Exploration downturn poses hard questions for offshore rig fleet

Caitlin Shaw

Quest Offshore

Houston

Deepwater exploration faces several difficulties and future projects will increase in complexity. Innovative technological solutions will remain a priority for companies moving into harsh and frontier areas. Volatility in global demand and oil and natural gas prices can cause near-term, temporary disruptions in project cycles, but opportunities still exist. Oil companies and supply chain members alike are working diligently on solutions that will provide positive long-term results for deepwater exploration.

Drilling rig utilization

Global deepwater drilling demand has experienced year-on-year decline since 2013, creating an oversupply of floating drilling assets and unparalleled idling and stacking.

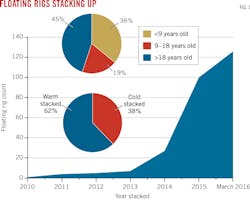

Continuing the trend of 2015, new contracts for floating rigs will remain very limited in 2016, resulting in an increasing number of idle units. Twenty-six floating rigs have been stacked in first-quarter 2016 bringing the total stacked count to 123, of which 80% have been sidelined in just the past 12 months. More than 60% of the idle fleet remains in warm stack mode incurring costs of $40,000-100,000/day.

Nearly 50% of the stacked units are more than 18-years old and will likely never work again (Fig. 1). Nearly 20% are part of a dying fourth and fifth-generation fleet being squeezed out of the market by an abundant supply of newer sixth-gen units. Almost 40% of the stacked rigs are among the newest sixth and seventh-generation fleet which commanded day rates as high as $700,000 just 2 years ago.

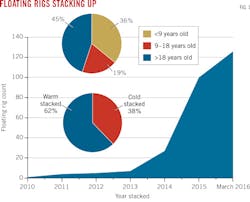

Heavy emphasis is placed on strategic stacking of newer rigs in an effort to keep the units in a semi-warm state at a reduced cost, capable of rapid reactivation once price recovery begins. With another 42 rigs rolling off contract through 2016, drilling rig utilization will continue to plummet, forcing day rates to near or below breakeven (Fig. 2, Table).

There are currently 260 floating rigs in marketed supply of which 180 are under contract, putting marketed utilization at 70%. Contractors could immediately increase marketed utilization to over 80% by retiring or cold stacking 41 older rigs currently warm stacked. Supply levers will only alleviate some of the pressure, however, and with more rigs rolling off contract every quarter their effects could be temporary. But supply is a measure contractors have control over and could act on immediately.

Quest Offshore forecasts rig demand for 2016 of around 165, suggesting operators are likely to let go of 15-20 more units this year. If contractors cold stack or retire at least half of those units (~10) utilization could stabilize at just under 80% heading into 2017.

Closing the oversupply gap will be a long process as demand recovery is expected to be gradual and its timing remains unclear. Leading-edge day rates will remain at or below breakeven on higher-specification rigs and the average day rate for sixth and seventh-gen units will continue to erode as more roll off their initial high-rate contracts. More than 70% of rigs working today at $500,000+ rates are rolling off contracts in the next 18 months and rig demand is expected to remain soft through this period.

The objective for 2017 should be to get leading-edge rates back to $400,000/day for the sixth and seventh-gen fleet through aggressive attrition focused on keeping marketed utilization at or near 80% by reducing marketed supply below 200 total units. This would mean that more than 80% of all marketed rigs would be sixth or seventh-gen while only about 40 older rigs, essential for mid-water or harsh environments where mooring capability is necessary, would remain in service globally (Fig. 3).

Deepwater discoveries

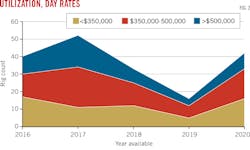

Deepwater exploration drilling demand has declined sharply over the past 4 years. Since its high point in 2010, global exploration drilling has fallen in all major deepwater basins. The success rate of these exploration spuds was decreasing at the same time (Fig. 4). This trend could stem from companies pursuing high-risk prospects while the oil price was high, with the more easily accessed reserves already identified.

More than 65% of drilling came from exploration activity during the 2010-12 peak. High oil prices enabled high-cost campaigns in Brazil, Australia, West Africa, and Norway, increasing rig supply as key major operators sought to open new development frontiers.

