OGJ Newsletter

GENERAL INTEREST — Quick Takes

Enbridge to remediate leak's environmental damages

Several Enbridge Inc. affiliates agreed to complete natural resource restoration projects along the Kalamazoo River to remediate damages from a 2010 crude-oil pipeline leak that resulted in one of the largest inland spills in US history, the US Department of Justice reported.

Under the proposed consent order, which DOJ filed on June 8 in US District Court for the Southern Division of Michigan's Western District, Enbridge and its affiliates also agreed to pay another nearly $4 million to fund more restoration projects, reimburse federal and tribal trustees' natural resource damage assessment costs, and support the trustees' ongoing restoration planning activities, DOJ said.

In a statement, Enbridge said the agreement was another step in the process of restoring Kalamazoo River and Talmadge Creek so they can be enjoyed by all Michigan residents and visitors to the state. "We completed the cleanup in 2014, and have begun a new phase with the state for long-term monitoring and invasive species control along the Kalamazoo River," the Calgary-based interstate pipeline company's statement said.

DOJ said the trustees reached a separate settlement resolving Michigan's claims against Enbridge relating to the July 2010 leak from the firm's Line 6B line in a May 13 consent settlement by the Calhoun County Circuit Court in Battle Creek (OGJ Online, July 12, 2010).

State settlement provisions that also will be enforceable under the June 8 settlement include commitments by Enbridge to perform work to restore or compensate for injuries to injured natural resources along the Kalamazoo River at an estimated cost of at least $58 million, DOJ said. "Thus, the two settlements combined result in estimated expenditures of at least $62 million to resolve natural resource damages," it noted.

Gulfport Energy to buy more Utica acreage

Gulfport Energy Corp., Oklahoma City, has agreed to acquire 35,326 net acres in the Utica shale in Ohio from American Energy-Utica LLC, a subsidiary of American Energy Partners LP.

The purchase price for 6,198 net undeveloped acres in Belmont and Jefferson counties is about $68.2 million, subject to adjustment. The acreage is near or adjacent to acreage in Gulfport's pending acquisition of Paloma Partners III LLC (OGJ Online, Apr. 16, 2015).

In a second agreement with AEU for about $319 million, Gulfport will acquire 27,228 net acres in Monroe County, including 14.6 MMcfd of net production, 11.3 net drilled but uncompleted wells, a fully constructed four-well pad location, and an 11-mile gas gathering system.

Gulfport also has agreed to acquire from AEU an additional 1,900 net acres in Monroe County for $19.4 million if completed within 30 days of the closing of the other Monroe agreement. The pending Paloma acquisition includes 24,000 net acres. Gulfport said its holdings of Utica shale leasehold are expected to total 243,000 net acres.

Pioneer offers to sell eastern Colorado leases

Pioneer Natural Resources Co., Irving, Tex., wants to sell some leases in eastern Colorado involving 640,000 acres, according to a sales listing with Meagher Energy Advisors in Denver.

The leases PNR offered for sell are in Bent, Cheyenne, Crowley, Elbert, Kiowa, Kit Carson, Lincoln, Prowers, and Washington counties. These leases involve Niobrara shallow oil and gas as well as other formations.

The leases include unconventional potential in the upper Cherokee and middle Atoka shales, the sales listing said. PNR has cored three vertical unconventional test wells. It also drilled two lateral appraisal wells, one each in Cherokee and Atoka, both testing oil to surface.

The leases are expiring during 2016-18, and most have 5-year extension options, the sale listing said.

Exploration & Development — Quick Takes

Statoil makes discovery west of Aasta Hansteen

Statoil ASA made a gas discovery in the Gymir prospect 20 km west of Aasta Hansteen field in the northern Norwegian Sea.

The Norwegian Petroleum Directorate said wildcat 6706/11-2 in PL602 encountered a 70-m total gas column in the Nise formation, with 40 m in sandstone of very good quality.

