OGJ Newsletter

GENERAL INTEREST — Quick Takes

BP's Macondo well blowout liability tops $60 billion

BP PLC has lifted its total cumulative pretax charge for the 2010 Macondo well blowout and oil spill by $5.2 billion to $61.6 billion after making "significant progress in resolving outstanding claims," the firm said on July 14.

The charge includes the estimated cost of settling all outstanding business and economic loss claims under the 2012 Plaintiffs' Steering Committee (PSC) settlement. Those are expected to be paid by 2019.

A vast majority of economic loss and property damage claims made by an estimated 85,000 plaintiffs who either opted out or were excluded from that settlement have since been settled or dismissed. The cost of the remaining claims, expected to be paid by yearend, is also included in the charge.

BP, which expects to take an aftertax nonoperating charge of $2.5 billion in its second-quarter results, believes any further outstanding Macondo-related claims will not have a material impact on the group's financial performance.

BP expects to continue to use divestment proceeds to meet its Macondo commitments. The firm last year reached agreements to settle outstanding federal, state, and local government claims (OGJ Online, Oct. 5, 2015).

Restructured UK government drops DECC

The UK Department of Energy & Climate Change apparently has been abolished.

The government being formed by incoming Prime Minister Theresa May announced on the DECC web site that Greg Clark had been named to the new position of secretary of state for business, energy, and industrial strategy. Amber Ruud, who had been head of the DECC, was named home secretary.

Whether the new Department of Business, Energy, and Industrial Strategy will handle policy for climate change as well as energy was not immediately clear.

Clark, however, issued a statement indicating department functions will be "delivering a comprehensive industrial strategy, leading government's relationship with business, furthering our world-class science base, delivering affordable, clean energy, and tackling climate change."

May became prime minister after the resignation of David Cameron, who called for a referendum on the question whether the UK should stay in the European Union. Against his wishes, a majority of voters favored leaving the EU.

Woodside to buy ConocoPhillips's Senegal interests

Woodside Petroleum Ltd., Perth, has agreed to acquire all of ConocoPhillips's interests in Senegal for $350 million plus a completion adjustment of $80 million.

The purchase covers 35% of three production-sharing contract exploration blocks offshore Senegal: Rufisque Offshore, Sangomar Offshore, and Sangomar Deep Offshore. The stake includes 35% interest in the 560 million-bbl SNE deepwater oil discovery as well as the FAN oil discovery closer to shore (OGJ Online, May 19, 2016; Nov. 20, 2015).

Woodside also has the option to operate the future development of the resource. Current operator Cairn Energy PLC, which has a 40% share of the permits, has indicated it would like to sell down its interest (OGJ Online, Mar. 19, 2013).

Other interest holders are FAR Ltd. 15% and Senegal national company Petrosen 10%.

The purchase has an effective date of Jan. 1 and completion of the deal is expected by yearend, pending agreement from the Senegal government.

The move also builds on Woodside's recent agreement to acquire 65% interest in the AGC Profond exploration block to the south in the Senegal-Guinea Bissau joint development zone.

EIA: US oil companies closer to self-finance

As US oil firms' spending falls and crude oil prices increase, their immediate financial situations are improving and the need for companies to find external sources of funding may decline.

According to an analysis from the US Energy Information Administration, first-quarter 2016 financial results from US onshore producers reveal an improving balance between capital expenditure and operating cash flow. Although operating cash flow was the lowest in any quarter in the past 5 years, larger reductions to capital expenditure brought these companies closest to self-finance, when capital investment can be paid for entirely from operating cash flow.

"Operating cash flow has declined over the past year, but it nonetheless has covered an increasing share of capital expenditure as companies are reducing their investment budgets more quickly," EIA said. "Smaller investment budgets are lowering the amount of cash US onshore oil producers need to raise through outside sources."

