OGJ Newsletter

GENERAL INTEREST — Quick Takes

Petrobras reports 30% drop in net profits for 2Q

Petroleo Brasileiro SA (Petrobras) reported a second-quarter net profit of $118 million, down 30% from last year's net profit in the same period, largely attributed to impairment charges related to its Comperj refinery project outside Rio de Janeiro (OGJ Online, July 25, 2016).

Offsetting the impairment, the Brazilian state-owned firm recorded 7% growth in total oil and natural gas output to 2.8 million boe/d, a 14% increase in oil and oil product exports, lower costs related to natural gas imports, and a 30% reduction in net financial expenses. It also posted a 15% decrease in net debt during the period.

As part of the firm's $15-billion divestment plan, Petrobras this year has agreed to sell its 67.19% interest in Petrobras Argentina to Pampa Energia for $897 million, Petrobras Chile Distribucion Ltda. to Southern Cross Group for $490 million, and its 66% interest in the BM-S-8 offshore license in the Santos basin to Statoil ASA for $2.5 billion (OGJ Online, July 29, 2016).

The firm last month said it entered discussions for the sale of its petrochemical unit Petroquimica Suape e Citepe with Mexican petrochemical firm Alpek.

Santos' earnings take hit on Gladstone LNG project

Santos Ltd., Adelaide, has taken a $1.5-billion write-down on the value of its Gladstone LNG (GLNG) project that sources gas from coal seam gas fields in the Surat-Bowen basins to supply an LNG plant on Curtis Island near Gladstone.

The company said the hit followed a review of key production assets and the decision to make the impairment charge was attributed to lower oil prices, a slower-than-anticipated ramp-up in coal seam gas production from its fields, and higher gas purchase prices from other companies on Australia's east coast.

The impairment charge on the $18.5-billion GLNG project is on top of the $565 million pretax write-down on the project last February.

Santos Chairman Peter Coates said the impairment charge was "clearly disappointing, but it is a consequence of the challenging environment which we now face."

He said, "We have decided to adjust our long-term operating assumptions for GLNG to reflect the reality of the current oil-price environment."

Santos said the noncash charge will result in an aftertax impact of $1.05 billion on the company's half-year profits, but it will not affect the debt facilities.

Production began at GLNG in September 2015 from Train 1. Train 2 came on stream this past May.

Santos is operator of the project with 30%. Other stakeholders are Malaysia's Petronas, France's Total SA, and South Korea's Korea Gas Corp.

Alberta GHG cap seen costing $250 billion

A proposed cap on emissions of greenhouse gases (GHGs) will limit production growth from Alberta's oil sands and cost the provincial economy as much as $254.74 billion (Can.) during 2025-40, according to a study by the Fraser Institute.

The Alberta government's proposed 100-megatonne cap on GHG emissions could reduce cumulative production by 3.34 billion bbl of oil during that period, the study estimates, based on production forecasts of the National Energy Board and current emission-intensity levels.

Lower emission intensity of oil sands production would delay the production cap to 2027 and trim cumulative losses to 2.03 billion bbl of oil and $153.41 billion (2015 dollars).

The policy will lower global GHG emissions by 0.035% by 2040, the study says.

Cumulative emission abatement could be 236 megatonnes of carbon dioxide-equivalent, at an average cost of $1,035/tonne of GHG emissions under current emission intensity, the study estimates.

Emission-intensity reductions would lower the cumulative emission abatement and raise the cost.

Exploration & Development — Quick Takes

Murkowski: Keep Alaska sales in 5-year OCS plan

US Sen. Lisa Murkowski, (R-Alas.), strongly urged US Bureau of Ocean Energy Management Director Abigail Ross Hopper to preserve all three oil and gas lease sales proposed for Alaska when BOEM finalizes its 2017-22 US Outer Continental Shelf program. The senator's request came during an Aug. 12 face-to-face meeting in downtown Anchorage, as Hopper neared the end of a week-long Alaska tour.

"I stressed to Director Hopper that Alaska must be allowed to develop its resources, especially in the Arctic," Murkowski said. "Offshore development is one of the best ways we can create jobs, generate revenues for our state treasury, refill our Trans-Alaska Pipeline, and protect our nation's long-term energy security."

She said, "From our vast resource potential, to our long history of safe production, to overwhelming support from Alaskans, this administration has every reason to make the right decision and keep our lease sales in the offshore program." Murkowski chairs the Energy and Natural Resources Committee.

BOEM is expected this fall to release a proposed final program, which can be made final after a 60-day congressional review period. BOEM included three Alaska sales in its 2017-22 proposed program: one in the Beaufort Sea in 2020, one in Cook Inlet in 2021, and one in the Chukchi Sea in 2022.

