Despite downturn, US, Canada shales drive gas production, processing growth

Warren R. True

Chief Technology Editor-Midstream

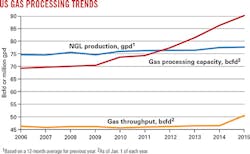

Shale-related development in the US and Canada pushed up natural gas processing in those countries in 2014 as Oil & Gas Journal's plant-by-plant survey of global gas processing on Jan. 1, 2015, reflects nearly a 6% growth in US processing capacity, following a similar increase the previous year. Data for both North American countries showed large increases in throughput as well. Much of this was new capacity; the rest were plant expansions and data new to OGJ's database.

Similar growth in NGL fractionation capacities was also evident, as development continued apace despite the plunge in hydrocarbon liquids prices beginning in mid-2014. Two tables, beginning on p. 62, display projects and statuses as of OGJ press time.

Growth in US gas processing capacity, data show, helped advance total global capacity by more than 3 bcfd; for 2013, US gas processing capacity helped advance total global capacity by more than 1 bcfd. For 2012, US capacity had grown by nearly 4 bcfd.

Overall, global natural gas production in 2014 gained over 2013 production by more than 4 tcf (OGJ, Mar. 9, 2015, p. 32; Mar. 10, 2014, p. 31), led by the US and Middle East countries. For 2014, the US produced more than 17% of global gas production, off from 21% in 2013. But that level was about flat with production for 2012 after advancing in 2011 by more than 7% compared with growth in 2010.

US gas processing capacity growth in 2013 kept North American production (including Mexico) ahead of the rest of the world. And that US growth even helped push the share held by US and Canada ahead of the rest of the world.

In 2014, the two countries' share of global gas processing capacity increased to more than 52% from a bit shy of 51% for 2013 and from slightly less than 50% in 2012.

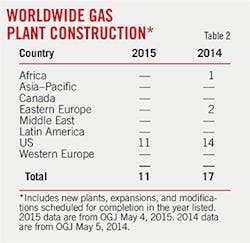

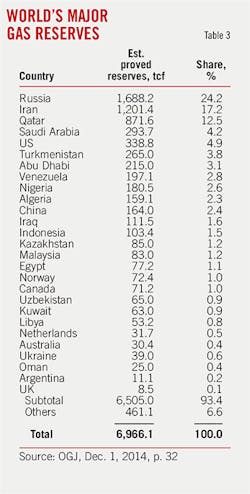

Table 2 presents a snapshot of global gas plant construction; Table 3, a review of global natural gas reserves; Table 4, a list of the world's leading gas producing countries; and Table 5, the leading NGL-producing countries.

Sources

Oil & Gas Journal's exclusive, plant-by-plant, worldwide gas processing survey and its international survey of petroleum-derived sulfur recovery provide industry activity figures.

Canadian data are based on information from Alberta's Energy and Utilities Board (EUB) that reflects actual figures for gas that moved through the province's plants and is reported monthly to the EUB. For 2000 for the first time, OGJ took these data for all of Alberta and compiled annual figures and thereby created a new baseline for data comparisons from that point.

(Effective Jan. 1, 2008, the province realigned the EUB into two separate regulatory bodies: the Energy Resources Conservation Board to regulate the oil and gas industry and the Alberta Utilities Commission to regulate utilities.)

In addition to EUB figures for Alberta and to operators' responses to its annual survey, OGJ has supplemented its Canadian data with information from British Columbia's Ministry of Energy, Mines and Petroleum Resources and Saskatchewan's Ministry of the Economy.

Activity

What follows reviews selected projects by global region and, in the case of the US, by development play to present a snapshot of activity last year.

Asia

In Australia at yearend 2014, Cooper Energy Ltd., Adelaide, bought from Santos Ltd. a 50% interest in the offshore Gippsland Sole dry gas field in retention lease Vic/RL3 as well as 50% of the Orbost onshore gas plant in eastern Victoria.

Sole field, originally discovered in 1972 by Royal Dutch Shell PLC, lies in the eastern Bass Strait about 40 miles from the Orbost plant. Gas will be piped to the Orbost plant, which was used for production from Patricia-Baleen gas fields operated by Santos.

