OGJ Newsletter

Turkey backs Iraq on oil after Kurdish vote

The government of Turkey said it will deal exclusively with the Iraqi government on oil exports after voters in the semiautonomous Kurdistan Region of Iraq supported independence in a controversial referendum.

Assurance from Turkish Prime Minister Binali Yildirim of support for Baghdad followed threats before the vote to close the pipeline that carries crude oil from Iraqi Kurdistan across Turkey to Ceyhan on the Mediterranean.

About 72% of eligible voters participated in the Sept. 25 referendum, which supported negotiations leading to separation from Iraq by nearly 93%.

Yildirim told Iraqi Prime Minister Haidar al-Abadi in a Sept. 28 telephone conversation that Turkey would deal only with Iraq on exports and that Iraq had "support of his country for all decisions," according to press reports.

Shutdown of the pipeline across Turkey would block shipment of as much as 650,000 b/d of crude, sales of which are crucial to Iraqi Kurdistan.

The Kurdish Regional Government, debts of which have grown to an estimated $20 billion during the 3-year slump in crude-oil prices, lists the absence of revenue-sharing promised in the Iraqi constitution among its grievances against Baghdad.

Meanwhile, the Iraqi parliament on Sept. 27 said Abadi should use military force to reclaim the region around giant Kirkuk oil field in northern Iraq.

Kurdish Peshmerga forces have controlled the city of Kirkuk and surrounding areas since 2014, when they defeated Islamic State insurgents after soldiers of the Iraqi military fled.

The Iraqi segment of the northern export pipeline between Kirkuk and the Turkish border is idle. But two other pipelines now connect Kurdish oil fields with the pipeline at Fishkhabur on the border.

Turkey and the central Iraqi government were joined in their opposition to the referendum by Iran. Turkey and Iran have large Kurdish populations and histories of clashes with Kurdish militants.

The US and United Nations also opposed the referendum.

Fitch: Lower costs, US shale likely to limit oil prices

Lower world production costs, US shale growth potential, and shale producers' ability to quickly respond to changing market conditions likely will keep average annual oil prices below $60/bbl for the long term, Fitch Ratings of Chicago said.

But Fitch analysts noted oil prices remain volatile and could periodically exceed their assumptions.

"We have updated our base-case price assumptions to reflect the limited upside for prices in the long term," Fitch said. "We have also reduced our UK National Balancing Point gas price assumptions due to our updated oil price assumptions and an expectation that global liquefied natural gas capacity additions will probably result in a supply surplus."

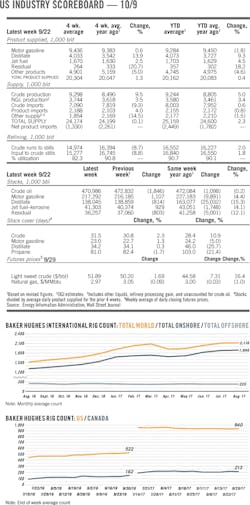

The US Lower 48 land rig count has risen around 45% since Dec. 31, 2016, contributing to a rebound in US crude production of more than 9.5 million b/d from a trough of about 8.4 million b/d in July 2016, Fitch said.

"We continue to expect US production growth to remain robust in the second half of 2017 based on the roughly 2-4-month lag between spudding shale wells and production," Fitch said, adding its analysts remain skeptical about the effectiveness of the Organization of Petroleum Exporting Countries production-cut targets. Lower production compared with October 2016 is intended to rebalance supply and demand in the near term.

Fitch noted Libya and Nigeria are exempt from the production-cut targets of 1.2 million b/d by OPEC members. Analysts said Libya and Nigeria both are producing at higher levels since the targets were implemented in January.

Other obstacles include weak enforceability and OPEC's poor adherence track record, Fitch said. OPEC's average compliance rate slipped to 75% in July from almost 100% at the beginning of the year, the International Energy Agency estimates.

