Near-term pipeline construction strong

Christopher E. Smith

Managing Editor, Technology

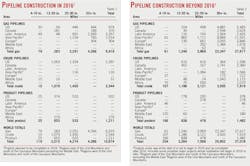

Planned pipeline construction to be completed in 2016 increased 64% from the year prior, with expected products, crude, and natural gas project completions all climbing even as future planned mileage slipped in all three categories, most markedly crude and products.

Operators plan to complete installation of 10,674 miles in 2016 alone (Table 1), with natural gas plans (6,919 miles) making up nearly 65% of the total, based on reports from the world's pipeline operating companies and data collected by Oil & Gas Journal. By contrast, crude and products pipelines made up nearly 60.5% of total planned construction as recently as 2013.

The softer plans for beyond 2016 reversed the uptick seen last year as uncertainty gripped the energy market. Sharp reductions in long-term pipeline plans in the US, Asia-Pacific, and Middle East, more than erased increased plans in Europe. The Middle East registered the largest outright decline, led by a 46.5% drop in gas pipeline plans.

Planned pipeline construction for beyond 2016 also registered decreases in the US, with slightly bigger gas pipeline plans failing to compensate for drops in planned crude and products mileage. Operators had announced plans to build more than 37,000 miles of crude oil, product, and natural gas pipelines extending into the next decade, a more than 11% decrease from data reported the prior year (OGJ, Feb. 2, 2015, p. 78).

As a whole, combining both current-year and forward estimates (Fig. 1), increases in planned construction were seen only in Europe and Latin America, with decreases everywhere else.

Outlook

EIA forecast world liquid fuels consumption to increase by 35% through 2040 (using a 2012 baseline), a period that encompasses the long-term pipeline construction projections stated here.

Demand growth will be strongest, according to the April 2015 analysis, among non-OECD countries, growing from 49% of world liquid fuels consumption in 2012 to 62% in 2040. This non-OECD growth will be led by Asia, with consumption more than doubling in that time period, the most dramatic increases (3%/year) coming outside of China and India. EIA still sees China replacing the US as the world's largest consumer of liquid fuels, but now by 2040 instead of 2035.

India's predicted liquid fuels demand in 2040 was steady from earlier projections at roughly 6.8-million b/d. The country's 2012 demand was 3.6-million b/d. EIA expects 43.5-millon b/d of total Asian liquid fuels demand in 2040.

EIA expects liquid fuels demand in Japan to drop 0.8%/year between 2012 and 2040, shrinking to 3.65-million b/d from 4.7-million b/d.

GDP growth estimates from EIA continued to reflect data from its September 2014 International Energy Outlook, the updated report not having been issued at press time. Non-OECD Asia growth slipped to 5.3%/year through 2040, led by India dropping from 6.1%/year, the highest projected growth rate in the world in EIA's 2013 estimates, to 5.4%/year. EIA expected a 3.5% global growth rate in its last report.

Slowing industrial activity and a sluggish service sector combined with as yet insufficient structural reforms to lower India's expected economic growth. The country is also trying to reduce subsidies on petroleum products.

Structural issues that have implications for medium to long-term growth in China include its continued labor-intensive and severely polluting production base, a large number of nonperforming loans undermining investment-led growth, acute income inequality, and demographic factors related to an aging population and shrinking workforce.

The EIA Annual Energy Outlook (AEO) 2015 forecast up-and-down movement in US liquid fuels consumption through 2040; peaking at 19.65 million b/d by 2020 (from 18.5 million b/d in 2012) before dropping back to 19.3 million b/d by 2035-2040, a level roughly 900,000 b/d higher than was forecast for 2040 last year.

EIA projects US crude and lease condensate production climbing about 54% from 7.5 million b/d in 2012 to 11.6 million b/d in 2020 and remaining at or above 10.4 million b/d through 2040. Anticipated 2040 production is roughly one-third higher than was predicted last year.

The agency predicted 45% 2013-2040 growth in US dry natural gas production in its 2015 AEO, growing to 35.5 tcf from 24.4 tcf. An expected 73% increase in Lower-48 shale gas production, led by the Marcellus and Haynesville plays, keys gas production growth projections. Even so, the 2040 level is roughly 2 tcf below last year's predictions.

The 2015 outlook projects the US becoming a net exporter of natural gas in 2017, one year earlier than AEO 2014. In its reference case, EIA sees net exports of natural gas from the US totaling 5.6 tcf in 2040. Most of the growth comes before 2030 when gross LNG exports reach 3.4 tcf, a level they continue at through 2040. Last year's outlook pegged 2039 LNG exports at more than 5.8 tcf. Net pipeline imports from Canada continue through 2040, but at lower levels than recently, while net pipeline exports to Mexico grow to 3 tcf in 2040 from 0.7 tcf in 2013.