While the sales are not area-wide or as frequent as Alaska's congressional delegation requested, BOEM cannot expand the scope of its offshore program as the planning process goes on. Murkowski convened an oversight hearing in May to examine DOI's proposed federal offshore leasing program.

Rosneft lifts seismic inventory

In the first half, OJSC Rosneft acquired more than 2,400 km of onshore 2D seismic surveys, a 17% increase from a year earlier, and more than 4,800 sq km of onshore 3D surveys, a 7.7% increase.

The company said it started seismic acquisitions at the Albanovsky and Vostochno-Pribrezhny license blocks in the Barents Sea and the Sea of Okhotsk.

Rosneft also started drilling two exploration wells in the Magadan-1 and Lisyanskiy areas in the Okhotsk with partner Statoil ASA.

In the first half, development drilling length totals increased 48% to 4,499 km from 3,039 km a year earlier.

In the second quarter, six new horizontal wells were commissioned at Samotlor field.

The company said its natural gas production of 33.23 billion cu m in the first half of 2016 was 6.9% higher than a year ago, but hydrocarbon liquids declined 0.1%.

In its operational report for the second quarter and first half, Rosneft said gas growth was driven by development in the Northern Chaivo area on the Sakhalin shelf and the 2015 launches of a gas treatment unit at Barsukovskoe field and the second stage of the Novo-Urengoy gas and condensate treatment facility.

Bill Barrett to pick up DJ basin development program

Bill Barrett Corp., Denver, will resume its extended reach lateral (XRL) development program in the Denver-Julesburg basin during the third quarter.

The firm expects to spud as many as 12 gross XRL wells before yearend that will then be placed on initial production in first-quarter 2017. Bill Barrett's capital expenditures for 2016 will now be at the high end of its previously disclosed guidance range of $75-100 million to account for the additional drilling activity.

"We believe that lower demonstrated well costs and operating expenses, combined with a narrowing DJ basin oil-price differential, will generate a competitive rate-of-return in the current commodity price environment," commented Scot Woodall, Bill Barrett chief executive officer.

The firm in the DJ basin during the second quarter produced 14,176 boe/d, up 21% from its first-quarter average. The increase is attributed to the startup of production from a 16-well drilling and spacing unit, which included 15 XRL wells, in Section 5-62-22 of northeast Wattenberg, which initiated production earlier than forecast.

Drilling & Production — Quick Takes

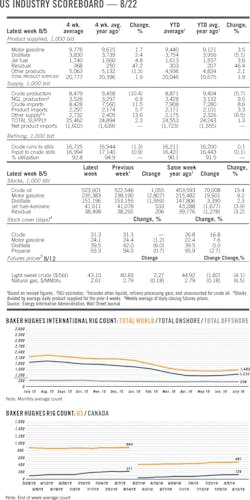

EIA: US crude output averaged 8.6 million b/d in July

The US Energy Information Administration estimated US crude oil production for July averaged 8.6 million b/d, down almost 200,000 b/d from June, said a Short-Term Energy Outlook released Aug. 9.

Although the agency's oil production forecasts for 2016-17 still calls for a decline, EIA revised its forecasts upward slightly in the August STEO from its previous forecasts.

As of Aug. 9, EIA forecast US production will average 8.7 million b/d in 2016 and 8.3 million b/d in 2017. In both June and July, EIA forecast US oil production would average 8.6 million b/d in 2016 and 8.2 million b/d in 2017. Crude oil production averaged 9.4 million b/d in 2015.

"The forecast reflects declining Lower 48 onshore production that is partly offset by growing production in the federal Gulf of Mexico," EIA said.

EIA said production is expected to fall most rapidly during April through September this year, declining by an average of 150,000 b/d each month, EIA said.

"Production is then expected to be relatively flat from October 2016 through July 2017, averaging 8.4 million b/d," the STEO said.

NPD: Norway's July oil output highest in 5 years

The Norwegian Petroleum Directorate reported that Norway's oil production in July reached its highest level in 5 years because many fields were "producing above prognosis."

Oil output of 1.728 million b/d was 10% above July 2015 and about 18% above this past June, which had 1.449 million b/d.

The July liquids total averaged 2.136 million b/d after combining the oil number with 375,000 b/d of natural gas liquids and 33,000 b/d of condensate.

Total gas sales in July were 9.1 billion cu m, up from 8.2 billion cu m in June.

Statoil to drill Barents Sea injection well

Statoil ASA has started drilling a carbon dioxide injection well in Snohvit field in the Barents Sea, and will follow with a natural gas production well.

Drilling is taking place 143 km offshore Hammerfest with Songa Rig AS's Cat D Songa Enabler semisubmersible drilling rig. The rig came from South Korea and is on its first assignment on the Norwegian Continental Shelf.

The CO2 is separated from the well stream and stored in a dedicated seabed formation. Statoil said it captures 650,000 tonnes/year of CO2 from the feed gas. The stored CO2 is monitored to ensure that it does not mix with the main producing reservoir.