Exploration drilling began trending down in 2013 due to a nearly 60% drop in Brazil exploration activity, partially off-set by increases in the US Gulf of Mexico and expansion into East Africa. With the exception of Africa, exploration drilling in most regions in 2014 remained flat or slightly down and by 2015 exploration in all regions had dropped, leading to a nearly 50% year-on-year decline. Africa and Asia were hit particularly hard in 2015, with 60% and 50% declines respectively. Both are high-cost regions for deep water exploration and it is unlikely Africa will return to peak levels at oil prices below $70/bbl.

Australia LNG projects are slowing down, deterring the need to drill for more gas. In Brazil, Petrobras will likely use what limited funds it has to develop presalt plays. Less than 10 exploration wells are likely to be drilled in Brazil in 2016. The US Gulf, which was the most resilient region throughout 2015, is already showing signs of weakened demand as key major operators push plans into the future in an effort to preserve cash.

Global deepwater discoveries feed directly into the inventory for future development. Given the average cycle time for a major deepwater development is 7-10 years from discovery to first oil, any potential impact from this lower discovery-rate trend could emerge in the second half of next decade. The severe stall of projects during the current downturn should mitigate the majority of this effect through the middle of the next decade, as the industry works through its backlog of viable and undeveloped resources.

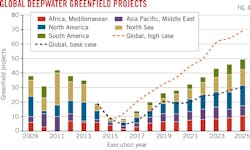

Looking at Quest's long-term, greenfield development opportunities, 2016 lies in the middle of the trough created by the current downturn (Fig. 5).

Most projects are going through reassessment to ensure the best development scheme possible, while only a handful have been completely scrapped and labeled uneconomic under any possible revisions. These projects have been pushed toward the end of the decade.

The work that operators and supply chain companies are doing to reduce cost and increase deepwater development returns will result in higher sanction numbers post-2017. Reducing project scope and cycle time are important in deepwater development and can potentially result in more projects being awarded each year.

Subsea trends

Quest tracks subsea tree awards as a leading indicator of the health of the overall subsea market. The depressed demand of 2014 and 2015 has been mirrored through other market segments. The subsea forecast has gone through two material adjustments since the start of this downturn; the first in late 2014-early 2015 when the oil price initially fell and most recently in first-quarter 2016 when still weak oil prices further exacerbated oil companies concerns regarding project execution timing.

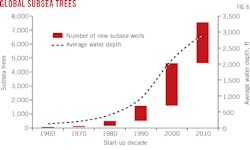

Over the 5-year forecast period, the mean (mostly likely) case for offshore exploration and development has been reduced by 20% and the base case by 30% (Fig. 6). Ongoing price weakness over the past few months has all but ruled out any recovery in subsea demand this year. Subsea recovery, however, is on the horizon and the backlog of opportunities that has been reassessed and reworked to find better project economics remains.

The US Gulf will be one of the most resilient areas during the downturn. The region's project diversity helps potential activity by fostering different reactions to market conditions. Africa has significant opportunity for subsea demand in both the northern and eastern offshore regions, but timing is always a risk in the area and even more so during this downturn.

The opening of presalt Brazil could generate future demand and has the potential to offset, at some point, some of the demand lost as a result of Petrobras's recent problems. The operator will continue to trim expectations and push projects that materially affect the local supply chain and its ability to survive to the next up cycle. Other operators have stakes outside the presalt plays and are expected to drill towards the end of the decade, providing development potential beyond 2020.

One bright spot in the subsea tree market is the install base in place and the life-of-field services they will require. Despite reduced spending, intervention, workover, maintenance, and eventual decommissioning and removal of this hardware will be required. As the number of trees in service grows, demand will grow for future goods and services.

Subsea trees are being installed in greater depths than ever (Fig. 6). Equipment will have to evolve to handle the additional requirements associated with these depths.

The author

Caitlin Shaw ([email protected]) is senior director of Quest Offshore's market research and data division in Houston. She holds a BS in marine biology from Texas A&M University at Galveston. She is a member of the Marine Technology Society and the Society for Underwater Technology.