OGJ tracks applications for gas pipeline construction to the US Federal Energy Regulatory Commission (FERC). Applications filed in the 12 months ending June 30, 2015 (the most recent 1-year period surveyed) demonstrated the renewed strength in the US pipeline market.

• Nearly 2,200 miles of gas pipeline were proposed for land construction. For the earlier 12-month period ending June 30, 2014, more than 520 miles were proposed for land construction.

• FERC applications for new or additional horsepower at the end of June 2015 also increased sharply, reaching more than 1.7-million hp, from more than 700,000 hp.

Bases, costs

For 2016 only (Table 1), operators plan to build nearly 10,700 miles of oil and gas pipelines worldwide at a cost of more than $57 billion. For 2015 only, companies had planned more than 6,500 miles at a cost of more than $43 billion.

For projects completed after 2016 (Table 2), companies plan to lay more than 37,000 miles of line and spend roughly $197 billion. When these companies looked beyond 2015 last year, they anticipated spending roughly $276 billion to lay nearly 42,000 miles of line. Land construction costs fell in the meantime from $6.6-million/mile to $5.2-million/mile.

• Projections for 2016 pipeline mileage reflect only projects likely to be completed by yearend 2016, including construction in progress at the start of the year or set to begin during it.

• Projections for mileage after 2016 include construction that might begin in 2016 but be completed later. Also included are some long-term projects judged as probable, even if they will not break ground until after 2016.

Based on historical analysis and a few exceptions and variations notwithstanding, these projections assume that 90% of all construction will be onshore and 10% offshore and that pipelines 32 in. OD or larger are onshore projects.

Following is a breakdown of projected costs, using these assumptions and OGJ pipeline-cost data:

• Total onshore construction (10,033 miles) for 2016 only will cost roughly $52.5 billion:

-$561 million for 4-10 in.

-$9.5 billion for 12-20 in.

-$20.1 billion for 22-30 in.

-$22.3 billion for 32 in. and larger.

• Total offshore construction (641 miles) for 2016 only will cost nearly $4.9 billion:

-$91 million for 4-10 in.

-$1.5 billion for 12-20 in.

-$3.3 billion for 22-30 in.

• Total onshore construction (35,972 miles) for beyond 2016 will cost more than $188 billion:

-$1.6 billion for 4-10 in.

-$15.4 billion for 12-20 in.

-$36 billion for 22-30 in.

-$135 billion for 32 in. and larger.

• Total offshore construction (1,116 miles) for beyond 2016 will cost more than $8.5 billion:

-$252 million for 4-10 in.

-$2.5 billion for 12-20 in.

-$5.8 billion for 22-30 in.

Action

What follows is a quick rundown of some of the major projects in each of the world's regions.

Pipeline construction projects mirror end users' energy demands, and much of that demand continues to center on natural gas, with the industry remaining focused on how to get that gas to market as quickly and efficiently as possible. The following sections look at both natural gas and liquids pipelines.

US, Canada activity Gas, NGL

TransCanada Alaska, the state's licensee to build a natural gas pipeline from Alaska's North Slope, received state clearance May 2, 2012, to change the project's focus to a large-diameter pipeline to an Alaska tidewater site for in-state use, liquefaction, and export. The move came after TransCanada Corp. and the North Slope's three major producers-BP PLC, ConocoPhillips, and ExxonMobil Corp.-announced Mar. 30, 2012, that they would work together to commercialize ANS gas by focusing on large-scale exports from south-central Alaska as an alternative to a pipeline through Alberta to markets in the US Lower 48. The four companies completed the project's concept selection phase in February 2013.

BP PLC and ConocoPhillips's Alaskan subsidiaries in October 2015 provided written assurances that they will commit their shares of ANS natural gas to a future pipeline project. Each company's primary focus remains on the Alaska LNG Project, BP Exploration (Alaska) Inc. Pres. Janet L. Weiss and ConocoPhillips Alaska Pres. Joe Marushack separately indicated. But the two subsidiary leaders each added that their company's gas would be available to a future Alaska pipeline project on mutually agreeable commercial terms if the one that currently is proposed does not move ahead or the company withdraws from it. ExxonMobil did not make a similar commitment, but did approve the project's 2016 budget.

TransCanada was awarded rights to build a North Slope gas pipeline under the Alaska Gasline Inducement Act in January 2008. In June 2009 TransCanada agreed with ExxonMobil Corp. affiliates to work together on the pipeline. The Alaska Pipeline Project the two companies formed initially presented two alternatives for assessment by potential shippers, only one of which would move forward. One option would have transported an estimated 4.5 bcfd of gas from Alaska's North Slope about 1,700 miles across Alaska to Alberta, Canada, where it could be sent on existing pipelines to North American gas markets. The second option called for shipping an estimated 3-3.5 bcfd of gas about 800 miles to Valdez, Alas., where shippers could liquefy the gas in a plant constructed by others and ship it on tankers to US and international markets.

