Harvey curtails petrochemical, refinery NGL demand

Dan Lippe

Petral Consulting Co.

Houston

Just before Labor Day in 2005, Hurricane Katrina caused extensive damage to New Orleans and southern Mississippi. From a midstream perspective, the impact was limited to a few gas plants and a few small fractionators, with most market impacts resulting from extensive damage to offshore oil and natural gas production platforms.

With the exception of Hurricane Ike in 2008, tropical storm and hurricane damage along the western Gulf of Mexico coast had been limited since 2005. Two weeks before Labor Day 2017, however, a minor tropical disturbance just north of the Yucatan Peninsula grew into a tropical storm and soon into Hurricane Harvey, which made landfall northeast of Corpus Christi on August 25 as a Category 4 storm with sustained winds of 130-156 mph, hitting a segment of the South Texas Coast untouched by a major hurricane since Hurricane Celia in 1970.

Ordinarily, the second midstream article for 2017 would focus on recent developments in NGL supply, domestic consumption, and exports during the first half of the year. This year's fourth installment in the series, however, evaluates Hurricane Harvey's disruption to midstream infrastructure, NGL demand in the US Gulf Coast (USGC) ethylene and refinery feedstock markets, and US NGL waterborne exports.

Infrastructure, NGL markets

Landfall and hurricane tracking forecast models called for Harvey to come ashore, reverse course, and return to the Gulf of Mexico, rebuild and strengthen, and then bump along the Upper Texas Coast with record rainfall of 30-50 in. in 3 days before coming ashore a final time somewhere in the Beaumont-Port Arthur, Tex., area. These forecasts were correct on all major points except one: The eye of the storm moved northeast into South Central Texas almost as far as San Antonio before reversing course to return to the Gulf of Mexico via a slow move across the coastal counties of Southeast Texas, including Harris and Chambers Counties, home to the greater-metropolitan area of Houston-Galveston and the NGL-trading hub of Mont Belvieu, Tex., respectively.

The northeast quadrant of all tropical storms in the Atlantic Basin is always the strongest, generating the most rainfall, and Harvey was no exception. Before Harvey, Harris County rainfall records were roughly 35 in. As Harvey slowly moved in an easterly direction, however, Harris and Chambers Counties experienced the full brunt of wind and rain in the northeast quadrant for 3-4 days. Most rain gauges in the two counties recorded 25-50 in. of total rainfall, with Mont Belvieu fractionation and storage operators reporting 50 in. of rainfall.

In these two affected counties, petrochemical companies operate 16 ethylene plants that, when operating at full rates, have a combined capacity of 30.3 billion lb/year and consume 575,000 b/d of ethane as well as 105,000 b/d of propane. These plants were down for 6-8 days at the end of August and 8 days in early September, reducing ethylene production by 1 billion lb, ethane demand by 8.5-9.5 million bbl, and propane demand by 2.0-2.5 million bbl. A few plants experienced major damage due to Harvey-related flooding, still not returning to service even after waters subsided. These plants are likely to remain offline for 4-8 weeks.

Almost all ethylene plants in the Upper Texas Coast (Corpus Christi to Beaumont-Port Arthur) experienced at least 5 days of downtime. Based on PetroChem Wire's daily reports, Petral Consulting Co. estimates ethylene production losses were 0.6-0.7 billion lb during the 10-day period of Harvey's arrival and immediate aftermath. Downtime reduced feedstock demand for ethane by 4.5-5.0 million bbl and 1.3-1.8 million bbl for propane. The storm's slow slide along the Upper Texas Coast also delayed startup of at least two new ethylene plants with a combined capacity of 6.6 billion lb/year, representing about 180,000 b/d of new baseload ethane demand.

During and for 2-3 weeks following the storm, all LPG export terminals along the Upper Texas Coast-except a small export terminal near Corpus Christi-were shuttered, restricted to daylight operations, and subject to US Coast Guard-mandated limitations. Harvey delayed loading 6-7 million bbl of scheduled LPG exports.

