New bid round accelerates Mexico's shale potential

Scott Stevens

Keith Moodhe

Advanced Resources

International Inc.

Arlington, Va.

Mexico's shale industry may find traction in 2016. Well-prepared early movers will bid on the choicest geologic areas in one of the most anticipated shale offerings of recent years.

Development hasn't occurred as quickly as expected. Not only were early Petroleos Mexicanos (Pemex) shale wells meager producers, they also were expensive to drill and frac. Despite the disappointing start, Mexico's geologic and commercial qualities could thrust the country to the front of the emerging global shale market.

Low oil prices delayed the country's first shale auction, originally scheduled for last year and designed to attract needed foreign investment and technology. But it could take place later this year or in 2017.

Recognizing its vast shale resources, Mexico's government is opening the country's most prospective acreage, formerly the exclusive domain of Pemex, to foreign capital and expertise. The opening of Mexico's onshore and offshore basins to foreign investment for the first time in 75 years is a key part of the country's ongoing reforms.

Mexico's resource potential ranges from mature onshore fields to rank deepwater settings, including conventional and unconventional reservoirs. The country's upstream renaissance will continue to be an area of interest for the global oil and gas industry.

Delayed development

Mexican regulator National Hydrocarbons Commission (CNH) has not yet announced a revised schedule for Round 1 of its unconventional shale lease. Industry interest has been growing steadily despite the delay, along with an appreciation of Mexico's shale geology.1

The macro outlook for shale is also improving, with more than $10 billion invested in pipeline construction and a burgeoning cross-border trade in oil and gas, as US and Mexico move to integrate their refining and marketing systems. Secretaria de Energia de Mexico (Sener) announced 11 pipeline projects totaling 2,300 km and costing $5.2 billion to be built 2014-15 (OGJ Online, May 29, 2014). The recent US Department of Commerce decision to allow crude oil swaps with Mexico is another sign of the countries' closer energy integration (OGJ Online, Aug. 24, 2015).

Favorable geology

Mexico's shale geology appears prospective, especially in identified sweet spots. Stratigraphy will be familiar to North American geologists, particularly those working the Gulf Coast, because the two principal shale targets in Mexico are stratigraphic equivalents of major source rocks and productive shales in the US. Northern Mexico hosts the southern portion of the greater Gulf of Mexico basin.

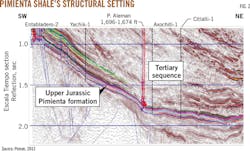

The Upper Cretaceous Eagle Ford shale extends directly into northern Mexico from South Texas, though it undergoes significant structural and lithologic changes just inside the border. The less renowned Upper Jurassic Pimienta formation, a prolific Gulf Coast source rock correlating with the Cotton Valley-Bossier-Haynesville sequence of East Texas, is regionally more extensive and uniform and could be a superior target to the Eagle Ford shale.

Regional geologic mapping reveals the Pimienta trend stretching 1,000 km across northeast Mexico (Fig. 1). The regional structure is simple throughout much of this trend, with few faults and mostly gentle dip angles (Fig. 2).2 Shale thickness, depth, and thermal maturity are prospective within a belt 50-200 km wide and spanning 27,000 sq miles (17 million acres), covering just the Pimienta shale's two key basins: Burgos and Tampico-Misantla.

Total organic compound (TOC), mineralogy, porosity, and reservoir pressure appear mostly favorable, however, understanding is constrained due to fewer data. Further potential exists in the Sabinas, Veracruz, and Macuspana basins, though these tend to be structurally more complex. One geologic feature that differs from most US shale basins is the significant igneous activity (Miocene to Recent, both intrusive and extrusive) which may sterilize local areas.

As noted, many of the early Pemex shale wells tested at low rates, despite in some cases being directly adjacent to successful Eagle Ford producers in South Texas. This suggests operational issues, such as poor lateral placement or ineffective stimulation, rather than inferior geologic conditions.