This option, now called Alaska LNG and including the Alaska Gasline Development Corp., is in pre-front end engineering and design (pre-FEED), expected to be complete early 2016. Alaska bought TransCanada's share of the project in November 2015. The US Department of Energy (DOE) in November 2014 granted Alaska LNG authority for exports to countries covered by free-trade agreements (FTA), approving exports to non-FTA destinations like Japan, China, India, and Taiwan in May 2015.

Large gas pipeline projects in Canada centered on shipping material from shale plays in Alberta and British Columbia to the Pacific coast for liquefaction and export. In early 2013, Chevron Canada Ltd. announced plans to buy 50% of Kitimat LNG and the proposed Pacific Trail Pipeline. Pacific Trail is a 290-mile, 36-in. OD pipeline which would move gas from Spectra's pipeline system to the Kitimat LNG terminal. The British Columbia government in July 2013 extended Chevron and partner Apache's window to start construction of the line to 2018. Woodside bought Apache's interest in Kitimat LNG in late 2014 (OGJ Online, Dec. 15, 2014).

Spectra Energy Corp. is itself planning with BG Group PLC to jointly develop a 42-in. OD, 525-mile gas pipeline from northeast British Columbia to supply BG's potential LNG plant in Prince Rupert, BC. The line would move 4.2 bcfd of gas from the Horn River and Montney developments to the coast for liquefaction and export. Canada's National Energy (NEB) in late-2013 approved a 25-year natural gas export license to BG, but subsequent new BC-government tax proposals prompted the company to delay its final investment decision (FID) on the project to 2017 (OGJ, Apr. 7, 2014, p 120) and BG's pending merger with Royal Dutch Shell PLC may see the project consolidated with others in the area.

Progress Energy Canada Ltd. in August 2013 signed firm transportation agreements for an interconnection with TransCanada's proposed Prince Rupert Gas Transmission (PRGT) project to provide gas to the proposed Pacific Northwest LNG export plant near Prince Rupert. PNW LNG is owned by Petronas (77%) and Indian Oil Corp. Ltd. (IOC, 10%) in partnership with Progress. Delivery of 2.1 bcfd from TransCanada's Nova Gas Transmission Ltd. system to the 470-mile, 48-in. OD PRGT would begin in 2019.

TransCanada in October 2015 received final permits for PRGT from the BC Oil & Gas Commission (BCOGC) giving regulatory approval for the construction and operation of the PRGT. The permits cover the pipeline's entire route from just north of Hudson's Hope, BC, to Lelu Island, off the coast of Port Edward. The permits also approve construction of three compressor stations and a meter station where the gas is to be delivered to PNW LNG. PNW LNG still must receive a positive decision from the federal government under the Canadian Environmental Assessment Act 2012 to begin PRGT construction.

Projects to move NGL to market made headway in the US. Kinder Morgan Energy Partners LP and MarkWest Utica EMG LLC's proposed Utica Marcellus Texas Pipeline (UMTP) Y-grade transportation project from the Utica and Marcellus shales to Mont Belvieu would have an initial design capacity of 150,000 b/d and be expandable to 430,000 b/d. The companies held on open season for the project last year, and are currently conducting public outreach, route selection, and permit preparation targeting a fourth-quarter 2018 in-service date. The first 964 miles of the line would consist of converted Tennessee Gas Pipeline system, with 200 miles of new-build between Natchitoches, La., and Mont Belvieu, and 120 miles of laterals to provide basin connectivity.

Project Mariner, announced in 2010 by Sunoco Logistics Partners LP and MarkWest Energy Partners LP, will transport 50,000 b/d of Marcellus shale ethane to the US Atlantic Coast for shipment to Gulf Coast chemical producers and European markets. Mariner West, a 65,000-b/d expansion of Project Mariner, began moving ethane to Sarnia, Ont., in 2013.

The combined projects include just 85-miles of new pipeline construction, using existing Sunoco infrastructure for the balance of each route. MarkWest is building ethane storage in the Philadelphia, Pa., and Nederland, Tex., areas as part of the project, using existing storage in Sarnia.

Sunoco held a binding open season in 2012 for Project Mariner East, which began propane operations in fourth-quarter 2014 and began shipping ethane in time to meet a February 2016 initial loading. The 70,000-b/d system uses Sunoco's existing 8-in. OD pipeline between Delmont, Pa., and Philadelphia, with new pipe between Houston, Pa., and Delmont.

