GENERAL INTEREST — Quick Takes

PDC enters Delaware basin in $1.5-billion deal

PDC Energy Inc., Denver, has agreed to acquire two privately held units managed by energy-focused privately equity firm Kimmeridge Energy Management Co. LLC, including 57,000 net acres in Reeves and Culberson counties in Texas, with average working interest of 93%, for $1.5 billion.

Current net production from the acreage is 7,000 boe/d from 21 horizontal wells, with two additional wells in the completion and flowback phase. Of the total output, 42% is oil and 65% is liquids.

The total net acreage, of which 41,000 acres are in Reeves County and 16,000 acres are in Culberson County, features more than 700 gross estimated horizontal drilling locations targeting the Wolfcamp A, B, and C zones with upside potential through downspacing and additional intervals, the firm says.

Based on a combined total of 4-12 wells/section, preliminary estimated net reserve potential is 530 million boe.

Expected to close in the fourth quarter, the deal includes scalable owned and operated midstream infrastructure, including gas gathering systems, pipelines, right-of-ways, and five salt water disposal wells.

During the remainder of the year, PDC plans to spud nine horizontal wells, seven of which have 1.5- or 2-mile laterals, and expand certain midstream infrastructure for expected total capital outlay of $55-65 million. The firm also is finishing completion operations on two horizontal wells and plans to operate two drilling rigs by yearend.

“Adding this Delaware position to our Core Wattenberg acreage gives us more than 1 billion net boe of liquid-rich reserve potential in two of the top-tier US onshore basins,” commented Lance Lauck, executive vice-president, corporate development and strategy.

PDC in June agreed to a Wattenberg acreage swap with Noble Energy Inc. as the firms sought to consolidate their positions in the Colorado natural gas and condensate field (OGJ Online, June 16, 2016).

Continental to sell North Dakota, Montana acreage

Continental Resources Inc., Oklahoma City, has agreed to sell nonstrategic properties in North Dakota and Montana to an undisclosed buyer for $222 million.

The sale includes 68,000 net acres of leasehold primarily in western Williams County, ND, and 12,000 net acres in Roosevelt County, Mont. It covers net production of 2,800 boe/d.

“This is our third sale of nonstrategic assets this year, with total expected proceeds of more than $600 million,” said Harold Hamm, Continental chairman and chief executive officer. In May, the firm reported the sale of 132,000 net acres of leasehold in the Washakie basin of Wyoming for $110 million. On Aug. 3, Continental said it had signed an agreement with an undisclosed buyer to sell 29,500 net acres of nonstrategic leasehold in the eastern SCOOP play in Oklahoma for $281 million.

Meanwhile, Continental has invested $560 million in drilled but uncompleted wells (DUCs), including both operated and nonoperated DUCs. The firm currently has 215 gross operated DUCs in inventory, of which 165 are in the Bakken. Continental expects the total to grow to 240 gross operated DUCs at yearend, with 190 in the Bakken.

The firm says its Bakken DUCs have an average estimated ultimate recovery (EUR) of 850,000 boe/well and can be completed at an average cost of $3-3.5 million/well.

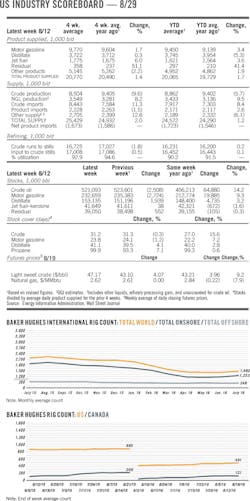

API: US gasoline demand hit 9.7 million b/d in July

Total motor gasoline deliveries, a measure of consumer demand, increased 2.4% from July 2015 to average nearly 9.7 million b/d last month, according to data from the American Petroleum Institute. Compared with June, total motor gasoline deliveries increased 0.3%. For year-to-date, total motor gasoline deliveries increased 2.5% compared with year-to-date 2015 to a record level just above 9.3 million b/d.

