OGJ Newsletter

GENERAL INTEREST — Quick Takes

Schlumberger to acquire Cameron in $14.8-billion deal

Schlumberger Ltd. has agreed to buy Cameron International Corp. in a deal valued at $14.8 billion. Company officials said the acquisition will position Schlumberger to better compete in the oil and gas industry's current price environment.

"With oil prices now at lower levels, oil field services companies that deliver innovative technology and greater integration while improving efficiency…will outperform the market," said Paal Kibsgaard, Schlumberger chief executive officer.

He added that the combination of Schlumberger's reservoir and well technologies with Cameron's surface, drilling, and flow-control expertise will lead to the industry's next "breakthrough" technology as well as a streamlined supply chain and improved manufacturing processes.

Schlumberger's offer values Cameron at $12.74 billion, based on the company's diluted shares as of June 30. Cameron shareholders will get $14.44 in cash and 0.716 of a Schlumberger share for each share held.

Schlumberger said it expects the deal to add to earnings by the end of the first year after closing, which is expected in first-quarter 2016. The deal is subject to Cameron shareholder and regulatory approvals.

API: US petroleum demand up in July

Total petroleum deliveries, a measure of demand, rose 2.2% from July 2014 to average nearly 19.6 million b/d last month, according to the American Petroleum Institute's most recent Monthly Statistical Report.

"Demand for and production of oil and refined products grew across the board over the last year," said API Chief Economist John Felmy. "In fact, demand for and production of oil and refined products were the highest July in 8 years, since 2007."

Gasoline demand rose 2.1% last month from July 2014 to just above 9.4 million b/d, and distillate demand rose 1.1%.

US crude oil production increased 8.8% from July 2014 to an average of 9.5 million b/d-the highest July level since 1920. Natural gas liquids production averaged nearly 3.4 million b/d, marking the highest for the month on record and the new all-time record.

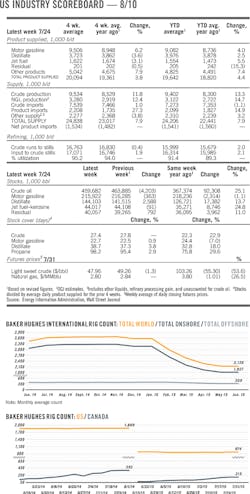

According to the latest reports from Baker Hughes Inc., the number of oil and gas rigs in the US in July was 866, 53.8% below the year-ago level. Last month's count was the second lowest count since January 2003.

US total petroleum imports in July averaged nearly 9.4 million b/d, down 1% from the previous year. Meanwhile, crude oil imports in July fell 5.5% from a year ago to average 7.2 million b/d.

At an average of nearly 10 million b/d, production of gasoline in July was the second highest level ever for the month. Production of distillate fuel in July rose 1.6% from the prior year to reach an average output of 5.1 million b/d-the second highest July level ever.

Refinery gross inputs in July rose 0.1% from last year to a record high for the month at nearly 16.9 million b/d. The refinery capacity utilization rate in July averaged more than 90% for the fourth consecutive time this year at 94%. API's latest refinery operable capacity was 17.956 million b/d.

Crude oil stocks ended in July at nearly 460 million bbl, the highest July inventory level in 85 years. Stocks of motor gasoline ended down 0.2% from last year to 216.5 million bbl. Distillate, jet fuel, and "other oil" stocks were up from year ago levels.

Cobalt to sell deepwater Angolan blocks

Cobalt International Energy Inc. has agreed to sell its interests in two blocks in deep water offshore Angola to state-owned Sonangol for $1.75 billion and will concentrate on appraisal and development of deepwater discoveries in the Gulf of Mexico.

Cobalt, Houston, holds 40% interest each in Angolan Blocks 21/09 and 20/11 and operates both. It claims to have opened the Kwanza basin presalt play with the Orca and Lontra discoveries on Block 20/11 and the Mavinga, Cameia, and Bicuar discoveries on Block 21/09 to the south.