The company in late 2014 announced it had received sufficient shipper interest to move ahead with its 275,000 b/d Mariner East 2 pipeline, largely paralleling the route of the first line. Sunoco expects to put the 300-mile, 16-in. OD Mariner East 2 in service by yearend 2016 (OGJ Online, Nov. 7, 2014).

Construction of natural gas pipelines in the northeast US was delayed in large part by increasingly strident environmentalist protests. Williams's Constitution (124 miles, 30-in. OD, Marcellus shale to New York citygate) and Kinder Morgan's Northeast Energy Direct (415 miles, 30 and 36-in. OD, connecting Troy, Pa., Wright, NY, and Dracut, Mass.) were two of the higher-profile projects affected, but by no means the only ones.

In the Permian basin, Energy Transfer Partners LP and Regency Energy Partners LP's joint-venture Lone Star NGL LLC is building a 533-mile 24- and 30-in. OD pipeline to Mont Belvieu, converting its existing 12-in. OD NGL pipeline along the same stretch to crude and condensate service. The companies expect the new NGL line to be operational by third-quarter 2016 and the converted crude line by first-quarter 2017 (OGJ Online, Nov. 18, 2014).

Crude

TransCanada announced plans in July 2008 for the Keystone Gulf Coast Expansion Project (Keystone XL), providing additional capacity of 830,000 b/d from western Canada to the US Gulf Coast by 2012. The expansion would have boosted the Keystone system's total capacity to 1.1-million b/d. US President Barack Obama in November 2015 announced his administration's rejection of TransCanada's application for permission to construct the pipeline. Keystone XL would have included 1,179 miles of 36-in. OD line starting in Hardisty, Alta. and extending to a delivery point in Steele City, Neb.

Energy Transfer Equity LP, Energy Transfer Partners LP, and Phillips 66 formed joint ventures late last year to build two crude oil pipelines that together will connect the Bakken-Three Forks play in North Dakota to the US Gulf Coast. Dakota Access LLC will run roughly 1,100 miles, linking North Dakota and the hub at Patoka, Ill., and delivering at least 450,000 b/d via 30-in. OD pipe to various points in the Midwest. The project as of January 2016 was still seeking condemnation against 23 North Dakota property owners to secure easement. Energy Transfer Crude Oil Co. LLC will deliver from Patoka to Nederland, Tex, converting existing natural gas lines to crude service. The companies expect both to enter service fourth-quarter 2016 (OGJ Online, Oct. 29. 2014).

Magellan Midstream Partners LP in October 2014 announced sufficient shipper interest in transporting various grades of crude oil from the Niobrara shale to its storage site in Cushing, Okla., to proceed with its proposed 600-mile, 20-in. OD Saddlehorn pipeline. Saddlehorn will carry as much as 400,000 b/d from Platteville, Colo., to Cushing, using existing right-of-way for what Magellan described as a significant portion of its route.

Saddlehorn in November 2015 combined projects with Grand Mesa Pipeline LLC, extending the proposed pipeline about 20 miles north of Platteville to a junction near Grand Mesa's Lucerne, Colo., starting point. The previously competing projects will share the costs of the now 340,000-b/d pipeline already under construction. Saddlehorn will own 190,000 b/d of capacity and Grand Mesa, 150,000 b/d. Saddlehorn has the option to expand the pipeline to more than 450,000 b/d in the future at its sole discretion and cost. It would own all incremental capacity. The companies expect the Platteville-to-Cushing segment to enter service mid-2016, with the balance coming online by the end of the year.

Enbridge's North Dakota Pipeline Co. LLC is proposing to build the 612-mile Sandpiper pipeline. Sandpiper will transport light crude from Enbridge's Beaver Lodge Station, near Tioga, ND, through Clearbrook, Minn., to an existing terminal in Superior, Wisc. Sandpiper would use 24-in. OD pipe from Beaver Lodge to Clearbrook and 30-in from Clearbrook to Superior. Enbridge's Line 81 ends in Clearbrook and Sandpiper will carry its volumes to Superior.

Sandpiper will generally follow Enbridge's existing pipelines and other infrastructure right-of-way. In Minnesota, more than 75% of the route follows pipelines and other infrastructure already in operation. Enbridge will install a new pump station and storage in Clearbrook.

As of end-2015, environmental resistance was delaying the project, the Minnesota Supreme Court having declined to review a lower court's ruling that the project needed to secure an environmental impact statement (EIS) to proceed. The state's public utilities commission had authorized Sandpiper without an EIS.

Enbridge is also undertaking its $7.5-billion Line 3 Replacement (L3R) program, which the company describes as its largest project ever. L3R will replace the majority of Enbridge's existing 34-in. OD Line 3 with new 36-in. OD pipeline on either side of the Canada-US border, a total of 1,031 miles.