By the third week of September, operators had restored fractionation to normal. US Coast Guard restrictions and operator safety regulations, however, continued to limit LPG and ethane exports at export terminals in the Houston Ship Channel and elsewhere in the region. By late September, salt-cavern storage sites were the only midstream operations still constrained by Harvey-related impacts.

Brine quality, supply

Mont Belvieu storage operators depend on the accumulated volumes of fully salt-saturated brine in surface-brine ponds to recover NGL inventory from underground wells in the Mont Belvieu salt dome. Most brine ponds at Mont Belvieu measure 30-ft deep, with ground surfaces covered by a few inches of thick polyethylene sheeting to prevent brine seepage into the underground water supply. Brine ponds also are protected by raised banks on all sides to prevent surface-water runoff from diluting-brine supply. These brind ponds, however, are open-air systems, and rainfall always causes brine dilution.

Rainfall is a common occurrence in Chambers County during spring and summer. Equal to about 10-12% of the capacity of surface brine ponds in Mont Belvieu, annual rainfall in the Upper Texas Coast averages about 50 in., with June usually the wettest month. By late September, when brine supply in surface ponds is at its seasonal peak, typical rainfall (March-September), has reduced salt content to about 90% saturation.

During April-September, NGL markets routinely accumulate surplus supplies of propane and normal butane, and occasionally, surpluses of ethane, isobutane, and natural gasoline. As NGL products are pumped into salt-storage caverns, brine is displaced to the surface and accumulates in surface ponds for use to meet market demand. Storage operators are accustomed to pumping slightly unsaturated brine into salt-cavern storage wells during the winter months. In a typical year, 35-45 million bbl of brine are displaced from storage wells into surface-brine ponds.

Brine supply for winter 2017, however, is likely to be only 75-80% fully salt-saturated because of Harvey unless substantial volumes of salt are dissolved into the diluted-brine supply in surface ponds.

After Mont Belvieu operations normalized in early September, storage operators realized they had to deal with the early and unprecedented problem of how to saturate 45-50 million bbl of unsaturated brine. NGL marketers and traders viewed the substantial dilution of brine supply as a supply disruption that could persist for a few months.

Alongside reducing demand for ethane and propane feedstock, and forcing an immediate need to resolve any problems pumping unsaturated brine into salt-cavern storage wells will cause in fourth-quarter 2017, Harvey-related power outages also reduced pumping capacity into Mont Belvieu storage wells. Limited flow of NGL raw mix into the storage hub consequently forced some South Texas, West Texas, and New Mexico oil and gas producers to flare associated natural gas for several days.

Harvey-related flooding also has delayed startup of two new US ethylene plants that-with a combined capacity of 6.6 billion lb/year-were scheduled to enter service between September-December. Postponed commissioning of these plants, likewise, has reduced previous industry expectations of increased ethane demand during fourth-quarter 2017.

Petral Consulting estimates US gas plants that rejected ethane in August will probably continue to reject ethane in the fourth quarter unless prebuying activity boosts purity-ethane prices to 29-31¢/gal.

NGL raw-mix production

Since 2012, crude oil production has been the primary driver for gas plant NGL production in the USGC, Midcontinent, and Rocky Mountains. After 18 months of free fall in the oil -directed rig count, US oil exploration companies began increasing oil-directed drilling activity in third-quarter 2016, boosting the oil directed rig count to 764 rigs in July-August 2017 before its fall to 751 rigs in September. The oil-directed rig count in Texas was constant at 448-450 during June -September vs. 174 rigs in second-quarter 2016.

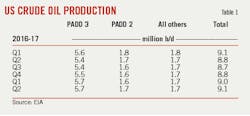

As exploration companies increased drilling activity in the various oil-prone shale plays (mostly in Texas), crude production in the other key states of New Mexico, Oklahoma, North Dakota, Colorado, and Wyoming resumed growth almost immediately. In May-June 2017, oil production in the USGC (PADD 3) reached 5.78 million b/d vs. 5.40 million b/d in May-June 2016 (Fig. 1).

