OGJ Newsletter

GENERAL INTEREST — Quick Takes

Blackstone targets Midland, Delaware basins

Blackstone Energy Partners LP, an affiliate of multinational private equity firm Blackstone Group LP, has partnered with a seasoned oil and gas executive and a producing firm to target acreage in the Midland and Delaware basins of West Texas and southern New Mexico.

Blackstone and Jay Still, a former senior executive for Pioneer Natural Resources Co. and Laredo Petroleum Inc., have formed Dallas-based, Midland basin-focused Guidon Energy and acquired 22,000 gross acres (16,000 net) in the core of Martin County, Tex.

Blackstone and affiliated funds have committed $500 million of capital to Guidon, "with the potential to commit significantly more" in future acquisitions. The firm plans to "develop its leasehold through manufacturing styled horizontal well development."

Separately, Blackstone and an affiliate of Jetta Operating Co. Inc. have formed Jetta Permian LP, a Fort Worth-based firm focused on the Delaware basin. With $1 billion committed in capital, Jetta's strategy includes pursuing asset and leasehold acquisition opportunities, farm-in deals, and partnerships or joint ventures with existing operators and landowners.

Blackstone is among a horde of entities to recently target Permian basin acreage. In the Midland basin alone, Pioneer Natural Resources, Laredo Petroleum, Callon Petroleum Co., QEP Resources Inc., SM Energy Co., Concho Resources Inc., and Parsley Energy Inc. have all made moves this summer to expand their positions.

Denver-based PDC Energy Inc. last month entered the Delaware basin by agreeing to purchase two units managed by energy-focused privately equity firm Kimmeridge Energy Management Co. LLC for $1.5 billion (OGJ Online, Aug. 24, 2016). Silver Run Acquisition Corp., Houston, agreed in July to acquire a controlling interest in Delaware producer Centennial Resources Production LLC (OGJ Online, July 22, 2016).

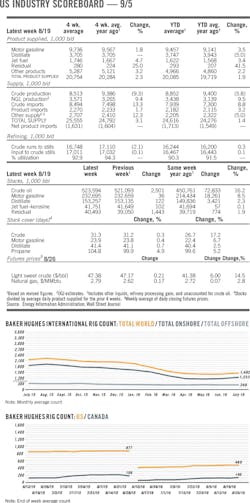

Drilling has concurrently ramped up in the Permian, with more than two thirds of all rigs added during the recent US rig count rebound coming in the basin.

EnVen Energy to buy Shell's Brutus, Glider assets

EnVen Energy Ventures LLC, an affiliate of Houston-based EnVen Energy Corp., has agreed to acquire 100% of the record title interest in Gulf of Mexico Green Canyon Blocks 114, 158, 202, and 248 from Shell Offshore Inc., an affiliate of Royal Dutch Shell PLC, for $425 million in cash.

The deal, expected to close in October, includes the Brutus tension leg platform (TLP), the Glider subsea production system, and the oil and gas lateral pipelines used to evacuate production from the TLP. The Brutus and Glider assets have a combined current production estimate of 25,000 boe/d.

Earlier this year, Shell temporarily shut in production to Brutus after an oil spill from a subsea flow line at Glider field was detected (OGJ Online, May 17, 2016).

Timor Gap arbitration begins in The Hague

The long-running dispute between Australia and Timor Leste concerning maritime boundaries in the Timor Sea started to be played out Aug. 29 in the Permanent Court of Arbitration in The Hague.

Timor Leste triggered the compulsory conciliation for the disputed territory in the so-called Timor Gap under the United Nation's Convention on the Law of the Sea in April.

The Timor Gap holds natural gas fields with resources estimated to be worth $40 billion.

Australia previously has refused to negotiate a permanent sea boundary with Timor Leste and temporary revenue-sharing arrangements were agreed by the two countries in 2002 and again in 2006.

Timor Leste says the 2006 treaty should be abandoned and charges the Australian government with illegal bugging of the Timor Leste cabinet rooms during negotiation that gave the Australians an unfair advantage.

