OGJ Newsletter

GENERAL INTEREST — Quick Takes

EIA: Refining margins unable to offset low oil prices

First-quarter financial results for globally integrated oil companies indicated that higher refining margins in the downstream sector were unable to fully offset the impact of lower crude oil prices on the upstream sector, according to data from the US Energy Information Administration.

The 11 companies reported total first-quarter earnings of $22 billion, down 54% compared with first-quarter 2014 results. Upstream profits fell 80% year-over-year to $28 billion, while downstream profits jumped 95% to $6 billion—the largest for any quarter since third-quarter 2012, EIA says.

As a result, downstream accounted for 63% of combined earnings in the first quarter compared with a 15% average downstream share during 2011-14.

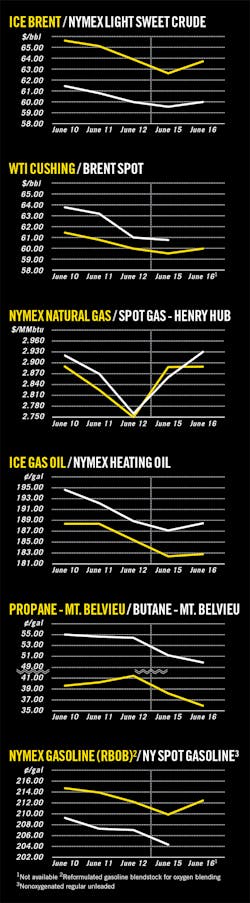

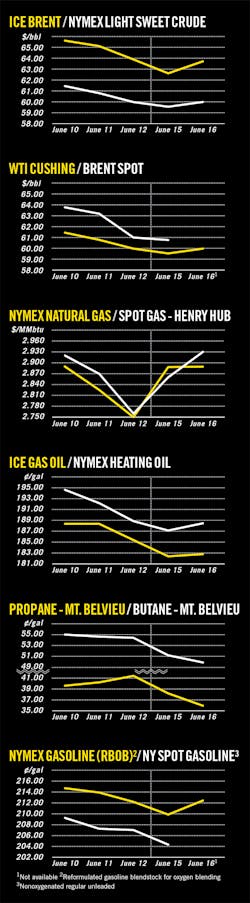

EIA says first-quarter earnings statements show that high crack spreads during the period contributed to higher downstream profits. Even though absolute prices for both crude oil and products declined in this year’s first quarter compared with first-quarter 2014, North Sea Brent prices fell more than wholesale gasoline and heating oil prices, resulting in an increase in refining margin.

First-quarter crack spreads for gasoline and heating oil—based on futures prices for North Sea Brent crude oil and gasoline and heating oil in New York Harbor—averaged 28¢/gal and 49¢/gal, respectively, representing year-over-year increases of 7¢/gal for gasoline and 4¢/gal for heating oil.

Shell, BG merger clears US antitrust hurdle

The US Federal Trade Commission (FTC) has granted early termination for the US antitrust waiting period for the $70-billion merger of Royal Dutch Shell PLC and BG Group PLC (OGJ Online, Apr. 8, 2015).

The firms reported in April that they had agreed on the terms of a recommended cash and share offer to be made by Shell for the entire issued and to be issued share capital of BG.

"Securing early termination of the US antitrust waiting period from the FTC at this early stage is a clear demonstration of the good progress we’re making on the deal," commented Ben van Beurden, Shell chief executive officer.

"We’re well under way with the antitrust and regulatory filing processes in relevant jurisdictions around the world and we’re confident that, following the usual thorough and professional review by the relevant authorities, the deal will receive the necessary approvals," he said. "We remain on track for completion in early 2016."

Petrovietnam acquires Chevron assets in Vietnam

Petrovietnam has acquired Chevron Corp. assets in Vietnam for an undisclosed price. The deal includes a 42.38% operating interest in a production-sharing contract for Blocks B and 48/95, and a 43.4% operating interest in a PSC for Block 52/97, all offshore southwestern Vietnam. The contract areas cover 3,200 sq km of the Maylay-Tho Chu basin in 60-80 m of water.