On the Canadian side of the border Enbridge will replace most of the existing Line 3 between its Hardisty Terminal in east-central Alberta and Gretna, Man (Fig. 2). In the US, Enbridge will replace Line 3 between Neche, ND, and Superior, Wisc. (Fig. 3). Enbridge expects the new line to enter service second-half 2017. It will decommission the existing Line 3.

Shell Pipeline in September 2015 cancelled the 226-mile, 400,000-b/d Westward Ho pipeline between St. James, La., and Sunoco Logistics terminal in Nederland, Tex., designed to have added westbound capacity following reversal of its Ho-Ho Pipeline to run from Houston to Houma, La.

Enbridge planned for the Northern Gateway Pipeline to transport 525,000 b/d of oil sands crude from near Edmonton, Alta. to a tanker terminal in British Columbia for shipment to China, other parts of Asia, and California. A line running parallel to the crude line would ship 193,000 b/d of condensate from the coast to Alberta. Enbridge would also operate the Kitimat terminal. The terminal would have 2 mooring berths, 14 storage tanks for petroleum and condensate, and be called on by roughly 225 ships/year.

Enbridge expected to build Northern Gateway 2014-17, pending regulatory approval of filings made in 2009. British Columbia Premier Christy Clark, however, declared in July 2012 that the environmental risks of the project outweighed its economic benefits and asked that BC be compensated for allowing the pipeline, which was already encountering opposition from environmental groups, to cross its territory. That same month Northern Gateway announced additional measures to ensure pipeline integrity, including: increased WT, more remote-operated isolation valves, more in-line inspections, and staffing at remote pump stations.

In December 2013 a Canadian federal Joint Review Panel recommended the Canadian government approve Northern Gateway, subject to 209 required conditions and following 18 months of community hearings. Northern Gateway received final approval from the Canadian government in July 2014. The project, however, continues to face both environmental and aboriginal opposition. Enbridge in December 2014 announced plans to increase aboriginal participation in and control of the project. The project, however, was further undermined by the November 2015 election of new Canadian Prime Minister Justin Trudeau, who instructed his incoming transport minister to make a campaign-promised crude oil tanker ban on Canada's west coast a priority.

TransCanada's Trans Mountain Expansion project would also move crude west from Alberta. The project would use 36-in. OD pipe to twin 987 km of its existing Trans Mountain pipeline. The company filed for NEB approval in December 2013 as part of a targeted late-2017 in-service date. NEB delayed any decision in September 2014 after meetings with aboriginal groups were extended. It's status was also affected by Prime Minister Trudeau's election and the potential west-coast crude tanker band.

TransCanada in 2013 reached binding long-term shipping agreements to build, own, and operate the Alberta-based Heartland Pipeline and TC Terminals projects. The projects will include a 200-km, 900,000 b/d pipeline connecting the Edmonton region to Hardisty, Alta., and a crude terminal with 1.9 million bbl of storage in the Heartland industrial area north of Edmonton. The Alberta Energy Regulator (AER) approved the projects in May 2015.

TransCanada announced the related Grand Rapids Pipeline project in 2012, a 500-km system to transport crude oil and diluent between the producing area northwest of Fort McMurray and the Edmonton-Heartland region. The system will deliver 900,000 b/d of crude and 330,000 b/d of diluent by second-half 2017. Keyera Corp. agreed in August 2015 to acquire a 50% stake in the southernmost section of the 20-in. diluent line, partnering with Grand Rapids Pipeline LP, itself a 50-50 JV of TransCanada and a subsidiary of PetroChina Co. Ltd..

Pembina Pipeline Corp. in 2013 reached binding commercial agreements to move ahead with its $2-billion Phase III Pipeline Expansion. Pembina expects the 540-km expansion to enter service by mid-2017. Phase III will follow and expand certain segments of Pembina's existing pipeline systems from Taylor, BC, southeast to Edmonton, Alta., with priority placed on areas in need of debottlenecking. The core of the expansion will entail building a 270-km, 24-in. OD pipeline from Fox Creek, Alta., to the Edmonton area.

The expansion will have an initial capacity of 320,000 b/d, but could ultimately ship more than 500,000 b/d. Once complete, Pembina will have three distinct pipelines in the Fox Creek-to-Edmonton corridor, with a combined capacity of as much as 885,000 b/d. The expansion will also increase pipeline interconnectivity between Edmonton and Fort Saskatchewan, including Pembina's Redwater and own Heartland Hub sites and third-party delivery points in these areas.

Latin America

TAG Pipelines Sur S de RL de CV let a contract to ICA Fluor, a joint venture of Fluor Corp. and Empresas ICA SAB de CV, to build the 1.42 bcfd Los Ramones II Sur Gas Pipeline (project Phase 3) through San Luis Potosí, Queretaro, and Guanajuato states in Mexico.