The Hague commission doesn't have the ability to force Australia to agree to any boundaries that may be prescribed by the court's panel of commissioners, however there are indications that the Australian government may be softening its position.

Foreign Minister Julie Bishop is reported as saying that Australia considers the decision of the compulsory conciliation binding on both sides.

Another interpretation of this statement is that the Australians are confident its argument that the 2002 and 2006 treaties are valid in international law will prevail.

However, it is likely in the broader sense that any decision made by the court in this dispute could have repercussions by setting a precedent for other ongoing territorial disputes in the South China Sea.

Exploration & Development — Quick Takes

Statoil to ramp up Barents Sea activity in 2017

Statoil ASA plans to step up exploration efforts in several parts of the Barents Sea in 2017-18. The Blamann (PL849) prospect in the Goliat area, Koigen Central in PL718 on Stappen High, and the Korpfjell prospect in PL859 each hold promise for future exploration.

The Norwegian operator in January was awarded the Blamann prospect in the 2015 APA round and plans to drill an exploration well in 2017 (OGJ Online, Jan. 25, 2016). The company also reported it will partner with Eni SPA on an exploration well in the Goliat license PL229. In all, Statoil plans to drill 5-7 wells in the Barents Sea within the next year, and has a suitable rig on contract.

Statoil has entered or increased its share in five licenses in the Norwegian part of the Barents Sea within the past several months. Jez Avery, Statoil head of exploration, cited the new acreage "demonstrates our belief in continued exploration potential on the NCS."

Statoil entered License 722 of the Hoop area by acquiring 35% interest from Point Resources; bought 25% from ConocoPhillips Skandinavia AS and 20% from OMV (Norge) AS in Licenses 615 and 615B in Hoop, bringing its total stake in both licenses to 80%; and bought 30% from ConocoPhillips Skandinavia AS and 10% from DEA Norge AS in Licenses 718 and 720 in the Stappenhoyden area, bringing its total operated interest in both licenses to 60%.

The operator completed a comprehensive exploration campaign in the Barents Sea in 2013-14 with no impact discoveries, but it did add volumes to Johan Castberg through the Drivis discovery (OGJ Online, May 2, 2014).

The firm has worked on reducing costs through technology development. Averty said, "The wells to be drilled in the southeastern part of the Barents Sea next year seem to be the most inexpensive offshore exploration wells throughout Statoil."

Det norske finds oil at Langfjellet in North Sea

Det norske oljeselskap ASA encountered a 109-m gross oil column in the Vestland Group while drilling exploration well 25/2-18 S on the Langfjellet prospect in the North Sea.

A technical sidetrack was drilled to collect data, and the well is being prepared for a sidetrack and well test. Preliminary volume estimates for the discovery range 24-74 million boe.

The licensees will evaluate the discovery with regard to potential development with other discoveries in the area. Following the drilling results at Langfjellet, the licensees have identified further prospectivity within the license.

Det norske is operator and holds 90% working interest in PL442. Lotos Exploration & Production Norge AS holds the remaining interest.

Petrobras, Statoil sign upstream MOU

Statoil ASA and Petroleo Brasileiro SA (Petrobras) have signed a memorandum of understanding to serves as a framework for the evaluation of joint participation in future tenders for exploration areas and the increase of upstream collaboration in producing fields in the Santos and Campos basins offshore Brazil.

"The agreement also sets out a potential framework for cooperation on value creating opportunities in the gas value chain," Statoil said.

The MOU follows an agreement signed in July whereby Statoil acquired Petrobras's 66% operated interest of the BM-S-8 offshore license in the Santos basin, subject to government approval (OGJ Online, July 29, 2016).

The companies aim to capture value through application of technology and simplification of operational activities, Statoil noted. Petrobras and Statoil currently are partners in 13 blocks in either exploration or production; 10 in Brazil and three abroad.

Drilling & Production — Quick Takes

Funding lapses blamed for Libyan output woes

Libya's reconstituted government is receiving blame for failure of oil production to recover from a slump caused by civil war and for the related loss of income.