OPEC compliance improved to an estimated 82% in August, but overall Fitch expects average compliance rates in the second half of 2017 and beyond will be weaker than in the first half.

Wirth to succeed Watson as Chevron chairman, CEO

Michael K. Wirth has been elected chairman and chief executive officer of Chevron Corp., effective Feb. 1. He will succeed John S. Watson, who will retire from the company and its board after 37 years of service, including 8 years as chairman and CEO.

Wirth, who was named Chevron's vice-chairman this year and executive vice-president of midstream and development last year, previously served as executive vice-president of downstream and chemicals at the company for nearly a decade.

Prior to his downstream involvement, he was Chevron's president of global supply and trading and president of marketing for the Asia-Middle East-Africa business based in Singapore. Wirth joined Chevron in 1982 as a design engineer.

Watson joined Chevron in 1980 as a financial analyst and went on to hold financial, analytical, and leadership positions before being appointed president of Chevron Canada Ltd. in 1996. Two years later, he was named a corporate vice-president.

Watson in 2000 led Chevron's integration effort following its merger with Texaco Inc. and then became the combined company's chief financial officer. In 2005, he became president of Chevron International E&P. In April 2009, he was named vice-chairman of the company before being elected chairman and CEO in September of that year.

NEB assesses marketable oil, gas in Duvernay shale

Canada's National Energy Board estimates in-place 3.4 billion bbl of marketable light oil in Alberta's Duvernay shale, which covers nearly 20% of the province from just below Grande Prairie to just north of Calgary and east of Edmonton.

The number of available resources equate to 17 years of Alberta's annual production, which was 550,000 b/d of light oil and condensate in 2016. NEB's latest assessment also determined that the Duvernay region has the potential to produce 6.3 billion bbl of marketable natural gas liquids and nearly 77 tcf of marketable gas.

The Duvernay shale was first developed in 2011 when Celtic Exploration Ltd. opened Kaybob field 150 miles northwest of Edmonton. Duvernay's western basin has been more developed in recent years but provincial land sales show increasing industry interest the basin's eastern region.

The Duvernay is prospective for oil and gas below 2,500 m, generally with oil in shallow deposits above 3,000 m and gas in areas deeper than 3,000 m. The Duvernay is rich in condensate, which is in high demand in Alberta as it is mixed with bitumen from the region's oil sands to more easily flow through pipelines. Northern Alberta contains recoverable oil sands reserves of 165 billion bbl.

NEB developed its new assessment with data from the Alberta Geological Survey, a branch of the Alberta Energy Regulator. Later in the fall NEB has said it will release a second report examining the economics of the Duvernay shale.

Gazprom Neft discovers offshore field

Pending a detailed assessment in mid-2018, Gazprom Neft has discovered a field that could contain as much as 255 million tonnes of oil equivalent.

Subsidiary Gazpromneft-Sakhalin reported that it has completed an appraisal well in the Ayashsky block on the Okhotsk Sea continental shelf. The block is part of the Sakhalin III project and is next to developed fields of the Sakhalin I and Sakhalin II projects.

The operator collected 162 m of core from potentially productive strata encountered in the 2,700-m well. The company reported the discovery with no indication of the type and consistency of encountered hydrocarbons.

In addition to the Ayashsky block, Sakhalin III includes Kirinsky and Vostochno-Odoptinsky blocks where Gazprom is engaged in further exploration. Similarly, the company reported a "substantial gas and condensate inflow" from a well on the Kirinsky block in 2016 but with no further details.

Sherritt resumes Cuban drilling after storm Sherritt International Corp., Toronto, has resumed drilling of a key exploration well in Cuba after an interruption caused by Hurricane Irma.

The storm did minor damage to the company's oil and gas, power, and mining operations in Cuba.

Sherritt said on Sept. 20 that drilling had recommenced at its second exploration well on Block 10, for which it received a production sharing contract from state-owned Cubapetroleo SA (Cupet) in 2014.