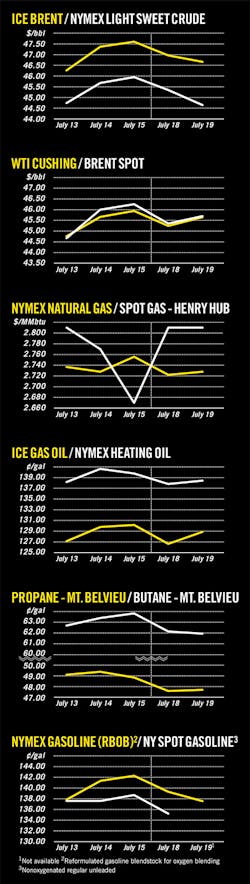

With crude oil prices such as the global benchmark Brent price in the second quarter averaging more than $45/bbl-a 34% increase from first-quarter 2016-cash flow may improve and help offset declining revenue from lower production.

The companies included in this analysis are 39 public US crude oil producers operating only onshore fields. Their collective production averaged 2.1 million b/d, or 30% of US Lower 48 production in first-quarter 2016. These companies will release second-quarter 2016 results in mid-August.

Exploration & Development — Quick Takes

Devon STACK spacing test flows 1,400 boe/d/well

Devon Energy Corp.'s Alma spacing pilot in the overpressured oil window of the Oklahoma STACK play tested five wells per section across a single interval in the Mississippian Upper Meramec, delivering 30-day production rates averaging 1,400 boe/d/well, of which 60% was light oil.

In addition to the strong initial production rates, early flowback results from the Alma pilot indicate minimal interference between wells, suggesting potential for tighter spacing in the overpressured oil window, Devon says.

The Alma wells were drilled with 5,000-ft laterals. They were brought online on 12⁄64-in. chokes, gradually increased to 20⁄64-in.

In the overpressured oil window in southwest Kingfisher County, the Pony Express 27-1H well, drilled with a 5,000-ft lateral, recorded a 30-day average rate of 2,100 boe/d, 70% oil.

Devon says oil productivity from the Pony Express is the highest of any Meramec well drilled to date in the play on a per-lateral-foot basis.

After the Alma test, Devon says it has two successful spacing pilots in the core of the Meramec oil window. Production from the two-well Born Free pilot continues to perform well, achieving a 90-day average rate of 1,500 boe/d/well, of which 60% is oil. The Born Free pilot wells were 400 ft apart and landed in two intervals in the Upper Meramec.

Devon's next pilot is the Pump House test in southwest Kingfisher County. The Pump House is testing seven wells per section in a single interval in the Upper Meramec. Initial flow rates are expected in the third quarter.

To determine the optimal approach for developing stacked-pay intervals in the Meramec, the firm is participating in several additional spacing pilots during the remainder of the year.

The spacing pilots are focused in the overpressured oil window, testing up to eight wells per section in a single Meramec interval and evaluating the joint development of multiple stacked-pay intervals through staggered well pilots.

The firm expects to start full-field development in 2017.

PPL well yields possible tight gas discovery

The Pakistan Petroleum Ltd.-operated Hadi X-1A exploration well, located on the Gambat South block in the Sanghar district of Pakistan's Sindh province, flowed 0.85 MMscfd on a 32⁄64-in. choke, confirming the presence of natural gas.

Hadi X-1A was spudded on Feb. 5, and reached the final depth of 4,020 m on Apr. 19. Based on wireline logs interpretation, potential hydrocarbon bearing zones were identified in the Sembar formation.

During initial testing in Sembar, gas flowed at the surface for 3 days and the reservoir appeared to be tight, PPL says. To further evaluate the tight gas potential, a frac job was conducted after which flow rates improved significantly.

Post-frac results suggest a tight gas discovery. However, PPL says further evaluation is needed to determine its size and commerciality based on post-well studies and integration with geological, geophysical, and engineering data collected during drilling and testing of the well.

