Iran's joint fields offer development, partnership opportunities

Omid Shokri Kalehsar

Yalova University

Yalova, Turkey

After 36 years of limited access to tools, technologies, and international exploration and development partners, Iran is now working to expand its domestic hydrocarbon resources.

The UN Security Council in July 2015 unanimously adopted Resolution 2231 endorsing the Joint Comprehensive Plan of Action, providing Iran with sanctions relief in exchange for the country's commitment to curtail its nuclear program.

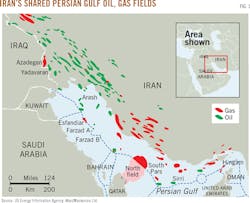

Three-fourths of the country's reserves lie within its national borders, but Iran shares 28 oil and gas fields with neighboring countries. These joint fields contain 20% of Iran's oil reserves and 30% of its natural gas.1 Of the 28 joint fields, 15 are oil fields and 11 are located in the Persian Gulf.2 Ongoing sanctions have caused Iran's development of these cross-border fields to lag those of its neighbors.

Joint fields with Iraq

Five of Iran's joint oil fields are on its border with Iraq, which has a 7-year plan to increase oil production to 12 million b/d. The Iraqi government invited Iran to invest in its cross-border fields in 2010 with the aim of improving development and increasing production, but Iran declined the offer due to a lack of financial resources.

While Iran was under international sanctions, Iraq produced 295,000 b/d from its joint fields compared with Iran's 130,000 b/d. Iraq's government also signed agreements with several major international oil companies to increase the country's production from its cross-border fields.3 Iran announced in January 2016 a plan to increase oil production from Iraqi joint fields to 200,000 b/d in 2017 and as much as 700,000 b/d in subsequent years.4 Both countries have revised their oil contracts with benefits outlined for joint fields, but Iraq's ongoing development gives it an economic advantage as Iran revives its oil and gas sector.5

Azadegan oil field, which is shared with Iraq, holds an estimated 33 billion bbl of oil and is one of the largest oil fields in the world (Fig. 1). It is divided into north and south sectors. Iraq produced more than 185,000 b/d in 2016 from North Azadegan and plans to increase production by 40,000 b/d. Iran produces only 50,000 b/d from South Azadegan field.6

Iran's President Hassan Rouhani has put forth a 52-month development plan for South Azadegan, calling for 320,000 b/d of oil production and 197 million cu m/day (MMcmd) of natural gas production in its first phase, with a second phase to add 60,000 b/d of oil.7 Iran already has made several attempts to improve development in Azadegan. As early as 2004, Japan's Inpex Corp. signed an agreement to produce 150,000 b/d of oil from Azadegan, but the company withdrew from Iran's energy sector in 2006 under pressure from the US government. Russia's Gazprom and the Government of India made subsequent attempts to develop Iran's Azadegan field but were unsuccessful. China National Petroleum Corp. was the latest international operator to sign development agreements with Iran regarding Azadegan, but the operator has experienced major delays in bringing the field online. Azar oil field is in the Ilam province near the Iraqi border in the Anaran Block and its stony surface conditions have impeded development. The field is estimated to contain 400 million bbl of oil. In 2014, Iranian operators began producing 30,000-35,000 b/d from Azar. The Iranian government plans to increase production to 65,000 b/d.8

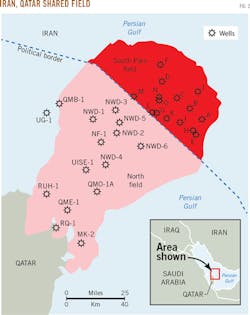

South Pars field

South Pars, one of the world's largest gas fields, is shared by Iran with Qatar (North field), and has proven natural gas reserves of 14 trillion cu m (tcm), or 7.5% of global gas reserves. The field also contains an estimated 18 billion bbl of condensate. The joint field covers 9,700 sq km, of which 3,700 sq km constitute Iran's South Pars (Fig. 2). Qatar began producing and exporting natural gas from North field in 1998, and the Qatari government has signed development agreements with Total SA, Eni SPA, and Statoil ASA, among others.