Of the discoveries, Cameia is closest to development. Cobalt said a final investment decision is expected by yearend. It estimates the Cameia resource at 300-500 million bbl and expects productivity of 30,000 b/d/well of 39°-41° gravity oil.

Cobalt will operate both blocks until replaced by Sonangol or another operator. Sonangol will bear all costs in the interim.

In the Gulf of Mexico, Cobalt operates the North Platte Lower Tertiary discovery in the Garden Banks area with 60% interest and holds nonoperating interests in the Heidelberg, Shenandoah, and Anchor discoveries.

Exploration & Development — Quick Takes

Mexico's CNH approves geochemical survey

Mexico's National Hydrocarbons Commission (CNH) has authorized the acquisition of multibeam, coring, and geochemical analysis data over a 600,000 sq km area in Mexican waters. TGS-NOPEC Geophysical Co. (TGS) will conduct the work.

The project will cover the entire deepwater area of the offshore sector of Mexico, including producing trends such as the Perdido Fold Belt and Campeche Bay.

This project will be conducted in conjunction with the 186,000-km TGS Gigante seismic survey, which is currently 12% complete.

The multibeam data will be acquired by Fugro using vessels equipped with the latest generation of multibeam sonar equipment. Multibeam bathymetry and backscatter data will be used to identify possible oil and gas seep targets for sediment sampling. More than 1,000 navigated piston cores will be collected by TDI Brooks International and detailed geochemical analysis will be performed.

"It is a complementary addition to our Gigante regional 2D seismic program that is currently being acquired," said Katja Akentieva, TGS senior vice-president, Western Hemisphere.

TGS will start acquisition of multibeam and coring data in this year's third quarter, with expected completion in early fourth-quarter 2016.

This survey is supported by industry funding.

Erin Energy enters next phase of Kenya exploration

Houston independent Erin Energy Corp. has entered into the next phase of onshore exploration in Kenya after being given government approval to enter the first additional exploration period (FAEP) on its L1B and L16 onshore blocks.

The company earlier this year completed the required work program for the initial exploration period of the blocks. It previously announced it had exercised its right to apply for the FAEP and move to the next phase of exploration.

The FAEP of blocks L1B and L16 is effective as of July 9 for 2 years. The minimum work program for each block includes the acquisition, processing, and interpretation of 300 sq km of 3D seismic data and the drilling of one exploration well.

Most recently, Erin Energy started production from the Oyo-7 well in OML 120 offshore Nigeria. (OGJ Online, June 18, 2015).

AWE upgrades reserves estimates for Perth basin field

AWE Ltd., Sydney, reported initial 2P reserves and upgraded 2C contingent resource estimates for its onshore Perth basin Waitsia gas field in light of the Waitsia-1 and Waitsia-2 well results.

Data gathered from Waitsia-2 has significantly increased the company's previous estimate of 2C resources to 306 bcf and enabled it to book initial 2P reserves for the field at 178 bcf. Total recoverable gas on a P50 basis has risen 67% to 484 bcf from 290 bcf.

AWE added that gross reserves for Waitsia and nearby discoveries at Senecio, Irwin, and Synaphea are now estimated to be 721 bcf of gas.

AWE is now moving forward with development plans for a low-cost, early-stage gas production from Waitsia timed to come on stream by mid-2016.

The preliminary later full-field development plan will involve drilling 20 vertical or deviated production wells, including the three wells drilled to date: Waitsia-1, Waitsia-2, and Senecio-3. There are plans for a centralized gas processing facility and plateau production rate is expected to be 85 MMcfd feeding into domestic markets.

AWE has 50% interest in the Waitsia licenses L1 and L2. Origin Energy Resources Ltd. holds 50%.