Chevron also sold to Petrovietnam the shares of Chevron Southwest Vietnam Pipeline Co. Ltd., which held a 28.7% working interest in a pipeline project that would deliver gas from offshore to Vietnam (OGJ Online, Mar. 16, 2010).

Petrovietnam said the Block B-O Mon project is designed to transport gas to the O Mon, Kien Giang power plant hub and to supplement gas supply to the Ca Mau gas fertilizer hub.

"The Block B gas project is Petrovietnam’s main oil and gas project," said Nguyen Xuan Son, chairman of the Petrovietnam members council.

Beach exits Romania with sale of Block 28 interest

Beach Energy Ltd., Adelaide, reported that its wholly owned subsidiary, Beach Petroleum (CEE) SRL, has transferred its 30% interest in Block 28 Est Cobalcescu to the operator, Petroceltic Romania BV, a wholly owned subsidiary of Petroceltic International PLC, for "nominal consideration."

The transaction, which was approved by the National Agency for Mineral Resources of Romania, effectively marks the exit of Beach from Romania.

Beach’s Romanian exit, it said, is "consistent with the company’s strategy to focus closer to home, where its core expertise can be leveraged to drive sustainable, value accretive growth."

Statoil to trim up to 2,025 jobs by yearend 2016

Statoil ASA reported a "next phase" of workforce reductions affecting as many as 1,500 employees and 525 consultants in the next 18 months.

Since yearend 2013, the Statoil workforce has been reduced by 1,340 permanent employees and 995 external consultants. The reductions have been achieved through more limited use of consultants, attrition, internal deployment into new positions, severance packages, and early retirement.

Statoil said the efficiency program addressed the industry-wide cost and competitiveness challenge "well ahead" of the current downturn.

Decisions on workforce reductions will be made in each business area from August to November. The current estimated range of reductions of Statoil employees is 1,100-1,500.

Exploration & Development — Quick Takes

Pemex makes first post-reform gulf oil find

Petroleos Mexicanos (Pemex) has discovered four oil fields in the shallow-water area off Tabasco and Campeche states, attributing the milestone to "new tools" provided by the nation’s recent energy reform.

The company describes the discoveries as "the first tangible result in exploration" since the reform, representing its biggest exploration milestone in the past 5 years after the Tsimin-Xux and Ayatsil discoveries (OGJ Online, Jan. 5, 2015).

The fields lie near the company’s Cantarell oil field complex, and could yield overall production of at least 200,000 b/d of crude and 170 MMcfd of gas, the company says. Pemex believes the fields could start production in 16 months.

One group of fields lying in Campeche offers possible short-term production startup with speculated output of 100,000 b/d of oil and 80 MMcfd of gas, while a second group in the Litoral de Tabasco area offers speculated production of 100,000 b/d of light oil and 90 MMcfd of gas.

Emilio Lozoya, Pemex chief executive officer, speculates the deposits could hold proved, probable, and possible reserves of 350 million boe. He noted that the findings are from recent exploration work by Pemex utilizing advanced technology including better seismic.

Santos, Drillsearch make another Cooper discovery

Santos Ltd., Adelaide, and its joint venture partner Drillsearch Energy Ltd., Sydney, have made a natural gas discovery in the Cooper basin of South Australia with the eighth and final well of the current (2014-15) program in permit PEL513 (OGJ Online, May 4, 2015).

Moonanga South-1 was drilled to a total depth of 3,177 m south of the JV’s producing Moonanga field and east of Raven field in an adjacent permit.

Drillsearch reported gas shows across the Permian-age Patachawarra formation between 2,597 m and 3,115 m. Elevated gas readings were recorded across both sandstone reservoirs and coal seams.

Preliminary interpretation of wireline logs suggests 4.3 m of net pay across two zones in the Patachawarra within a gross interval of 518 m.

The JV identified stacked reservoirs in the conventional play as well as several zones with unconventional gas potential.

Moonanga South-1 has been cased and suspended as a future gas producer.

Drillsearch has now drilled more than 40 wells during the past 12 months in this and other joint ventures and achieved better than 70% success rate.

The company is now finalizing its 2015-16 program.

Drillsearch holds 40% of the Moonanga South discovery, while operator Santos has 60%.

