Nigeria advances programs to rehabilitate, expand refining capacity

Robert Brelsford

Downstream Technology Editor

State-owned Nigerian National Petroleum Corp. (NNPC) and Nigeria's Department of Petroleum Resources (DPR) have opened their doors to private local and international investors to boost both crude oil processing capacity and output of finished fuels. The move comes as part of a plan to eliminate the country's inability to satisfy domestic refined products demand and curb its reliance on foreign imports.

The call for private capital investment to help overhaul the country's refining sector follows a series of efforts by recently elected President Muhammadu Buhari to enhance the focus, accountability, competitiveness, and transparency of state-owned petroleum operations, measures which included a restructuring and reorganization of NNPC in early 2016 (OGJ Online, Mar. 4, 2016).

The invitation to investors also forms part of Buhari's commitment to end persistent fuel scarcity in West Africa, caused by a combination of aging infrastructure at Nigerian refineries, persistent interruptions to crude supply caused by militant attacks to pipelines, and the country's lack of adequate crude processing capacity to meet the finished-product needs of its growing population, as well as that of the surrounding West African subregion.

Background

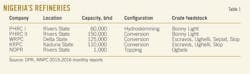

Nigeria has five government-sanctioned refineries with a combined capacity of 456,000 b/sd. NNPC operates 455,000 b/sd of capacity at four refineries through its wholly owned subsidiaries Port Harcourt Refining Co Ltd. (PHRC), Warri Refining & Petrochemcial Co. Ltd. (WRPC), and Kaduna Refining & Petrochemical Co. Ltd. (KRPC). A fifth refinery-Niger Delta Petroleum Resources Ltd.'s (NDPR) 1,000-b/sd topping plant in Ogbele field in Rivers State-remains Nigeria's only privately held crude processing plant, authorized to operate under an official license issued by the government (Table 1).

With the country's total domestic refinery utilization rates during the last decade yet to exceed 20% (Table 2) and NNPC's recognition that, even if running at full capacity, all four state-owned refineries would be unable to meet regional demand for finished fuels, the federal government in 2016 accelerated programs designed to increase the efficiency of existing crude processing and add 150,000 b/sd in fresh capacity.

The program involves three levels of possible participation from private investors, including:

• Provision of funds and technical expertise to restore and upgrade NPPC's subsidiary-operated refineries to perform at their nameplate capacities for production of ultralow-sulfur fuels.

• Relocation and colocation of foreign brownfield refineries at existing NPPC refining site pads to augment overall site capacity.

• DPR licensing for construction of privately owned and operated grassroots refineries.

Rehabilitation, modifications

As part of its proposed rehabilitation program for existing Nigerian capacity, NNPC in April 2016 launched a tender inviting bids from investors to become financial and technical joint-venture (JV) partners for the phased modernization of its four refineries. The program aimed to make each plant a standalone profitable entity operating at 100% capacity, according to a June 16, 2016, presentation from Dr. Ibe Kachikwu, Nigeria's minister of state for petroleum resources.

Based on a system similar to Nigeria's existing LNG model, the program calls for restructuring the refineries to operate as incorporated JVs, with NNPC holding 51% interest and its potential partner 49% interest. If selected, partners will agree to fund, rehabilitate, and jointly operate the re-fineries with NNPC for a defined period, and in return, receive all offtake and marketing rights to refined products to be sold primarily in the Nigerian market until each partner recovers its investment.

The rehabilitation program mainly seeks financial support for projects that will enable NNPC's refineries to produce ultralow-sulfur fuels meeting AFRI 5 (Euro 4-equivalent)-quality specifications. Modifications will specifically to involve technology and catalysis upgrades of each of the refineries' fluid catalytic cracking (FCC) units for production of ultralow-sulfur gasoline. Following the estimated $500-million rehabilitation works, the PHRC, WRPC, and KRPC refineries must be equipped with post-treatment desulfurization technology, Kachikwu said.

NNPC has yet to disclose detailed results of the rehabilitation-and-operations tender, bids for which were due May 30, 2016. In its most recently published Energy in Brief monthly newsletter to stakeholders updating operations for the months of July-August 2016, however, NNPC said it has started discussions for technical partnership and support in the refineries with Royal Dutch Shell PLC, Chevron Corp., and Total SA, all of which operate in Nigeria's upstream.

