OGJ Newsletter

Saudi-Russia warming yields collaboration

Gazprom Neft and Saudi Aramco signed a memorandum of cooperation on oil and gas as Saudi King Salman met with Russian President Vladimir Putin during a visit signaling a warming of relations between the world's two top crude oil producers. Other cooperation agreements were expected.

Long-tense relations, aggravated by divergent allegiances in the Syrian civil war, began relaxing last year as the countries collaborated to limit oil supply in support of crude prices.

Crown Prince Mohamed bin Salman, the king's favorite son, visited Moscow in May seeking Russian investment in projects related to Vision 2030, a program he instigated to modernize the Saudi economy and move away from dependence on oil.

The memorandum between Gazprom Neft and Aramco envisions collaboration in drilling and workover technologies, improvements to pumping systems, and development of large-scale nonmetal pipes.

Gazprom Neft said the companies also plan to discuss collaboration in research and development and engineering. The companies also might collaborate on production of oil field equipment in Russia or Saudi Arabia.

During Salman's visit, the governments were expected to establish a $1 billion fund for energy investments and discuss other areas of cooperation.

'National vision' urged for Canadian energy

The Canadian Association of Petroleum Producers has proposed a six-point approach to enable Canada "to share its energy prosperity abroad and drive to a lower-carbon economy at home." The group made its recommendations, which it said are based on "an analysis and forthcoming report," the day before Natural Resources Canada opened a forum in Winnipeg "to explore Canada's path to affordable energy, the next generation in technology and innovation, energy governance, and Canada's role in the global energy transition."

CAPP called on the federal government to create "a national vision for oil and gas development" that focuses on "accessing world markets, effective regulatory outcomes, a commitment to innovation, global climate leadership, and enabling a fiscal framework to achieve the vision."

It also called for a national, clean-energy task force that includes oil and natural gas and is committed to research and development and a fiscal framework that encourages investment in Canadian oil and gas innovation.

Recommending "a competitive, equivalent climate-leadership plan," the industry group said the approach should be "balanced" and include "an equivalency basis including Alberta, British Columbia, Quebec, and Ontario, where there is a price on carbon."

CAPP said trade policy should recognize the oil and gas industry's exposure to international pressures to "prevent carbon leakage" and preserve competitiveness of Canadian producers.

It called for "an effective and efficient, outcomes-based approach to regulation," which it said will improve access to new customers and encourage investment. And it urged improvement in market access "to ensure Canadian oil and natural gas production can reach more customers."

BNP Paribas quits shale, oil sands funding

France's largest bank said it will shun investment in unconventional and Arctic oil and gas resources as the country's lower house of parliament upheld a government plan to ban oil production. BNP Paribas Group said it no longer would do business with producers, distributors, marketers, or traders focused on oil and gas from shale or oil sands.

It also said it won't finance projects mainly involved in transport and export of oil and gas from shale or oil sands.

BNP Paribas also will quit financing oil and gas exploration and production in the Arctic.

"These measures mean that BNP Paribas will gradually cease to finance a significant number of players who are not actively part of a transition to a lower-carbon economy," the firm said.

It said it is aligning its financing and investment with a global target of limiting atmospheric warming to 2°C. above a preindustrial baseline by 2100.

"To achieve this goal, the world must reduce its dependence on fossil fuels, starting with oil and gas from shale and oil from tar sands, whose extraction and production emits high levels of greenhouse gases and has harmful effects on the environment," it said.

BNP Paribas earlier withdrew from financing coal mines and coal-fired power plants. BNP Paribas wants its financing of renewable energy projects to reach €15 billion by 2020.

By a vote of 316-99, meanwhile, the National Assembly supported the government's initiative to cease exploration and production licensing and oil production by 2040.

French production recently was 15,000 b/d of oil.

The government also plans to halt sales of cars powered by diesel or gasoline by 2040.

Shell, Kufpec cancel Thailand deal

Royal Dutch Shell PLC and Kuwait Foreign Petroleum Exploration Co. (Kufpec) have canceled their deal in which a Kufpec unit was to buy stakes in two Shell subsidiaries that hold interest in Bongkot field offshore Thailand.

