Cross-border reserves development benefits from collaboration on rules, fiscal regimes

David Auty

Carlos Canales

Canales Auty

Mexico City

Framework agreements for transboundary hydrocarbon resources (THR) can provide access to new acreage in potentially attractive areas. In December 2012, a minority staff report from the US Senate Committee on Foreign Relations reported that Mexico could double its estimated 10.5 billion bbl of proven oil reserves once the country's unconventional and additional deepwater resources become proven. The 2014 US-Mexico agreement opened more than 1.5 million acres in the Gulf of Mexico that were previously off limits because of border issues.

According to the International Energy Agency (IEA), 60% of oil and gas producing countries have reserves which either straddle defined international boundaries or are in contested regions. Geopolitical and environmental uncertainties introduced by cross-border plays make companies reluctant to explore them.

As a result, large areas remain undeveloped. Progressive governments aware of these issues have sought to resolve them and expedite oil and gas development.

Political boundaries

Political boundaries are governed by the United Nations principle of permanent sovereignty, which provides nations the right to freely exploit their natural resources in accordance with national interests. In the subsurface, oil and natural gas does not adhere to political demarcations. Resources migrate across borders as reservoir fluids move from high to low pressure areas.

Sovereign nations unitize reserves covering multiple blocks within their borders under compulsory national laws, but internationally there are typically no such obligations.

With large financial gains at stake, political disputes concerning sovereignty of THRs are common. The risk of such disputes often deters investors and can make financing exploration and development nearly impossible. For example, a sovereignty dispute between Venezuela and Guyana is affecting Exxon's Liza-1 discovery (OGJ Online, May 20, 2015). The International Court of Justice will hear in September 2016 a similar maritime border dispute between Kenya and Somalia.

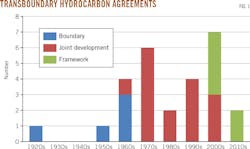

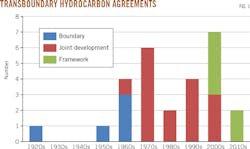

Since the early years of the oil and gas industry governments have benefited from working together to make exploration investments more secure in border regions (Fig. 1). Initial bilateral agreements were simple such as the 1958 Bahrain-Saudi Arabia boundary agreement establishing equal sharing of the net revenue from oil production.

Over time, however, agreements have become more robust in establishing a clear regulatory framework for both exploration companies and the financial community. In many cases, these initial boundary agreements have developed into joint development agreements for hydrocarbon reservoirs in areas of contested sovereignty and, more recently, framework agreements for THRs along undisputed boundaries.

Onshore application

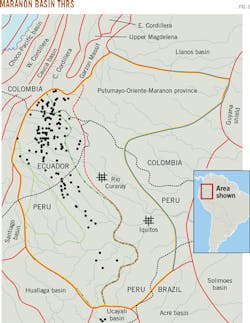

Opportunities exist globally for THR agreements (Fig. 2). Modern framework agreements such as the US-Mexico, UK-Norway, and Trinidad and Tobago-Venezuela agreements have focused on offshore areas. Some of the precursors to these agreements-the boundary agreements between Saudi Arabia, Kuwait, and Bahrain-apply to onshore exploration and development. These early agreements identified areas where hydrocarbon resources would be shared equally but did not address regulatory frameworks and coordination between governments. The continued need for onshore framework agreements is perhaps greater than in offshore areas. Onshore operations are more visible and the general public is more likely to raise objections, particularly over environmental and social issues. Sensitive rainforest regions are areas in which THR treaties could benefit onshore operations. Public pressure could result in developing policies centered on conservation. Alternately, exploration companies can provide expertise and, with government cooperation, build an effective development framework.

The Maranon basin is in the dense rainforests shared by Colombia, Ecuador, and Peru (Fig. 3). The region has the potential to share infrastructure such as the North Peruvian Pipeline. The proper development framework could bring about the cost reductions and limited environmental impacts needed to attract investment.

Mexico's unconventional basins (Fig. 4) have seen limited exploration activity but data show the border region has similar potential to the adjacent Eagle Ford shale in the US. A framework agreement similar to the US-Mexico offshore agreement could further unconventional development in northern Mexico.