The well was not formation tested, but Statoil conducted extensive data acquisition and sampling. The well was drilled in 13 days to a vertical depth of 2,556 m subsea in 1,272 m of water. Transocean Ltd.'s Transocean Spitsbergen semisubmersible rig has completed its contract with Statoil and will be laid up at Averoy, NPD said.

It's the third gas discovery in the area in as many months, Statoil said. Gymir is 8 km west of Roald Rygg in PL602 (OGJ Online, Apr. 13, 2015) and 14 km west of Snefrid Nord in PL218 (OGJ Online, Mar. 18, 2015).

Statoil and partners will assess the discoveries with regard to development and tie-in to Aasta Hansteen.

Aasta Hansteen production startup is expected in 2017 (OGJ Online, Aug. 26, 2014).

Repsol completes tests of two ANS wells

Repsol SA says it has completed testing two wells during its winter exploration campaign in Alaska's North Slope with better-than-expected yields of good quality crude that, along with positive results from previous campaigns, confirm the development potential of the area.

Including sidetracks, the ANS campaign has resulted in 16 positive wells drilled during four winter exploratory campaigns since Repsol acquired its acreage in 2011 (OGJ Online, Mar. 10, 2011; Apr. 23, 2013).

The current campaign has seen the Qugruk 8 (Q-8) well flow 30° gravity crude at rates of as much as 2,160 bo/d, and Qugruk 301 (Q-301) horizontal well yield rates as high as 4,600 bo/d. Repsol operates the discovering consortium with 70% interest, partnering with Armstrong Oil & Gas subsidiary 70 & 48 LLC with 22.5%, and GMT Exploration Co. with 7.5%. The consortium will continue with another drilling program next winter and has begun the process to obtain permits for a development phase in the Nanushuk and Alpine areas.

In addition to Alaska, Repsol's US assets reside in the Gulf of Mexico and Mississippian Lime, as well as the Eagle Ford and Marcellus shale plays, both of which were added through the recent purchase of Talisman Energy Inc. (OGJ Online, Dec. 16, 2014). Repsol produces 200,000 boe/d in North America, including 135,000 in the US.

Alpha Petroleum updates Cheviot development

Alpha Petroleum Resources Ltd., London, updated its development plans for Cheviot oil field in the UK North Sea.

In March, Alpha reported the selection of a floating production, storage, and offloading vessel as the basis for the field's development (OGJ Online, Mar. 19, 2015).

Alpha says that it has decided to include Jurassic Padon gas field and Palaeocene Peel and Poppy oil fields as part of Cheviot's development. It is envisaged that Cheviot will serve as an infrastructure hub to some of the more than 20 additional discoveries and prospects in vicinity of the field.

Following the decision to use an FPSO, Alpha has finalized the field's basis of design and also completed the selection process for a pre-front-end engineering and design study. Alpha has let the pre-FEED study contract to Xodus Group.

Results from the pre-FEED work will be incorporated into the field development plan and environmental statement to be submitted to the Oil and Gas Authority in September, Alpha said. FEED tenders will be issued before yearend, and awarded in first-quarter 2016.

Alpha remains on track to achieve Cheviot field project sanction no later than first-quarter 2017 and to start oil production in 2020, it said.

Cheviot, a redevelopment of Emerald field in the northern part of the sea, lies on Blocks 2/10b, 2/15a, and 3/11b. Privately owned Alpha has increased its estimate of recoverable oil from the field to at least 55 million bbl basing the estimate on the potential of combining reinjected produced gas and water injection with optimizing well numbers and well lengths.

Dana Gas begins drilling Balsam-2 well

Dana Gas has started drilling the Balsam-2 development well on the Balsam lease onshore the Nile delta (OGJ Online, Feb. 18, 2014). The well, which is being drilled by Egyptian Drilling Co.'s Rig No. 48, is targeting the Qawasim formation at a depth of 3,200 m. A slanted and fully cored pilot hole will be drilled through the Qawasim reservoir, which will be followed by the drilling of a 700-m horizontal section.