The Petroleum Facilities Guard said it will close Gulf and Al Wafa oil fields in southern Libya because it hasn't been paid for security services, Reuters reported.

The group earlier reached an agreement with the Presidency Council to open the Ras Lanuf, Es Sidra, and Zuetina terminals, but Reuters said the facilities remain closed (OGJ Online, Aug. 1, 2016).

The security force had claimed to be blockading the terminals to resist corruption and illicit oil sales. As part of the agreement to reopen the ports, it was to receive funds said to be overdue salary payments.

Libyan oil production has fallen below 400,000 b/d. Before civil war began in 2010, it was 1.6 million b/d.

National Oil Corp. Chairman Mustafa Sanalla said funding shortfalls by the Presidency Council, formed at the end of last year with support from the United Nations, was damaging Libyan oil fields.

"The Financial Arrangements Committee of the Presidency Council needs to explain the delay because every day our country loses over $10 million because of the shortfall, and that is money we will never recover," he said in a statement.

According to Sanalla, NOC budget shortfalls have cut production in fields operated by subsidiaries Sirte Oil Co. and Arab Gulf Oil Co. by 229,000 b/d.

"Systemic underinvestment, combined with the blockades on our major oil fields, is going to impose enormous costs on the oil sector in future to recover lost capacity," he said. "Because of changes in the reservoirs, some oil is going to be lost to us forever. We have a very long to-do list once stability is restored."

Statoil starts production from Gullfaks Rimfaksdalen

Statoil ASA has started production from its Gullfaks Rimfaksdalen natural gas and condensate development in the North Sea. The project, southwest of the Gullfaks A platform, had been slated to start up on Dec. 24.

Development comprises a standard subsea template with two simple gas production wells and the potential for tie-in of two more wells. The well stream is connected to the existing pipeline leading to the Gullfaks A platform.

Gas and condensate are transported in existing pipelines to the processing plant at Karsto north of Stavanger. Gas is then exported to European markets.

The cost of development was $443 million compared with the $575 million originally estimated in the plan for development and operation (PDO) (OGJ Online, Dec. 16, 2014). Recoverable reserves from the project total 80 million boe, most of which is gas.

"The volumes from Gullfaks Rimfaksdalen help us reach our ambition of maintaining production and a high activity level on the [Norwegian Continental Shelf] beyond 2030," said Arne Sigve Nylund, Statoil executive vice-president for development and production, Norway. "We have a well-developed infrastructure and we will keep realizing opportunities in the North Sea."

Statoil operates Gullfaks Rimfaksdalen with 51% interest. Partners are Petoro AS 30% and OMV AG 19%.

Statoil boosts Johan Sverdrup output expectations

Statoil ASA said it has cut its planned spending on Johan Sverdrup field in the North Sea to ensure profitability even if oil prices were to fall drastically. Statoil also forecast as much as a 40% increase in initial daily production capacity.

The field's Phase 1 production capacity was estimated at 440,000 b/d compared with a previous estimate of 315,000-380,000 b/d, Statoil said. First-phase planned spending was cut to 99 billion kroner from the previous 123 billion kroner.

Total spending, including Phase 2 investment and production expansion, was listed at 140-170 billion kroner, down from 170-220 billion kroner, Statoil said.

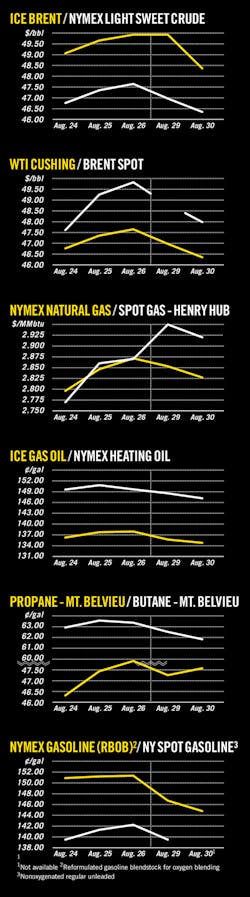

Executives calculated the project will be profitable at below $25/bbl, down from Statoil's February forecast of below $30/bbl. Brent crude oil for October delivery closed on the London market Aug. 26 at $49.92/bbl. Oil is traded in US dollars.