Kenya, Tanzania, Uganda, and Somalia share basins and would benefit from framework agreements (Fig. 5) and the subsequent likely reduction of political conflict. The dipute between Kenya and Somlia regarding their maritime border has deterred investors from this region's Lamu basin for more than 6 years.

Oil and gas companies should increase their understanding of regional issues and help governments improve development frameworks. Governments should focus on providing a regulatory environment attractive to exploration capital.

Acreage opportunities

In recent years exploration companies have moved toward unconventional plays and frontier regions. These operations often incur higher risks and costs. Many THRs, however, are found in traditional oil and gas producing countries with low political risk and frequently in basins where a large amount of geophysical data and analysis has already been conducted for other producing fields. This reduces exploration and production costs, making THRs attractive investment targets. The governments of the UK and Norway understood this when they developed a regulatory framework to attract investment to marginal THR fields in the North Sea in 2006 (OGJ Online, July 11, 2005). This framework allowed development of the Enoch and Blane fields by Paladin Resources.

In 2014 the US and Mexico developed a framework for the highly technical and costly deepwater THRs in the Gulf of Mexico. The framework covers the maritime border within the Perdido fold belt, where Petroleos Mexicanos (Pemex) estimates reserves of 8-13 billion bbl of oil. The Tiaras-1 field, the first development to which the framework was applied, is 3 km south of the international border and within 15 km of Royal Dutch Shell PLC's Perdido field complex. Pemex discovered noncommercial indications of oil and gas in April 2016. But the results were otherwise encouraging and further exploration activity is expected in the area.

Cross-boundary development

THR development requires collaboration among the governments involved and exploration companies interested in exploring these resources. Fully understanding the risks, jointly developing solutions to the identified problems, and outlining the benefits to all parties is paramount to successful THR exploration and development.

Most of the difficulties involved center on issues of sovereignty and investor security. Each THR will have its own specific version of these issues requiring a tailored solution. Exploration companies capable of presenting concise development plans that cater to these concepts will find governments are willing to establish clear regulatory frameworks to minimize operational risks, making THR projects executable.

Sovereignty, cooperation

THRs present governance problems by nature. Existing agreements have developed a best practice approach that establishes a joint commission of high-ranking government officials to oversee THRs and make decisions on matters such as approving unitization agreements (Fig. 6).

These commissions are often too distant to manage day-to-day activities or review technical matters, requiring subcommittees to report on these issues and make recommendations. The subcommittees are not necessarily permanent and may cover a wide range of topics such as geophysical analysis, regulations, and operational compliance.

To ensure proper governance, subcommittees include technical experts both from the involved governments and independent parties. Disputes on technical matters, such as the existence and extent of a THR and the subsequent reserve allocation, are typically resolved by an independent expert, often with authorization to make binding decisions. To resolve disagreements between the governments over nontechnical matters a tribunal or arbitration may occur.

Projects are affected by the clarity and transparency of governance, and analysis exposes failings in most modern THR treaties. The Trinidad and Tobago-Venezuela agreement, for example, failed to establish timeframes for making exploration decisions and governing committees with timeframes have not adhered to them. Only two steering committee meetings have occurred in 6 years. The agreement initially required bimonthly meetings.

In the case of the US-Mexico agreement, uncertainty as to whether joint commissions are required to make unanimous or majority decisions could generate delays and provide grounds for legal action. Failure to understand these risks can increase the potential for political problems and limit THR treaties' success.

Exploration companies are reluctant to commit resources to seismic acquisition and drilling with no clear framework in place ensuring a stable investment environment. To avoid inactivity of this type, governments have an imperative to establish a methodology for reserve allocation once exploration proves the resources. Advanced THR treaties evaluate a reserve allocation proposal made by the operators based on the exploration data. The fiscal implications of these data, however, can often lead governments to question an operator's motives.

Each government will also have different levels of knowledge and capabilities and varying goals for resource development. Companies that can develop unique approaches to manage the sometimes difficult relationships between neighboring countries will be more successful in THR projects.