Pemex has since improved shale performance, testing 500 bo/d (37° API) from a horizontal Pimienta well in the volatile oil window.3 Another Pimienta well, this one in the dry gas window, tested 10.9 MMcfd. Considering only 30 shale wells have been drilled thus far in Mexico, all Pemex operated, these results indicate that improved drilling and completion practices coupled with better sweet-spot well placement could lead to commercially viable production.

Ample resources

Pemex's latest official shale-resource estimate is 60.2 billion boe, comprising 31.9 billion bbl oil, 36.8 tcf wet gas, and 104.1 tcf dry natural gas.4 The methodology and assumptions used for this estimate were not disclosed by Pemex. Separately, Advanced Resource International Inc.'s (ARI) 2013 assessment for the US Energy Information Agency (EIA), which included areas not assessed by Pemex, found 104 billion boe of risked, technically recoverable resources, comprising 13.1 billion bbl of oil and 545 tcf of natural gas.5

Our current analysis, based on a larger public data set that we assembled for our multiclient study, indicates the oil potential could be greater. Shale areas in the Burgos and Tampico-Misantla basins are structurally simple with few faults. Owing to gentle or flat structural dips, the liquids-rich windows often are wider than in the Texas Eagle Ford. Overpressuring occurs locally in these prolific and still actively generating source-rock shales.

Bid rounds

Seeking to reverse its declining oil output, Mexico is transforming its petroleum industry, with shale leasing as one of the pillars of reform. CNH and Sener recently published a detailed multiyear plan to auction shale blocks in the Burgos and Tampico-Misantla basins in four separate bid rounds.6 Round 1 will focus on the Tampico, while Round 2 will feature extensive areas in the southern Burgos. Both regions offer liquids-rich shale targets, with the subsequent Rounds 3 and 4 allowing room for growth.

CNH has identified an estimated 24.1 billion boe potential in 282 blocks totaling nearly 33,000 sq km in the Burgos, Burro-Picachos, Tampico-Misantla, and other onshore basins (see accompanying table). Our independent analysis shows the offered blocks varying widely in reservoir quality and surface conditions, from excellent to poor. The better blocks have thick organic-rich shale of mainly carbonate-silica lithology at optimal depth (~3,000 m) and thermal maturity (Ro ~1.1%), with few faults and flat surface topography. Other blocks have shale targets that, in our view, are too shallow (<1,000 m) or thermally not sufficiently mature to be prospective (Ro <0.5%). Access to infrastructure and services also affects block desirability.

Service access, security risks

Once shale blocks have been awarded, service companies based in the southern US (Eagle Ford, Permian, and Haynesville) are positioned to bring in specialized drilling and completion equipment and expertise. The Mexican government is working to facilitate such cross-border trade. Local established service companies experienced with conventional oil and gas development in the Burgos and Tampico-Misantla basins offer partnering options.

Early Pemex shale wells reportedly cost $20-25 million each, triple the cost of equivalent Eagle Ford wells in South Texas. These wells were dispersed across the shale trend and required additional engineering. But capital costs should fall with greater geologic subsurface control, increased competition amongst service providers, and the inevitable logistical economies of scale. An influx of shale-savvy oil companies from abroad also will introduce needed efficiencies.

Potential complications, however, remain a part of the nascent Mexican shale industry. One of the largest is the local security situation. Both the Burgos and Tampico-Misantla basins are plagued by organized criminal gang activity. Shale development involving thousands of widely spaced wells and surface infrastructure presents daunting security issues. The government will need to focus law enforcement and security resources in these areas to enable large-scale shale development. Other countries (e.g., Colombia) have successfully grappled with similar concerns, but the security situation remains an active risk in Mexico.

Future prospective

With the contract structure for shale licenses still somewhat uncertain, there is talk that the government may consider sweeter terms due to low oil prices. This seems likely following the poor response to the recent shallow offshore bidding round, only two out of 14 blocks being successfully awarded.