The production well will be for replenishment of gas for the onshore Hammerfest LNG plant, which has been online since 2007. Statoil said it will be the first new production well at Snohvit since the field came on stream in 2007.

The next major step for Hammerfest LNG will be development of Askeladd field, which is part of the plan for development and operation of the Snohvit license. It is expected to come on stream in 2020-21.

Gazprom Neft adds more wells at Prirazlomnoye field

PJSC Gazprom Neft brought on production two more wells in Prirazlomnoye field in the Pechora Sea, bringing crude oil output to more than 6,000 tonnes/day (OGJ Online, Mar. 17, 2016).

The company now has four production wells at its ice-resistant rig, located 60 km offshore, and envisions the commissioning of 32 wells. The first well was commissioned in December 2013. All wellheads are within the platform.

Gazprom Neft also added a second and a third injection well. Waste is either reinjected or transported onshore for further recycling.

Eni restarts Val d'Agri oil output in southern Italy

Eni SPA is gradually restarting oil production connected with the Val d'Agri Oil Centre in Viggiano, Italy, which is the subject of a continuing investigation, the company said.

The resumption of production follows notification from a judge that the court lifted a seizure order on the plant in the southern part of the country. The National Mining Office for Hydrocarbons and Earth Resources of the Ministry of Economic Development also authorized the plant's operation (OGJ Online, Aug. 1, 2016).

The field was closed in late March following the arrest of some Eni employees. The probe continues, but Eni said Aug. 12 it was "confident that it will be able to confirm the correctness of its actions."

Eni reiterated that it will cooperate fully with the Court of Review while waiting on the outcome.

Executives said Eni used the downtime to carry out maintenance work at the oil field. Before the shutdown, the site produced 75,000 b/d, with most of that going to Eni. Royal Dutch Shell PLC also owns a stake in the field.

PROCESSING — Quick Takes

Gunvor plans upgrades for Rotterdam refinery

Gunvor Petroleum Rotterdam BV (GPR), a subsidiary of Gunvor Group Ltd., Geneva, has secured project financing for a series of planned development and system upgrades at its 88,000-b/d refinery and supporting product distribution network in Rotterdam, the Netherlands.

The facility launched at $200 million, and as a result of strong support, was oversubscribed by nearly 40%, Gunvor said.

The financing will enable execution of improvement plans developed for the Rotterdam operations over the coming years as part of a program to further increase its value within the Gunvor portfolio, said Erwin Goosen, GPR's refinery manager.

Without disclosing specific details regarding the nature or scope of upgrades to be supported by the financing, the company said Rotterdam's upgrading program would integrate the refinery with Gunvor's existing European refinery network, which includes the 110,000-b/d refinery in Antwerp, Belgium, and the 107,500-b/d refinery in Ingolstadt, Germany.

The company did not reveal a timeline for when it would complete the upgrades at Rotterdam.

Gunvor completed its purchase of the Rotterdam refinery and distribution network from Kuwait Petroleum International Ltd. earlier this year as part of an ongoing strategy to integrate and optimize its refining assets (OGJ Online, Feb. 2, 2016).

Located at the Port of Rotterdam, the GPR refinery includes several crude oil processing units, a gasoline production plant, a lube oil plant, and extensive distribution center and tank terminal, which provide direct access to international waterways for transport of finished and intermediate products to markets within and beyond Europe.

Fire shuts hydrocracker at Motiva's Convent refinery

Houston-based Motiva Enterprises LLC is investigating a fire that broke out in a processing unit at its 227,000-b/cd Convent refinery in St. James Parish, La.

The fire, which occurred at about 10:50 a.m. on Aug. 11 in the refinery's resid hydrocracker, or H-Oil unit, was contained and extinguished by emergency response teams, with no injuries or off-site impacts occurring as a result of the incident, Motiva said.

No other units at the refinery were impacted by the fire, and save for the H-Oil unit, all units continue to operate.

A cause of the fire remains under investigation, the company said.

Motiva, the soon-to-be-dissolved refining and marketing joint venture of Saudi Aramco and Royal Dutch Shell PLC, did not disclose details regarding the extent of damage to the H-Oil unit, or a possible timeframe for its repair (OGJ Online, Mar. 16, 2016).

Installed to enable the 227,000-b/cd refinery to process increased volumes of vacuum residuum available in its feedstock of Arab crudes, Convent's H-Oil unit has a processing capacity of 45,000 b/cd, according to Shell's latest investor's handbook, which reports operating data as of Mar. 31.

Released in June, the US Energy Information Administration's annual Refinery Capacity Report, however, shows the Convent refinery operating as of Jan. 1 with an overall crude processing capacity of 235,000 b/cd and a residual hydrocracking capacity of 52,000 b/sd (about 46,800 b/cd).