Drilling & Production — Quick Takes

Eagle Ford production sees growth, despite slowdown

Eagle Ford wells brought online are expected to fall to around 2,700 from 4,000 in 2014, according to analyst group Wood Mackenzie Ltd. The company's most recent analysis cites that production growth is slow in the near term, but the full effect of lower oil prices is moderated by improved recoveries in core areas.

The Eagle Ford is expected to produce 2 million b/d of oil and condensate by 2020, the report said. The company divided the play into nine subplays, three of which account for about 75% of the Eagle Ford's remaining NPV10 reserves. The Karnes Trough, Edwards Condensate, and Black Oil subplays are predicted to grow an average of 10% in 2015, the company said.

The study highlighted the Karnes Trough as having one of the lowest breakevens in the Lower 48 at $42/bbl. Year-on-year, NPV is up $27 billion due to well performance improvements as well as derisking of acreage.

Spending cuts have impacted all shale plays in the US, however, the Eagle Ford is expected to attract $20 billion in development costs in 2015.

While the long term appears beneficial, Texas has seen a decline in the rig count this week after four straight of increases (OGJ Online, Aug. 21, 2015). The Permian and Eagle Ford dropped 2 units apiece to 253 and 99, respectively.

Ministry approves PDO for first phase of Johan Sverdrup

Statoil ASA reported the plan for development and operation (PDO) for Johan Sverdrup field in the North Sea has been approved by Norway's Ministry of Petroleum and Energy.

The ministry also approved associated plans for installation and operation of pipelines and power supply from shore.

Phase 1 will have four bridge-linked platforms and three subsea water injection templates. Production from the first phase is expected to reach 380,000 b/d of oil.

Statoil said contracts worth more than 40 billion kroner have been awarded with more contracts expected this year (OGJ Online, June 15, 2015).

The first piece of the Johan Sverdrup development-a 280-tonne predrilling template with eight well slots-was recently installed.

Second production well online at Prirazlomnoye field

JSC Gazprom Neft said a second well has been brought on production in Prirazlomnoye field in the Pechora Sea. The well extends more than 4,500 m.

The company said output at Prirazlomnoye totals 1,800 tonnes/day of oil. Commercial production began in December 2013, and the field produced 300,000 tonnes of oil in 2014.

The field, 60 km offshore, is expected to have 19 production wells, 16 reinjection wells, and one absorption well (OGJ Online, Sept. 15, 2014).

Maersk Oil lets contract for Culzean field work

Maersk Oil North Sea UK Ltd. has let a contract to Tenaris for work relating to the Culzean field development project in the UK North Sea.

Tenaris will supply casing and related services for the project, which is an ultra high-pressure, high-temperature (HPHT) gas project that accounts for six HPHT production wells together with one produced water reinjection well. The agreement will be effective for 5 years with the option to extend it for 2 more years.

Late last year Maersk Oil let a multimillion-pound contract to DNV GL for work in Culzean field (OGJ Online, Nov. 20, 2014).

PROCESSING — Quick Takes

BP restarts crude unit at Whiting refinery

BP PLC has restarted the largest of three crude distillation units (CDUs) at its 413,000-b/d refinery in Whiting, Ind., following the unit's unplanned shutdown in early August for unscheduled repair work (OGJ Online, Aug. 18, 2015).

The processing unit, which shut down on Aug. 8, has returned to service and has resumed production of fuel, BP said.

While restart of the unit is helping to increase the refinery's overall fuel output, the 250,000-b/d CDU will continue to ramp up to its full processing capacity over time, BP said.

The company did not disclose an estimate of when the unit would return to planned processing rates.

The rest of the Whiting refinery remains in full operation at scheduled rates, and despite a still-reduced fuel production at the site, BP said it continues to meet its contractual fuel supply obligations to customers.

Following the CDU shutdown, US congressional representatives Jackie Walorski (R-Ind.) and Fred Upton (R-Ind.) sent a letter to BP Chief Executive Robert Dudley asking for information pertaining to the unit's sudden closure, which caused a sharp spike in gas prices throughout the upper Midwest.