Expected to take 4 months to drill and complete, Balsam-2 will be Dana Gas Egypt's first horizontal well, and one of very few to date onshore the Nile Delta, the company says.

The well also is the first in a major drilling campaign comprising some 30 wells and a large number of workovers to be drilled over the next 3 years as part of the gas production enhancement agreement work commitment.

Drilling & Production — Quick Takes

US shale oil output to decline 91,000 b/d

Crude oil production in July from seven major US shale plays is expected to drop 91,000 b/d to 5.49 million b/d compared with June, according to the US Energy Information Administration's latest Drilling Productivity Report (DPR). The forecasted decline is up 5,000 b/d compared with June's decline from May (OGJ Online, May 12, 2015).

The DPR focuses on the Bakken, Eagle Ford, Haynesville, Marcellus, Niobrara, Permian, and Utica, which altogether accounted for 95% of US oil production increases and all US natural gas production increases during 2011-13.

The monthly decline will again be led by the Eagle Ford, whose expected 49,000-b/d drop to 1.59 million b/d is only 2,000 b/d higher than the previous month's decline. Production from the Bakken is expected to fall 29,000 b/d, also up 2,000 b/d from June, to 1.24 million b/d. The Niobrara is expected to see a 17,000-b/d drop, up 1,000 b/d from June, to 414,000 b/d.

In the Permian, where production growth has been maintained over the course of the year although at a shrinking rate, EIA forecasts a 3,000-b/d increase to 2.06 million b/d. That rate is less than half of last month's increase and only a seventh of April's growth.

New-well oil production/rig across the seven plays will increase in July by a rig-weighted average of 15 b/d to 419 b/d, with a 23-b/d rise in the Bakken to 654 b/d, 22-b/d rise in the Eagle Ford to 741 b/d, 19-b/d rise in the Permian to 315 b/d, and 13-b/d rise in the Niobrara to 510 b/d.

Natural gas production across the plays is expected to drop 221 MMcfd during July to 45.65 bcfd, led by a 108-MMcfd decline in the Eagle Ford to 7.14 bcfd and 53-MMcfd decline in the Niobrara to 4.56 bcfd. EIA forecasts the Utica will be the only play to report an increase, gaining 42 MMcfd to 2.56 bcfd.

Statoil begins work on Asgard compression modules

Statoil ASA has started installation of the modules comprising the subsea gas compression plant for Asgard field in the Norwegian Sea. A total of 22 modules will be installed and connected, forming two 1,500-tonne compressor trains.

The modules over the summer will be laid in place in a large subsea frame that was installed 2 years ago (OGJ Online, June 13, 2013). The newly rebuilt North Sea Giant vessel is carrying out installation work.

The modules comprising plant vary in size, with the smallest installed via the vessel's "moonpool," a large opening in the bottom of the hull through which modules weighing as much as 70 tonnes are lowered.

The larger modules are installed by the North Sea Giant's crane system, which has been modified to incorporate a special handling system. The system is designed to carry 420 tonnes and operate in 9-m-high waves. Each module is guided into place with a remotely operate underwater vehicle and cables.

All modules are provisionally stored at Vestbase in Kristiansund, Norway, where they're shipped out following commissioning and testing in Egersund. Statoil notes that the installation sequence has been planned so that start-up work can be carried out on the first compressor train while installation work continues on modules for the second train.

Conducted in 300 m of water, the project will result in additional production of 282 million bbl from the field, the company says. Last year, a contract was given to Technip SA for intervention services on the compression stations (OGJ Online, Feb. 11, 2014).

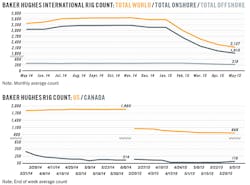

NEB notes shift to gas-directed drilling

Canada's National Energy Board says the percentage share of rigs in western Canada targeting natural gas has been on the rise since 2012. By late 2014, the majority of rigs were drilling for gas instead of oil, and in January and February of 2015, the share had increased to 62%.