ICA Fluor will conduct engineering, procurement, construction, testing, commissioning, and start-up services for the 291.7-km, 42-in. OD pipeline. The line will use one compressor station, sited in the southern portion of the system. The companies expect second-quarter 2016 completion.

Los Ramones is only one of several pipelines expected to come online in the next few years and underpin the substantial growth of US gas flows to Mexico. Comision Federal de Electricidad (CFE), Mexico's state-owned electric utility, awarded Sempra Mexico a contract to build, own, and operate a roughly 500-mile, $1 billion pipeline network connecting the northwestern Mexico states of Sonora and Sinaloa. The network will consist of two segments interconnecting with the US interstate pipeline system in Arizona, shipping natural gas to new and existing CFE power plants currently using fuel oil.

The network's first segment, a 36-in. OD, 310-mile pipeline from Sasabe, south of Tucson, Ariz., to Guaymas, Sonora, began shipping 770 MMcfd in late 2014. The second segment, from Guaymas to El Oro, Sinaloa, will be a 30-in. OD, 200-mile pipeline moving 510 MMcfd. CFE expects it to start third-quarter 2016. CFE has fully contracted system capacity under dual 25-year firm agreements denominated in US dollars.

CFE also awarded TransCanada Corp.'s Mexican subsidiary, Transportadora de Gas Natural de Noroeste (TGNN), the contract to build, own, and operate two new pipelines. The 30-in. OD, 329-mile El Encino-to-Topolobampo pipeline will run from El Encino, in the state of Chihuahua, to Topolobampo in Sinaloa, at a contracted capacity of 670 MMcfd. TransCanada expects to spend about $1 billion on the pipeline, supported by a 25-year natural gas transportation service contract with the CFE. The company anticipates the pipeline will enter service third-quarter 2016.

TGNN also won the contract for the El Oro-to-Mazatlan pipeline. The 24-in. OD pipeline will run 257 miles and have contracted capacity of 202 MMcfd. TransCanada expects the pipeline, which will interconnect with the El Encino-to-Topolobampo pipeline, to enter service fourth-quarter 2016.

Work on the 4,144-km Argentine Northeast Gas Pipeline (GNEA), transporting Bolivian gas shipped on the Juana Azurduy pipeline to Formosa, Chaco, and Santa Fe provinces, Argentina, will conclude this year. The pipeline will be able to move 3.2 bcfd of natural gas.

Asia-Pacific

KazMunaiGaz and China National Petroleum Corp. (CNPC) are planning a new crude oil pipeline between Atyrau on the eastern coast of the Caspian Sea and China's Xinjiang province. The pipeline would parallel an existing 350,000 b/d line. The companies expect the 1,384-mile, 28-in. OD pipeline to enter service in 2018.

OAO Gazprom and CNPC in 2014 signed a 30-year natural gas supply contract reportedly worth $400 billion. The contract stipulates that 38 billion cu m/year (bcmy) will be supplied from Russia to China. It includes provisions for a price formula linked to oil prices and a take-or-pay clause. Gas will be delivered via the 2,465-mile Power of Siberia trunk line from Chayanda and Kovyktin fields. Work on the 56-in. OD line began in Yakutsk in September 2014, with construction of the Chinese section beginning June 2015.

The companies in December 2015 agreed on design and construction of the pipeline's cross-border section under the Amur River. They expect to commission the pipeline's first stage from Yakutia to Vladivostok in 2017 with the full line operational the following year.

The two companies later signed an agreement for 30 bcmy to be supplied via a western route provided by the Altai pipeline (OGJ Online, Nov. 11, 2014). The 2,600-km, 56-in. OD line will enter China just west of Mongolia, with completion planned for 2018.

Rosneft and Transneft agreed in September 2012 to jointly build a branch off the Eastern Siberia Pacific Ocean (ESPO) oil pipeline linking it to Rosneft's Komsomolsk-on-Amur refinery. Construction of the 8-million tpy branch began in 2014. Crude currently arrives at the refinery by rail. Transneft is financing the project, scheduled for 2017 completion, using long-term fees paid by Rosneft as part of a separate shipment agreement.

Turkmengaz plans to build a 770-km, 56-in. OD natural gas pipeline from eastern Turkmenistan to the Caspian Sea, moving 30 bcmy by 2016 for continued shipment to Europe.

The company will also lead the consortium of national governments planning to build, own, and operate the 1,800-km Turkmenistan-Afghanistan-Pakistan-India (TAPI) natural gas pipeline. The group had once sought an international company to lead the project, planned to carry 33 bcmy by 2018.

GSPL India Gasnet Ltd. is building a 2,460-km natural gas pipeline between Mehsana and Jammu. The project received its environmental permits from the Indian government in May 2013. GSPL expects the 42-in. OD pipeline to enter service in 2018 with a capacity of 30-million cu m/day (mcmd).