Kufpec Thailand Holdings Pte. Ltd. in January agreed to acquire a stake in Shell Integrated Gas Thailand Pte. Ltd. (SIGT) and Thai Energy Co. Ltd. (TEC) for $900 million. SIGT and TEC together hold 22.222% interest in Bongkot field and adjoining acreage off Thailand consisting of Blocks 15, 16, and 17 and Block G12/48.

The deal was announced alongside Shell's $3.8-billion sale of UK North Sea assets to Chrysaor Holdings Ltd. as part of Shell's ongoing divestment program after buying BG Group.

Shell, which to date has completed or announced more than $25 billion in divestments, says it remains on track to meet its target of $30 billion of sales between 2016-18.

Shell's partners in the Bongkot asset are operator PTT Exploration & Production (PTTEP) with 44.445% interest and Total SA with 33.333%.

SIGT and TEC will continue to support PTTEP in the operation and development of Bongkot, Shell says. SIGT also plans to participate in an upcoming licensing round for the extension of the Bongkot concession.

ExxonMobil logs Turbot as fifth discovery off Guyana

With an additional well already planned for 2018, ExxonMobil Corp. has completed its Turbot-1 well in the southeastern portion of the Stabroek block, about 30 miles southeast of the Liza Phase 1 project. The Stena Carron, which spudded Turbot-1 on Aug. 14, is moving to the Ranger prospect.

The Turbot-1 well encountered 75 ft of high-quality, oil-bearing sandstone in its primary objective, the operator said. The well was drilled to 18,445 ft in 5,912 ft of water.

In July, ExxonMobil reported the 500 million-boe Payara discovery, which is northwest of the Liza Phase 1 project. At the time, the company estimated the 26,800-sq-km Stabroek block to contain 2.25-2.75 billion boe in recoverable resources.

Guyana does not currently produce any oil; therefore ExxonMobil's latest discovery sets up the country for future offshore exploration. Pablo Medina, Wood Mackenzie Ltd.'s senior analyst, Latin America upstream, said, "We expect around 350,000-400,000 b/d of oil production by 2026, making Guyana one of top oil producers in Latin America."

Chevron picks up new permits off Western Australia

Chevron Australia Pty. Ltd. has acquired three exploration permits in the north Carnarvon basin off Western Australia.

The permits-WA-528-P, WA-529-P, and WA-530-P-are contiguous and cover 23,170 sq km. They lie in deep water north of the company's Gorgon-Jansz and Wheatstone systems about 220 km northwest of Dampier.

Chevron Australia will operate the permits with a 50% interest and is joined by Woodside Petroleum Ltd., which holds the remaining 50%.

Nigel Hearne, Chevron Australia managing director, said the new permits strengthen the company's position in the gas-prone region where it already has a significant established network of production systems.

Hearne added that offshore Western Australia is a global focus area for Chevron. The company has already discovered 50 tcf of gas resources and is working towards full commercialization through collaboration and efficient use of existing equity or third-party facilities.

Eni looks to Crete to further East Med exploration

Italy's Eni SPA is eyeing acreage near Crete as Greece works toward opening its offshore to oil and gas development. According to Greece's Kathimerini web site, Eni is taking the likely step from its foothold on the neighboring Cypriot market to expand its scope in the southeastern Mediterranean and the Greek market.

The company is expected to face strong competition with the consortium of Hellenic Petroleum SA, Total SA, and Edison SPA considering the same area for development. Competition will strengthen Greece's negotiating position ahead of signing concession contracts.

The Hellenic Petroleum consortium is interested in the block offshore Crete and south of the Peloponnese, while Energean Oil & Gas SA is interested in the area southwest of Corfu and west of Lefkada. The former block is an extension of the Herodotus basin that accounts for Israel's large gas reserves, while in the Ionian Sea belongs to the broader Periadriatic zone, which is geologically related to the regions of Montenegro, Croatia, and Albania, all of which are on the verge of exploration and development.

