Post-sanctions Iran advances refinery modernization, expansion program

Robert Brelsford

Downstream Technology Editor

Iran's state-owned National Iranian Oil Refining and Distribution Co. (NIORDC), a subsidiary of the country's Ministry of Petroleum (MOP), is seeking international investors to help complete a long-planned program to increase crude oil and condensate processing capacities and improve the quality of production at the country's refineries.

Alongside an estimated $14 billion in rehabilitation, modernization, and expansion projects at five of its existing refineries, Iran's downstream program involves construction of five new processing plants, Abbas Kazemi, NIORDC's managing director and MOP deputy petroleum minister, said in a June release from NIORDC.

The call for increased capital investment to help revitalize the country's refining sector comes in the wake of sanctions relief that began in mid-January following the July 2015 agreement Iran reached on its nuclear program with international negotiators (OGJ Online, Feb. 23, 2016; Nov. 12, 2015; July 22, 2015).

Primarily intended to reduce Iran's dependence on foreign fuel imports, the refining optimization also aims to reduce fuel oil output to expand the nation's market share as an exporter of fuels such as jet fuel, low-sulfur gasoline, and diesel grades.

Background

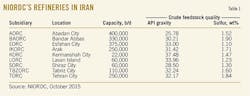

Through its wholly owned and partly privatized subsidiaries, NIORDC operates nine major refineries in Iran that have a combined crude processing capacity of 1.86 million b/d (Table 1).

The refineries' historical production of predominantly heavier, low-value products (i.e., fuel oil) and mounting energy costs stemming from their inefficient original configurations (Table 2) initiated a series of proposals over the past 10 years aimed at upgrading and renewing Iran's refining sector to address rising and subsidized demand for imported gasoline.

The Iranian government allocated $15 billion to expand capacity and increase efficiency in 2010 at NIORDC's refineries at Tehran, Lavan Island, Abadan, Arak, and Esfahan, as well as build seven new refineries to ensure the country's energy security amid ongoing international sanctions, according to a June 14, 2010, release from NIORDC.

While NIORDC undertook several of those projects, a combination of escalated sanctions, financing problems following the drop in global crude oil prices, and sector-specific management issues resulted in delays for many of them.

But a renewed focus on reforming the country's oil and gas sector after the 2013 election of current President Hassan Rouhani, a May-2015 cut in government subsidies supporting domestic consumption of refined petroleum products, and the subsequent lifting of international sanctions against the country's oil industry led NIORDC to accelerate its timeline for refinery optimization. The company now plans to add up to 3.2 million b/d in new plant capacity by 2020, according to recent media reports from the region.

Revamps, modernizations

NIORDC's proposed $14-billion modernization plan for existing operations includes a combination of projects at the following five refineries:

• Abadan Oil Refining Co.'s (AORC) 400,000-b/d refinery in Abadan City, Khoozestan province.

• Bandar Abbas Oil Refining Co.'s (BAORC) 330,000-b/d refinery in Bandar Abbas, Hormozgan province.

• Esfahan Oil Refining Co.'s (EORC) 375,000-b/d refinery in Esfahan City, Esfahan province.

• Imam Khomeini Shazand Oil Refining Co.'s (IKORC) 250,000-b/d refinery in Arak, Markazi province.

• Tehran Oil Refining Co.'s (TORC) 250,000-b/d refinery in Tehran City, Tehran province.

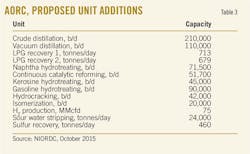

At AORC's refinery in Abadan, NIORDC has proposed a suite of projects to increase crude processing, expand clean-fuels production and residue upgrading, and improve overall efficiency and environmental performance at the plant (Table 3), according to an October 2015 presentation by Kazemi.

A new 210,000-b/d crude distillation unit, replacing three of the plant's aging units, will allow production of Euro 5-quality fuels and is targeted for startup in 2019.

As part of its ongoing revitalization of the plant, NIORDC between 2012-13 completed a series of upgrades and capacity enhancements, including installation of:

• Fluid catalytic cracking (FCC), 45,000 b/d.

• Alkylation, 12,000 b/d.

• Isomerization, 10,000 b/d.

• Sulfrex, 10,000 b/d.

• Gas amine treating, 330 tonnes/day.

