Analysts optimistic Iran can increase oil production medium-term

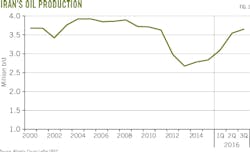

Iran's oil production has increased since the lifting of international nuclear-related sanctions in January 2016. Estimates put Iran's production at 3.7-3.9 million b/d in October 2016, compared with pre-sanctions levels of 3.6 million b/d.

Iran wants to increase its total production capacity to 4.69-4.79 million b/d by 2020-2022, said Sara Vakhshouri, senior nonresident fellow at Global Energy Center, Atlantic Council, and president at SVB Energy International in Washington, DC.

Iman Nasseri, senior consultant and acting manager for Facts Global Energy (FGE) in Tehran, said FGE believes Iran's production will average about 3.8 million b/d for 2017.

"Looking forward, we think 5 million b/d of oil production before 2020 is possible if you include condensate," Nasseri said.

Recurring rounds of sanctions since its 1979 revolution have hampered Iran's oil production and export capacity. Iran's oil production hasn't gotten above 4 million b/d since 2004 despite its massive resources (Fig. 1).

The US Energy Information Administration estimated Iran has 546 billion bbl of OIP with 158 billion bbl recoverable. Iran also is estimated to have 1.2 tcf of natural gas reserves.

Separate reports by Vakhshouri1 and the Arab Petroleum Investment Corp. (APICORP)2 each note that Iran must attract outside capital and technology to boost production beyond the short-term.

APICORP said Iran started preparing oil fields in mid-2013 for the end of nuclear-related sanctions. China National Petroleum Corp. (CNPC) and Sinopec Group helped the National Iranian Oil Co. (NIOC) refurbish production equipment during 2012-14.

Vakhshouri said "assiduous preparation" enabled Iran's production and exports to respond rapidly to the lifting of sanctions in 2016. APICORP said oil exports initially surged as Iran released onshore and floating storage, estimated at more than 40 million bbl as of Dec. 31, 2015.

Substantial investments in both mature and undeveloped fields promise to expand production capacity within 5 years. Iran's oil industry, however, still faces considerable uncertainty amid both commodity-price and international political volatility.

Saudi Arabia Foreign Minister Adel al-Jubeir told Bloomberg that Saudi Arabia will work with US President Donald Trump, who has said he wants to renegotiate the accord that lifted international sanctions on Iran in 2016.3

Saudi Arabia has cut diplomatic relations with Iran, its Middle East rival. Al-Jubeir said Iran "had adopted a policy of supporting terrorism." Saudi Arabia and Iran support opposing sides in ongoing conflicts in Syria and Yemen.

Nasseri said that most international companies are unlikely to be deterred from doing business in Iran despite the Trump administration's statements and Saudi-Iranian disagreements. He noted, however, that "US companies will most likely continue to be banned from any participation in the Iranian oil market."

Regaining market share

Iran re-entered world oil markets while prices languished. Most international oil companies and investors, particularly in Europe and the US, remain cautious despite both the continued low prices and political tensions. The US on Feb. 3 imposed economic sanctions on certain Iran businesses and individuals.

"Doing business with Iran still requires navigating a complex web of targeted sanctions," Vakhshouri said. Iran also faces internal divisions that could delay reforms. These include Iran's upstream investment regulations and the Iran Petroleum Contract (IPC).

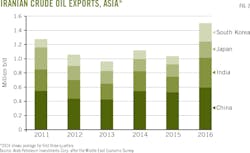

Fig. 2 shows Iranian exports to Asia since 2011. New production can be exported worldwide, APICORP said.

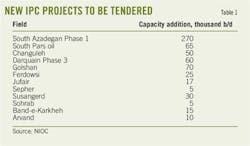

Iran has sought to promote its energy industry with a new IPC that increases flexibility and profits for non-Iranian investors (Table 1). Iran worked with international groups to assist with financial arrangements.

On Nov. 30, 2016, the Organization of the Petroleum Exporting Countries (OPEC) agreed to reduce overall output by about 1.2 million b/d starting in January 2017 for 6 months, with plans to review production levels at that time.

