India's upstream needs independent regulator

Sanjay Kumar Kar

Rajiv Gandhi Institute of Petroleum Technology

Jais, India

India's upstream sector's history suggests that the government's varying roles of policy maker, regulator, and operator has led to conflicts of interest and eroded investor confidence. India could better develop competitive, transparent, and efficient oil and gas operations by forming an independent regulator.

Experts have advocated in favor of an independent regulator for India's upstream sector since the 1990s. The 2014 Kelkar Committee and the Parliamentary Standing Committee on Petroleum and Natural Gas (PSCPNG) (2015-16) reviewed the functions of the Directorate General of Hydrocarbons (DGH) and supported the idea of an independent regulator.

The Kelkar committee recommended upgrading DGH to be an independent regulator with statutory power similar to other sector-specific regulatory bodies.1

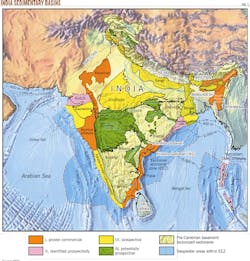

Inefficient management of offshore Block KG-DWN-98/2 (OGJ Online, Jan. 7, 2008), migration of natural gas to adjacent blocks, and ongoing disputes regarding Krishna-Godavari (KG) basin could provide further impetus for regulatory reforms in India's upstream sector (Fig. 1). Aligning regulations along the entire hydrocarbon value chain would also help attract more foreign exploration and production investment in India.

Various committees, including the Dasgupta Committee (1990) and Kaul Committee (1992), have recommended that an independent body regulate oil and gas developments in India, but the government continues to oversee the country's exploration and production. India founded the DGH on Apr. 8, 1993, through a cabinet resolution that gave the Ministry of Petroleum and Natural Gas (MoPNG) administrative control.

Contrary to its intent, the DGH is not a regulator but rather a technical support wing of MoPNG. In 2016, the Justice A.P. Shah committee, appointed by MoPNG, recommended stronger regulations for India's upstream sector, pointing out that DGH needed technical, commercial, and functional efficiency improvements.2 The Shah committee's report suggested the need for a diligent independent regulator to prevent legal entanglements diverting DGH from promoting and managing India's petroleum and natural gas resources.

DGH objectives

The DGH's prime objective is promotion and management of India's petroleum and natural gas resources. Its explicit functions and responsibilities include:

• Offering technical advice to MoPNG on issues relevant to exploration and optimal exploitation of oil and gas reserves in India and abroad.

• Reviewing and advising about the adequacy of exploration programs in the country.

• Reassessment of hydrocarbon resource discoveries.

• Advising the government regarding exploration acreage offerings and relinquishment.

• Reviewing and assessing field development plans to advise the government.

• Reviewing and auditing reservoir management programs.

• Regulating data preservation and storage, including samples pertaining to petroleum exploration, drilling, and production.

The DGH has no constitutional or statutory power to regulate the sector and will likely never do so. It's administrative power is in line with the 1959 Petroleum & Natural Gas Rule.

The functions and responsibilities of the DGH instead are largely advisory, and decision making lies with the government.

Comparing DGH with other sector-specific regulators such as the Telecom Regulatory Authority of India established in 1997, the Securities and Exchange Board of India (1992), and the Insurance Regulatory and Development Authority of India (1999), one can argue that DGH does not in fact regulate India's upstream oil and gas sector.

The DGH is better defined as a technical wing of the government. Roughly 80% of its manpower comes from Oil & Natural Gas Corp. (ONGC), with the remaining 20% from other oil and gas public sector undertakings (PSUs) including Oil India Ltd., Indian Oil Corp. Ltd., Gas Authority of India Ltd. (GAIL), and Hindustan Petroleum Corp. Ltd.

Capacity building

The DGH is sanctioned for 255 officers, but currently has 187.3 DGH officers are appointed on a tenure basis in consultation with CEOs from the various oil PSUs. The DGH does not have its own internal recruitment and ill-defined recruitment rules have delayed appointments of past Directors General. The PSCPNG expressed concern about this ad-hoc approach to staffing and recommended DGH create an internal recruitment mechanism. DGH also has not focused on retention or training.

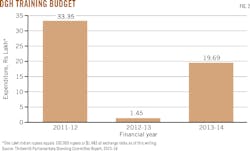

The DGH reported to PSCPNG that it trains staff "from time to time," but the budget for training is low (Fig. 2). Per employee training for 187 officers was Rs.17,834 ($269) in 2011-12. For the following two years, training per employee was Rs.765 ($12) and Rs.10,529 ($189), respectively.