Yannis Bassias, head of the Hellenic Hydrocarbons Resources Management Co., told OGJ in August that Greece may have up to three successful exploration wells drilled offshore by 2020.

Total to study deep, ultradeep areas off Guinea

Total SA and the National Office of Petroleum of Guinea (ONAP) signed a technical evaluation agreement to study some 55,000 sq km in deep and ultradeep areas offshore Guinea Conakry.

The agreement gives Total a year to assess the potential of the basin based on existing data and the option to select three licenses on which to start an exploration program. As part of the deal, Total will also train ONAP staff to develop their technical skills in exploration and production.

Kevin McLachlan, Total senior vice-president, exploration, noted the agreement gives his company "the opportunity to evaluate a very large area located in an extension of the prolific Mauritania-Senegal basin" where Total already has a presence.

"This will allow us to capitalize on our know-how and experience acquired in West Africa," he said.

Drilling & Production — Quick TakesOPEC production rose 90,000 b/d in September

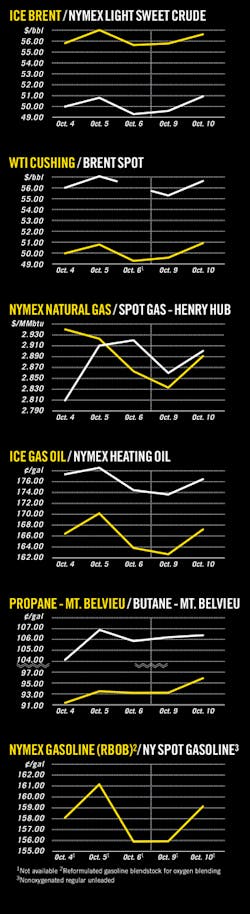

The Organization of Petroleum Exporting Countries raised its forecast for crude demand, adding that production by members rose by nearly 90,000 b/d in September despite production-cut targets by OPEC members and some other major producers.

The statistics came in OPEC's latest Monthly Oil Market Report, which analysts say complicates efforts by the cartel and other major producers to limit output and reduce world oil supplies. The September production was 32.75 million b/d, which was about 100,000 b/d higher than the average in 2016.

OPEC also noted an increase of 31,000 b/d by non-OPEC countries in September, which it attributed to rising US production. OPEC raised its forecast for world oil demand growth to 1.5 million b/d in 2017 and 1.4 million b/d in 2018.

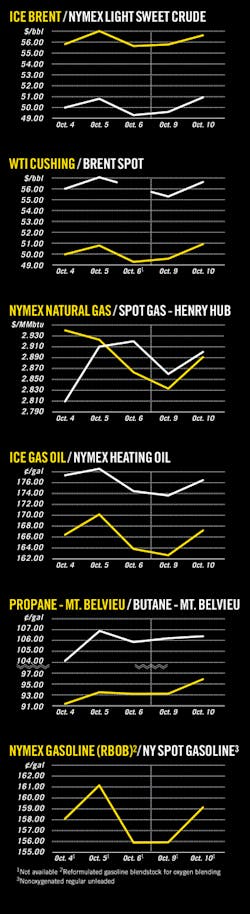

Regarding oil prices, OPEC expects Brent to remain at $50-55/bbl next year. Brent traded higher near $57/bbl on Oct. 11.

German, Egyptian companies to partner with Pemex

Deutsche Erdoel AG (DEA) of Germany has acquired a 50% license share and operatorship of onshore Ogarrio oil field in southern Mexico's Tabasco state 197 km west of Villahermosa.

The share was offered in the latest farmout auction of the National Hydrocarbons Commission. Petroleos Mexicanos (Pemex) will be the partner, holding the other 50%.

Separately, Cheiron Holdings Ltd. of Egypt, part of the Pico Group, was let a contract to join Pemex in a 50-50 partnership to develop onshore Cardenas and Mora fields, also in Tabasco.

DEA said Ogarrio's current gross production is about 12,500 boe/d. The mature field was discovered in 1957. Nearly 530 wells have been drilled. More than 100 wells are now active.

In June, DEA won a shallow water exploration license on Block 2 in consortium with Pemex in the Gulf of Mexico.