Sole field will be produced via a single development well (expected to produce as much as 70 MMcfd) and pipeline direct to the Orbost plant, which in turn is connected to the major Eastern gas line extending to Sydney in New South Wales. The Orbost plant is currently processing gas from the Longtom gas field in Bass Strait and will need modifications to cater for Sole gas, said the company.

Final investment decision is likely third-quarter next year.

Elsewhere in Asia, regional media reported late last year that Azerbaijan would commission two new gas processing and petrochemical plants, being built under the new Oil and Gas Processing and Petrochemical Complex (OGPC), in early and late 2020, respectively. OGPC Organization and Control Department Director Orkhan Jafarov said raw material will be provided from Azeri-Chirag-Guneshli, Umid, and other fields developed independently by Azerbaijan's state energy company.

The project envisions building a petrochemical business able to produce 1.7 million tonnes/year (tpy) of finished products, an oil refinery with a capacity of 10 million tpy, as well as a gas processing plant of about 1 bcfd capacity.

A company announcement said the plant is to produce 3 million tpy of gasoline and nearly 3.6 million tpy of diesel. It will also be able to produce nearly 1.7 million tpy of exportable petrochemical products. According to the announcement, a feasibility study set the cost at about $1.7 billion.

Earlier this year, in Uzbekistan, Russia's OAO Lukoil let a contract to a consortium headed by South Korea's Hyundai Engineering Co. Ltd., Seoul, to build its long-planned Kandym gas processing plant about 320 miles southwest of Tashkent (OGJ Online, Feb. 13, 2015; Mar. 28, 2012).

The proposed 8.1-billion cu m/day (cmd) plant will process sour natural gas from the Kandym group of fields in the Bukhara region of Uzbekistan to produce treated natural gas, stable gas condensate, as well as solid and granulated sulfur, Lukoil said.

Total value of the contract for construction of the project, which received final approval from the Uzbek government in November 2014, amounts to nearly $2.7 billion.

Hyundai Engineering said it expects construction, once under way, to last 44 months.

In June last year in Pakistan, OMV AG and partners (Pakistan's) Government Holding Private Ltd. (GHPL; 25%), Ocean Pakistan Ltd. (OPL; 11.8%), and Zaver Petroleum Corp. Ltd. (4%) commissioned the 30 million cmd Mehar gas processing plant, which will produce 30 MMcfd in residue gas and 3,300 b/d of condensate.

OMV had acquired the Mehar exploration license and development and production lease as part of the acquisition of Petronas Carigali (Pakistan) Ltd. (renamed OMV Maurice Energy Ltd.) in July 2011.

Mehar development included the drilling of one additional production well, completion of three production wells, and construction of a central gas and condensate processing plant in Mehar.

Gas will be exported through a 37-mile pipeline to the Sui Southern Gas Co. Ltd. network; condensate will be sold to Pak-Arab Refinery Co.'s (Parco) refinery. Stabilized condensate will be trucked to Karachi until completion of a condensate pipeline.

A second-phase expansion of the Mehar gas plant will push residue-gas production to 80 MMcfd and condensate to 8,800 b/d. LPG production will be up to 170 tonnes/day (tpd).

Elsewhere, Honolulu-based consultancy FGE reported in late 2014 on the evolution of China's LPG demand and supply for the previous 10 years. It noted that at least 95% of China's domestic LPG production has been from refineries with smaller volumes from gas processing.

Over 2000-13 and with a dip during the 2008-09 global financial crisis, China's LPG production grew by 7.5%/year. Over the same period, LPG demand grew an average 5.5%/year, accelerating in the later years: 9.5%/year in 2013, reaching almost 782,000 b/d.

LPG demand in China is mainly residential (cooking), said the FGE report. Natural gas imports via LNG and pipeline began to crowd out LPG in more Chinese cities starting in the middle of the last decade. LPG consumption dropped 10.8% year-over-year in 2008, reaching negative territory for the first time since 1990.

Development of pipeline infrastructure, particularly the commissioning of two west-to-east gas pipelines, accelerated the reduction in LPG demand in residential use, the report stated. At the same time, however, LPG use as petrochemical feedstock began to grow. Increased petrochemical interest appears in the boom of the share of petrochemical use in overall LPG sales, said FGE. That share hit 30% in 2013. The share of the residential sector in total LPG demand, however, fell to less than 45% in 2013 from more than 70% in 2005.