OPEC agreed to cut overall aggregate output to 32.5 million b/d. The cartel agreement calls for Iran to keep production 4.5% below its 2005 peak of 3.97 million b/d, capping Iranian production at 3.8 million b/d.

Iran reported producing 3.9 million b/d in October 2016. OPEC's Monthly Oil Report, however, said secondary sources suggest Iran still could increase production by 90,000 bbl before hitting its 3.8-million b/d cap.

Vakhshouri, however, maintains that "an increase of [Iran's] crude oil production of 50,000-90,000 b/d in 2017 is not technically doable."

Fig. 3 shows how the 2012 implementation of nuclear-related sanctions caused Iran to lose its former OPEC production-share position, switching places with Iraq. Vakhshouri said this "was not an easy adjustment for Iran, to put it mildly. Hence, regaining its pre-sanctions position in OPEC has been crucial."

Sanctions hit production hardest in Iran's southern oil fields, mature fields known for using enhanced oil recovery to produce heavy oil. These fields increased output by 500,000 b/d during 2016, Vakhshouri said.

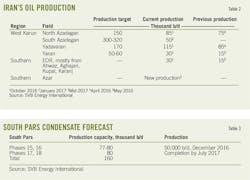

Production from less developed fields will become increasingly important. These fields include West Karun, in southern Iran where production more than doubled during late 2015 and October 2016. Most of Iran's new oil production by 2020 likely will come from three West Karun fields: Azadegan, Yaran, and Yadavaran (Table 2). Production from these regions rose to 280,000 b/d in October 2016 from 100,000 b/d in 2015.

"Analysts project that the completion of development projects, particularly in North Azadegan and Yadavaran, will boost total West Karun production to between 550,000 and 650,000 b/d by 2020," Vakhshouri said. Iran's oil officials are more optimistic, suggesting West Karum production could reach 700,000 b/d by early 2018.

Mature southern fields

APICORP said NIOC ramped up production from onshore fields such as Marun, Gachsaran, and Ahwaz. About 70% of it in late 2016 came from 10 fields, mostly southern Iran.

The company has increased gas injection and EOR. Gas injection in the southern oil fields was 33% higher in March 2016 than March 2015. NIOC has also reworked wells, repaired processing units, and cleaned export pipelines.

Vakhshouri still sees limited long-term prospects for the southern oil fields, which have natural depletion rates of 8-11%/year and a recovery factor of 20-25%. These fields require investment for gas reinjection to maintain production levels. Iran's Ministry of Petroleum estimates depletion causes losses up to 500,000 bbl/year.

Most of NIOC's recent gas injections and EOR-Improved Oil Recovery (IOR) activities focused on seven southern oil fields: Ahwaz, Aghajari, Gachsaran, Kupal, Karanj, Mansouri, and Bibi Hakimeh.

FGE's Nasseri said the southern fields will remain important despite high decline rates. Iran is looking to sign EOR-IOR contracts with non-Iranian companies.

"If successful, significant upside would emerge from those projects," Nasseri said, noting that "500,000 b/d could be [re-]added to Iran's production only by avoiding the expected decline from mature fields."

He said the contracts timing depends on negotiations and the award process as well as international politics during the next 12 months. Iran's presidential election is scheduled for May, with Hassan Rouhani seeking re-election.

Vakhshouri described the prospects for individual southern fields as follows:

• Aghajari was where NIOC concentrated its largest volumes of gas injections during March 2015 to March 2016. The total injection of 6.8 billion cu m of gas marked a 13% year-over-year increase. Average gas injections in May 2016 were 32 million cu m/d, sometimes reaching as high as 54 million cu m/d. By April 2016, heavy gas injection and other EOR techniques had increased the field's production by 130,000 bbl. Aghajari also provided most of Iran's increased NGL and naphtha production.

• Karanj and Kupal oil fields also experienced some of the highest gas injection increases since 2014. In Karanj, gas injection increased 33% to 3.4 billion cu m during March 2015 and March 2016. Gas injection in the Kupal field rose 83% during the same period to reach 1 billion cu m.