“Gasoline deliveries…hit their highest level on record in July,” said Erica Bowman, API chief economist. “With this indication of increased demand, it’s clear that consumers have continued to benefit from lower gasoline prices at the pump.”

Total petroleum deliveries in July moved up 0.8% from July 2015 to average 20.1 million b/d, marking the highest July deliveries in 9 years. Compared with June, total US petroleum deliveries increased slightly by less than 0.1%. For year-to-date, total US petroleum deliveries moved up 1.1% compared with the same period last year.

Crude oil production was down from the prior month, the prior year, and the prior year-to-date as production continued to slow and reached its lowest output level for any month since March 2014. Crude oil production fell 1.9% from June, and was down 10% from July 2015 to average 8.5 million b/d in July.

US total petroleum imports in July averaged just below 10.5 million b/d, up 6.8% from the prior month and up 9.9% from the prior year, but were the 4th lowest total petroleum imports for the month of July in 19 years, since 1997.

At 10.2 million b/d, gasoline production for the month of July reached its highest level for any month on record. This was up by 1.9% from the prior year, and up 1.3% from the prior month. For year-to-date, gasoline production increased 1.9% compared with the same period last year and was the highest year-to-date on record.

Refinery gross inputs moved down 0.7% from July 2015, but remained the second highest inputs for the month of July, averaging 17.1 million b/d. Compared with June 2016, refinery gross inputs were up 1.9%.

Exploration & Development — Quick Takes

Algerian drilling campaign ends with oil discovery

Algeria’s state-owned Sonatrach and its partners completed its drilling campaign in Hassi Bir Rekaiz with the Bou Goufa-2 (BOG-2) well that flowed 2,406 b/d of oil and 2.9 MMcfd of associated gas. BOG-2 was drilled to TD 4,064 m at the end of April. Drillstem tests showed flow rates from the Triassic Argilo Greseux Inferieur (TAGI) formation.

Hassi Bir Rekaiz is onshore in the southeastern part of Algeria. It covers an area of 2,686 sq km and includes Blocks 443a, 424a, 414ext, and 415ext. PTTEP is the operator during the exploration period with 24.5% interest. Its joint venture partners are Sonatrach with 51% interest and CNOOC Ltd. with 24.5% interest. The development proposal is under way and will submitted to the Algerian government in early 2017, PTTEP said.

GeoPark’s Jacana 5 well extends Colombian oil field

The GeoPark Ltd.-operated Jacana 5 appraisal well on Llanos 34 block in Colombia reached a TD of 11,467 ft, testing with an electric submersible pump in the Guadalupe formation at 2,500 b/d of 15.5° gravity oil.

Oil flowed through a 41/64-mm choke with wellhead pressure of 90 psi, showing less than 1% water cut. The firm says additional production history is required to determine stabilized flow rates of the well. Surface facilities are in place and the well is already on production.

The Jacana 5 well followed the recent Jacana 4 and Jacana 3 wells, which expanded the size of Jacana field by extending its northwestern limit (OGJ Online, July 8, 2016). Jacana 5 was drilled 780 m north of Jacana 3 further down dip to a bottom-hole location below the previous lowest-known oil.

With these results, the test of the Jacana 5 well further extends the limits of the field. GeoPark expects to continue exploring and appraising the Tigana-Jacana oil trend to determine the full extent of the oil accumulation.

Once testing of the Jacana 5 well is completed, the drilling rig will move northeast along the trend to Tigana field, followed by other locations, to continue GeoPark’s program of five more wells on Llanos 34 block, of which the firm holds 45% working interest, before yearend.

Energean to develop two fields off Israel

Energean Oil & Gas, Athens, has committed to submit within 6 months a development plan for deepwater Karish and Tanin natural gas and condensate fields offshore Israel, 100% interests in which it agreed to acquire.

The $148-million deal accommodates antitrust stipulations in the Israeli government’s natural gas framework allowing development of nearby Leviathan gas field and expansion of Tamar field, both much larger than Karish and Tanin (OGJ Online, Dec. 17, 2015).