PPL holds 65% interest in Gambat South alongside joint venture partners Government Holdings Private Ltd. 25% and Asia Resources Oil Ltd. 10%.

PPL in May reported the Kotri X-1 well on the Kotri block of the Hyderabad district in Sindh province flowed gas at 3.4 MMcfd with a wellhead pressure of 608 psi (OGJ Online, May 24, 2016).

Alliance formed for Xanadu prospect off Australia

Norwest Energy NL and Transerv Energy Ltd., both of Perth, have formed an alliance to facilitate the farmout and drilling of the Xanadu prospect in shallow territorial waters just offshore Western Australia.

Xanadu lies in permit TP/15 about 20 km south of Cliff Head oil field, which is producing in the offshore North Perth basin.

The new alliance also takes in Norwest's onshore permits in the basin, including EP 368 and EP 426, which lie east and adjacent to the Waitsia gas discovery, and EP 413, which contains the Arrowsmith discovery.

As part of the alliance, Transerv will acquire, via a share placement, 100 million shares for $200,000 (Aus.) in Norwest. Transerv also will have the right to participate in farmout wells in all of Norwest's Perth basin permits.

The placement to Transerv will take place alongside further placements of a total of 300 million shares to professional investors. The combined placements will raise $800,000 (Aus.).

The planned Xanadu-1 well will target the prominent Horst block feature, which lies parallel to the Western Australia coast. The primary target is the Dongara Sandstone at a depth of about 800 m subsurface. Secondary targets are the Irwin River coal measures and the High Cliff Sandstone.

Other programs in the alliance include plans to drill Lockyer Deep-1 in EP 368 and Arrowsmith-3 in EP 413.

Drilling & Production — Quick Takes

Gazprom Neft conducts 30-stage frac operation

PJSC Gazprom Neft said it completed a 30-stage hydraulic fracturing operation in Russia's Yuzhno-Priobskoye field.

The company conducted an 18-stage operation in the same field in March and a 15-stager last December (OGJ Online, Mar. 17, 2016). The well's total length was more than 4,600 m. The 30-stage operation was in a 1,500-m horizontal section, and the company used 1,200 tonnes of proppant.

The oil-bearing strata lies at a depth of more than 2,600 m. The anticipated operational capacity of the well is likely to be in excess of 130 tonnes/day, some 20% higher than forecast levels following lower-stage fracing operations.

Marathon begins gas flow off Equatorial Guinea

Marathon Oil Corp. has started natural gas production at its Alba B3 compression platform at the Alba gas and condensate field, 32 km offshore Malabo in the Gulf of Guinea.

Production from the B3 platform allows Marathon Oil to convert 130 million boe of proved undeveloped reserves, more than doubling the company's remaining proved developed reserve base in Equatorial Guinea.

"The Alba B3 compression project will allow us to maintain plateau production for the next 2 years, mitigating base decline, while extending the Alba field's life by up to 8 years," said Mitch Little, Marathon Oil vice-president, conventional.

Execution of the Alba B3 compression project involved engineering and construction in four countries with Heerema Fabrication Group (HFG) serving as the general contractor.

The Alba B3 platform is connected by bridge to the existing Alba B2 platform, where gas and condensate are currently sent to an onshore gas plant at Punta Europa for processing into various products, including propane and butane.

Marathon Oil's wholly owned subsidiary Marathon EG Production Ltd. is operator of Alba field with 63% working interest-65% with government carry. Samedan of North Africa LLC, a subsidiary of fellow Houston independent Noble Energy Inc., holds the remaining 35%.

Marathon also owns 52% interest in an Alba LPG plant, 45% interest in Atlantic Methanol Production Co. LLC and its plant that produces 3,000 gross tonnes/day of methanol, and 60% interest in a 3.7 million-gross-tonnes/year LNG production facility on Bioko Island.

Contract let for Zubair water injection installation

A group led by Eni SPA awarded a water-injection installation contract worth about $60 million in the ongoing redevelopment of supergiant Zubair oil field in southern Iraq. Drake & Scull International PJSC announced July 18 that it received an engineering, procurement, and construction contract.