Although rig counts collapsed after fourth-quarter 2014, oil exploration companies continued to drill new wells in Texas and New Mexico, expanding the backlog of drilled but uncompleted (DUC) wells. The US Energy Information Administration (EIA) reported the backlog of uncompleted wells in Texas (Permian, Eagle Ford basins) had ballooned to almost 3,700 wells in August 2017 from 3,100 wells in April and only 2,000-2,100 in fourth-quarter 2014. Even if the rig count in Texas remains constant and equal to the June-September average, Texas-New Mexico crude oil production will continue to increase for the next 12-18 months. Based on 450-b/d average oil production per new well, the current DUC backlog alone will increase Texas-New Mexico production by 1.6 million b/d.

Table 1 summarizes quarterly trends in US crude production through second-quarter 2017.

While Hurricane Harvey had direct but limited impact on central Eagle Ford drilling activity, drilling in the Permian basin remained unaffected.

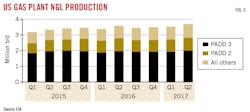

Regional trends. According to EIA statistics, US gas plant NGL production increased in first-quarter 2017 to 3.53 million b/d before rising to 3.71 million b/d in the second quarter. Production of propane and heavy components averaged 2.20 million b/d in first-quarter 2017 and 2.32 million b/d during the following quarter, while year-over-year growth in propane+ production in second-quarter 2017 for the USGC was 29,700 b/d and 38,500 b/d for the East Coast (Fig. 2).

In first-quarter 2017, ethane production averaged 1.33 million b/d, up 134,100 b/d from first-quarter 2016. Ethane production during the second quarter increased to 1.39 million b/d, or 47,700 b/d more than the same period in 2016, according to EIA data (Table 2). Changes in ethane rejection will have consistent and major impacts on trends in US NGL production for the next 18-24 months.

NGL market overview

Three markets account for more than 90% of US NGL demand:

• Petrochemical feedstock.

• Gasoline blending.

• Retail space heating and internal combustion.

All five NGL components are used as feedstock in petrochemical production, and normal butane, isobutene, and natural gasoline are used in gasoline blending. Retail space heating and internal combustion-engine markets, however, consume only propane. Of the three primary domestic end-use markets, only the petrochemical industry has the potential to considerably increase domestic NGL consumption. During 2017-19, petrochemical companies will start more than 15 billion lb/year of new ethylene capacity based on primarily purity-ethane feedstock. In most new plants, ethane will be the only feedstock.

Petrochemical feedstock demand

Petral Consulting estimates ethylene feedstock demand by direct contact with ethylene producers. Other segments of the petrochemical industry include propane dehydrogenation (propane), methyl tertiary butyl ether (MTBE; normal butane, isobutane), and propylene oxide (isobutane).

Demand for NGL feed in the US ethylene feedstock market was 1.6 million b/d in first-quarter 2017 (84,200 b/d lower than first-quarter 2016) before increasing in second-quarter 2017 to 1.7 million b/d (188,500 b/d higher vs. second-quarter 2016). Increased demand for NGL feed resulted primarily from higher ethylene production in second-quarter 2017, which was 18 million lb/day more than the same period in 2016.

In July, demand for NGL feed was 1.77 million b/d before falling in August to 1.55-1.60 million b/d amid a combination of previously scheduled and Harvey-precipitated outages at ethylene plants along the Upper Texas Gulf Coast. NGL feedstock demand in September likely was little changed from August, as production levels remained about the same between early September and late August.

Ethane accounted for 69% of ethylene industry NGL-feedstock demand in first-quarter 2017 and 68% in the second quarter. During the first quarter, US ethylene producers increased ethane demand in multifeed ethylene plants to 1.2 million b/d and to 1.26 million b/d in the second quarter, both new record highs for ethane demand on a quarterly-average basis. Record-high demand for ethane on a monthly basis occurred in June 2017, with demand reaching 1.29 million b/d (Table 3).