Chinese imports grew 27% year-over-year to nearly 134,000 b/d in 2013, of which some 40,000 b/d was re-exported in 2013, said the FGE report.

The Middle East continued to dominate as a source for Chinese imports of LPG. Basing its conclusions on Chinese customs, FGE said the UAE had replaced Qatar as the leading LPG supplier to China since 2012. In 2013, the UAE accounted for 26% of total LPG supply into the country, followed by Qatar (24%) and Kuwait (13%).

In the first 8 months of 2014, the share of LPG supply from the UAE reached 53%, with absolute volume jumping threefold from 2013 levels. The FGE report speculated, however, that in spite of the surge in UAE imports, some cargoes may have originated from Iran. "China became a major conduit for Iranian LPG" since early 2014, with many of the cargoes "believed to be transshipped off Fujairah in the UAE."

South China's Guangdong Province, the largest LPG-importing province, accounted for 57% of China's LPG imports in 2013. The portion of LPG exported from Guangdong to other provinces has since slowed from 72% in 2009, on the strength of growing imports via other provinces such as Zhejiang. Imports into Zhejiang accelerated in recent years through Oriental Energy and Huachen Energy, said the report.

According to FGE, China Petrochemical Corp. (Sinopec) has shelved plans to build a $3.1 billion ethylene plant at Qingdao in Shandong Province. The plant was to be the first based on natural gas and light-end feedstocks. Otherwise, said FGE, LPG use as feed, such as at Secco Petrochemical and BASF in Shanghai, has been "small and limited to imports."

With a designed production capacity of 1 million tpy of ethylene, the Qingdao plant was planned to be built over 3 years and be completed in 2016-17. Half of the LPG feed would come from imported natural gas and ethane and the remaining produced from a nearby refinery in Qingdao. The plant received environmental clearance in June 2013, said the report.

While the fate of Sinopec's Qingdao ethylene plant remains uncertain for now, FGE says it is likely that future olefin plants in China may allow for higher feedstock flexibility for lighter hydrocarbons. Use of LPG could accelerate based on increased supply of US LPG into Asia coupled with the widening spread between LPG and naphtha prices.

The FGE report said that United Petroleum & Chemical Corp. Ltd. (Unipec) had signed two propane supply agreements over a 5-year period with Enterprise Products (0.5 million tpy) and Phillips 66 (1 million tpy), with deliveries to begin this year and next, respectively. Meanwhile, China National Offshore Oil Co. (CNOOC) is considering using LPG for its upcoming 1-million-tpy ethylene cracker in South China's Guangdong Province (OGJ Online, Dec. 20, 2013).

In addition to the use of LPG in steam crackers, FGE reports that petrochemical interest in LPG has come from another direction. China is short on propylene, says FGE; about a third of the country's needs run around 4 million tpy. In 2011, several companies realized this deficit could be filled (profitably) by building propane dehydrogenation (PDH) plants. At that time, says the report, the propylene-propane price differential had exceeded $500/tonne, while the cost of producing propylene from propane was pegged at $300/tonne.

Propylene production by PDH needs 90% purity propane; very little produced in China meets this quality, says FGE. A new propane import requirement of PDH feed has surfaced. As many as 20 PDH plants had been needed at one time, but fewer were actually built. Nonetheless, their propane-purchasing activity has already affected international LPG-trading markets.

Middle East

Earlier this year, United Arab Emirates started up the Shah gas project and expected it to reach full capacity sometime this quarter, according to a Reuters report. The project, developed with Occidental Petroleum Corp. (40%), is to produce gas from the high-sulfur field and process about 1 bcfd of sour gas into 0.5 bcfd of residue gas. It will also produce large volumes of condensate as well as 22,000 tpd sulfur.

Shah gas fields are in the desert about 112 miles southwest of Abu Dhabi city and have H2S levels that average 23%, as well as high CO2 levels.