Drake & Scull Oil & Gas also will oversee construction of a natural gas pipeline to a power plant. The EPC water-injection contract calls for installation of flow lines, trunk lines, manifolds, and wellhead hookup work to enhance oil recovery. The work is scheduled to be completed by early 2018.

Zubair produces about 360,000 b/d of oil, twice its level when a technical services contract with South Oil Co. for field redevelopment went into effect in February 2010 (OGJ Online, Mar. 3, 2016).

Production is expected to increase during the next few years to 850,000 b/d, a target renegotiated from the originally agreed 1.2 million b/d.

Eni leads a consortium that includes Korea Gas Corp., Occidental Petroleum Corp., and state partner Missan Oil Co.

PROCESSING — Quick Takes

Kazakhstan advances refinery revamp projects

Kazakhstan's state-owned KazMunaiGas (KMG), through a contractor, has let a contract to Ergil Group, Istanbul, to supply equipment for the second phase of the $2.9-billion revamp of its 5 million-tonne/year refinery Atyrau, Kazakhstan (OGJ Online, Jan. 7, 2015).

Ergil will manufacture and supply shell and tube heat exchangers to be installed as part of the Atyrau refinery's deep oil refining complex (DORC) project, the service provider said.

Scope of delivery for the order will include a mix of 11 heat exchangers total comprised of the following types: diethanolamine regenerator reboiler, methyldiethanolamine regenerator reboiler, reboiler sour-water stripping, hydrogenation cooler, and stripped-water trim cooler.

Ergil disclosed neither a value of the contract nor a timeframe for equipment delivery.

Initiated in 2010, the Atyrau modernization and reconstruction comes as part of KMG's program to boost Kazakhstan's overall crude processing capacity.

KMG commissioned Stage 1 of Atyrau's overhaul, which involved construction of a complex for production of aromatic hydrocarbons, in December 2015, according to the company's latest annual report.

Designed to expand the refinery's crude processing efficiency up to 5.5 million tpy as well as increase its ability to convert residual heavy oils into finished fuels that meet Euro 4 and 5-equivalent specifications, Stage 2's deep oil conversion complex, or DORC, is scheduled for startup by yearend.

Modernization and reconstruction projects under way at KMG's 6 million-tpy Shymkent refinery and 6 million-tpy Pavlodar refining and petrochemical complex are due to be completed by yearend 2017, the company said (OGJ Online, Oct. 30, 2014).

Petro Rabigh partially restarts ethylene unit

Rabigh Refining & Petrochemical Co. (Petro Rabigh), a joint venture of Saudi Aramco and Sumitomo Chemical Co., has initiated restart of the 1.6 million-tonnes/year ethane cracker at its refinery and chemicals complex in the port city of Rabigh on the Red Sea following a preventative shutdown of the unit in late June (OGJ Online, Oct. 22, 2012).

Petro Rabigh began restarting the cracker on July 14 after completing temporary repairs to damage in an associated turbine generator that led to the unit's precautionary shutdown on June 21, the company said in a July 17 filing to the Saudi Stock Exchange (Tadawul).

Full repair work on the unit, however, cannot be completed until the company receives a requisite new spare part from the manufacturer.

The unit's unscheduled shutdown will negatively impact gross-profit margins for the second and third quarters of 2016 by about 350 million riyals ($93.3 million), Petro Rabigh said.

The company disclosed no details regarding either the current status of operations at the cracker or an estimated timeframe for its return to full production rates.

Earlier in the year, Petro Rabigh completed the Rabigh Phase 2 ethane cracker expansion, which lifted ethane gas processing capacity at the complex by 30 MMcfd to 125 MMcfd and raised ethylene production capacity to 1.6 million tonnes/year from a previous output of 1.3 million tpy (OGJ Online, Apr. 26, 2016).