Upton, who is chairman of the House Energy and Commerce Committee, and Walorski, whose congressional district includes the refinery, specified an Aug. 21 deadline for Dudley to answer a series of questions regarding the outage.

As of Aug. 25, neither Upton nor Walorski have confirmed whether Dudley responded to the inquiries.

Irving plans massive turnaround for refinery

Irving Oil Ltd. will undertake the largest turnaround in the privately held company's history beginning next month at its 300,000-b/d St. John refinery in the eastern Canadian province of New Brunswick.

The $200-million (Can.) scheduled maintenance project, called Operation Falcon, will begin on Sept. 16 and will involve work to improve the safety, reliability, and long-term competitiveness of the refinery, which is Canada's largest, the company said.

While Irving confirmed the turnaround will include substantial upgrades to numerous areas of operations at the refinery, the company did not disclose details regarding the specific units involved in the project or possible impacts to production during the maintenance period.

Irving previously took the St. John refinery down for an 8-week, $20 million (Can.) turnaround last September, which involved unidentified work to ensure the ongoing safety and reliability of plant operations (OGJ Online, Sept. 15, 2014).

Earlier in 2014, the company completed a 6-week, $60-million (Can.) round of planned work that entailed maintenance and upgrades on several unidentified units in the refinery's Central, South, and East Process areas. That project included cleaning, equipment inspection, repairs, replacements, and piping upgrades (OGJ Online, Mar. 3, 2014).

Unit remains shuttered at Shell's Pulau Bukom complex

An investigation remains under way into a fire that broke out at an unidentified unit of Royal Dutch Shell PLC's Pulau Bukom manufacturing site on Bukom Island, Singapore, which houses a 500,000-b/d refinery, 1 million-tonne/year (tpy) ethylene cracker complex (ECC), and 155,000-tpy butadiene extraction plant (OGJ Online, Aug. 21, 2015).

The Aug. 21 fire, which was extinguished by on site emergency responders within an hour of its occurrence, resulted in burn injuries to six contract workers, three of whom remained hospitalized as of 9 a.m. Singapore local time on Aug. 22, Shell said in its latest update on the incident.

While Shell has yet to identify either the specific Pulau Bukom plant or unit at which the fire struck, the company now confirms that the unit was undergoing scheduled maintenance at the time of the event.

Units currently involved in ongoing inspection, repair, and maintenance work at the refining portion of the Pulau Bukom manufacturing site include crude distillation unit No. 5, high vacuum unit No. 5, and the hydrocracker, according to information available from the Singaporean government and a Singapore-based contractor involved in scheduled 2015 turnaround projects at the complex.

Shell said it is continuing to work closely with the Singapore Civil Defense Force (SCDF) to investigate the cause of the incident.

Aside from the unit in question, there remains no other impact to operations at the manufacturing site, the company said.

SCDF and Shell's on site fire department previously battled a 32-hr blaze that broke out at the Pulau Bukom refinery on Sept. 28, 2011, in what ultimately became a national civil emergency requiring an 8-day, multigovernment agency operation to fully resolve, according to a description of the incident on SCDF's web site.

TRANSPORTATION — Quick Takes

Colorado oil and gas group calls for route change

The West Slope Colorado Oil & Gas Association urged the US Bureau of Land Management to move an existing natural gas pipeline, which its owner-operator wants to reroute and upgrade, out of a residential subdivision and onto public land.

SourceGas LLC subsidiary Rocky Mountain Natural Gas wants to upgrade and possibly reroute 4.6 miles of its Avon-to-Rifle Pipeline in the Eagle Ranch subdivision south of the town of Eagle to comply with US Pipeline & Hazardous Materials Safety Administration regulations, BLM said in an Aug. 5 notice (OGJ Online, Aug. 6, 2015). Comments will be accepted through Sept. 4.