Qatar has invested a cumulative $400 billion in North field's development, becoming one of the world's largest exporters of LNG earning about $100 billion/year as a result.9 Qatar produces 650 MMcmd of gas and 425,000 b/d of oil from North field, and plans to add 52,000 b/d.10

Iran has invested $70-80 billion to develop South Pars, which explains the disparity with Qatar's production. Iranian Minister of Petroleum Bijan Zanganeh said the country's gas production would "equal Qatar's by late 2017 or early 2018." He added that even under sanctions South Pars gas production has increased 150 MMcmd since 2013, when President Rouhani came to power. Zanganeh said more than 85 MMcmd will be added in 2017.11

Saudi Arabia

Iran shares several fields with Saudi Arabia. Esfandiar field contains 532 million bbl of proven oil reserves. Iran signed agreements with Malaysian firm Petronas for its development before sanctions disrupted financing in 2009. The project was planned to deliver 10,000 b/d and 20,000 b/d in two phases, respectively. Iran is seeking investors to issue exploration licenses for the field.

Iran shares Farzad A and B natural gas fields with Saudi Arabia in the Persian Gulf. Farzad B, which was discovered by India's state-owned Oil and Natural Gas Corp. Videsh, contains 5.1 tcm of gas. Iran estimates that Farzad B will cost $5 billion to develop. A consortium from India has shown interest in the project. Minister Zanganeh has said Farzad B is Iran's first development priority and he expects to have a development agreement signed by March 2017.12

Arash gas field, known as Aldorah in Kuwait, lies southwest of Khark Island in the Persian Gulf. Geographically, the field is shared between Iran and Kuwait, but Saudi Arabia has laid claim to the resource in recent years. Arash field has proven gas reserves of 368 billion cu m (bcm). Arash is a needed domestic supply of natural gas for Kuwait and Saudi Arabia, both of which have oil-centered reserves.

Kuwait and Saudi Arabia established Al-Khahji Joint Operations in 2000 to develop Arash field with a goal of producing 1 bcm/year of natural gas by 2017.

Iran is not operating in Arash field, but it has invited investors to develop its gas reserves. The field is expected to become a point of contention between Iran's renewed oil and gas sector and neighboring Arab countries.14

UAE, Oman

Salman oil and gas field holds 473 million bbl of oil and 5.2 bcm of natural gas. Studies for this field have shown 70% of the reserves are Iran's with the UAE controlling 30%. Iran produces 40,000 b/d from the field and the UAE 70,000 b/d.10

The UAE holds the majority of reserves from the joint Nosrat oil field, but Iran began producing from the field in 1995. Iran's production, however, peaked at 3,300 b/d, and while the country had planned on raising production to 45,000 b/d, financial constraints led to cancellation of the project.13

Hengam oil and gas field is Iran's only joint field with Oman. Eighty percent of Hengam lies inside Iran, with production of 20,000 b/d of oil and 40 MMcmd of natural gas outstripping Oman's.10

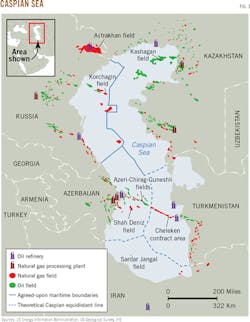

Caspian Sea

The Caspian Sea is shared by Iran, Russia, Azerbaijan, Turkmenistan, and Kazakhstan. These countries have attempted to agree to terms for Caspian Sea exploration, but negotiations have not yielded a defined framework (Fig. 3). Iran has proposed that the Caspian be divided into five equal parts, but the governments cannot agree on boundary locations.

Maritime boundaries also directly confound the relationship between Azerbaijan and Iran, with both countries maintaining conflicting claims of offshore energy reserves. Foremost among these disputes are Azerbaijan's Araz-Alov-Sharg hydrocarbon blocks: a 1,400 sq km area containing an estimated 700 bcm of natural gas. Azerbaijani control of Alov field, 120 km southeast of Baku and known as Alborz in Iran, is particularly disputed, Iran claiming that it lies partially in its territorial waters. As recently as 2001, two BP PLC research vessels were driven from Alov field by an Iranian gunboat, and work has stalled in the region.

