Lebanon completes first offshore bid round, predicts initial discovery in 2019

Tayvis Dunnahoe

Exploration Editor

Lebanese officials will award four offshore blocks by year-end 2017 in the country's first attempt at developing its domestic oil and gas resources. Lebanon's path to offshore licensing has been delayed for 4 years but is now coming to fruition.

Lebanon's second prequalification round announced Apr. 28 confirmed ONGC Videsh Ltd. as operator and nonoperators PJSC Lukoil, Sapurakencana Energy Sdn. Bhd., Sonatrach International Petroleum E&P Corp. (SIPEX BVI), Qatar Petroleum International Ltd., Petropars Ltd., JSC Novatek, and New Age (African Global Energy) Ltd.

According to Lebanon's Ministry of Energy and Water, 51 companies to date have been qualified to bid in the 2017 round. The 2013 round prequalified 12 operators to bid along with 34 nonoperating companies. At a July 6 press conference in Houston, hosted by law firm Mayer Brown, Lebanon's Minister of Energy and Water Cesar Abi Khalil said that prequalified companies in 2013 were eligible to participate in the current round provided they still met the country's criteria and submitted audited financial statements for 2014-15 and unaudited 2016 statements.

Offshore potential

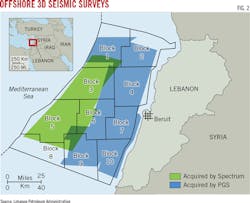

Lebanon has worked during the delay to better prepare for the current round. "Our goal is to strike a commercial discovery by 2019," Khalil said. To this end, the Lebanese Petroleum Administration (LPA) has acquired 2D seismic of 100% of the available acreage. "We've shot 3D seismic over 85% of the offshore territory," Khalil added (Fig. 1 and 2).

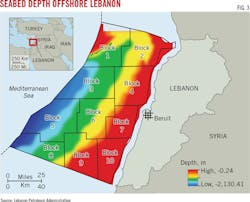

Lebanon's offer includes offshore Blocks 1, 4, 8, 9, and 10. Block 8 is in 1,900 m of water and, along with Blocks 3 and 5, currently not on offer, comprises Lebanon's deepwater prospects. According to Wissam Chbat, LPA head of geology and geophysics, the southern portion of the offered area (Blocks 8-10) is most prospective for oil, and Blocks 1 and 4 are prospective for gas and condensate (Fig. 3). The Lebanese round is offering five blocks of 10 delineated for the entire sector. The ministry said it will award no more than four blocks in the current round.

The Levant margin runs close to shore and the prospective for oil and gas decreases as the water shallows. The northernmost Block 1 is believed to contain both structural and stratigraphic plays featuring Late Cretaceous anticlines in a multistack formation with potential hydrocarbons in Pliocene, Messinian, and Oligocene reservoirs. Block 4 in the central offshore contains Late Miocene anticlines. LPA describes a medium-certainty seep in an area where gas chimneys are observed as the Messinian thins with velocity pull-downs.

Further offshore, the Deep basin contains mainly biogenic hydrocarbons, Chbat said (Fig. 3). The southern Block 9 shows large transpressive anticlines with overly deep-rooted structures and faults. Block 9 is believed to contain biogenic gas-filled reservoirs with possible migration of hydrocarbons from deep thermogenic source rocks. "Oil seeps are located above two structures very similar to nearby Karish field," Chbat said.

The neighboring Israeli Petroleum Commission approved in August Energean Oil & Gas SA's field development plan to produce first gas from its Karish Main development in 2020 (OGJ Online, Aug. 30, 2017). The Karish discovery is 6 km from Lebanon's Block 9 maritime boundary.

East Med analog

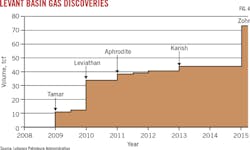

The Levant basin has been elevated in importance following discovery of Tamar and Leviathan gas fields in 2009-10 (Fig. 4). The curve somewhat flattened as Aphrodite and Karish were added in 2011-13, but the giant Zohr gas discovery in 2015 has reinvigorated East Mediterranean exploration.

Compared with neighbors Israel to the south and Cyprus to the west, Lebanon is a pure frontier exploration play, with a wealth of anologs and new discoveries providing confidence in the new acreage available this year.

Cyprus is now on its third offshore bid round (OGJ Online, Feb. 19, 2016) and Khalil implied that Lebanon is likely to partner with the country on cross-border fields.

Lebanon remains locked in a prolonged state of war with neighboring Israel, with the last major armed conflict taking place in 2006. These problems extend offshore where the countries dispute a shared maritime border (OGJ Online, Sept. 8, 2011).

But, Khalil said, "the three blocks to be auctioned along the southern border received the most attention from interested exploration companies." He added that several prospective reservoirs spanning both Lebanese and Israeli waters will not be explored by either country in the early phases of offshore development.

Petroleum law

"In Lebanon, when a law is passed it remains unchanged for some time," Khalil said, citing the difficulty of finally passing the country's petroleum law in 2007. "Lebanon provides a stable working environment for foreign investors."

Lebanon's Exploration and Production Agreement (EPA) calls for 25 years of production in the event of a commercial oil or gas discovery. Royalties paid to the state will be equal to 4% of the gas produced and vary between 5% and 12% for oil production. Companies can propose a percentage rate of oil and gas allocation to recoup exploration costs, with the remaining resources split and a higher percentage going to the State once exploration costs are recovered. Lebanon's EPA ensures domestic growth by requiring Lebanese goods and services receive preference in awarding contracts and that 80% of companies' employees be Lebanese nationals.

Domestic supply

With no current domestic production of natural gas, Lebanon generates most of its electricity by burning imported heavy fuel oil. "Energy security is the main pillar of our petroleum law, and we need to switch our power grid to utilize cheaper natural gas," Khalil said. In the case of a discovery, Lebanon is expecting an increase in construction onshore as power plants and much of its industrial infrastructure are updated to accommodate the new domestic gas resources.

Lebanon is one of the largest suppliers of concrete in the Middle East and Europe and Khalil cited the ceramic industry's particular need for natural gas.

"Lebanon has one of the most modern contract structures in the world," Khalil said, citing the country's upfront engagement as simplifying the bidding process and paving a smoother path for operators who enter the region to explore for oil and gas. "A large part of the exploration has already been done. It took 4 years but we are prepared," Khalil said.

As of this writing, Lebanon had extended the deadline for its bid round to Oct. 12 (OGJ Online, Sept. 11, 2017). The Ministry said prospective bidders needed more time to finalize legal paperwork and that it also hoped to increase the total number of bids. No delay was announced in the remaining schedule. Lebanon's Council of Ministers will sign exploration and production agreements with the winning companies in January 2018.