Vaquero commissions Delaware basin gas plant

Vaquero Midstream LLC, The Woodlands, Tex., has commissioned its Caymus I natural gas processing plant in Pecos County, Tex., in the southern Delaware basin.

Supported by long-term commitments with major producers in the area, the Caymus 1 development consists of a UOP Russell 200-MMcfd cryogenic processing plant on 330 acres to enable expansions of as many as four additional 200-MMcfd trains for accommodating future production growth in the region, Vaquero Midstream said.

Alongside connection to a Vaquero-owned and dedicated electrical substation that will ensure uninterrupted power service to the facility, the Caymus 1 plant is equipped with the following features: oversized inlet-liquids handling with 5,000 b/d of condensate stabilization and storage, inlet compression to minimize field pressure, amine treating, propane refrigeration prior to cryogenic processing, and Energy Transfer Technologies Ltd.'s proprietary Dual-Drive residue compression.

Given its configuration, Caymus 1 has flexibility to handle future production from Avalon, Wolfcamp, and Bone Spring shale formations, the operator said.

The plant receives feed gas via an 80-mile, 800-MMcfd, high-pressure gathering pipeline system directly connecting to Pecos, Reeves, Ward, and Culberson counties, while a residue header connects multiple outlets at the WAHA market, including connections with Atmos, Enterprise, Northern Natural Gas, and Oneok's WestTex Transmission system, the latter of which connects to the Roadrunner gas transmission pipeline.

These four connections allow processed volumes from Caymus 1 access to more than 12 residue gas outlets in the US Midwest, US Gulf Coast, as well as California and Mexico.

Vaquero's NGL header line additionally includes outlets connecting to Lone Star's West Texas Gateway pipeline and Enterprise Chaparral systems, the company said.

TRANSPORTATION — Quick Takes

Wolf Midstream to buy Devon's stake in Access line

Wolf Midstream Inc., a portfolio company of the Canada Pension Plan Investment Board (CPPIB), has agreed to acquire Devon Energy Corp.'s 50% ownership interest in Access pipeline for $1.4 billion (Can.).

Expected to close in the third quarter, the deal also includes the potential for an incremental $150 million payment with the sanctioning and development of a new thermal-oil project on Devon's Pike lease in Alberta.

Under terms of the agreement, Devon's thermal-oil acreage is dedicated to Access pipeline for an initial term of 25 years. A market-based toll will be applied to production from Devon's three Jackfish projects, which are fully operational.

The agreement also includes the potential for the Access pipeline toll to be reduced by as much as 30% with the development of new thermal-oil projects in the future. Devon's next potential project is the first phase of Pike, immediately adjacent to the Jackfish complex.

Devon is operator of the joint venture leasehold with 50% working interest. Front-end engineering and design work at the first phase of Pike is complete, but the project has not been sanctioned.

Devon says its divestiture program is now complete with proceeds totaling $3.2 billion, surpassing the top end of its $2-3 billion guidance range.

CPPIB, alongside Broe Group, struck a deal last year to acquire Encana Corp.'s DJ basin assets in Colorado for $900 million (OGJ Online, Oct. 8, 2015).

Saudi shipping firm to be top VLCC operator

National Shipping Co. of Saudi Arabia (Bahri) says it will become the world's largest operator of very large crude carriers (VLCCs) following acquisitions by a shipping fund it's launching with Arab Petroleum Investments Corp. (APICORP).

The APICORP Bahri Oil Shipping Fund plans to acquire 15 VLCCs in three phases with debt and equity investments totaling as much as $1.5 billion.

APICORP will invest 85% in the 10-year, closed-end fund and be the fund manager. Bahri will invest the remainder and be the exclusive commercial and technical manager.

Bahri CEO Ibrahim Al Omar said the targeted acquisitions will join 36 VLCCs now in the company fleet and 10 VLCCs under construction to be delivered during 2017-18.