The North Sea field, discovered in 2010, is estimated at 1.9-3 billion boe. Production drilling has started on the first of a total of 35 wells to be drilled during Phase 1 (OGJ Online, Mar. 1, 2016).

Partners in the project include operator Statoil 40.0267%, Lundin Norway 22.6%, Petoro 17.36%, Det norske oljeselskap 11.5733%, and Maersk Oil 8.44%.

Shell tests Ormen Lange gas compression, power pilot

Norske Shell successfully finished a multiyear test of a subsea natural gas compression system with a full subsea power supply, transmission, and distribution system supplied by GE Oil & Gas for a pilot on Ormen Lange field offshore Norway.

The pilot was designed to test a full-scale integrated subsea compression system in submerged conditions with gas. Norske Shell ran the pilot with its partners Petoro AS, Statoil ASA, DONG Energy, and ExxonMobil Corp. The pilot started in 2011 at Shell's testing station at Nyhamna, Norway.

GE said the system enables operators to conduct gas compression on the seabed, reducing the need to provide additional power generation from nearby offshore platforms.

Technologies that were successfully tested included a 12.5-Mw vertically orientated centrifugal compressor, subsea switchgear, subsea variable speed drives, and subsea uninterruptible power supply.

Ormen Lange, producing since 2007, is among the largest gas fields in development on the Norwegian Sea's continental shelf. The field is 120 km northwest of Kristiansund (OGJ Online, Nov. 30, 2007).

PROCESSING — Quick Takes

Fire hits Rompetrol Rafinare Petromidia refinery

Rompetrol Rafinare SA, a subsidiary of Kazakhstan's state-owned KazMunayGas, is investigating a fire that broke out at a major processing unit of its 5 million-tonne/year Petromidia refinery in Navodari, Romania, on the Black Sea.

The Aug. 22 fire, which killed one worker and left three others injured, occurred at pipeline PM-100-025-80-40H next to valve 100-FV-071 at the refinery's vacuum distillation unit (VDU) during repair work to eliminate a leak in the unit's flowline, Rompetrol and KazMunaiGaz said in separate releases.

A preliminary investigation into the incident indicates all equipment was operating within normal parameters and that the workers were executing repairs in accordance with established rules and procedures using a special device for isolating the flowline when a spill of distillate ignited, the firms said.

Contrary to various media reports, official results of the government's initial investigation into the incident confirm the fire was not preceded by an explosion, according to Rompetrol.

Rompetrol is cooperating with a series of Romanian government agencies on a full-scale investigation into the causes of the fire as well as assessment of material damages to the VDU, which remains shuttered.

While other units at the refinery continue to operate at reduced capacity, Rompetrol's technical teams currently are evaluating necessary measures required to safely maintain operations on a medium to long-term basis, the company said.

Rompetrol disclosed no details regarding current operating rates at the refinery or an estimated timeframe for when it would determine the extent of damage to impacted installations.

Sadara commissions mixed-feed cracker at Jubail

Sadara Chemical Co., a joint venture of Saudi Aramco and Dow Chemical Co., has commissioned Saudi Arabia's first mixed-feed cracker (MFC) at the company's Jubail integrated chemical complex in Jabail Industrial City II, in the Eastern Province (OGJ Online, July 26, 2011).

Entered into operation on Aug. 28, the MFC includes 12 furnaces, seven of which will be used to crack ethane, with the remaining five liquid furnaces dedicated to cracking naphtha, Sadara said.

Three of the five liquid furnaces, however, are equipped to switch between gas and liquid feedstock to further enable Sadara to adjust its production levels of chemicals between naphtha-based and ethane-based feedstock in accordance with market demand, the company said.

