeted for 2016. The company's investment in US upstream will climb to $2.5 billion from $2.1 billion a year ago.

In 2017, Devon Energy Corp. expects to further accelerate activity in its US resource plays to as many as 20 operated rigs by yearend. With this level of planned activity, the company expects to invest $2-2.3 billion of E&P capital in 2017, up 53% from last year, with nearly 90% of the capital devoted to US resource plays.

Noble Energy Inc. has set its organic capital expenditures for 2017 at $2.3-2.6 billion vs. $1.3 billion set for 2016. About 75% of the firm's total capital program is allocated to US onshore development, primarily focused on liquids-rich opportunities in the DJ basin, Delaware basin, and Eagle Ford. US onshore organic investments are up 90% from 2016 levels.

EOG Resources Inc. reported planned capex for 2017 of $3.7-4.1 billion vs. $2.7 billion in 2016. Capital will be allocated primarily to EOG's highest rate-of-return oil assets in the Eagle Ford, Delaware basin, Rockies, and Bakken. The company expects to complete about 480 net wells in 2017 compared with 445 net wells in 2016.

Pioneer Natural Resources Co. reported its capex plans for 2017 to total $2.8 billion, up from $1.8 billion for 2016. The budget includes $2.5 billion for drilling and completion activities and $275 million for water systems, vertical integration, and field facilities. This capital program assumes that further efficiency gains will offset the company's estimated cost inflation of 5%.

Marathon Oil Corp. announced a 2017 capital program of $2.2 billion with more than 90% allocated to its high-return US resource plays. This compares with capital spending of $1.1 billion in 2016.

Apache Corp. announced a capital spending budget of $3.1 billion for 2017, up nearly 60% from spending in 2016.

RSP Permian Inc.'s full-year development capex soared to $625-700 million vs. $294 million in 2016. Production is seen jumping 82-95% to 53,000-57,000 boe/d. RSP Permian agreed last year to pay $2.4 billion for drilling rights to 41,000 net acres in the Delaware portion of the Permian.

Carrizo Oil & Gas Inc. plans to spend $530-550 million in 2017 for drilling and completion projects as it expects oil field service costs to increase this year.

Oasis Petroleum Inc.'s capex plans for 2017 will reach $605 million, up from $400 million in 2016, excluding acquisitions.

Refining

The 2016 refining market proved to be a challenging environment, as higher global inventories, capacity additions, and a warmer-than-usual winter in much of the country weighted heavily on refining margins. A few independent refiners experienced losses in 2016. Refining investments in 2016 were lower than the budgets approved at the start of the year.

Elevated product inventories and increasing fuels regulations will combine to keep US refiners under pressure this year. Most proposed capital projects at US refineries now are smaller-scale, regionally based, and aim to improve operational efficiency, lower transportation costs, and meet regulation requirements. In addition, planned refinery maintenance turnaround activity will increase in 2017.

Valero Energy Corp. expects 2017 capital investments to be about $2.7 billion, of which $1.1 billion is for growth and $1.6 billion is for sustaining projects. For 2016, capital investments totaled $2 billion, consisting of $1.4 billion for sustaining the business and $600 million for growth projects. In 2015, the company's capital expenditures were $2.5 billion.

Marathon Petroleum Corp. reported capex plans for 2017 totaling $1.165 billion for refining and marketing compared with $1.1 billion in 2016 and $1 billion in 2015. In 2017, the company plans to spend $840 million on maintaining facilities and meeting regulatory requirements, including Tier 3 gasoline standards.

Phillips 66 Co. plans to spend $905 million in refining, down from $1.15 billion in 2016 and $1.07 billion in 2015. Sixty-five percent of the capital is slated for reliability, safety, and environmental projects. Growth capital in refining will be directed toward small, high-return, quick pay-out projects, primarily to reduce feedstock costs and improve clean product yields. These include a project at the Billings, Mont., refinery to increase heavy crude processing capabilities and yield improvement projects at the Bayway and Ponca City refineries.

PBF Energy reported 2017 capital expenditures of $625-650 million for refining operations, down from $1.47 billion in 2016 and $970 million in 2015. In 2017, the company is committed to the continued integration of both Torrance, Calif., and Chalmette, La., refineries.

Delek US's refining capex declined to $27 million in 2016 from $164.5 million in 2015, as the refiner has completed large capital investment refining programs. In 2017, Delek US plans to spend $30 million for sustaining activity.

ExxonMobil's capital investments in US downstream totaled $2.5 billion in 2016, a decrease of $200 million from 2015, mainly reflecting lower refining project spending.

Petrochemicals

The US petrochemical industry continues to enjoy optimism about future investment, thanks to the continued low cost of natural gas liquids, a primary feedstock for building-block chemicals such as ethylene.

