Newfoundland, Labrador prepare for deepwater exploration

Tayvis Dunnahoe

Exploration Editor

Canada-Newfoundland and Labrador Offshore Petroleum Board's (C-NLOPB) most recent call for bids for the Eastern Newfoundland Region is coming to a close Nov. 12, 2015. Since 2011, state-owned Nalcor Energy Oil & Gas has invested with seismic partners TGS-NOPEC Geophysical Co. and Petroleum Geo-Services (PGS) to acquire more than 84,000 km of 2D seismic of Newfoundland and Labrador's offshore territory. Prospectivity and certainty are becoming more refined for the province's underexplored offshore, beyond legacy development in the Jeanne D'Arc basin.

Historical

Newfoundland and Labrador's offshore sedimentary basins consist of more than 910,000 sq km (350,000 sq miles). According to Nalcor President and Chief Executive Officer Ed Martin, in an interview with OGJ, "Newfoundland's offshore is parallel to the North Sea in size and scope."

Development of Newfoundland and Labrador's geologically varied offshore basins began in the late 1960s, about the same time as the North Sea. Newfoundland and Labrador's offshore area is comparable in size to the North Sea, but lags considerably in the amount of seismic data and development wells.

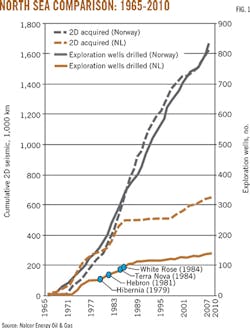

Regulatory uncertainties in the 1970s and 1980s slowed Newfoundland and Labrador's offshore development, according to Martin. By 2010, the Norwegian North Sea had seen more than 1.6 million km of 2D seismic acquired, with more than 800 exploration wells drilled, according to Nalcor. Offshore Newfoundland accounted for slightly more than 600,000 km of 2D seismic and has had only 155 wildcats drilled in its history. Less than 20% of these were in deep water.

In the UK sector of the North Sea, roughly one well has been drilled per 139 sq km of 2D seismic. For Norway this rate is 461 sq km/well. Newfoundland has one well drilled per 4,396 sq km of 2D seismic, according to Nalcor.

"There is an unexplored potential in Newfoundland and Labrador's offshore acreage," Martin said.

Newfoundland's exploration and appraisal wells have found 19.8 million bbl of oil on average, compared with Norway's 27.1 million bbl/well. The underexplored region has potential, as further seismic studies isolate areas of interest and decrease uncertainty.

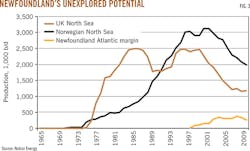

Production built in the North Sea through the 1990s with Norway reaching more than 3 million b/d in 2001. Newfoundland and Labrador's offshore production began in 1997 and peaked in 2007 at 500,000 b/d (Fig. 3). "The key takeaway is that while Newfoundland has seen fewer wells, its finding success is similar to that of the UK and Norwegian sectors of the North Sea," Martin said.

Improved access, technology

An unclear regulatory framework served as the biggest roadblock for offshore development in Canada's Eastern Provinces, Martin told OGJ. The NL15-01EN call for bids is the first round under C-NLOPB's Scheduled Land Tenure Regime, which for the first time provides a data-backed research period during which prospective operators can investigate the blocks on offer. Once this first round closes in November, new areas will become available annually.

"We're seeing a variety of play types in the new data we've gathered to date," said Richard Wright, exploration manager at Nalcor. "Where the Jeanne D'Arc is a Jurassic sourced play, many of the newly imaged areas are showing additional Jurassic plays and also potential Cretacious and Tertiary plays with analogs to many other regions including the Gulf of Mexico, North Sea, and West Africa."

Most interest in offshore Newfoundland and Labrador focused on the shelf through the 1970s-1980s, but the province's new seismic acquisition is showing promise for slope and deepwater exploration as well.

According to Tom Neugebauer, project development manager at TGS-NOPEC, there have been no data available beyond Newfoundland and Labrador's shelf in the Labrador Sea until now. TGS and PGS have worked with Nalcor to acquire more than 84,000 km of 2D seismic since 2011, an area one and a half times that of the Gulf of Mexico.

TGS worked in the province during 1998-2003, but regulatory issues slowed its progress. "In July 2012, Canada changed its law to remove restrictions on foreign-flagged vessels for seismic operations," Neugebauer said. This move led to the wide expansion of Newfoundland's data acquisition. Now with a clear regulatory framework in place, the region should see an increase in activity.