Lundin Norway to drill Luno II North test

Lundin Norway AS will test Jurassic-Triassic sandstone with an exploratory well on the Luno II North prospect about 15 km south of Edvard Grieg oil and gas field under development in the Norwegian North Sea.

The 16/4-9S well location is in PL359 northwest of the 2013 Luno II discovery, which the company says probably is commercial (OGJ Online, May 6, 2013).

Lundin describes the Luno II structure, including the Luno II North prospect, as a combined stratigraphic and structural trap with the target strata deposited in a fluvial-alluvial setting.

The prospect is on the west flank of the Utsira High feature in a separate subbasin north of the Central basin in which the Luno II discovery was made. Water depth in the area is about 100 m.

The Bredford Dolphin semisubmersible rig will drill the 16/4-9S well to 2,490 below mean seal level.

Drilling & Production — Quick Takes

ExxonMobil begins Kearl oil sands production

ExxonMobil Corp. has begun bitumen production at its Kearl oil sands expansion project in Alberta. It expects output to reach 110,000 b/d, doubling previous Kearl production.

The expansion project consists of three additional trains that use a paraffinic froth treatment to produce bitumen. The process makes an onsite upgrader unnecessary, reducing operating costs, energy requirements, and environmental impacts, the company said. It enables salable bitumen to be produced in one processing step, the first mine of its kind in Alberta.

The company used an improved understanding of oil sands from initial Kearl development phases to bring the expansion onstream ahead of schedule, said Neil Duffin, ExxonMobil development company president. The project will help the company access the expected 4.6 billion bbl of recoverable resources in Kearl (OGJ Online, May 5, 2014).

The project lies about 47 miles northeast of Fort McMurray and is operated by ExxonMobil affiliate Imperial Oil Ltd.

Statoil lets contracts for Johan Sverdrup drilling

Statoil ASA has let two contracts to Odfjell Drilling for work in Johan Sverdrup field offshore Norway. The contracts are for the Deepsea Atlantic semisubmersible rig and a fixed-drilling unit yet to be installed. Statoil says the total value of the contracts is 4.3 billion kroner.

The charter for Deepsea Atlantic semi begins in March 2016 and continues for 3 years with an additional six 6-month options. The rig will drill at least 13 pilot wells before beginning production in 2019, according to Statoil’s Oivind Reinersten, senior vice-president of the company’s Johan Sverdrup operations.

The 4-year contract for Statoil’s fixed-drilling unit will begin in December 2018 and includes a subsequent six 1-year options. The rig will be built by Aibel AS, AS Nymo Dek, and National Oilwell with engineering support from Odfjell.

Both contracts are subject to approval by the Norwegian Parliament later this year. These are the fifth and sixth contracts let by Statoil for Johan Sverdrup this year (OGJ Online, June 8, 2015).

Statoil says Johan Sverdrup has recoverable resources of 1.4-2.4 billion boe and consists of 95% oil and 5% rich gas.

The company has invested 117 billion kroner in Phase 1 of the field’s development consisting of four installations: a utility and accommodation platform, a processing platform, a drilling platform, and a riser platform. These are in addition to three subsea templates for water injection. (OGJ Online, Feb. 13, 2015). Statoil’s goal is a 70% recovery rate from the field.

Foster Creek resumes operations after forest fire

Cenovus Energy Inc. reported on June 11 that it has resumed operations at its Foster Creek oil sands project in northern Alberta after a forest fire on the Cold Lake Air Weapons Range (CLAWR) led to a precautionary, 11-day shutdown of the operation on May 23 (OGJ Online, May 26, 2015).

The company expects the shutdown will result in a 10,500-b/d net reduction in output during the second quarter, and 2,600-b/d net reduction for the full year. However, Cenovus expects full-year production to remain within its annual guidance of 62,000-68,000 b/d net.

Essential staff was cleared to return to Foster Creek on June 1 to inspect the site and begin start-up activities. The company says that crews found no damage to the facility and infrastructure, and the restart of operations went smoothly. The company is assessing expected costs incurred as a result of the evacuation and the shutdown.