Energean will acquire interests of 47.059% from Noble Energy Mediterranean Ltd. and 26.4705% each from Avner Oil Exploration LP and Delek Drilling LP, according to Delek Group.

The fields, about 40 km apart in Israel’s exclusive economic zone, will supply the Israeli market.

The agreement is subject to government approvals.

Statoil submits development plan for Byrding strike

Statoil ASA has submitted a plan for development and operation (PDO) for the 2005 Byrding discovery to Norwegian authorities, and said recoverable volumes are estimated at 11 million boe.

Byrding, previously known as Astero, lies in 360 m of water on Block 35/11 about 3.8 km north of Fram field.

The reservoir is about 3,100 m below the ocean surface, according to the Norwegian Petroleum Directorate, which also said the 35/11-13 discovery well was appraised by the 35/11-14 well in 2006.

NPD said development of Byrding “has been considered multiple times” in the past 10 years.

The plan includes a duo-lateral well drilled from the existing Fram H-Nord subsea template. The duo-lateral well is expected to be 7 km long, with the first kilometers shared by the two laterals.

Oil and gas will flow to the Troll C platform for partial processing and then be sent onshore by existing pipelines to Mongstad and Kollsnes.

Capital expenditures are estimated at 1 billion kroner, down from initial estimates of 3.5 billion kroner.

The development is expected to come on stream in third-quarter 2017, with production lasting as long as 10 years. An estimate of peak production in 2017 and 2018 is about 8,000 boe/d.

Byrding is within PL 090 B. Operator Statoil has 45%, Wintershall Norge AS 25%, Idemitsu Petroleum Norge AS 15%, and Engie E&P Norge 15%.

Drilling & Production — Quick Takes

Tullow begins oil flow from TEN project off Ghana

Tullow Oil PLC has started oil production from Tweneboa, Enyenra, and Ntomme (TEN) fields offshore Ghana.

Tullow expects oil production to ramp-up gradually towards the Prof. John Evans Atta Mills floating production, storage, and offloading vessel’s capacity of 80,000 b/d of oil through the remainder of this year. The firm estimates TEN average annualized output for the year will be 23,000 bo/d gross and 11,000 bo/d net.

The first TEN discovery was made in 2009. The government of Ghana approved the project’s plan of development in 2013.

Tullow is operator of the TEN fields with 47.175% interest. Partners are Anadarko Petroleum Corp. with 17%, Kosmos Energy Ltd. 17%, Ghana National Petroleum Corp. 15%, and PetroSA 3.875%. Tullow also is operator of offshore Ghana’s Jubilee field, which has been on stream since 2010.

DNO drilling in Tawke field in Iraq’s Kurdistan region

DNO ASA, a Norwegian oil and gas operator, said it plans to drill five production wells yet this year in Tawke field in the Kurdistan region of Iraq. The drilling follows an extensive workover program.

Two rigs currently are working, DNO said. The Tawke-31 well, targeting the main Cretaceous reservoir, is the first Tawke production well to be drilled since 2014. It is expected to reach 2,200 m in September.

A third rig will be added to drill an appraisal well in the fourth quarter in Peshkabir field.

DNO said its second-quarter operated production was up 27% to 122,900 boe/d. Tawke production alone was 117,000 b/d.

Statoil’s Fram C East starts output to Troll C platform

Statoil ASA said it has started production from the Fram C East well. Technology and improved drilling efficiency helped slash costs for the Norwegian North Sea development designed to maximize production from the Fram area and boost Troll C platform production.

The development originally was estimated to cost $97 million, but expenses were reduced to $72.8 million, Statoil said.

Fram C East is a long production well drilled from the existing Fram subsea template. Production is tied back to Troll C, Statoil reported Aug. 24. Natural gas will be transported to Kollsnes via Troll A. Oil will move by pipeline to Mongstad for processing.

