Wood Mackenzie says Delaware basin oil offers economic potential

At least one analyst believes the Wolfcamp shale, particularly the Delaware basin within the Permian basin, offers among the best economic potential of tight oil plays to help sustain US operators through distressed oil prices. Benjamin Shattuck, analyst with Wood Mackenzie Ltd. in Houston, said focus on the Wolfcamp play has shifted since 2014 from the Midland basin to the Delaware basin, which straddles West Texas and New Mexico.

"Operators are talking the most now about the Delaware," Shattuck told OGJ, adding that cost reductions and productivity improvements continue in the Midland basin.

During recent earnings calls, operators touted Delaware basin efficiency improvements in both drilling and completions."I would certainly agree with that," Shattuck said. "Service prices are down roughly 40-45%. Operators are drilling much faster. Average penetration rates in the Delaware basin are up 20-25% compared to 2 years ago. A well that would have cost $10-11 million to drill 2 years ago is going to be closer to $6.5-7.5 million today."

A few operators have drilled 10,000-ft laterals in the Delaware basin, Shattuck said, adding that the Delaware presents more completion complexities for operators than the Midland basin.

"It's a much deeper formation in the Delaware, which makes it more difficult from a technical perspective to drill out that far," Shattuck said. "Operators just are not seeing quite the same replicability," in the Delaware basin as they have in the Midland basin.

He noted some leasing terms constrain lateral lengths in the Delaware basin to 4,500-5,000 ft. "It's a very fragmented leasing pattern out there," Shattuck said. "Building a position that would support longer laterals has been at the forefront of some operators minds, but it is still a limiting factor in a lot of cases today."

The Permian basin has a larger inventory of wells with superior economics than other tight oil plays, he said. "It's a juvenile play from the unconventional perspective," which has helped keep operators interested in the Permian. "It would be the oldest play from a conventional perspective."

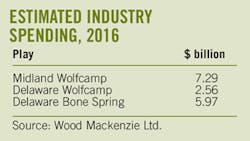

WoodMac's expectations for producers' 2016-17 spending in the Permian basin have fallen 37% compared with 2015, Shattuck said. Other US unconventional plays are down more than 50%.

"We've moved into such a dynamic environment that small changes in the price of oil can have a pretty profound impact on our expectations for spending," Shattuck noted. "The best way to look at it today is how much spending fell out of our expectations as the price of oil fell."

About the Author

Paula Dittrick

Senior Staff Writer

Paula Dittrick has covered oil and gas from Houston for more than 20 years. Starting in May 2007, she developed a health, safety, and environment beat for Oil & Gas Journal. Dittrick is familiar with the industry’s financial aspects. She also monitors issues associated with carbon sequestration and renewable energy.

Dittrick joined OGJ in February 2001. Previously, she worked for Dow Jones and United Press International. She began writing about oil and gas as UPI’s West Texas bureau chief during the 1980s. She earned a Bachelor’s of Science degree in journalism from the University of Nebraska in 1974.