Global demand for ethylene and other chemicals remains strong, providing export opportunities for US producers, resulting in increased investment in the US.

In November 2016, ExxonMobil announced plans to add a production unit at its Beaumont, Tex., polyethylene plant that would increase capacity by 65%, or about 650,000 tonnes/year. Construction of the unit has begun and start-up is expected in 2019.

In September 2016, LyondellBasell said it will build a high-density polyethylene plant with capacity of 500,000 tonnes/year at its La Porte, Tex., manufacturing complex. Construction is scheduled to begin early this year with start-up planned for 2019.

Meanwhile, construction of several crackers is reaching completion. Joint-venture partners OxyChem and Mexichem are likely to be the first to finish a project this year, with their Ingleside ethylene plant on track for commissioning in January. Two separate 1.5 million-tpy crackers being constructed in Texas by CPChem and Dow Chemical are on target to come online in midyear. ExxonMobil's 1.5 million-tpy cracker in Baytown, Tex., also is expected to come online this year.

US pipelines, LNG

With near-term US crude and product pipeline construction plans shrinking, gas pipeline projects will account for a large portion of pipeline capital outlays in the US this year. However, there is increased concern that a number of pipeline projects targeting startup in this year's second half might not hit their deadlines.

OGJ's most recent Worldwide Pipeline Construction report identified plans for the construction of 350 miles of crude and products lines and 1,156 miles of gas pipelines in the US this year (OGJ, Feb. 6, 2017, p. 62). Plans in 2016 called for construction of 3,329 miles of crude and product lines and 974 miles of gas lines.

Expenditures for oil and product pipelines, including pump stations, will total $2.3 billion. This represents a 89% plunge in capital outlays from 2016. In contrast, spending for gas pipelines and associated compressor stations will jump 18% from the previous year to $7.6 billion.

Construction activity at LNG projects, meanwhile, will remain elevated thanks to the sanctioning of US projects pre-2014 that are currently under construction. However, due to market oversupply, LNG investment could drop off steeply post-2018 as currently under construction projects become completed.

Canadian E&P, oil sands

All monetary figures in the next two sections are expressed in Canadian dollars. Capital expenditures for oil and gas exploration, drilling, and production in Canada will rise 40% to $27 billion in 2017, following a 36% decline in 2016.

The Canadian Association of Petroleum Producers forecasts 5,400 wells to be drilled in Canada in 2017, up 44% from 2016.

The Canadian rig count increased significantly to 341 rigs in February, with oil rigs reaching 201 rigs and gas rigs reaching 140 rigs, Baker Hughes Inc. said.

Oil sands capital spending, which includes funds for in-situ extraction, mining, and upgraders, will continue to fall another 11% from a year ago to about $15 billion. This follows a decrease of 26% last year.

CAPP reported that oil sands capex totaled $22.9 billion in 2015, the latest year for which the association has reported such data.

Suncor has set a 2017 capital spending program of $4.8-5.2 billion, down from $5.98 billion last year. Upstream spending will range $4.13-4.47 billion this year.

The Fort Hills oil sands project was more than 76% complete at yearend 2016. The overall cost of the project is now estimated at $16.5-17 billion due to the construction delay caused by the forest fires in second-quarter 2016. Suncor's share of Fort Hills' remaining project capital is $1.6-1.8 billion. The majority of the spend will occur in 2017.

Encana Corp., Canada's No. 2 oil and gas producer, announced capex plans of $1.6-1.8 billion for 2017, up 50% from last year.

Canadian Natural Resources Ltd. announced its 2017 capex will total $3.89 billion, up from $3.845 billion last year. In 2017, $1.71 billion will be allocated to Horizon Oil Sands Project, down from $2.73 billion last year.

CNRL's 2017 E&P capital budget for North America will increase to $1.37 billion from $845 million a year ago, while its international E&P spending will fall to $420 million from $480 million a year ago.

Husky Energy Inc., which reported 2016 capex of $2 billion, plans 2017 capital spending of $2.6-2.7 billion. The company has budgeted $685-720 million in heavy oil for 2017. During 2016, $28 million was invested in oil sands compared with $264 million in 2015. The decrease in spending in 2016 compared with 2015 reflects the completion of Phase 1 of the Sunrise Energy Project in third-quarter 2015. The company has budgeted $90-100 million for oil sands projects for 2017, primarily for the continued development of the Sunrise Energy Project.

MEG has set a 2017 capital budget of $590 million, about 55% of which is directed towards initiation of the eMSAGP growth project. The company invested $125 million in 2016, a reduction of 62% from its original 2016 budget of $328 million.

