Argentina exploration spend increases, operations underway

Tayvis Dunnahoe

Exploration Editor

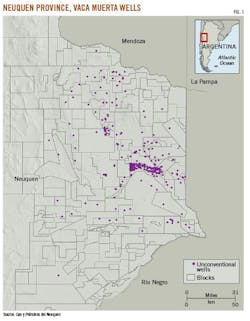

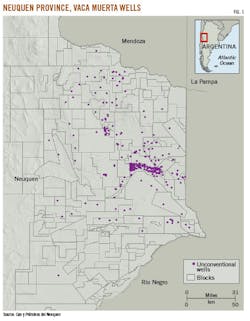

Argentina's Vaca Muerta shale will remain active through 2018 as two major operators have committed a combined $700 million to the region. The 30,000-sq km Vaca Muerta formation is thought to contain 308 tcf of technically recoverable shale gas and 16 billion bbl of oil and condensate. It lies primarily within the Neuquen basin, in the central-western part of the country (Fig. 1).

Chevron signed its initial agreement with YPF SA in July 2013. The company has experienced a 50% reduction in horizontal drilling costs during the 4 years the joint venture has been active in the region. Costs are down to $8.2 million from $16.2 million/well in 2013 (OGJ Online, Oct. 24, 2017). The company added a third drilling rig at its 96,000-acre Loma Campana concession and committed to investing $500 million in development.

Chevron has divested its assets in Argentina's Rio Negro Province to focus on its Neuquen basin operations. President Energy, a subsidiary of the UK's President Petroleum, reported in September that it had purchased 100% of Chevron's producing Estancia Vieja-Puesto Flores block in the northern part of Roca, Argentina. President holds a 90% interest in the blocks with Ediphsa, Rio Negro's provincial energy company, holding the remaining 10% stake.

ExxonMobil Corp. holds six unconventional blocks and one conventional block in Argentina's Vaca Muerta shale. The company has invested $500 million in the region since entering in 2011.

It plans to launch a long-term pilot project at Vaca Muerta that could result in 300 wells and 11 million cu m/d of gas over a 35-year development span. The operator's Los Toldos I South block is 175 km northwest of Neuquen City. An initial $200-million investment will bring seven wells to production and pay to build production facilities and develop export infrastructure (OGJ Online, Oct. 25, 2017).

Neuquen Province has approved the company's development plan. Subsidiary ExxonMobil Exploration Argentina SRL will operate the block with 80% interest. Province-owned Gas y Petroleo del Neuquen SA (GyP) and Tecpetrol each hold 10%.

Neuquen basin

Neuquen basin has a 6,000-m sedimentary column with marine and continental rocks covering from Triassic to the Paleocene. The Precuyo Group, Los Molles, Vaca Muerta, and Agrio fomations form most of the source rocks for production in the region. Most of the area's reservoirs range from late Triassic to late Cretaceous, with seals from Jurassic to Cretaceous.

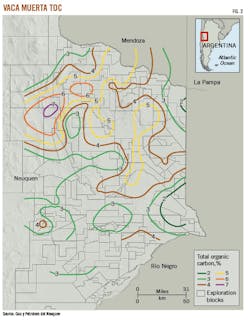

The northwestern part of the basin features predominantly dry gas with wet gas and oil windows moving south and east (Fig. 2).

While Neuquen Province contains the bulk of the basin's prospective acreage, Mendoza Province to the north also holds Vaca Muerta prospective.

GyP put out its fifth call to bid in May for several blocks in the Vaca Muerta play. The company expects up to 50 more investment opportunities through 2018.

Recent activity

GeoPark Ltd. and Wintershall Energia SA discovered a Neuquen basin oil field in the CN-V block in August. The GeoPark Rio Grande West 1, which was drilled to 5,500 ft, flowed 300 b/d of 28° gravity oil naturally with 7% water during early tests of four reservoir sands (OGJ Online, Aug. 10, 2017). It targeted the Lower Cretaceous Neuquen Group. According to GeoPark CEO Jim Park, the company will drill a second exploration well on the block in 2018 and is currently evaluating appraisal well locations. "The field is being tested for the next several months to put the well in production," Park said.

The company reports 15 potential reservoir sands below 1,800 ft.

GeoPark's Argentina work program for 2017 included seven gross wells at a total cost of $5-7 million. Its Argentina program was part of its total 2017 35-well program across Latin America.

"The Argentina program includes exploration projects in the Puelen and Sierra del Nevado blocks in the Neuquen basin," Park said. Five of these wells have been drilled and are being evaluated and completed. Park said the company expects to increase this drilling program in 2018.

The Sierra del Nevado and Puelen blocks are operated by Pluspetrol SA. Puelen block is north of the producing El Corcobo oil field operated by Pluspetrol, and Sierra del Nevado is east of the Llancanelo oil field operated by YPF.

GeoPark's three blocks are in the Mendoza Province (political boundary) which is within the Neuquen basin (geological boundary). The company's 117,000-acre CN-V block has Vaca Muerta upside potential, and there are several Vaca Muerta projects underway in Mendoza Province.

Legacy conventional

GeoPark has a Latin American portfolio of 37 blocks in five countries: Colombia, Peru, Chile, Brazil, and Argentina. "The Vaca Muerta is an exciting new unconventional resource play," Park said. "However, our principal focus in Argentina remains its large attractive low-risk conventional oil and gas opportunities." GeoPark has discovered 600 million bbl of oil in Argentina exploring underdeveloped, low-cost acreage.

Argentina is more suitable to agile, independent operators, according to Park. But increased investment by major operating companies will benefit the Vaca Muerta play by bringing more service providers to the region and lowering the general cost of shale operations.