Shell, which will own and operate Motiva's Convent refinery as well as the 229,000-b/cd Norco refinery in St. Charles Parish, La., following the split with Aramco, has yet to confirm an official timeline for the partners' previously announced plan to integrate the two manufacturing sites into a single refining system (OGJ Online, Mar. 26, 2015).

Alberta regulator approves plan for sour gas plant

The Alberta Energy Regulator (AER) has approved Calgary-based SemCAMS ULC, a subsidiary of SemGroup Corp., Tulsa, to build its proposed Wapiti sour gas processing plant, which would serve Montney producers in the Wapiti region of the Western Canadian Sedimentary Basin.

SemCAMS received AER's engineering and license approval for the project on Aug. 17, SemGroup said.

Designed to process as much as 200 MMcfd of raw sour gas and 20,000 b/d condensate, the Wapiti plant would be able to process acid gas via both acid-gas injection and by transport via SemCAMS's existing pipeline systems to its Kaybob South No. 3 (K3) and Kaybob Amalgamated (KA) sour gas plants, which have a combined processing capacity of 1.5 bcfd.

Currently in negotiations with multiple producers in the region to secure long-term processing commitments, SemCAMS plans to take final investment decision on the proposed plant upon executing one or more of those agreements, SemGroup said.

While a firm timeline for the project has yet to be confirmed, SemGroup told investors in an Oct. 6, 2014, release that it expected to commission the Wapiti plant in fourth-quarter 2017.

Keyera doubles ownership stake in Alberta gas plant

Keyera Corp., Calgary, has closed on its previously announced deal to acquire additional ownership interest from partner Bellatrix Exploration Ltd., also of Calgary, in the O'Chiese Nees-Ohpawganu'ck (Alder Flats) deep-cut natural gas processing plant and related pipelines in west-central Alberta (OGJ Online, July 8, 2016).

Finalized on Aug. 9, the transaction includes Keyera's acquisition of an additional 35% interest in the gas plant and associated pipelines from Bellatrix for a total cash payment of $112.5 million, as well as prepayment of 35% of future construction costs for a second phase of the plant Bellatrix currently is building, said Keyera.

As part of deal, the companies also have entered a midstream services and governance agreement under which Bellatrix will have exclusive access to the purchased capacity-about 80.5 MMcfd post-commissioning of Phase 2-for a term of 10 years.

With its purchase completed, Keyera now holds 70% ownership interest in the Alder Flats project.

Alongside retaining a 25% ownership interest and continuing on as acting operator, Bellatrix also maintains an option to reacquire 5% interest in the gas plant at a cost of $8 million near expiry of the Alder Flats construction, ownership, and operating agreement.

Due to be on stream during first-half 2018, Phase 2 will add a design inlet capacity of 120 MMcfd to the project's Phase-1 capacity of 110 MMcfd, which came on stream in mid-2015.

TRANSPORTATION — Quick Takes

Court backs Iran vs. Israel in pipeline case

The Swiss Federal Tribunal has rejected an arbitration appeal and left intact an order that Israel pay Iran about $1.1 billion plus interest in a longstanding dispute over a crude-oil pipeline the countries built cooperatively before the Islamic Revolution of 1979.

The 158-mile, 42-in. pipeline connects the Israeli ports of Eilat on the Gulf of Aqaba with Ashkelon on the Mediterranean. An Israeli-Iranian joint venture built it to bypass the Suez Canal, which was blockaded during the 1967 Middle East War (OGJ Online, Nov. 6, 2003). Iran's revolution ended relations with Israel.

Eliat-Ashkelon Pipeline Co. operates the now-bidirectional pipeline, as well as a 16-in. products pipeline between Eliat and Ashkelon and crude lines between Ashkelon and refineries at Haifa and Ashdod.

The Swiss order covers Iranian claims to its share of revenue from pipeline operations during the decade before the revolution. It also awarded Iran $461,000 in court costs and lawyer fees.

Shell Australia lets contract for Prelude FLNG facility

Shell Australia Pty. Ltd. has let a contract to Norwegian firm DOF Subsea for underwater services and supply of a multipurpose supply vessel to the Prelude floating LNG facility soon to be stationed in the Browse basin 475 km offshore northwestern Western Australia.

The 5-year contract entails inspection, maintenance, and repair (IMR) work for the vessel and contains two 2-year extension options.

DOF will provide project management, engineering, and integrated services for IMR programs as well as the Prelude facility and options for other vessels.

The 488 m by 74 m Prelude vessel is currently under construction at Samsung Heavy Industries' shipyard in South Korea.

The FLNG facility is scheduled to remain on station at the Prelude gas field for 25 years. It will produce 3.6 million tonnes/year of LNG along with 1.3 million tpy of condensate and 400,000 tpy of LPG.