Sister-company GSPL India Transco Ltd. is building a 1,585-km pipeline between Mallavaram and Bhilwara. The pipeline will use pipes between 18- and 36-in. OD, also moving 30 mcmd by 2017 and having received its environmental approvals in 2013. Both pipelines will carry production and imports from India's east coast to consumers in central and northern parts of the country.

GSPL also plans by 2018 to build a 1,825-km gas pipeline from Surat to Indian Oil Corp.'s (IOC) 15 mtpy refinery in Paradip. The 36-in. OD west-to-east line passing through Maharashtra and Chhattisgarh includes five spur lines totaling 124 km.

Construction began in July 2015 on the first phase of GAIL (India) Ltd.'s Jagdishpur-Haldia natural gas pipeline. The 2,050-km pipeline-922 km of 36-in. OD trunkline and 1,028 miles of 12-30 in spur and feeder lines-will connect eastern India to the national grid. The initial phase will ship 7.4 mcmd, with total capacity reaching 16 mcmd.

The pipeline will cross Bihar, Jharkhand, West Bengal, and Uttar Pradesh states. It will pass through 13 districts in Bihar, supplying both a refinery plant and refinery in Barauni. It will also supply local gas networks in Barauni, Gaya, and Patna.

Europe

Gazprom and BASF SE in August 2015 signed a memorandum of intent stipulating cooperation on building the Nord Stream II gas pipeline. The companies would build strings No. 3 and No. 4, connecting the Russian and German coasts under the Baltic Sea and doubling the line's 55-bcmy capacity. E.On, Shell, and OMV AG each previously agreed to participate in construction of the two strings.

Russia in late 2014 decided against building the 930-km South Stream natural gas pipeline across the Black Sea from Russia to Bulgaria, citing delays on the part of the European Union in taking the steps necessary to move forward. Gazprom Chief Executive Alexei Miller and Mehmet Konuk, chairman of Botas Petroleum Pipeline Corp., signed a memorandum of understanding Dec. 1 on instead building an offshore gas pipeline from the Russkaya compressor station (also South Stream's starting point), under construction in the Krasnodar Territory across the Black Sea, to Turkey (OGJ Online, Dec. 2, 2014).

The new pipeline would have the same 63 bcm/year overall capacity, with 14 bcm/year to be used in Turkey and the balance shipped to a border crossing with Greece, the location of which had yet to be decided. The 448-Mw Russkaya station will provide as much as 28.45 MPa of pressure, enough to have shipped gas on South Stream to Bulgaria without intermediate compression.

In December 2015, however, the downing by Turkey of a Russian aircraft flying missions against Islamic State militants inside Syria prompted Russia to stop work on the pipeline.

Partners in the Shah Deniz consortium made a final investment decision (FID) in December 2013 on Stage 2 development of the Caspian Sea natural gas field offshore Azerbaijan, triggering plans to expand the South Caucasus Pipeline (SCP) through Azerbaijan and Georgia, build the Trans Anatolian Gas Pipeline (TANAP) across Turkey, and begin work on the previously selected Trans Adriatic Pipeline (TAP) for shipment into Europe (Fig. 4).

SCP expansion will twin the existing Baku-Tbilisi-Ceyhan (BTC) pipelines through Azerbaijan and Georgia, as well as adding two compressor stations to boost capacity by 16 bcmy. Project plans call for 441 km of new 56-in. OD pipe; 385 km through Azerbaijan and another 56 into Georgia, at which point the expansion will connect to the existing SCP. The first additional compressor station will be 3 km inside Georgia, collocated with an existing BTC station near Rustavi. The second new station will be at a greenfield site on the existing line, 139 km downstream, west of Tsalka Lake, Georgia. SCP's current capacity is 7 bcmy. BP expects work to be completed by end-2018.

TANAP would run 1,800 km at an estimated cost of at least $7 billion. The 48- and 56-in. OD pipeline will move as much as 30 bcm/year by 2018, coinciding with first gas from Shah Deniz II.

The Shah Deniz II consortium in June 2013 selected the Trans Adriatic Pipeline (TAP) as the project's European transport option. TAP will transport as much as 20-billion cu m/year of natural gas from Shah Deniz II through Greece and Albania to Italy, from where it can be shipped further into Western Europe.

The project will use 36- and 48-in. OD pipe, with service also expected to begin in 2018. The 36-in. pipe will make up the line's 115-km offshore section, with the 48-in. pipe used onshore. Total planned length is 800 km. The Italian government approved the project in December 2013.

TAP in October 2015 awarded a contract to Salzgitter Mannesmann International GMBH for 270 km of the onshore 48-in. line, as well as the bends required for the both the onshore and offshore sections. The company said the award would allow it to begin construction in Greece, Albania, and Italy during 2016, as planned.