One of 26 manufacturing units in Sadara's $20 billion complex, the MFC is designed to allow flexible cracking capabilities for on site production of more than 3 million tonnes/year of high-quality chemical products and performance plastics, including polyurethanes (isocyanates, polyether polyols), propylene oxide, propylene glycol, elastomers, linear low-density polyethylene (LLDPE), low-density polyethylene, glycol ethers, and amines (OGJ Online, July 22, 2014).

Commissioning of the MFC follows startup of the complex's first production unit in late-2015, when the polyethylene plant-which uses proprietary processing technology from Dow Chemical-began producing LLDPE, according to a Dec. 8, 2015, release from Sadara.

Matador commissions Delaware basin gas plant

Matador Resources Co., Dallas, has commissioned its Black River cryogenic natural gas processing plant at the Rustler Breaks prospect area of the Delaware basin in Eddy County, NM.

The Black River plant, which has an inlet capacity of 60 MMcfd, entered operation during the week of Aug. 22-26 on time and on budget, Matador said.

Nearly twice the size of a previous processing plant Matador built at its Wolf prospect area of Loving County, Tex., and later sold to an affiliate of EnLink Midstream LLC, the Black River plant will process Matador's own Rustler Breaks gas production as well as that of third-party producers in the region, the company said (OGJ Online, Aug. 4, 2016).

Alongside the new gas plant, Matador also confirmed it has completed installation, testing, and startup of a 15-mile, 12-in. natural gas line that extends the length of and already is gathering production from its Rustler Breaks acreage.

TRANSPORTATION — Quick Takes

RasGas starts LNG deliveries to Italy's Toscana FSRU

RasGas Co. Ltd. delivered its first LNG cargo on Aug. 23 via the Al Thakhira LNG tanker to the Toscana floating storage regasification unit (FSRU) offshore Italy.

International energy trading company DufEnergy Trading SA, Lugano, Switzerland, received the cargo.

Located 22 km off the Italian coast between Livorno and Pisa, FSRU Toscana is permanently anchored to the seabed through a mooring system, with a single point of rotation at the bow.

Qatar's RasGas, a Qatari joint stock company established in 2001 by Qatar Petroleum and ExxonMobil RasGas Inc., has an integrated shipping fleet consisting of 27 long-term chartered LNG vessels.

Protests halt Energy East Montreal hearing

Canada's National Energy Board canceled a hearing in Montreal over the proposed Energy East Pipeline on Aug. 29 when protestors disrupted the meeting (OGJ Online, July 15, 2016).

One protestor charged the head table and was arrested, along with two others.

TransCanada proposes the 4,500-km system, involving conversion and construction, to carry 1.1 million b/d of crude from Alberta and Saskatchewan to refineries and terminals in eastern Canada.

The project faces opposition from politicians, environmentalists, and aboriginal groups.

Video released for crude-by-rail first-responders

The American Petroleum Institute released a new video designed to help first responders to accidents involving crude oil shipments by rail.

"The video gives first responders a look at specific tank car markings and other visual depictions of what to consider when responding to an incident, should one occur," API Midstream Group Director Robin Rorick said.

It complements an instructor-led course API and the American Association of Railroads released in 2015 that educates firefighters, cleanup crews, and other first responders on the characteristics of crude oil, the rail cars in which it is shipped, considerations and strategies for spill response and firefighting, and the importance of following training and the incident command system.

Federal regulators and lawmakers also have moved to improve training and procedures for first responders who try to combat environmental and other impacts when crude is accidentally spilled during a rail shipment.

The US Pipeline & Hazardous Material Safety Administration recently proposed new oil spill response and information procedures for high-hazard flammable trains in coordination with the Federal Railroad Administration (OGJ Online, July 22, 2016).

The US Senate approved legislation this spring that Sen. Heidi Heitkamp (D-ND) introduced in 2015 to improve emergency first responders' capacity to act following accidents involving rail shipments of crude oil and other hazardous materials (OGJ Online, May 11, 2016). It referred S. 546 to the US House Transportation and Infrastructure Committee for further action.