Gasoline-blending demand

The refining industry is the second largest industrial-commercial market for NGLs. Refineries buy normal butane, isobutane, and natural gasoline for use in gasoline blending. As is true for propane demand in retail markets, refinery demand for normal butane is strongly seasonal but demand for isobutane and natural gasoline is only moderately seasonal.

Refinery demand for normal butane reaches its seasonal peak November-January, but refinery demand for isobutane and natural gasoline is usually at its seasonal peak in May through August. The counter-cyclical nature of refinery demand for isobutane and normal butane offsets some of the strongly seasonal demand for normal butane.

EIA statistics for refinery inputs show demand for butanes and natural gasoline was 547,000 b/d in first-quarter 2017. Consistent with typical seasonal patterns, demand declined to 440,000 b/d in second-quarter 2017.

Refinery inputs of gas plant normal butane were 216,700 b/d in first-quarter 2017, or 6,200 b/d (2.9%) more than first-quarter 2016. Consistent with the shift to summer RVP limits, refinery inputs of gas plant normal butane declined to 64,300 b/d in second-quarter 2017, still up 1,600 b/d (9.3%) from second-quarter 2016, according to EIA data.

Some refineries purchase gas plant normal butane during the offseason for use as clean feed to internal butane isomerization units. Since 2011, winter-RVP blending demand for normal butane has increased by 89,000 b/d (54%). Refiners, in response to weaker prices, have found ways to increase normal butane's contribution to winter gasoline supply. If prices in winter 2017 are stronger-especially during the fourth quarter-RVP-blending demand will probably fall well below winter-2016 levels.

EIA statistics show refinery inputs of isobutane fell to 193,300 b/d in first-quarter 2017 vs. 212,100 b/d in fourth-quarter 2016. The decline was consistent with seasonal operating trends in first-quarter 2017, including reduced crude runs and lower feed rates at fluid catalytic cracking units (FCCU). During second-quarter 2017, as crude runs and FCCU feed rates rebounded, refinery inputs of isobutane increased to 212,800 b/d, up 7,600 b/d (3.7%) from second-quarter 2016.

The factors that determine refinery demand for natural gasoline differ from demand drivers for normal butane and isobutane. Petral Consulting's ongoing economic analysis indicates refineries primarily seek natural gasoline for use as supplemental feed to pentane-hexane isomerization units. While some refineries have these units, many do not. This consideration results in demand variability that is not seasonal but often random (Table 4). Refinery demand for natural gasoline was 136,900 b/d in first-quarter 2017 and 163,000 b/d during the second quarter, according to EIA statistics.

Refiners can use natural gasoline directly as a blendstock for gasoline without the octane upgrade from pentane-hexane isomerization units. Until May-June 2017, economics for direct blending were rarely favorable. In second-half June, however, prices were 8-14¢/gal less than direct-blending values. Favorable economics for direct blending contributed to the surge in refinery demand for natural gasoline in coastal refineries in Texas and Louisiana. As natural gasoline production from raw-mix fractionation facilities in Mont Belvieu increases-and local production in Alberta limits a need for natural gasoline imports-weaker prices in Mont Belvieu will continue to support stronger refinery demand.

Hurricane Harvey disrupted refinery operations in the Upper Texas Coast in late August-early September, during which time EIA statistics showed PADD 3 crude runs were about 3 million b/d (33%) less vs. the first 3 weeks of August. With reduced crude runs translating directly into reduced gasoline production as well as reduced demand for butanes and natural gasoline-and with September the first full month of RVP-blending demand for normal butane-downtime had limited impact on total winter-season demand. Petral Consulting estimates demand for isobutane fell by 35,000-40,000 b/d, with demand for natural gasoline down by 30,000-50,000 b/d during the period.

NGL exports

Waterborne exports continued to offer an outlet for the US NGL product-supply surplus during first half-2017. According to statistics published by US International Trade Commission (USITC), NGL exports (all products) increased to 1.44 million b/d in first-quarter 2017, up 0.24 million b/d (20%) from first-quarter 2016. During second-quarter 2017, exports declined from the previous quarter to 1.33 million b/d, still up 112,000 b/d (9%) vs. the same quarter in 2016 (Table 5).