"The Rifle-to-Avon Pipeline is a critical delivery mechanism of natural gas to Aspen, Avon, Basalt, Carbondale, Breckenridge, Frisco, and numerous other municipalities where winter tourism and mountain lifestyles are hugely dependent on continued delivery of affordable, reliable natural gas," WSCOGA Executive Director David Ludlam said.

The pipeline carries gas produced throughout western Colorado and elsewhere to mountain resort communities where it is used to heat homes, vacation properties, condominiums, sidewalks, businesses, and winter resorts, he said in a comment submitted to BLM's Colorado River Valley field office in Silt, Colo.

"While modern, technologically advanced pipeline systems are safe, our association believes relocating the pipeline right-of-way out of an occupied subdivision, and onto public lands, is the most appropriate course of action," Ludlam said.

"Public land relocation is the best option for two reasons: Relocation would reduce construction-related impacts on landowners and homeowners; and future maintenance would be more cost effective and less disruptive to local citizens," he said.

Ludlam said that alternatives two or three under the proposal should be approved because all possible impacts to BLM and open space resources can be adequately mitigated. Any nominal surface impacts to open space and BLM lands from the proposed action are highly temporary. "Once reclamation is completed the lands will be reclaimed," he said. "Topsoil will be conserved and reused in the process with native seed and vegetation used for restoration of right-of-way."

WSCOGA, which is based in Grand Junction, includes in its mission ensuring that gas is produced, stored, and transported in a manner which supports Colorado's important tourism economies, Ludlam said. "Reliable, safe pipeline systems are an important part of this effort," he indicated. "Please expedite approval of the pipeline relocation/upgrade as soon as practicable."

TransCanada, LDCs reach deal on projects

TransCanada Corp. has reached an agreement with local distribution companies Gaz Metro Ltd. Partnership, Enbridge Gas Distribution Inc., and Union Gas Ltd. ensuring that the Energy East and the Eastern Mainline projects will provide Eastern Canada with sufficient gas transmission capacity and reduced transmission costs.

As part of the deal, TransCanada will size the Eastern Mainline project to meet all firm requirements including gas transmission contracts resulting from both 2016 and 2017 new capacity open seasons plus 50 MMcfd of additional gas capacity.

The Eastern Mainline project will add 250-300 km of gas pipeline in the Toronto-Montreal corridor. Energy East is a proposed 4,600-km oil pipeline that will have capacity to transport 1.1-million bo/d from Alberta and Saskatchewan directly to refineries and port terminals in Eastern Canada (OGJ Online, Apr. 2, 2015).

TransCanada proposes to convert 3,000 km of one of its Canadian Mainline pipelines from natural gas to oil service for Energy East.

Polarled gas pipeline crosses Arctic Circle

The Statoil ASA-operated Polarled gas pipeline construction project reported crossing the Arctic Circle. The line will connect Aasta Hansteen field in the Norwegian Sea to Nyhamna in western Norway.

The 482-km, 70 million standard cu m/day pipeline is being laid in as much as 1,265 m of water, marking the first time a 36-in. OD gas pipeline has been installed at such depths, Statoil says, adding that Polarled is the first pipeline to take Norwegian gas infrastructure across the Arctic Circle.

During the start-up of construction in March, the pipeline was pulled in to Nyhamna (OGJ Online, Mar. 27, 2015).

"We are progressing well at the moment, conditions have been good for more than 50 days in a row, and at the end of July we set a record of laying 4.8 km of pipes in one day," said Kenneth Aksel Kristensen, one of Statoil's company representatives on board the vessel.

The Polarled pipe-laying operation is scheduled to be completed by the end of August. Nyhamna will be ready to receive Aasta Hansteen gas in 2017. When the pipeline comes on stream, Gassco will operate the pipeline and Nyhamna plant.

The original investment budget for the pipeline project was 11.1 billion kroner, Statoil said, but it is now expecting an investment level of about 7.5 billion kroner, "due to good planning, good market knowledge, and good execution."