Its first Block 10 well, drilled directionally from land to a target in the Bay of Cardenas off Matanzas Province, reached 4,232 m MD of a planned 5,836 m in March.

It failed to reach the target formation in the Upper Jurassic-Lower Cretaceous Veloz Group, the most important producing formation in Cuba. Sherritt has gross working-interest production totaling about 14,545 b/d of oil from Varadero, Puerto Escondido, and Yumuri fields on older blocks in Cuba.

The Block 10 well targeted the Lower Veloz carbonate, from which a hole Sherritt drilled in 1994 briefly tested 3,750 b/d of 13.6° gravity oil.

The new well lost wellbore stability before reaching the Lower Veloz because of repeated occurrence of the less stable Vega Alta formation.

Sherritt sidetracked the well into the Upper Veloz formation, identified before drilling in reprocessed 3D seismic data.

The Upper Veloz yielded good oil shows, but the sidetrack trajectory was not high enough on the structure.

Testing of the sidetrack produced oil at noncommercial rates.

David Pathe, Sherritt president and chief executive officer, said results of the first well didn't change his company's assessment of Block 10 potential and provided important data about the basin's fold-and-thrust geology.

Drilling & Production — Quick TakesOutput drops from mature oil fields seen quickening

Production from maturing oil fields is declining faster globally due to the fall in capital spending since the oil-price crash, Oslo-based industry research firm Rystad Energy AS observes.

The firm largely attributes the relatively stable global production since 2015-despite the decreased spending-to project startups that were approved before the price collapse that began in mid-2014. Meanwhile, drilling of new wells on mature fields has dropped by about half since that time.

Mature offshore oil fields now decline at a rate of 8%/year, Rystad says, whereas the same fields declined by just 5% in 2014 before the decrease in drilling activity.

"Old offshore fields are now declining faster, and as a consequence, 1 million bbl of oil have been removed from production balances," said Magnus Nysveen, Rystad head of analysis.

As of early October, global oil and liquids production totaled 97 million b/d, exactly 10 million bbl higher than at the start of this decade, according to Rystad data. The firm predicts a continued shift of market share from conventional oil production to US shale oil.

"We expect US oil production will continue to ramp-up towards its full potential of 15 million bbl within the next 5 years, and then we would again see quite a dramatic tightening of the oil market," said Nadia Wiggen Martin, Rystad vice-president of markets.

Scotland to extend frac ban indefinitely

By extending its ban on hydraulic fracturing, the Scottish government "is turning its back on a potential manufacturing and jobs renaissance," according to an industrial supporter of shale-gas production.

Ineos Shale, operator of two exploration licenses between Glasgow and Edinburgh, criticized a decision announced Oct. 3 by Energy Minister Paul Wheelhouse in the Scottish Parliament to continue indefinitely a moratorium in place since 2015 on the completion technique.

Environmental groups welcomed the decision, which Wheelhouse said means fracing "cannot and will not take place in Scotland." Parliament is expected to support the ban in a final vote when it reconvenes after an October recess.

"It is a sad day for those of us who believe in evidence-led decision-making," said Tom Pickering, Ineos Shale operations director, calling the decision "a slight on the dedicated professionalism that Scottish workers have pioneered."

Pickering predicted Scottish workers will leave the country to find work as the mature North Sea oil and gas industry declines.

Ineos Shale's parent is a chemical producer importing ethane at its refinery and petrochemical complex at Grangemouth. The operator also holds licenses for shale exploration in England.

Although consultation on hydraulic fracturing in Scotland focused on water safety and earthquakes, Sam Gardner, acting director of the environmental group WWF Scotland, said the ban relates to climate change.

"The climate science is clear. The vast majority of fossil fuel reserves need to be left in the ground," he said. "It's fantastic Scottish ministers agree that we need to start placing them off limits."