Developing complementary skills is critical for improving DGH's efficiency. Understanding commercial development, economics, and contract management are important interdisciplinary areas in which many officers could benefit from additional training.

DGH officers have access to specialized training through arrangements with deputizing organizations and parent companies, but this has produced mixed results. More importantly, roles with specialized functions require customized training programs from the outset. Roles and responsibilities within a regulatory or administrative environment often differ from those in an operating environment. DGH must develop training systems that increase its capacity and continually address possible skills gaps.

Financial independence

The budget approved by the DGH Administrative Council was fully funded by the Oil Industry Development Board (OIDB) through a grant. The DGH does not generate reve-nue through fees or other sources. Both the Kelkar Committee and the PSCPNG recommended allocation of a separate budget for DGH.

Neither, however, was consistent in recommending sources to fund DGH's daily operations, despite considering financial autonomy to be crucial for its smooth functioning.

Downstream regulator, other sectors

In contrast to India's upstream sector, the downstream sector is well protected through the Petroleum & Natural Gas Regulatory Board (PNGRB), empowered by the 2006 Petro-leum & Natural Gas Regulatory Board Act. The PNGRB has developed regulations in the last 10 years to protect stakeholder interests and promote fair competition. The PNGRB has consistently increased natural gas penetration across the country. From a handful of geographical areas gas distribution has expanded to more than 70 cities and will soon reach more than 100.

Other sectors such as telecommunications, insurance, power generation, and securities and exchange are regulated through appropriate rules developed by their respective regulatory agencies. Performance in these sectors suggests that market efficiency and stakeholder experience have improved.

Upstream regulation

The PSCPNG recommended vesting regulatory power over the upstream sector with PNGRB.3 Doing so, however, would require the government to amend the PNGRB Act to address new roles, functions, and structural issues, as the current PNGRB Act excludes upstream operations.

Investors support the idea of an independent regulator for the upstream sector.4 The government operates on a basic principle of maximum governance-minimum government, but an independent, accountable regulator would provide an even more realistic option for the future. Ideally, the agency would have clear regulatory objectives with no conflicts of interest.5

Investment impact

The PSCPNG has raised concerns about lost investor opportunities in the upstream sector. Through March 2014, companies had invested $23.92 billion ($14.49 billion on explo-ration and $9.42 billion on development) during the New Exploration Licensing Policy (NELP) regime. Despite some criticism, DGH and NELP have expanded India's explora-tion and production, with participating companies increasing to 117 from 35 (11 PSUs, 58 private, and 48 foreign).

A variety of other policy measures, however, have hindered this growth. The include the withdrawal of tax incentives, ineffective handling of cost recovery models, and ineffective micromonitoring leading to disputes and arbitration. The cumulative effect of these actions has been an overall decrease in potential foreign investment.

India has taken corrective measures by introducing the Hydrocarbon Exploration Licensing Policy (HELP) in March 2016 (OGJ, Jan. 2, 2017, p. 42). HELP includes:

• Uniform licensing for exploration and production of all forms of hydrocarbon.

• An open acreage policy.

• An easy to administer revenue sharing model.

• Marketing and pricing freedom for produced oil and natural gas.

HELP is expected to attract more investment and reduce complications, but investment uncertainties are likely to remain without an independent upstream regulator. New policy measures, supported by an independent agency with statutory power, would boost confidence in India's upstream sector, opening the possibility of the government achieving its stated goal of attracting $40 billion in foreign investments to monetize India's petroleum resources.6

References

1. Government of India, Ministry of Petroleum and Natural Gas, "Roadmap for Reduction in Import Dependency in the Hydrocarbon Sector by 2030-Final Report," September 2014.

2. Justice A.P. Shah Committee, "Report Of The Committee On Dispute Regarding Oil And Gas Blocks In KG Basin," Aug. 29, 2016.

3. Ministry of Petroleum & Natural Gas, Standing Committee on Petroleum & Natural Gas (2015-16), "Functioning of Directorate General of Hydrocarbons (DGH) Thirteenth Report," May 2016.

4. Press Trust of India, "Vedanta for an independent regulator for oil and gas sector," The Economic Times, Aug. 29, 2014.

5. Australian Government, Productivity Commission Research Report, "Review of Regulatory Burden on the Upstream Petroleum (Oil and Gas) Sector," April 2009.

6. Mallet, V., "India targets $40bn of untapped oil and gas," Financial Times, Mar. 14, 2016.

The author