One unintended positive consequence of Newfoundland's late offshore development is the ability to benefit fully from deployment of the latest technologies. Deep-tow streamer technology is improving the quality of current shoots by avoiding the sometimes harsh conditions at surface. Fig. 2 shows the benefits of technological advance from 2000-2014.

"Much of Newfoundland and Labrador's offshore acreage is categorized as harsh environment including challenges associated with high wind and waves," Wright said.

Flemish Pass

The three most recent discoveries off Newfoundland-Mizzen, Bay du Nord, and Harpoon-were made in Flemish Pass basin by Statoil ASA in 2013. The discovery region lies 100-200 km northeast of Jeanne D'Arc basin and about 400 km from St. John's in 1,100 m of water. Mizzen holds an estimated 100-200 million bbl of oil. Bay du Nord holds 300-600 million bbl, and the Harpoon discovery is still under evaluation. Mizzen was drilled in 2009; Bay du Nord and Harpoon in 2013. Statoil is operator of all three prospects with a 65% interest. Husky Energy Inc. holds the remaining 35%.

Newfoundland and Labrador's current offshore bid round includes 11 parcels surrounding the area of these discoveries. According to Wright, these additional areas of the Flemish Pass are potentially prospective and some of the recent new seismic acquisition activity has focused on this region to reduce exploration uncertainty in advance of the license round. The round features a broad range of water depths from 200 m on the shelf to around 2,800 m in the deepwater blocks.

C-NLOPB's scheduled land tenure system is designed to provide increased timeframes for bids in more frontier areas within the Newfoundland and Labrador offshore area. This area is divided into eight regions categorized as either low activity, high activity, or mature, based on the level of oil and gas exploration and development.

Historical production areas such as Jeanne D'Arc, where most of Newfoundland's offshore production occurs, would qualify as mature basins.

In this system there are three rights-issuance timing cycles corresponding to activity designations. Low-activity regions are on offer for a 4-year cycle. High-activity and mature areas are ascribed a 2 and 1-year bid period, respectively.

Block 1135 is centrally located between Jeanne D'Arc basin and NL15-01EN blocks. Last year it was purchased for $559 million by a consortium including ExxonMobil Corp., Suncor Energy Inc., and ConocoPhillips. The block remains undeveloped, but its purchase could indicate a successful November close for the Eastern Newfoundland bid round.

Pseudo frontier

From an analyst's perspective, Canada's eastern provinces are not frontier exploration territories. "Offshore Newfoundland and Labrador has been producing oil for 17 years, and we've developed a full suite of technology and approaches for this environment," Wright said. Much of the region exists in a frontier status, however, due to the underexplored nature of most of its acreage. As early as the 1970s, many of the productive basins on the continental shelf were known, but as of January 2013, at least three new basins had been identified in newly imaged slope and deepwater regions (Fig. 4).

Ongoing projects such as Hebron and proven production from current producing fields provide a safe landing for operators looking to move into the region for exploration drilling. Statoil, ExxonMobil, Suncor, and Husky are active in projects off Newfoundland.

Even with the current decline in oil prices, offshore Newfoundland will likely be an investment risk worth taking. "We find that operating companies are generally taking the long view to exploration in our region as they evaluate newly imaged frontier acreage coming up for bid in some cases for the first time," Wright said.

Limiting uncertainty

Part of Nalcor's mission in extending successful development of Newfoundland and Labrador's offshore resources is making sure it keeps pace with resource assessment. Nalcor, in collaboration with Newfoundland and Labraodor's Department of Natural Resources, will conduct detailed resource assessments in advance of new scheduled license round closings. The state-owned company has contracted France-based firm Beicip-Franlab to provide risk and unrisked resource reports on each new sector. The first will come out in September before the November 2015 round closing.

"Our primary goal is to reduce uncertainty for potential investors, providing an objective externally validated resource perspective on the acreage up for bidding," Wright said. To further that goal, Nalcor also has joined with Canadian firm C-CORE, a harsh-environment consulting company. The partnership is aggregating 30 years of metocean data for the Newfoundland and Labrador offshore region, including information on ice flow, wind, waves, and other hazards associated with the harsh environment. The researchers have divided Newfoundland's offshore territory into 391 cells, with metocean data provided for each individual cell.

Constructed as an analysis of surface conditions, this study is intended to link to offshore exploration plans to compare harsh conditions with other harsh environments globally. According to Wright, the report will be released in mid-2015.