• Azar region of the southern oil fields, 20 km southeast of Mehran in Ilam Province, is undergoing increased development and rising production. The National Development Fund allocated $800 million in 2015 for oil drilling in Azar region. "Field complexity tests NIOC's technology, mainly due to well depth and high pressure," Vakhshouri said. "The wells average 4,700 m, requiring about 270 days to drill. Despite these difficulties, the field's production is expected to reach 30,000 b/d through March 2017."

Condensate, NGL production

Iran currently produces about 750,000 b/d of condensate and NGLs. Pars Oil and Gas Co. (POGC) is the primary condensate producer, followed by the National Iranian South Oil Co. (NISOC) and Iranian Central Oil Fields Co. (ICOFC). NISOC and ICOFC, both NIOC subsidiaries, produce 150,000 b/d and 80,000 b/d of condensate, respectively.

Iranian condensate production, primarily a byproduct of non-associated gas from South Pars field, has risen modestly to about 520,000 b/d in January 2016 from an average of 480,000 b/d in 2015.

NIOC expects production capacity to increase due to higher South Pars gas production from Phases 15-16 and completion of ongoing Phase 16-17 development (Table 3).

Phases 15-16 were completed in January 2016 but produced at only 40,000-50,000 b/d capacity that year. Iran's condensate has high sulfur and mercaptans content, which can make it difficult to sell. Phases 17-18 were expected to be completed by July 2017, adding another 80,000 b/d.

With more investment, Iran's total condensate production capacity could reach 1 million b/d by 2021. That target could prove difficult to reach depending on Iran's ability to attract international investment and technology. Any condensate production increase also depends on Iran's ability to market it.

Joint ventures, MOUs

International oil companies have announced joint ventures and memorandums of understanding (MOU) with Iran. Total SA signed a preliminary agreement in November 2016 to help develop South Pars gas field offshore Iran. The transaction, expected to be finalized this year, marked the first Western energy investment in Iran since sanctions were lifted (OGJ Online, Nov. 8, 2016).

Terms call for Total, CNPC, and Iran's state-owned Petropars to develop South Pars Phase 11, estimated at 1.7 bcfd production capacity.

Total plans to operate Phase 11 with 50.1% interest. CNPC will take 30% interest, with Petropars holding the rest. Total said it will avoid US sanctions on Iran by using euro-denominated cash to finance the transaction.

Initial plans call for Phase 11 to be developed in two parts. The first, estimated to cost $2 billion, will involve 30 wells and 2 wellhead platforms. Two subsea pipelines will transport gas to existing onshore treatment plants.

Royal Dutch Shell PLC in December 2016 confirmed a nonbinding MOU with NIOC "to further explore areas of potential cooperation." Shell declined to specify fields or investment levels.

Dana Energy Co., a private company in Iran, in late January signed an MOU with Austria's OMV to evaluate possible development and redevelopment projects in Iran.

OMV entered Iran in 2001 as operator of the Mehr exploration block in the western part of the country. It discovered Band-E-Karkheh in 2005. In 2016, OMV signed an agreement with NIOC to evaluate various Zagros-area fields in western Iran. OMV also signed a joint study agreement with NIOC Exploration for the Fars area.

The Iranian Oil Ministry has listed 29 non-Iranian oil and gas companies as qualified to participate in upcoming exploration and production tenders.

References

1. Vakhshouri, S., "Post-Vienna: Prospects for Iran's oil production and exports," Atlantic Council Global Energy Center, January 2017.

2. APICORP Energy Research, "Iran's impressive return: more to follow?" Vol. 2, No. 3, December 2016.

3. Nereim, V., "Saudi Arabia Says It Will Work with Trump to Contain Iran," Bloomberg, Jan. 24, 2017.

About the Author

Paula Dittrick

Senior Staff Writer

Paula Dittrick has covered oil and gas from Houston for more than 20 years. Starting in May 2007, she developed a health, safety, and environment beat for Oil & Gas Journal. Dittrick is familiar with the industry’s financial aspects. She also monitors issues associated with carbon sequestration and renewable energy.

Dittrick joined OGJ in February 2001. Previously, she worked for Dow Jones and United Press International. She began writing about oil and gas as UPI’s West Texas bureau chief during the 1980s. She earned a Bachelor’s of Science degree in journalism from the University of Nebraska in 1974.