Propane exports accounted for 69% of total NGL exports in first-quarter 2017 but only 62% in the second quarter. US ITC statistics showed first-quarter propane exports to buyers in the Asia Pacific were 509,200 b/d (55% of total waterborne exports) and 374,600 b/d in the second quarter. Before 2017, all exports to Asian-Pacific destinations originated from export terminals located in the Texas Gulf Coast. During first-quarter 2017, however, Sunoco Logistics Partners LP's Marcus Hook, Pa., terminal shipped one cargo before shipping another two cargos in the second quarter. Exports to Asian-Pacific destinations accounted for 55% of total waterborne exports in the first quarter and 50% in the second quarter.

Fig. 3 shows annual trends in US NGL exports.

Hurricane Harvey forced the shutdown of all export terminals in the Texas Gulf Coast during the last 8 days of August. Based on USGC exports in June and July, Petral Consulting estimates Harvey-related downtime for Texas Gulf Coast terminals resulted in an export backlog of 6-8 million bbl of propane. In December 2016 and January 2017, propane exports from USGC terminals were 28 million bbl and 30 million bbl, respectively. Based on a typical monthly loading schedule of 18-22 million bbl, USGC LPG export terminals had sufficient capacity to fully work off the backlog carried forward from August to September by the end of September.

NGL price trends

Petral Consulting tracks gas processing economics based on netback values of NGL raw mix for gas plants in Texas, New Mexico, and the Rocky Mountains. Gas plants in these regions are the primary sources of NGL raw-mix deliveries to fractionators in Mont Belvieu. We determine netback values for gas plants in these regions by subtracting fractionation fees and raw-mix pipeline tariffs from Mont Belvieu spot prices.

Mont Belvieu NGL prices were generally stronger during first-half 2017 vs. first-half 2016. Propane exports in winter 2017 were 32.7 million bbl more than in winter 2016, which was enough to liquidate 38.6 million bbl of propane inventory in primary USGC storage. Furthermore, inventory continued to fall through the end of April, reducing the inventory build season by 30 days, or 16%, and leaving inventory build rates during May-July at less than their 3-year average. Overall inventory in USGC storage remained 16-18 million bbl less than in 2016. Inventory on May 1, 2017, was 52% down from May 1, 2016, with inventory surplus on May 1, 2017, only 10 million bbl vs. an average of 30-32 million bbl on that date between 2005-2010.

Historically, competition among various feedstock options available to ethylene plants along the Texas-Louisiana Gulf Coast has been the paramount influence on Mont Belvieu NGL prices. When supply of one major feedstock tightens, the bullish impact affects prices of other products.

Cash costs for ethylene production in second-quarter 2017 were 13¢/lb, equal to average costs in second-quarter 2016. Producers and traders recognized propane supply likely would remain tight at the beginning of winter 2017, prompting spot prices in Mont Belvieu higher to 88¢/gal in mid-September from 60¢/gal in June.

Ethylene cash costs increased as well, rising to 28¢/lb in September from 13¢/lb in June. Production costs based on propane in September were 5¢/lb more than for natural gasoline. A cost premium of 5¢/lb should encourage ethylene producers to reduce propane demand and increase the use of natural gasoline or refinery-sourced supplies of light paraffinic naphtha.

In June, spot prices for gas plant normal butane were 70¢/gal, with ethylene cash costs less than 7¢/lb. By mid-September, gas plant normal butane spot prices were 100-102¢/gal and ethylene cash costs, 19¢/lb. While ethylene production costs for normal butane jumped 12¢/lb, they remained lower than prices for propane and natural gasoline but 6¢/lb more than ethane prices. During second-quarter 2017, normal butane inventory in USGC storage increased 14.4 million bbl, reversing a 2.3-million bbl deficit. The sustained increase in normal butane inventory indicates plentiful butane supply, with the bullish cross-product influence between propane and normal butane a key factor supporting the second-quarter 2017 surge in normal butane prices.