The Athabasca natural gas operation, also shut down due to the forest fire, has returned to normal operations as well. The facility produces 20 MMcfd of gas used as fuel for Foster Creek. While the forest fire caused minor damage to peripheral equipment at some well sites, the natural gas wells were not affected.

Alberta Agriculture and Forestry declared on June 9 that the forest fire on the CLAWR was being held and thus lifted the precautionary 2-hr evacuation notice for Foster Creek.

Dongfang 1-1 field starts first-phase production

CNOOC Ltd. reported startup of natural gas production from its Phase 1 adjustment project at Dongfang 1-1 field in the South China Sea (OGJ Online, Sept. 24, 2003).

One wellhead platform was added during the project. CNOOC said five wells are producing 53 MMcfd; design peak production of 54 MMcfd is expected this year.

The field lies in 70 m of water in the Yinggehai basin in the Beibu Gulf. CNOOC is operator and holds 100% interest (OGJ Online, May 27, 2015).

PROCESSING — Quick Takes

Egyptian refiner lets contract for processing complex

Assiut Petroleum Refining Co. (ASORC), a subsidiary of Egyptian General Petroleum Corp. (EGPC), has let a contract to Axens to supply technology for a grassroots naphtha processing complex to be built at its 4.5 million-tonne/year refinery in Asyut, Egypt, about 400 km south of Cairo.

Axens will provide a series of processing technologies for the complex, which will process a total of 660,000 tpy of naphtha to produce high-octane gasoline for domestic Egyptian markets, Axens said.

In addition to the supply of catalysts, adsorbents, equipment, and technical support, Axens’s scope of work includes delivery of a naphtha hydrotreater, a continuous catalytic reformer (CCR), which will use Axens’ proprietary Octanizing technology, and a pentane-hexane isomerization unit with a de-isohexanizer recycle unit.

While a value of the contract was not disclosed, the proposed complex has required an investment of $250 million, according to Egypt’s Ministry of Petroleum (MOP).

The naphtha processing complex comes as part of ASORC’s plans to expand and modernize the refinery (OGJ Online, Sept. 3, 2014).

Last year, MOP and EGPC announced ASORC had secured $198 million to finance construction of a 1.4 million-tpy diesel hydrocracking complex to convert lower-quality heavy fuels into high-quality petroleum products such as LPG, naphtha, kerosine, and gasoline.

According to a March release from MOP, the new hydrocracking complex would have production capacities of gas oil, 959,000 tpy; jet fuel, 438,000 tpy; and naphtha, 644,000 tpy.

The project, which will require a total investment of $2.1 billion, also is designed to help meet Egypt’s growing demand for petroleum products, MOP said.

While MOP previously said the diesel hydrocracking complex was due to be operational as early as 2016-17, revised timetables for the proposed hydrocracking and naphtha processing complexes at Asyut have yet to be released.

Neste wraps maintenance at Porvoo refinery

Neste Oil Corp. has completed a 2-month planned maintenance turnaround at its 10.5 million-tonne/year Porvoo refinery in the Kilpilahti Industrial Area, about 20 miles east of Helsinki, Finland.

Start-up activities proceeded as planned, and production at the refinery has resumed, Neste Oil said.

The company plans to reach normal utilization rates at Porvoo within a few days.

The scheduled turnaround, the largest in Porvoo’s history, began in April and was designed to ensure the refinery’s optimized performance and safety for the next 4-6 years, the company said (OGJ Online, Mar. 23, 2015).

With strong refining markets in this year’s second quarter, slight delays to work on some units during the turnaround period likely will result in a loss of about €130 million to the company’s operating profit for the quarter compared with an expected loss of about €100 million prior to the maintenance shutdown, Neste Oil said.

The negative impact to quarterly profits, however, should not impact the company’s full-year 2015 comparable operating profit, which Neste Oil said it still expects to be higher than that achieved during 2014.

The refinery’s major turnaround, which occurs once every 5 years, included work associated with Neste Oil’s previously announced €500 million investment plan to closely integrate refinery operations at its Porvoo and 3 million-tpy Naantali refineries to help keep the company’s European operations competitive (OGJ Online, Oct. 7, 2014).