Elsewhere in Canada

Based on plans outlined in OGJ's Worldwide Pipeline Construction report, which calls for 149 miles of gas lines to be constructed in Canada this year, capex for these lines and associated compressor stations will be $990 million. During 2016, such expenditures were $2.4 billion based on the construction of 370 miles.

Plans also call for 278 miles of products pipelines and 476 miles of crude lines to be constructed in Canada this year, bringing capital spending for these projects to $5 billion.

Refining and marketing expenditures will increase 7% from a year ago to $2.9 billion.

The large capital projects that were undertaken in the petrochemical industry were essentially completed in 2016, and no new major projects were commenced.

At yearend 2016 the Province of Alberta announced through the Petrochemical Diversification Program that it will support two major projects should they decide to proceed in that province.

The first project is a joint venture between Calgary-based Pembina Pipeline Corp. and Petrochemical Industries Co., based in Kuwait, to build a $3.8-4.2 billion facility in Sturgeon County to process 22,000 b/d of propane into polypropylene. Construction is expected to start in 2019, with the facility operating by 2021.

The second project, by Calgary-based Inter Pipeline, entails plans to build a $1.85-billion facility in Strathcona County to process 22,000 b/d propane into propylene. Construction is expected to start this year with the facility expected to reach production by 2021.

International spending

The latest Barclays' E&P Spending Survey, released on Jan. 9, showed that international upstream spending outside the US and Canada will increase modestly in 2017 following back-to-back declines of 23% in 2015 and 18% in 2016.

In stark contrast to last year where the Middle East was the only region to see spending growth, this year growth is expected in almost every region except Europe. However, the growth is constrained by a continued decline in international spending by the majors, which primarily reflects offshore exposure.

Offshore spending is expected to fall 20-25% in 2017, following respective declines of 12% and 34% in 2015 and 2016. However, Barclays believed 2017 will be the final year of a 3-year consecutive decline in offshore spending as rig contract cancellations have slowed and the impact of structural cost reductions for offshore projects could lead to deepwater project sanctioning as early as this year's second half.

Spending by Russia and the former Soviet Union is expected to increase 10% in 2017 following a 5% decline in 2016, according to the survey. In 2017, Rosneft, Russia's largest oil company, plans an investment program of $18.5 billion, up from 2016, with particular focus on building up capacity at the new fields.

According to the survey, spending in the Middle East will continue to tick higher in 2017. Following an 8% rise last year, growth is expected to be more muted in 2017 as mid-single digit growth from most countries is offset by declines in spend by Abu Dhabi National Oil Co. (ADNOC) and South Oil Co. Saudi Aramco's spend is forecast to increase 4% this year, despite OPEC's production cut announcement.

Petroleo Brasileiro SA (Petrobras) expects to spend 30% more in exploration, production, and refining projects this year. Chief Executive Officer Pedro Parente told reporters at an event in Rio de Janeiro that Petrobras's capital spending could rise to $19 billion in 2017 from $14.6 billion in 2016. Expenditures of Petroleos Mexicanos (Pemex) and YPF will continue to decline this year.

China National Offshore Oil Corp. (CNOOC) will increase its expenditures, including in the Gulf of Mexico, to $10.2 billion for 2017 after cuts in the last 2 years. In 2017, the company plans to drill 126 exploration wells and acquire about 13,000 sq km of 3D seismic data.

Some US-based companies have also released details of their capital budget plans outside North America.

ExxonMobil will advance longer-term projects focused on growing higher-value production in Canada, Guyana, and the UAE. ExxonMobil expects the startup of five major upstream projects in 2017-18, which will contribute an additional 340,000 boe/d of working-interest production capacity. Odoptu Stage 2 in Far East Russia and the Hebron project in Eastern Canada are expected to start up by yearend. Other projects planned for startup in the period are the Upper Zakum expansion in the UAE, Barzan in Qatar, and Kaombo in Angola.

Chevron plans to spend $11.6 billion on its international upstream businesses, down from $15.4 billion spent in 2016 and $23.5 billion in 2015. About $2 billion of the firm's budget will go to the completion of the Gorgon and Wheatstone LNG projects in Australia.

About the Author

Conglin Xu

Managing Editor-Economics

Conglin Xu, Managing Editor-Economics, covers worldwide oil and gas market developments and macroeconomic factors, conducts analytical economic and financial research, generates estimates and forecasts, and compiles production and reserves statistics for Oil & Gas Journal. She joined OGJ in 2012 as Senior Economics Editor.

Xu holds a PhD in International Economics from the University of California at Santa Cruz. She was a Short-term Consultant at the World Bank and Summer Intern at the International Monetary Fund.