Lars Hoier, Statoil vice-president operations for Troll and Fram, said, “Fram C East is a small development project, but a key element of our plans to capture maximum value in the Fram area.” He believes Fram C East could yield a positive cash flow yet this year.

Statoil holds 45% interest in Fram C East. Partners are ExxonMobil Corp. 25%, Engie 15%, and Idemitsu 15%.

Fram C East was discovered in 2007. Oil was found in the Middle Jurassic reservoir rocks (OGJ Online, Jan. 15, 2008).

Yme platform removed in a single lift

The mobile offshore production unit (MOPU) installed in Yme field in the Norwegian North Sea was removed in a single lift on Aug. 22 by the Pioneering Spirit vessel owned by Allseas Group SA.

The 13,500-tonne platform was sea-fastened onboard the installation, decommissioning, and pipelay vessel for eventual dismantling in Lutelandet, Norway.

The Norwegian Petroleum Directorate on Aug. 19 granted consent to Repsol Norge AS for removal of the Yme MOPU in PL 316/316B.

Yme began producing in 1996. In late 2000, licensees decided to shut down production of 16,000 b/d from seven wells due to forecasts for production and oil prices (OGJ Online, Nov. 23, 2000).

In 2007, partners received approval to reactivate the field (OGJ Online, Jan. 11, 2007). In 2012, Talisman Energy Inc. announced a writedown and put production on hold (OGJ Online, Mar. 12, 2013).

The platform had been unmanned since 2012 when cracks were found in platform legs.

Repsol SA became operator after its 2015 acquisition of Talisman Energy Inc. Earlier this year, OKEA AS, Trondheim, agreed to acquire Repsol’s 60% stake in Yme.

PROCESSING — Quick Takes

Inter Pipeline to buy olefinic NGL business

Inter Pipeline Ltd., Calgary, has agreed to buy the olefinic offgas extraction and fractionation business in Canada of Williams and Williams Partners, Tulsa, for $1.35 billion (Can.) and proposes to expand into propane dehydrogenation (PDH).

The acquisition covers an extraction plant each at the bitumen upgraders of Suncor Energy Inc. and Canadian Natural Resources Ltd. near Fort McMurray, Alta. The plants, with combined capacities of 40,000 b/d, recover NGLs and olefins from coker offgas under long-term supply contracts.

Inter Pipeline also will acquire the 420-km, 43,000-b/d Boreal Pipeline, which carries recovered liquids to Williams’s 40,000-b/d olefinic fractionator at Redwater, north of Edmonton, operated by Pembina Pipeline Corp., Calgary.

Nova Chemicals Corp. buys as much as 17,000 b/d of ethane-ethylene mix produced at Redwater under a long-term fee-based agreement. US and Canadian energy marketers and refiners buy remaining NGLs and olefinic liquids under shorter-term, commodity-based agreements.

Inter Pipeline says the purchase price represents a 45% discount to the original cost of the assets.

It envisions the addition of a PDH plant, which it says would be Canada’s first, to convert about 22,000 b/d propane from Redwater and other sources into 525,000-tonnes/year of polymer grade propylene.

Inter Pipeline has invested $250 million so far in the PDH facility, which would be built near the Redwater fractionator. It estimates total capital expenditure of $1.85 billion.

Target service date is in 2020, depending on a final investment decision expected by yearend.

ENOC to expand Dubai condensate refinery

State-owned Emirates National Oil Co. (ENOC) of Dubai plans to expand capacity of its 140,000-b/sd condensate refinery at Jebel Ali to 210,000 b/sd. The expansion is part of a national plan for growth through 2021.

ENOC built the refinery in 1999 and added a reformer and hydrotreater in 2010.

Eni lets contract for Zohr gas processing plant

Belayim Petroleum Co. (Petrobel), a joint venture of wholly owned Eni SPA subsidiary IEOC Production BV and Egyptian General Petroleum Corp., has let a contract to Frames Group BV, Alphen aan den Rijn, the Netherlands, to provide processing equipment for a gas plant connected to the first phase of development of deepwater Zohr natural gas field on the Shorouk block offshore Egypt (OGJ, Sept. 7, 2015, p. 60).