No bids were received recently for two shallow water fields under a production-sharing contract.

"At the end of the day the result is favorable for Pemex, which will receive cash payments for more than $500 million," Pemex's Chief Executive Jose Antonio Gonzalez Anaya said at an Oct. 5 news conference.

Reliance lets contract for gas project off India

Reliance Industries Ltd. (RIL) has let an engineering, procurement, and construction contract for a subsea production system for dry natural gas on Block KGD6 offshore eastern India to OneSubsea, a Schlumberger Ltd. company.

The EPC includes trees, subsea manifolds, control system, tie-in system, multiphase meters, intervention tooling, and testing equipment for R series (D34) fields. The contract also includes installation and commissioning for life-of-field services.

BP PLC and RIL are developing the R-Series deepwater gas fields on Block KGD6. The R-series is in more than 2,000 m of water about 70 km offshore. The fields will be developed as a subsea tieback to the existing control and riser platform.

The project is expected to produce as much as 12 MMcfd of gas. It is expected to come on stream in 2020.

It's the first of three planned projects on Block KGD6 that are expected to be developed in an integrated manner, producing from about 3 tcf of discovered gas resources.

Development of the three projects, with total investment of $6 billion, is expected to bring a total 1 bcfd of gas production on stream over 2020-22.

PROCESSING — Quick TakesOrpic's Mina Al Fahal refinery enters turnaround

Oman Oil Refineries & Petroleum Industries Co. (Orpic) has shuttered its 106,000-b/d Mina Al Fahal refinery near Muscat for 45 days of planned maintenance and turnaround activities.

The scheduled shutdown, which began on Oct. 3, will run through Nov. 16 and involve a series of maintenance works aimed at improving the facility's performance, Orpic said.

Undertaken every 4 years, this year's turnaround will include necessary unit inspections and testing, as well as unidentified debottlenecking, revamp, and catalyst-regeneration projects required to ensure reliability and improved efficiency of all refinery downstream units, the operator said.

Specific work will cover modifications to the existing plant to allow a full integration of the new units, under construction as part of the Sohar Refinery Improvement Project and Muscat Sohar Product Pipeline project, including a distribution depot in Jifnain, that are due for commissioning later this year.

Orpic said all product supply during the turnaround has been meticulously scheduled through the firm's other delivery points to ensure product delivery to all local companies.

Gazprom, KMG explore creation of gas processing JV

PJSC Gazprom of Russia and Kazakhstan's state-owned JSC National Co. KazMunayGas (KMG) are exploring the possibility of creating a joint venture to process gas from Karachaganak oil, gas, and condensate field using the capacities of the existing Orenburg gas processing plant in Russia.

The companies signed a roadmap agreement for setting up the Russian-Kazakhstani JV at the 7th St. Petersburg International Gas Forum on Oct. 5, Gazprom said.

As part of the roadmap, the parties have agreed to create a working group as well as conduct a feasibility study for the proposed combine.

The companies, however, did not disclose a timeframe for when they would reach a final decision on the new group.

Discussion for this latest possible collaboration follows an existing partnership between Gazprom and KMG in their KazRosGas LLP venture, which was established in June 2002 on a parity basis for processing gas from Karachaganak field at the Orenburg gas plant and selling it to consumers in Kazakhstan and Russia beginning in 2007.

The Orenburg plant has installed capacities to process 37.5 billion cu m/year of natural and associated gas as well as 6.26 million tonnes/year of oil and gas condensate, according to Gazprom's web site.

Veresen starts up second Montney gas plant

Veresen Midstream LP, a 50-50 venture of Veresen Inc. and Kohlberg Kravis Roberts & Co. LP started up the 400-MMcfd Sunrise processing plant on Sept. 27 in the Montney area of northeastern British Columbia's Dawson region.

Sunrise is the second of three processing plants that support Calgary-based Encana Corp.'s condensate-focused growth plan in the Montney. The first plant, the 200-MMcfd Tower rich-gas processing plant, began operating on Sept. 20.