Shah Deniz II will add 16 bcmy of gas production to the roughly 9 bcmy of Shah Deniz Stage 1. Field development, some 70 km offshore Baku in the Azerbaijan sector of the Caspian Sea, will include two new bridge-linked production platforms; 26 subsea wells to be drilled with 2 semisubmersible rigs; 500 km of subsea pipelines built in up to 550 m of water; the 16 bcmy upgrade to SCP; and expansion of the Sangachal Terminal.

Middle East

Despite a ceremonial groundbreaking in March 2013 between Pakistani President Asif Ali Zardari and Iranian President Mahmoud Ahmadinejad, the long-contemplated gas export line from Iran to Pakistan remains incomplete. Iran cancelled a $500-million loan to Pakistan for construction of the pipeline in December 2013, citing the effects of ongoing economic sanctions, but one year later waived penalties it had imposed on Pakistan for delays in completing its section of line.

The project would transport as much as 2.2 bcfd of natural gas from the South Pars field in the Persian Gulf through 1,850 km of 56-in. OD line. (Iran, 1,100 km; Pakistan, 750 km). The Iranian section of the line is built. The section in Pakistan would include 700 km of line from a planned LNG terminal in Gwadar to Nawabshah, with the balance spanning the gap from the Iranian border to Gwadar.

The export pipeline would enter Pakistan in southern Balochistan, running to Sindh province where the country's main pipeline hub lies. From Sindh, gas would travel through Sui Southern Gas Co.'s existing distribution network.

China Petroleum Pipelines Bureau bid to build both the LNG line and line from Iran. The company would also build the LNG terminal and floating storage and regasification unit.

Iraq began technical work in 2014 on twin 1,043-mile pipelines-one crude oil, one associated fuelgas-running from Basra to the Red Sea at Aqaba, Jordan. The oil pipeline would use 56-in. OD pipe and the gas line 36-in. OD, with respective capacities of 1-million b/d and 258 MMcfd. The pipeline would cross 422 miles inside Iraq with the balance in Jordan.

Iraq and Jordan signed an agreement on the project in April 2013. Jordan will retain 150,000 b/d for domestic refining. Jordan will also use rouhgly 100 MMcfd of the natural gas with the rest used as fuel for the oil pipeline. Iraq is pursuing the project to decrease its dependence on the Persian Gulf as an oil export route. The countries are targeting a late 2017 in-service date. SNC-Lavalin Group Inc. won a FEED contract for the pipeline.

Oman Gas Co. (OGC) plans to build a 250-km, 36-in. OD pipeline to deliver natural gas from Saih Nihayda in central Oman to an industrial and maritime hub being developed in Duqm. OGC expects the 25-mcmd pipeline to enter service 2018.

National Iranian Gas Co. (NIGC) plans to build the 300-km Iranshahr-Chabahar pipeline by 2017. The pipeline would use 240 km of 56-in. OD line and 60 km of 36-in. OD line, delivering natural gas to power the Chabahar free trade and industrial zone.

Africa

Uganda and Kenya plan to build a 930-mile, 24-in. OD heated crude oil pipeline (UKCOP) from fields in Uganda and western Kenya to the Kenyan port of Lamu. The pipeline would transport roughly 300,000 b/d. This could be expanded by 130,000 b/d to include South Sudan's participation. The World Bank in 2014 pledged $600 million to help build the pipeline. The countries awarded a design contract to Toyota Tsusho in November 2014, with design work completed in 2015.

Kenya Pipeline Co. Ltd. (KPC) in July awarded the construction contract for a 20-in. OD multi-product pipeline from Mombasa to Nairobi to Zakhem International Construction Ltd. Zakhem will build the 450-km pipeline in KPC's existing right-of-way. Construction will include four new pumps at Pump Station (PS) 1, Changamwe; PS 3, Maungu; PS 5, Mtito Andei; and PS 7, Sultan Hamud. Each station will have two pumps, one in operation and one on standby. Zakhem will also add two booster pumps at PS 14, Kipevu. The companies expect work to take 18 months, targeting a 2016 in-service date.

Construction was underway in August 2015, with 44 km of pipe strung and 16 km welded. The $500-million pipeline is replacing a 14-in. product pipeline in service for 37 years. KPC expects the new pipeline to meet regional demand for petroleum products through 2044.

Ethiopia and Djibouti plan to build a 550-km multi-product pipeline from a port site in Damerjog, Djibouti, to storage in Awash, central Ethiopia. Black Rhino Group and South Africa-based Mining Oil & Gas Services (MOGS) will build the 240,000-b/d line and expect it to be operational by 2018.

The greenfield port at Damerjog will include an import terminal and 950,000 bbl of storage. The pipeline will replace truck transport of petroleum products.