Operators gain knowledge across the project life cycle. Knowing when and how reserves allocation should be updated is vital for all parties, given its effect on fiscal take for the governments and financial returns for the operators.

Rules, boundaries

Capital investments require clear rules. Sovereignty concerns in THR projects are a source of uncertainty, exposing the operator to multiple sets of potentially conflicting regulations. Governments should define THRs' location and jointly agree on a single set of regulations within this area.

Establishing too small an area could place some THRs outside the agreed upon acreage. The US-Mexico agreement established an area within 3 miles of the delimitation line. Presumably, Mexico and the US would argue the law of capture applies for THRs beyond the 3 miles, but the uncertainty creates additional risks, potentially deterring future investments in exploration and development.

Underlying fiscal terms are vital to successful THR agreements. Options include developing a new fiscal regime for the specific THR or applying each country's existing fiscal system to the reserve allocation on a proportional basis. The former of these would be more desirable for exploration companies as it would simplify development, but the politics involved are complex and time consuming. As a result, the latter is normally the case.

Reserve allocation can expose complications in the governing process. The operator normally proposes the reserve allocation, which can be a conflict of interest as the greater portion of reserves could be allocated to the more favorable fiscal regime. As reservoir knowledge improves, reallocation may become necessary, potentially altering the financial outcome of future production and ultimately the proportion of profits divided by all parties. When fiscal systems are applied proportionately, exploration companies should include constraints on future reallocations to mitigate profitability risks.

Rules guiding environmental policy, public participation, supervision, and oversight should also be clear. Development plans, approval processes, and other operational regulations need to be identified. Many of these may not have an impact on long-term profitability, but in the absence of a clear understanding, deviation from the stated policies could affect a project severely. As an example, imagine an incident such as the Macondo blowout if it occurred in a transboundary region. Conflicts in supervision, regulations, and oversight in the event of a crisis could lead to delayed mitigation, long legal cases, project delays, and higher costs.

Subcommittees responsible for developing regulations within THRs should receive ample legal and technical support.

Field development

Proper reservoir management benefits operators and governments as the increased production generates more revenue and broadens the tax base.

Some agreements mandate the shared use of infrastructure. Rather than treating each field as an individual project, agreements may require open access to other infrastructure to avoid the waste of constructing new platforms, pipelines, and gathering systems. Regardless of ownership, it may be more efficient to expand capacity of existing infrastructure, reducing capital costs and environmental degradation by limiting infrastructure redundancies.

Most THR agreements also apply mandatory health, safety, and environment (HSE) rules. Clarity on conservation and environmental regulations provides further security of investment. Where transnational regulations are involved, best practices can be subjective and uncertainties or disconformities should be well-defined.

In recent years, holistic environmental assessments have been deployed to assess the link between exploration, its cost and benefits, and its eventual impact on the local environment. In the UK and Norway, strategic environmental assessments are tools by which the governments determine environmental policies, programs, and plans to provide a basis for an environmental impact assessment (EIA).

EIA components such as subsequent mitigation actions and monitoring procedures need to be interpreted. When a THR agreement includes the environmental legislation of more than one country, the regulations and guidelines that will govern the agreement must be made clear.

The authors

David Auty ([email protected]) is a partner at Canales Auty, Mexico City. He previously was director for Latin America for WoodMackenzie and worked as director of industrialization for the Bolivian Ministry of Hydrocarbons and as an in-house advisor for the World Bank. He has an MS in energy studies from the Centre for Energy, Petroleum, Mineral Law and Policy, University of Dundee, Scotland, and the Institute of French Petroleum (IFP) in Paris. He also holds a law degree from the University of Leicester, UK.

Carlos Canales ([email protected]) is a partner at Canales Auty and previously worked as head of legal for Shell México, and head of legal for Iberdrola Ingenieria y Construcción. He is a PhD candidate in public international law at the University of Leicester and holds an MBA in oil and gas management and an LLM in resources law and policy both from the Centre for Energy, Petroleum, Mineral Law and Policy, University of Dundee.

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com