In late November, Dr. Maikanti Baru, NNPC's managing director, reiterated the company's commitment to upgrade and expand KRPC's 110,000-b/sd Kaduna refinery, confirming that efforts remain under way to explore building a more than 1,000-km pipeline from Agadem field, Niger Republic, to Kaduna as a way to secure alternative crude supply for the refinery. Kaduna has experienced extended downtime as a result of feedstock interruptions stemming from pipeline vandalism (OGJ Online, Jan. 22, 2016).

Alongside a restreaming of the refinery's FCC in June, KRPC is overhauling the plant's kerosine hydrotreating unit, added Malam Idi Mukhtar, KRPC's managing director, without disclosing further details.

Relocation, colocation

NNPC is advancing a concurrent plan to leverage capacity of its subsidiaries' operations by relocating brownfield refining from abroad and siting it within its existing four refineries to expand state-owned refining capacity to 695,000 b/sd.

Issued in February 2016, a tender seeking investors for the relocation-colocation program specified that potential brownfield refineries to be relocated to NNPC must be configured to strictly meet AFRI 5-quality standards for low-sulfur fuels.

In addition to increasing combined capacity of state-run refineries, the relocation-colocation of smaller but nonetheless cost-efficient modular refineries within its existing refineries' premises is another strategy to enable production of fuels with sulfur levels ≤ 50 ppm by 2020.

While NNPC confirmed in a Mar. 31, 2016, release that nine companies submitted bids by the tender's late April-2016 closing date, it has yet to confirm the winning bidders.

New capacity, plants

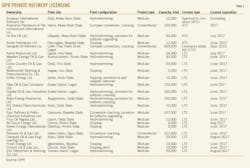

In addition to NNPC's rehabilitation and expansion programs, DPC has issued 25 licenses to private investors to establish refineries in Nigeria as part of the federal government's strategy to ensure ample fuel supplies.

Alongside revalidation of three previously awarded licenses, DPC in 2015 issued 22 new licenses for construction of privately funded grassroots refineries. A mix of modular and conventional construction, the proposed independent refineries would add about 1.3 million b/sd of fresh processing capacity to NNPC's expansion plan, according to a list published by DPC in March 2016 (Table 3).

To date, however, only two of the licensed independent refiners have advanced their projects. Late last year, Azikel Petroleum Ltd., Abuja, let a contract to Ventech Engineering LLC, Houston, to build its planned 12,000-b/sd hydroskimming modular refinery in Obunagha-Gbarain, Bayelsa State, Azikel said Dec. 1, 2016.

As of early December, construction of crude oil feedstock tanks and refined-products tanks was 55% complete, with fabrication also under way on Ventech's ISBL unit, which is to be the modular refinery's central processing equipment, according to Dr. Eruani Azibapu Godbless, president of Azikel. Due for startup in 2018, Azikel's refinery will produce high-quality variants of LPG, gasoline, kerosine, aviation fuel, diesel, and heavy fuel oil.

Construction also remains under way on Nigerian conglomerate Dangote Industries Ltd. subsidiary Dangote Oil Refining Co.'s grassroots integrated refinery and petrochemical plant in southwestern Nigeria's Lekki Free Trade Zone, near Lagos (OGJ Online, May, 13, 2015; Nov. 25, 2013).

Initially proposed as a $5-billion, 500,000-b/sd project to be commissioned by yearend 2016, the independent refinery now is to have a processing capacity of 650,000 b/d and, by its 2018-19 commissioning date, a capital cost of $9-11 billion.

Other initiatives

Independent NDPR, a subsidiary of Niger Delta Exploration & Production PLC, is expanding its 10,000-b/sd Ogbele field refinery (OGJ Online, Sept. 7, 2016). The project, which will involve installation of additional crude distillation units, a naphtha hydrotreater, a naphtha splitter, and a catalytic reforming unit for the production of gasoline, is scheduled to be commissioned in early 2018.

Elsewhere, the local government of Nigeria's Abia State has set aside 400 hectares at Owazza in Ukwa, for Hyundai Group of South Korea's plan to build a 250,000-b/sd refinery, the state government said on June 16, 2016.

Abia State government previously entered an agreement with Hermes Juno Ltd. for construction of a 50,000-b/sd modular refinery project at Owazza, according to the state government's website.