Iran's Alborz field development was financially and technologically limited during sanctions. The country identified several Caspian Sea prospects but had no access to technology to drill in 1,000 m of water, and sanctions limited access to western exploration companies.16

Azerbaijani officials argue the Caspian should be divided by its median line and perpendicular borders extending to the national coast lines, as outlined by the 1982 UN Convention on the Law of the Sea. Russia and Kazakhstan adhere to the UN Convention and both countries plan to develop hydrocarbon resources from their corresponding Caspian territories.15

Iran petroleum contract

The National Iranian Oil Corp. is targeting production increases from South Pars and West Karoun (Azedegan field) in the post-sanctions era.17

Iran's Petroleum Contract (IPC), meanwhile, was developed in November 2015 to provide more transparent and lucrative investment opportunities to international oil companies seeking development projects.

The preceding buy-back model's shorter operating windows, high upfront expenditures, and uncertainties of project continuity had limited international investment. IPC increases protection for commitments from international oil companies. It includes four phases: exploration, development, production, and enhanced oil recovery, but provides 15-20 year exploration phases as opposed to the buy-back version's 5-7 year window.

The Iranian government has said it will target nearly 50 oil and gas projects worth $185 billion for inclusion of IPC by 2020, many of which are in joint fields.18 Iran is seeking foreign investments of $50 billion/year, and France's Total and Italy's Eni have expressed interest in new developments.19

In addition to overseas investment, Iran will also rely on cooperation from neighboring countries to improve joint field development and increase security and stability in the region.

References

1. "Spiritual: in rounds of sanctions towards others lay our hands," Aug. 22, 2016, www.radiofarda.com.

2. "Iran's joint oil fields to know-common fields in the Persian Gulf," Aug. 20, 2016, www.namehnews.ir.

3. "Iran's share of joint oil and gas fields," Dec. 12, 2015, www.radiofarda.com.

4. Iran Daily, "Iran to increase crude from joint Iraq fields by 200,000 b/d," Feb. 2, 2016.

5. Tabnak Professional News Site, "Plunder Iran's oil fields," Mar. 30, 2016.

6. "Azadegan oil field," Mar. 30, 2016, www.taamolnews.ir.

7. Tasnim News, "Iran's backwardness in the impressions of the 28 joint oil and gas fields was confirmed," Dec. 5, 2016.

8. Iran Daily, "Azar Oilfield extraction from September 2015, Oct. 10, 2014.

9. Mehr News Agency, "Qatar's new tactics to delay the development of South Pars," Dec. 20, 2015.

10. Mashregh News, "Joint assessment of Iran's position in 28 oil and gas fields," Mar. 3, 2016.

11. Shana News Agency, "Zanganeh: Gas Extraction from South Pars to Equal Qatar's," Aug. 28, 2016.

12. Natural Gas Asia, "Iran, India to Seal Farzad-B Gas Field Before 2016 is Out," Apr. 10, 2016.

13. Fars News Agency, "Last detail of articulation in shared fields," May 2, 2016.

14. Aryan, H., "Arash gas field-Dura, the conflict with Iran, Kuwait and Saudi Arabia," July 30, 2016.

15. Shokri, O., "Iran-Azerbaijan Energy Relations in the Post Sanctions Era," Middle East Policy, Spring 2016, Vol. 23, No. 1, pp. 139.

16. Mnshv, R., "Iran's share of joint oil and gas fields," Dec. 12, 2015.

17. Shana News Agency, "Development of Joint Oil Fields Top Priority: NIOC," June 14, 2016.

18. Nasralla, S., and Sheahan, M., "Iran eyes $185 billion oil and gas projects after sanctions," Reuters News Service, July 23, 2015.

19. Wilkin, S., "Iran Expects $25 Billion Oil Contracts Signed Within Two Years," Bloomberg, Aug. 10, 2016.

The Author

Omid Shokri Kalehsar ([email protected]) is an energy analyst in Washington DC. He is a PhD candidate in international relations at Yalova University, Turkey. He has also served as country analyst at the PRIX Index on Political Risk and Oil Exports. He holds an MA in political science and international relations (2013) from Yeditepe University, Istanbul, and an MA in translation studies (2012) from Istanbul University. He holds a BA in English language translation (2006) from Ardebil Payam Noor University, Ardebil, Iran. He is a member of the European Political Science Association.