Although tighter supply supported rising prices for propane and normal butane, gas processing plants continued to reject 400,000-600,000 b/d of ethane. As a result, ethane prices were 24-26¢/gal in second-quarter 2017 vs. 22-25¢/gal in the first quarter. Ethane prices remained within this narrow range in third-quarter 2017. Upward pressures on spot prices for purity ethane will begin to emerge in the fourth quarter when two or three new ethylene plants start up and approach sustained, full-capacity operations. As feedstock demand increases, spot prices in Mont Belvieu will increase to support full-ethane recovery from gas plants with higher full-recovery costs.

Near-term outlook

Since 2011, US oil producers' application of horizontal drilling and hydraulic fracturing to oil-prone shale plays has been the key driver for ongoing growth in US NGL production and midstream infrastructure.

The November 2016 agreement between the Organization of Petroleum Exporting Countries' (OPEC), Russia, and a few non-OPEC oil-producing countries to stabilize global crude prices and provide the foundation for a sustained recovery to $60/bbl for the key global benchmarks by voluntarily reducing production by 1.6 million b/d, however, posed an inevitable challenge for US producers developing shale oil resources.

Led by Saudi Arabia, the late-2016 OPEC decision temporarily achieved its objective of stabilizing crude prices before US oil producers responded aggressively, increasing drilling activity in key shale plays in Permian, Eagle Ford, and Bakken basins to almost immediately increase domestic production levels. The US oil-directed rig count steadily increased until June 2017, when benchmark West Texas Intermediate (WTI) spot pricing briefly slipped below $45/bbl.

During first-half 2017, oil production in Texas, New Mexico, and North Dakota increased at an annualized rate of 774,000 b/d. These three states are now the primary drivers of US crude production.

By mid September, WTI spot prices recovered to $50/bbl. As oil prices moved higher in third-quarter 2017, the Baker Hughes weekly rig count showed increases in the oil-directed rig count, which rose to 768 by mid August. While Hurricane Harvey triggered a 6-week decline in rig counts, the oil-directed rig count recovered to 750 by the final week of September. The rig count in the Permian Basin, however, has never slowed, steadily increasing since OPEC's November-2016 decision.

Petral Consulting's forecasts for US gas plant NGL supply are based on continued growth in US oil production during the next 3-5 years. As crude oil and associated gas production in Permian, Eagle Ford, and Bakken shale regions continues to increase, US gas plant NGL production will also rise. Additionally, demand for ethane will increase between 350,000-420,000 b/d as petrochemical companies commission 15 billion lb/year of new ethylene capacity by yearend 2018. As ethane demand grows, ethane prices in Mont Belvieu will increase to levels that support full-ethane recovery for most US gas plants in the USGC, Kansas-Oklahoma, and Rocky Mountain regions. By mid-2018, US gas plant NGL production will increase to about 4 million b/d.

Finally, Canadian oil producers quietly increased drilling activity in Duvernay, Alta., particularly in the condensate zone of the Duvernay shale. Production of light and medium-gravity crude oil and lease condensate in Alberta during second-quarter 2017 was 30,000 b/d more than in fourth-quarter 2016, while gas plant NGL production during first-half 2017 was 58,000 b/d higher vs. the same period in 2016.

The author

Daniel L. Lippe ([email protected]) is president of Petral Consulting Co., which he founded in 1988. He has expertise in economic analysis of a broad spectrum of petroleum products including crude oil and refined products, natural gas, natural gas liquids, other ethylene feedstocks, and primary petrochemicals.

Lippe began his professional career in 1974 with Diamond Shamrock Chemical Co., moved into professional consulting in 1979, and has served petroleum, midstream, and petrochemical industry clients since. He holds a BS (1974) in chemical engineering from Texas A&M University and an MBA (1981) from Houston Baptist University. He is an active member of the Gas Processors Suppliers Association.