As part of the contract, Frames’ separation and heat transfer divisions, respectively, will design and supply eight sour-gas filter coalescers and eight shell and tube heat exchangers, all of which will be installed at the onshore El Gamil plant (OGJ Online, Aug. 22, 2014), the service provider said.

With the Zohr development now on the fast-track to begin production by yearend 2017 (OGJ Online, June 20, 2016), Frames said it plans to complete delivery of the filter coalescers and heat exchangers within a year.

The company did not disclose a value of the contract.

Eni, operating through IEOC Production, holds 100% interest the Shorouk license, with Petrobel acting as operator.

Earlier in the year, the Egyptian Ministry of Petroleum confirmed Eni also has started construction on the first of two new plants in Egypt’s Port Said as part of its program to increase processing capacity for Zohr gas production (OGJ Online, Apr. 28, 2016).

Expedited as part of an effort to reduce costs and financial exposure, Zohr’s accelerated 1-bcfd startup phase is scheduled to begin production from six subsea wells connecting via a gas pipeline to the onshore plant at Port Said by yearend 2017 (OGJ Online, Feb. 26, 2016).

The project’s second phase, or the accelerated ramp-up-to-plateau, will add another 14 wells to boost production to 2.6-2.7 bcfd from 2019.

Second-phase plans also include another gas line as well as an additional onshore processing plant, Eni said.

The gas processing plants will host four processing trains of 350 MMcfd each.

TRANSPORTATION — Quick Takes

AOPL releases annual pipeline safety report

The Association of Oil Pipe Lines released the 2016 API-AOPL Annual Liquids Pipeline Safety Excellence Performance Report & Strategic Plan, which it developed jointly with the American Petroleum Institute.

The report, which documents liquids pipeline safety performance and outlining industry-wide efforts to improve pipeline safety in 2016 and beyond, highlights trends since 2011. “Large pipeline incidents, those over 500 bbl, are down 32% over the last 5 years,” AOPL Pres. Andrew J. Black said.

During that time, the report said that:

• Incidents per mile larger than 500 bbl decreased by 32%.

• 99.999% of crude oil and petroleum products delivered by pipeline reached their destination safely.

• Pipeline incidents potentially affecting people or the environment outside of operator facilities fell 52% since 1999.

• Corrosion-caused pipeline incidents potentially impacting people or the environment outside operator facilities dropped 68% during that same period.

• In 2015, 65% of pipeline incident releases were fewer than 5 bbl.

• The 16.2 billion bbl of crude oil and petroleum products delivered during 2014—the most recent year for which figures were available—was 20% higher than 2010’s total.

• The 207,800 miles of liquids pipelines crossing the US represent a 13% increase in distance during the last 5 years.

AOPL said the Pipeline Safety Performance chapter provides further information analyzing the industry-wide safety record, including where performance is improving and which areas hold challenges. This in-depth examination of safety performance not only allows industry to gauge progress, but also helps prioritize safety efforts, it explained.

The new report also outlines specific industry-wide actions liquids pipeline operators are taking to improve safety and reduce the number of incidents, AOPL said.

PHMSA issues pipeline status advisory bulletin

The US Pipeline & Hazardous Materials Safety Administration issued an advisory bulletin about procedures for changing a pipeline’s status from active to abandoned for pipeline owners and operators, and federal and state pipeline safety personnel.

A 2014 pipeline failure which let 1,200 gal of crude oil to seep into a residential neighborhood near Los Angeles raised concerns about the need to remind pipeline operators about the proper way to purge and clean inactive pipelines, the US Department of Transportation agency said.

The Aug. 16 action makes it clear that federal regulations consider pipelines to either be active and fully subject to all parts of the safety regulations or abandoned, it said.

PHMSA said it is working hard to implement the 2016 federal pipeline safety reauthorization law, which Congress passed and US President Barack Obama signed early this summer.