TRANSPORTATION — Quick Takes

Obama to nominate new leaders of PHMSA, FRA

US President Barack Obama announced his intention to nominate Marie Therese Dominguez to lead the US Pipeline & Hazardous Materials Safety Administration, and Sarah Feinberg to lead the Federal Railroad Administration, the US Department of Transportation said on May 29.

The two DOT agencies, which are directly involved in regulating crude oil shipments by rail, have been without administrators for months. Dominguez has extensive transportation regulatory and management at the Federal Aviation Administration and other agencies, US Sec. of Transportation Anthony Foxx said. Dominguez also has worked with the US Army Corps of Engineers on water resource transportation, Foxx added.

Feinberg already has extensive experience at FRA, most recently during the Amtrak derailment north of Philadelphia, Foxx said. She has been active in rail safety issues, including those related to crude transportation by rail, he said.

The two DOT agencies and Canadian federal transportation agencies jointly issued regulations governing transportation of crude and other hazardous substances by rail on May 1 (OGJ Online, May 1, 2015).

Lithuanian ambassador urges US to move on energy

US policymakers must move more aggressively to export more oil and gas so European nations can continue reducing their dependence on Russian supplies, Lithuania’s ambassador to the US declared. "We need [LNG] from America now," Zygimantas Pavilionis said. "We can’t wait another 10 years."

Unlike the US, which only recently has begun to oppose Russia’s moves to use access to its natural gas supplies to heavily influence neighboring countries’ policies, Lithuania and the two other Baltic Sea states, Latvia and Estonia, have been concerned with Russia’s actions for 15 years, the ambassador said.

Lithuania’s LNG terminal—the region’s first—is open and accepting shipments, and a gas pipeline is being constructed from there to Poland, he told attendees at a June 11 breakfast hosted by the advocacy group LNG Allies.

"The whole Baltic region is suffering from Russian dependence, along with other former Soviet Union nations across eastern Europe," said Pavilionis, who is concluding a 5-year assignment in Washington. "I would rather have a big, strong, reliable supplier. This is the US’s opportunity. This is your time."

Europe and the US should develop a trans-Atlantic energy strategy, Pavilionis said. "If we don’t release this huge American resource outside your country and create more transparent markets, Putin and Russia will move ahead with their corruption and coercion," he said.

"Bad things are happening around or borders, and it’s time for us to push back together," he said. "We’ve achieved a lot since 2006. We can achieve more if we work together."

Cheniere outlines LNG project developments

Cheniere Energy Inc. plans to add 19 million tonnes/year of incremental production capacity to two LNG projects, bringing the company’s aggregate nominal production capacity to 60 million tpy by 2025.

The company is developing 9 million tpy of incremental LNG production capacity through the addition of two liquefaction trains adjacent to the existing site of the Corpus Christi liquefaction (CCL) project. Expected nominal production capacity of each of these trains is 4.5 million tpy, which would increase the expected aggregate nominal production capacity to 22.5 million tpy.

Cheniere initiated the regulatory process this month by filing the National Environmental Policy Act prefiling request with the US Federal Energy Regulatory Commission and Federal Transit Administration, and non-FTA approval requests with the US Department of Energy. Regulatory approvals would be expected in 2017. A final investment decision (FID) for CCL was reached last month (OGJ Online, May 14, 2015).

The company also has agreed in principle to partner with Parallax Enterprises LLC to develop as much as 10 million tpy of LNG production capacity through Parallax’s two midscale projects, Live Oak LNG on the Calcasieu Ship Channel in southwestern Louisiana (OGJ Online, Feb. 3, 2015) and Louisiana LNG on the Mississippi River 40 miles from New Orleans (OGJ Online, Oct. 8, 2014).

Both projects are expected to have two 2.5-million tpy liquefaction trains, utilizing liquefaction process technology and equipment developed by Chart Industries Inc. The facilities are being engineered by Bechtel Oil, Gas & Chemicals Inc.

Cheniere says it anticipates both project developments could be under construction as early as 2017, subject to receiving all required regulatory approvals and reaching a FID. The projects would be targeted to begin production as early as 2021, with all 19 million tpy targeted to be in production by 2025.