NEB cited three reasons for the gas rebound: increased targeting of tight gas containing natural gas liquids can earn more revenue for producers; evaluation of gas resources that would support proposed LNG export projects from Canada's West Coast; and the decline in oil prices.

Gas drilling averaged 73% of all activity between 2000 and 2008, NEB said. Industry started shifting from gas to oil in 2008 because of the discovery of tight oil in various formations in the Western Canada Sedimentary Basin and because oil prices were high enough to justify development. The share of rigs targeting oil became the majority in 2011 and peaked at 62% in 2012.

PROCESSING — Quick Takes

Total advances plan for grassroots steam cracker

Total Petrochemicals & Refining USA Inc. is progressing on its previously announced plan to build a new steam cracker to be tied in with its current refining and petrochemical production operations at the US Gulf Coast (OGJ Online, May 23, 2013).

The project, which will cover the company's ethylene needs for its US derivatives business, will involve construction of a 1 million-tonne/year ethane steam cracker to be built near the operator's current production platform in Port Arthur, Tex., Total SA said in a June 4 e-mail to OGJ.

"We intend to launch front-end engineering and design and to select an engineering company [for the project] in the coming months," a spokesperson for Total's refining and chemicals division said.

Commissioning of the grassroots steam cracker likely would occur sometime in late 2019, according to the company.

Last year, BASF Total Petrochemicals LCC (BTP), a joint venture of BASF Corp. (60%) and Total Petrochemicals & Refining USA (40%), commissioned a tenth furnace at its existing steam cracker in Port Arthur, which increased ethylene production at the site to more than 1 million tpy (OGJ Online, Mar. 24, 2014).

A final investment decision on the planned Port Arthur cracker, which will be integrated with the 174,000-b/d Port Arthur refinery as well as the BTP plant, is due in 2016, Total said on Mar. 26 in its annual report to investors.

The new cracker project at Port Arthur comes as part of Total's plan to take advantage of lower-cost feedstock (including ethane, propane, and butane), supplies of which have increased alongside higher production from US shale plays.

ETP provides details on Revolution pipeline

Energy Transfer Partners LP (ETP), Dallas, has released details on its Revolution project for the Marcellus and Upper Devonian areas of western Pennsylvania.

ETP has entered into long-term gas gathering, processing, and fractionation agreements with EdgeMarc Energy, Canonsburg, Pa. To execute the agreements, ETP has bought 20 miles of high-pressure pipeline from EdgeMarc and will build a cryogenic gas processing plant, a fractionator, and additional gas gathering pipelines.

The announcement did not disclose the planned capacities of the gas plant or NGL fractionator; a company spokesperson declined to provide further details to OGJ.

ETP plans to build 100 miles of high-pressure, 24-in. and 30-in. rich-gas pipeline resulting in a total gathering system capacity of more than 440 MMcfd. The Revolution pipeline originates in Butler County, Pa., and will extend to ETP's Revolution cryogenic gas plant to be built in western Pennsylvania. The Revolution plant is to be in service by second-quarter 2017 and will, ETP said, "allow for future processing growth for additional third-party gas."

Residue gas from this plant will be delivered into ETP's Rover interstate pipeline. The NGLs will be delivered to Sunoco Logistics' Mariner East pipeline system for delivery to domestic and export markets.

The project also includes fractionation to be built at Sunoco Logistics' Marcus Hook, Pa., industrial complex. The fractionation plant is to be in service by second-quarter 2017.

Overall expected capital cost for the pipeline system and associated facilities, which will be supported by long-term agreements, is about $1.5 billion, ETP said.

According to Chuck VanAllen, chief executive officer of EdgeMarc Energy, the project provides EdgeMarc effective gathering and processing for about 500 laterals that will be drilled to access rich gas from the stacked Devonian and Marcellus shales in Butler County.