Mexico's switch from its old service agreements to more standard production-sharing contracts, providing the contractor with actual title to the resource, is a positive development. The government's share is determined by a royalty on gross revenues, an exploration fee, and a negotiated percentage of operating profit after cost-recovery. Signature bonuses are not required.7

Data availability for assessing Mexico's shale resource potential could be problematic. Much of the basic geologic and well data publicly available in other countries is kept confidential in Mexico. And the future CNH data room may provide limited-to-no data outside the offered blocks, hampering regional geologic interpretation and leasing strategies.

Fortunately, a wealth of geologic data on source-rock shales has been published in various Mexican technical journals and university theses. ARI has spent several years synthesizing data from these public sources into a proprietary GIS data base of Mexico's shale geology. Data were compiled from nearly 500 Spanish-language technical articles, mostly published before shale development began and focused on conventional source rock geology.

Shale data locations plotted on our Mexico maps provide an indication of geologic control (Fig. 2). With about 10,000 mapped shale geologic and reservoir data points, we now have reasonably good control of thickness, depth, structure, lithology, and thermal maturity for the principal Upper Cretaceous and Upper Jurassic shale targets across northeast Mexico. Geochemical data such as TOC and hydrocarbon indicators (HI) also were found but were less abundant.

High-graded Pimienta shale areas, for example, may have more than 200 m of gross shale thickness, double the typical Eagle Ford thickness in South Texas. Mineralogy comprises mainly calcite with minor quartz and illite clay. TOC generally is lower than in the Eagle Ford at 2-3% (unadjusted).

The Pimienta can be found in the volatile oil to wet gas windows (0.8-1.2%) and at optimal depths of 2-3.5 km. Porosity has been measured at a reasonably high 7%. Reservoir pressure often is high, reaching 50% over hydrostatic in places. The stress gradient has tested at a moderate 0.9 psi/ft, enabling good 3D fracturing systems during stimulation. Coupled with the vast prospective area, these are intriguing reservoir properties.

References

1. Stevens, S.H. and Moodhe, K.D., "Evaluation of Mexico's Shale Oil and Gas Potential," SPE 177139, Society of Petroleum Engineers (SPE) Latin America and Caribbean Petroleum Engineering Conference (LACPEC), Quito, Ecuador, Nov. 18-20, 2015, pp. 13.

2. Pemex, "Aceite y Gas en Lutitas," June 21, 2012, pp. 54.

3. Araujo, O., Garza, D., Garcia, D., Ortiz, J.R., Bailon, L., and Valenzuela, A., "First Production Results from Pimienta Oil Source Rock Reservoir-A Promising Shale: Case History from Burgos Basin, Mexico," SPE 169420, SPE Latin America and Caribbean Petroleum Engineering Conference, Maracaibo, Venezuela, May 21-23, 2014, pp. 15.

4. Pemex, "Presente y Futuro del Proyecto Burgos," May 2014, pp. 38.

5. US Energy Information Administration (EIA), "Technically Recoverable Shale Oil and Shale Gas Resources: An Assessment of 137 Shale Formations in 41 Countries Outside the United States June 2013," Report by Advanced Resources International, Inc., pp. 730.

6. Sener, "Plan Quinquenal de Licitaciones para la Exploración y Extracción de Hidrocarburos 2015-19," Oct. 7, 2015, pp. 139.

7. Powell Shale Digest, "Mexico: Update on Energy Reforms," Sep. 1, 2015, p. 43.

The authors

Scott Stevens ([email protected]) is senior vice-president with Advanced Resources International, Inc. He has worked on unconventional reservoirs since starting his career with Getty Oil Co. and Texaco Inc. in 1983. He holds degrees in geology from Pomona College, Claremont, Calif., and Scripps Institution of Oceanography, University of California, San Diego.

Keith Moodhe ([email protected]) is a project manager with Advanced Resources International, Inc., having joined in 2006. He holds a BS in geology from the College of William and Mary, Williamsburg, Va. He is a member of the American Association of Petroleum Geologists and Society of Petroleum Engineers.