CERI forecasts oil sands production growth through 2036

The Canadian Energy Research Institute (CERI) forecast continual growth in oil sands production to 2036 in its latest report on oil sands supply costs. The report also evaluated how greenhouse gas emission caps will affect future production rates.

Low crude oil prices have caused oil sands producers, other unconventional producers, and conventional producers to cut capital spending since 2014. Light-heavy oil price differentials narrowed in recent years while operating costs fell. Relatively low oil prices also weakened the Canadian dollar compared to the US dollar.

Dinara Millington, economist and CERI vice-president of research, wrote "Canadian Oil Sands Supply Costs and Development Projects (2016-2036)." She expects oil price recovery will take years but that oil sands projects will remain a profitable long-term investment.

Millington notes some oil sands projects will be delayed for various reasons, including financing and transportation problems. Some project concepts likely will never make it beyond the concept stage.

CERI based its production forecast on information from oil sands producers, including news releases, annual corporate reports, and production capacities provided to Alberta regulators.

Information used in developing forecasts for oil sands production and supply chain optimization in existing and new projects included project schedules, delays, technology, and development status.

Production forecast

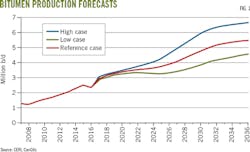

Fig. 1 shows CERI's production forecast, which lists a reference case, high case, and low case. The reference-case scenario provides what CERI calls a "plausible view" of anticipated oil sands production.

The high-case scenario envisions production from mining and in situ projects (thermal and cold bitumen) reaching a record 6.6 million b/d by 2036 compared with total oil sands production of 2.53 million b/d in 2015.

All three scenarios anticipate production growth for the report's 20-year forecast period. The scenarios differ in their production-growth-rate outlooks, which stem from a combination of changes in scheduled project startups and capacity curtailments.

Total initial and sustaining capital required for all projects is forecast at $502.5 billion (Can.) under the reference-case scenario. Capital investment for in situ projects is expected to surpass mining investments, consistent with an ongoing trend.

CERI forecast investors will spend almost $160 billion for mining and $304 billion on in situ, thermal, solvent, and primary and enhanced oil recovery (EOR) cold-bitumen projects.

Investors will spend the least on upgrading projects. CERI forecast upgrading spending at $39 billion for the entire period.

Supply cost

Oil sands producers have implemented operating efficiencies and cut supply costs, Millington said. They also benefitted from external factors like reduced labor costs and cheaper natural gas supply.

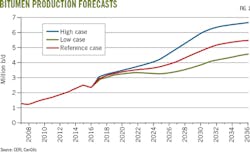

CERI defines supply cost as the constant dollar price needed to recover all capital expenditures, operating costs, royalties, and taxes and earn a specified return on investment (ROI). Economists calculated supply costs using an annual discount rate of 10%, which is equivalent to an annual ROI of 12% based on an assumed 2%/year inflation rate.

Researchers calculated the supply costs of crude bitumen using steam-assisted gravity drainage (SAGD) and surface mining and extraction for a hypothetical project. Fig. 2 shows plant gate supply costs, which exclude transportation and blending costs, of $43.31/bbl for a SAGD project and $70.08/bbl for a stand-alone mine.

The supply cost for a SAGD producer fell 27% since an August 2015 update. Mining project supply cost fell 6% in the new report compared with the August 2015 report.

After adjusting for blending and transportation, the West Texas Intermediate (WTI) equivalent supply costs at the oil hub in Cushing, Okla., is $60.52/bbl for a SAGD project and $75.73/bbl for a stand-alone mine.

WTI equivalents are in US dollars. Otherwise, all prices listed in the report are in Canadian dollars. Cushing is the price settlement point for WTI traded on the New York Mercantile Exchange.

Oil sands remain competitive against other crude oils. The nature of oil sands project development has changed. Megaproject mines and upgraders dominated the industry 10 years ago, but oil sands operations have since transformed into smaller, more manageable in situ projects.

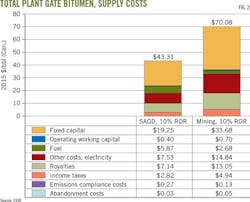

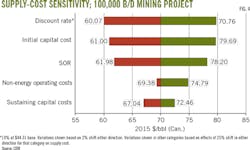

Fig. 3 shows SAGD supply cost is sensitive to changes in initial capital expenditures and the assumed discount rate. If the discount rate increases to 12%, the supply cost is estimated to increase by $5.57/bbl. When the discount rate falls to 8%, the cost decreases by $5.10/bbl from its base of $43.31/bbl. Fig. 4 shows supply-cost sensitivity for mining projects.

Emissions

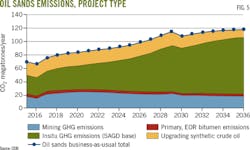

Fig. 5 shows CERI's greenhouse gas (GHG) emissions forecast for the reference-case production forecast. The forecast includes emissions from existing upgrading, electricity, fugitive emissions, and flaring, but excludes GHG emissions associated with upgrading capacity added after 2015.

Alberta's Climate Change Leadership Plan placed an absolute emissions cap on total oil sands emissions of 100 megatonnes/year (Mt/year). Canada's oil sands industry currently emits about 70 Mt/year. CERI expects the GHG cap will be reached in about 2026 without changes to bitumen production's energy-intensity.

The study suggests industry could lower GHG emissions and increase production through technologies to manage water and natural gas.

Millington foresees technological innovations such as enhanced well pad design and improved efficiency in using natural gas to create steam.

Canada has committed under the Paris Agreement of 2015 to decrease emissions 30% below 2005 levels by 2030. Canada's 2050 reduction targets are set at 80% below 2005 levels.

Emissions performance includes GHG emissions intensity as well as bulk emissions for a project. A project can reduce GHG emission intensity but still have total emissions rise if bitumen production increases faster than emissions fall, the report said.

The oil sands sector's share of total Canadian emissions is projected to increase to 12.8% from 4.6% based on Environment and Climate Change Canada's 742-Mt forecast for Canadian emissions in 2030, CERI said.

About the Author

Paula Dittrick

Senior Staff Writer

Paula Dittrick has covered oil and gas from Houston for more than 20 years. Starting in May 2007, she developed a health, safety, and environment beat for Oil & Gas Journal. Dittrick is familiar with the industry’s financial aspects. She also monitors issues associated with carbon sequestration and renewable energy.

Dittrick joined OGJ in February 2001. Previously, she worked for Dow Jones and United Press International. She began writing about oil and gas as UPI’s West Texas bureau chief during the 1980s. She earned a Bachelor’s of Science degree in journalism from the University of Nebraska in 1974.