Prism Midstream to start work on Bedrock facility

Prism Midstream LLC will begin construction this month of the Bedrock liquids-handling facility in Crockett County, Tex., to handle both on-specification and off-specification NGLs and off-spec condensate.

Scheduled to be in operation by the end of first-quarter 2016, the facility will have an initial capacity of 5,500 b/d and be expandable to 11,000 b/d of off-spec product. It will be equipped with five truck racks, expandable to 12, and will be north of Ozona with direct access to US Hwy 190 to receive incoming trucked liquids.

The facility will treat all normal off-spec issues-color, corrosion, carbon dioxide, and methane-and deliver NGLs that meet pipeline specifications or condensate that has a 9 psi RVP and less than 10 ppm sulfur.

Prism says it has executed definitive agreements with Enbridge Liquids Transportation & Marketing LP (ELTM) for firm capacity at the Bedrock facility and is negotiating additional commitments. ELTM purchases on-spec and off-spec NGLs and condensate in the Permian basin and has a fleet of trucks and trailers to transport Permian NGLs and condensate to the Bedrock facility.

TRANSPORTATION — Quick Takes

ExxonMobil Alaska LNG lets contract for G&G program

ExxonMobil Alaska LNG LLC (AKLNG) has let a contract to Fugro for a geotechnical and geophysical (G&G) program.

The 2015 G&G program follows successful completion of a similar but smaller program carried out by Fugro in 2014.

The geotechnical scope of work includes drilling and sampling of borings for the onshore liquefaction facilities, marine terminal, and offshore pipelines. It also includes installation of monitoring wells, seismograph, and in situ measurement of soil properties.

The geological and earthquake engineering scope will include assessment of geohazards, source characterization, probabilistic seismic hazard, and site response analyses. Bathymetric, side scan sonar, reflection and refraction surveys and sub-bottom profiling also will be conducted to assist in developing an integrated site model, the group said.

"These studies will assist AKLNG and its contractors to proceed with the [front-end engineering and design] level design of the LNG terminal and associated offshore pipelines," the companies said.

AKLNG is a consortium of ExxonMobil Corp., ConocoPhillips, BP PLC, TransCanada Corp., and the state of Alaska.

APA Group finalizes Queensland pipeline acquisition

Australian gas infrastructure entity APA Group has completed its purchase of BG Group's 543-km pipeline network linking BG Group's Surat-Bowen basin coal seam gas fields with the recently commissioned LNG plant on Curtis Island near Gladstone in Queensland.

APA already owns $12 billion (Aus.) worth of energy assets and the acquisition extends the group's east coast Australia pipeline grid to more than 7,500 km.

The final price for the BG line was $5.9 billion (Aus.) and APA has renamed it the Wallumbilla-Gladstone pipeline.

BG placed the pipeline on the market in 2014 to pay down debt and meet development commitments.

APA says has not only bought the pipeline, but gained two significant customers in BG and China National Offshore Oil Corp. as part of the transaction.

APA beat rivals including Envestra, Australian Pipeline, and Marubeni Corp. to make the purchase.

Gazprom Neft completes Yamal winter oil shipments

JSC Gazprom Neft reported completion of its first winter shipments of oil from Novoportovskoye field in Russia's Yamal Peninsula.

Beginning in February, seven leased tankers carried a total of 110,000 tonnes of Novy Port crude. The oil has been sold in northwestern Europe, with all payments made in rubles.

The first sea shipments of Novy Port oil were made in summer 2014. Plans for winter transportation were approved in December.

Novy Port crude has lower sulfur content than the Urals blend, the company said.

"The long-term strategy of Gazprom Neft envisages increasing production at fields in the far north, both on and offshore," said Alexander Dyukov, chief executive officer (OGJ Online, Sept. 15, 2014).

Production from those fields will account for a major proportion of the company's volumes in a few years, the company said.