Petrobel lets subsea contract for Zohr field Phase 2

Belayim Petroleum Co. (Petrobel), a joint venture of wholly owned Eni SPA subsidiary IEOC Production BV and Egyptian General Petroleum Corp., has let a subsea contract to Baker Hughes for Phase 2 of the supergiant Zohr gas field in the Mediterranean Sea offshore Egypt.

BHGE will provide project management, engineering procurement, fabrication, construction, testing, and transportation of a subsea production system, including seven manifolds, tie-in systems, long offset subsea and topside control systems, SemStar5 high-integrity pressure protection systems (HIPPS), and workover systems and tools, and will support the installation, commissioning, and startup operations.

The project draws on BHGE's experience in large-bore, long-offset gas fields and incorporates an integrated HIPPS network. For the first time, BHGE also will provide 10 e-EHXT trees, manufactured at its subsea center in Aberdeen. The trees were designed in collaboration with Eni as part of a standardization exercise, applying field-proven products and systems gained from previous projects with Eni on a range of successful deepwater projects in Africa.

BHGE also will provide wellheads as part of a separate contract awarded by Petrobel earlier this year.

Petrobel is leading development of Zohr field on behalf of PetroSherouk, a joint venture of Egyptian Natural Gas Holding Co., IEOC, and BP PLC.

PROCESSING — Quick TakesChinese operator to double capacity of PDH plant

Zhejiang Satellite Petrochemical Co. Ltd., also known as Zhejiang Satellite Energy Co. Ltd., has let a contract to Germany's Siemens AG to supply a reactor effluent compressor train for the second phase of its propylene dehydrogenation (PDH) plant in Pinghu City, Zhejiang Province, China.

As part of the order, Siemens will deliver two of its proprietary STC-SH single-shaft compressors as well as a 41-Mw Siemens SGT-750 industrial gas turbine to drive the dual-casing compressor train, which is scheduled for installation in late 2018, the service provider said.

Due to be commissioned in early 2019, Satellite Energy's Phase 2 PDH plant will mark the first downstream commercial application of the SGT-750 gas turbine, which alongside its optimized design for direct drives without intermediate gears and rotational speed of 6,100 rpm, also enables operators to extend intervals between maintenance events to help increase production uptime as well as reduce lifecycle costs, Siemens said.

This latest contract for the Phase 2 PDH plant follows Satellite Energy's award to Siemens in 2013 for the project's first-phase compressor train, for which Siemens supplied two of its proprietary STC-SH (14) compressors and a SGT-700 gas turbine.

Under construction since 2016, Satellite Energy's Phase 2 PDH plant will be able to produce 450,000 tonnes/year of propylene and 300,000 tpy of polypropylene, according to separate releases from the Pinghu Municipal Government and Sinopec Ningbo Engineering Co. Ltd., which completed work on the project.

Commissioned in 2014, Phase 1 of Satellite Energy's PDH plant produces 450,000 tpy of propylene from propane using Honeywell UOP LLC's proprietary C3 Oleflex process technology, according to a Dec. 23, 2014, from UOP.

Chengzhi Yongqing lets contract for second MTO unit

Nanjing Chengzhi Yongqing Energy Technology Co. Ltd., a subsidiary of Chengzhi Shareholding Co. Ltd., the investment arm of China's Tsinghua University, has let a contract to Honeywell UOP LLC, Des Plaines, Ill., to deliver technology licensing for a grassroots methanol-to-olefins (MTO) unit at its existing coal-to-chemical complex in the Changlu area of Nanjing Chemical Industrial Park, Nanjing, Jiangsu Province, China.

As part of the order, Honeywell UOP will license its proprietary advanced MTO process technology for the 600,000-tonne/year unit, which will convert coal-derived methanol into ethylene and propylene, the service provider said.

Alongside technology licensing, Honeywell UOP also will supply its proprietary catalysts, which will enable Chengzhi Yongqing to efficiently adjust the unit's propylene-ethylene production ratio to most effectively meet demand for those products.