Both plants began operations ahead of schedule and under budget, Encana said. The first of two 200-MMcfd trains at the third plant, the Saturn processing plant, is expected to be in-service by yearend, followed by the second train during first-half 2018. The Towerbirch lateral pipeline that connects all three plants to the NGTL system also started up on Oct. 1.

Encana's midstream agreement with Veresen Midstream LP enables Encana via the Cutbank Ridge Partnership to construct and operate the Tower, Sunrise, and Saturn plants, as well as any future building opportunities, on behalf of Veresen Midstream on a contracted basis.

Veresen Midstream funds and owns the facilities and Encana pays to use them through a fee-for-service agreement.

TRANSPORTATION — Quick TakesChevron brings Wheatstone LNG Train 1 on stream

Chevron Australia has begun production from Train 1 of its $34-billion Wheatstone LNG project in northwest Western Australia with the first cargo scheduled to be shipped soon.

Train 2 is expected to be brought on stream in 6-8 months, which will take the project up to its full capacity of 8.9 million tonnes/year of LNG.

In a deal signed with Alinta Energy in 2016, Chevron also will supply 200 terajoules/day of gas from the Wheatstone plant into the Western Australian grid. The 7-year agreement is for the delivery of 20 petajoules/year of gas starting in 2020.

The project was originally scheduled to come on stream at yearend 2016, but suffered a number of construction delays and cost increases.

Gas from offshore Wheatstone and Iago fields is piped to the onshore production facilities about 12 km west of Onslow on the Western Australia coast.

During construction phase the project created in excess of 7,000 jobs and more than $20 billion (Aus.) was spent on local goods and services through 300 different Australian firms.

IEnova buying stake in Los Ramones II Norte pipeline

Infraestructura Energetica Nova SAB de CV (IEnova), the Mexican subsidiary of San Diego-based Sempra Energy, has acquired Pemex Transformacion Industrial SA de CV's interest in Ductos y Energeticos del Norte, and, as a result, IEnova will increase its indirect interest in the Los Ramones II Norte natural gas pipeline to 50% from 25%.

IEnova will acquire Pemex's stake in the pipeline for $231 million plus the assumption of $289 million in debt, representing Pemex's portion of the outstanding debt in the pipeline.

The 452-km, 42-in. OD pipeline began operations in February 2016 and transports gas from Nuevo Leon to San Luis Potosi. It has a designed transportation capacity of 1.42 bcfd and two compressor stations. Los Ramones II Norte interconnects with the Los Ramones I pipeline and the Los Ramones II Sur pipeline in central Mexico.

The deal is expected to close in the fourth quarter once required authorizations have been obtained, including approval from Mexico's Federal Antitrust Commission.

Targa Resources creates Grand Prix NGL pipeline JV

Targa Resources Corp. reported that it will sell 25% joint venture interest in its previously announced Grand Prix natural gas liquids pipeline to funds managed by Blackstone Energy Partners. Once the deal is completed, Grand Prix will be a 300,000-b/d common-carrier NGL pipeline from the Permian basin to Mont Belvieu, Tex., with expansion capability to 550,000 b/d.

In a concurrent deal, Targa and EagleClaw Midstream Ventures LLC, a Blackstone portfolio company, signed a long-term raw product purchase agreement for transportation and fractionation services whereby EagleClaw will dedicate and commit NGLs associated with its gas volumes produced or processed in the Delaware basin.

Separately, Targa also reported that it has signed a letter of intent along with Kinder Morgan Texas Pipeline LLC and DCP Midstream LP with respect to the joint development of the proposed Gulf Coast Express Pipeline, which would provide an outlet for increased gas production from the Permian basin to the Texas Gulf Coast.

As part of the agreements, Targa would own 25% equity in GCX and would commit volumes to the proposed project, including volumes provided by Pioneer Natural Resources Co.

GCX is expected to have capacity of 1.92 bcfd and would include a lateral into the Midland basin consisting of 50 miles of 36-in. pipeline and associated compression.

The expected in-service date of the pipeline continues to be scheduled for second-half 2019, pending the timely completion of definitive agreements with shippers and a final investment decision by the three parties.