• Sulfuric acid recovery (SARP), 267 tonnes/day.

• Sulfur recovery (SRU), 80 tonnes/day.

• Gasoline post-treatment (GPTU), 25,666 b/d.

• Propylene recovery, 330 tonnes/day.

At its Bandar Abbas refinery, NIORDC already has 96.7% completed a project to expand production and improve the quality of finished fuels, the company said in a June 9 release.

In addition to a 500-tonne/day sour water stripper and 120-tonne/day SRU, the Bandar Abbas project will add the following units by yearend:

• Heavy naphtha treating, 25,000 b/d.

• Continuous catalytic reforming (CCR), 25,000 b/d.

• Light naphtha treating, 21,000 b/d.

• Isomerization, 16,000 b/d.

• Gasoil hydrodesulfurization, 50,000 b/d.

• Amine treating, 230 tonnes/day.

• Sulfur solidification, 250 tonnes/day.

The Abadan modernization program, which Iran's government has agreed to finance, and the ongoing revamp at Bandar Abbas financed by China are each projected to cost between $1.7-1.8 billion, NIORDC said in releases posted to its website on Apr. 18 and May 17.

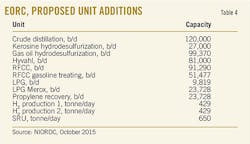

While NIORDC recently completed a series of capacity additions aimed at boosting the quantity and quality of fuel output at its Esfahan refinery that include a 62,000-b/d naphtha treater, a 32,000-b/d continuous catalytic reformer (CCR), and 27,000-b/d isomerization unit, the state-owned company's future plans at the plant include another round of projects to further expand capacities for crude processing as well as clean fuels production (Table 4).

At TORC's Tehran refinery, NIORDC plans to complete a clean fuels project that previously involved installing an 18,000-b/d naphtha treater and 18,000-b/d isomerization unit along with the following:

• Kerosine hydrodesulfurization, 31,500 b/d.

• Gas oil hydrodesulfurization, 53,500 b/d.

• H2 production, 42 MMcfd

• SRU, 110 tonnes/day.

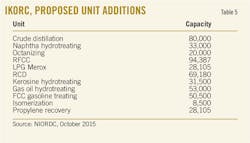

In addition to units added as part of an ongoing residue upgrading and optimization project at IKORC's refinery in Arak (Table 5), NIORDC plans to add a 341-MMcfd H2 recovery plant and 640-tonne/day SRU.

New capacity, plants

Iran also is advancing construction and commissioning activities for five new processing plants to accommodate the country's rising condensate and natural gas supplies.

Already under construction in Bandar Abbas, the Persian Gulf Star Refinery, tentatively due for startup in 2016-17, will have capacity to process 360,000 b/d of condensate from Iran's South Pars gas field to produce the following:

• LPG, 24,000 b/sd.

• Gasoline, 230,000 b/sd.

• Jet fuel, 21,000 b/sd.

• ULSD, 84,000 b/sd.

NIORDC is also building a 480,000-b/d gas condensate refinery in Siraf, at Assaluyeh in Booshehr province, to process stabilized gas condensate feedstock from different phases of South Pars.

The Siraf complex will consist of eight processing trains, each configured with the following capacities:

• Condensate fractionation, 60,000 b/sd.

• LPG recovery, 3,100 b/sd.

• LPG treatment, 3,100 b/sd.

• Naphtha hydrotreating, 34,450 b/sd.

• Kerosine treatment, 3,700 b/sd.

According to NIORDC, the Siraf complex, once completed, will be able to produce 25,000 b/sd of LPG, 276,000 b/sd of treated naphtha, 30,000 b/sd of jet fuel, and 148,000 b/sd of gas oil. Iran is also building the following refineries:

• Hormoz Oil Refining Co.'s 300,000-b/d Bahman Geno refinery at Bandar Abbas, which will process Iranian heavy and extra-heavy export crudes.

• NIORDC subsidiary Anahita Oil Refining Co.'s 150,000-b/d refinery in Kermanshah City, which will process 125,000 b/sd of Iran's North Desfull (26.35° API), 10,000 b/sd of NaftShahr (42.43° API), and 15,000 b/sd of SarkanMalehkuh (42.66° API) crudes.

• NIORDC's 120,000-b/d Pars condensate refinery in Shiraz, scheduled for startup in 2025, according to earlier company reports .