The proposed unit comes as part of China's broader investment in coal-to-chemicals technology, which during the next 5 years, is slated to exceed more than $100 billion, said John Gugel, vice-president and general manager of UOP's process technology and equipment business.

Honeywell UOP, however, did not disclose a value of the contract.

At a planned investment of 4.1 billion yuan, Chengzhi Yongqing's MTO unit-which will be the operator's second at the site-is scheduled for startup in 2019, Chengzhi said on its web site.

Commissioned in 2013 under previous owner Wison (Nanjing) Clean Energy Co. Ltd., the complex's existing 300,000-tpy MTO unit also is based on UOP's MTO technology.

Wison (Nanjing) Clean Energy officially became Chengzhi Yongqing on Nov. 25, 2016, after Chengzhi acquired the business, according to a Dec. 26, 2016, release from Chengzhi.

TRANSPORTATION — Quick TakesGIP to buy Medallion Pipeline for nearly $2 billion

An affiliate of Global Infrastructure Partners (GIP) has agreed to acquire Medallion Gathering & Processing LLC from affiliates of Energy & Minerals Group (EMG) and Laredo Petroleum Inc. for $1.825 billion in cash plus additional consideration.

The Medallion crude oil transportation system, owned 51% by EMG and 49% by Laredo, consists of more than 800 miles of pipeline, 670,000 dedicated acres, and total areas of mutual interest of almost 4 million acres, serving the Midland basin of West Texas.

Medallion will retain its name and headquarters in Irving, Tex., where it will operate as a GIP portfolio company. The leadership team, including Pres. and Chief Executive Officer Randy Lentz, will remain in their current roles and are investing alongside GIP in the deal.

Lentz noted that the deal "will be the catalyst for further expansion of Medallion's midstream infrastructure in the Permian basin."

Randy A. Foutch, chairman and chief executive officer of Tulsa-based Laredo, said his firm intends to use proceeds from the deal to repay debt, which should cut its outstanding debt balance by more than half.

"This will afford Laredo additional flexibility in our development plan as we test tighter spacing to add premium locations in the Upper and Middle Wolfcamp formations," Foutch said.

As part of the deal, GIP also will pay additional cash linked to its realized profits at exit. Funding of the $1.825 billion is expected to occur on or before Nov. 1 and includes $725 million of stapled debt financing.

All proceeds from the sale of Medallion, including both the base payment and the additional payment, will be distributed 51% to EMG and 49% to Laredo. EMG will continue to own Medallion Delaware Basin LLC.

Epic Pipeline to build 650-mile NGL line in Texas

Epic Y Grade Pipeline LP, a subsidiary of Epic Y Grade Services LP and Epic Midstream Holdings LP, has agreed with BP Energy Co., a subsidiary of BP PLC, to anchor a 650-mile NGL pipeline that will link the Permian and Eagle Ford regions to Gulf Coast refiners, petrochemical companies, and export markets.

Construction already has begun on the Epic NGL Pipeline, which will have throughput capacity of at least 220,000 b/d with multiple origin points in the Delaware and Midland basins. Destinations will include interconnects near Orla, Benedum, and Corpus Christi in Texas, where Epic's affiliate plans to build a complex with multiple 100,000-b/d fractionators to accommodate the pipeline's volume.

Epic will conduct an open season for the pipeline in the fourth quarter. It plans to have the initial phase of the pipeline in-service in early 2018 and fully completed in 2019.

The pipeline will run side-by-side with the previously announced 700-mile, 550,000-b/d Epic Crude Oil Pipeline for most of the route. Epic is actively acquiring rights of way, and in some cases, multiline rights will be pursued to accommodate both NGL and crude oil projects.

The Epic NGL Pipeline has secured a capital commitment from funds managed by global alternative asset manager Ares Management LP.

Epic's predecessors, TexStar Midstream Logistics LP and TexStar Midstream Services LP, owned and operated oil and gas midstream infrastructure throughout South Texas.