The $10 billion project involved building what officials at ADNOC said is the world's first single gas plant to process at least 1 bcfd of gas with such high levels of H2S. After processing to remove and transport more than 10,000 tpd of "pure granular sulfur" to export at Ruwais, the project will contribute 500 MMscfd of gas to the UAE system.

Late last year, Kuwait commissioned a new 800-MMcfd LPG Train 4 natural gas plant that will also separate raw liquids of up to 106,000 b/d into ethane, propane, and butanes. Kuwait already has three smaller plants totaling 1.5 bcfd in capacity, most of which is associated gas.

All Kuwait's gas goes to petrochemical manufacturing and as fuel for power plants. Although it has plentiful domestic reserves, Kuwait must import gas in summer to meet an increased demand from power stations. Kuwait is planning to increase natural gas production, raising its daily output to 4 bcfd by 2030.

In Oman in January, Oman Oil Co. Exploration & Production opened a new $1.3 billion unconventional (tight) gas processing plant in the country's Abu Butabul field. The plant took 3 years to build and was commissioned in September of last year.

The field covers 1.5 billion sq m and is owned and operated by OOCEP. Production is expected to reach nearly 2 million cmd and 6,000 b/d of liquids by the middle of this year.

Also last year, Qatar Petroleum announced that a new gas liquids processing plant and a new central production facilities offshore would be part of an $11 billion redevelopment of offshore Bul Hanine oil field. On production since 1972, the field lies about 75 miles off the country's east coast in the Arabian Gulf.

Drilling will occur from existing and modified wellhead jackets and from 14 new wellhead jackets. The new offshore complex, which will process all production streams, will have production, compression, utility, and accommodation platforms with topsides weights of 4,000-14,000 tonnes.

After the redevelopment, oil will continue to move by pipeline to Halul Island for export. A new 93-mile pipeline will carry about 900 MMcfd of sour rich gas to Mesaieed. After treatment, lean sweet gas will return offshore by a new pipeline for compression and injection (OGJ Online, May 14, 2014).

Canada

In May last year, Pembina Pipeline Corp., Calgary, announced it had reached agreement to build a 55,000-b/d C2+ fractionator (RFS III) at its Redwater fractionation and storage complex, along with a high-vapor-pressure pipeline lateral that will extend the gathering potential of its Brazeau pipeline in the Willesden Green area of south-central Alberta.

Pembina said RFS III, which is underpinned by long-term take-or-pay contracts with multiple producers, is to cost $400 million (Can.), including associated caverns and capital previously announced for the RFS III prebuild.

The plant will be the third fractionator at Pembina's Redwater site and will employ design and engineering work completed for Pembina's first two fractionators there.

At the time of the announcement, RFS I had an operating capacity of 73,000 b/d and was being debottlenecked to bring capacity to 82,000 b/d in fourth-quarter this year. When combined with RFS II, also expected to come into service in fourth quarter, the company's fractionation capacity will double to 155,000 b/d.

The addition of RFS III will bring Pembina's fractionation capacity to 210,000 b/d, making Redwater the largest fractionation site in Canada (OGJ Online, May 13, 2014).

In July last year, Mistral Midstream Inc., Calgary, began work on 60-MMscfd of deep-cut gas processing and NGL extraction, a 65-mile ethane pipeline, and a 47-mile gas gathering pipeline near Midale, Sask. (OGJ Online, July 17, 2014; Sept. 4, 2013). In October 2014, Mistral Midstream was acquired by Pembina Pipeline.

Mistral received required regulatory and environmental approvals at mid-2014 and began targeting a first-half 2015 in-service date.

The $70 million (Can.) cryogenic gas processing plant will be licensed for 7,500 b/d of ethane, propane, and other NGLs, and will recover 99% of the propane and heavier products from the gas. The plant will process gas originating on the TransGas system and from nearby sources operated by Crescent Point Resources Partnership, an affiliate of Crescent Point Energy Corp.

Ethane extracted from gas at the plant will be delivered via a 65-mile, 4-in. pipeline to the 40,000-b/d Vantage Pipeline near the US border, which then connects with the Alberta Ethane Gathering system at Empress.

Mistral was also building an 8-in. gas gathering line adjacent to the ethane system capable of transporting as much as 30 MMscfd of gas from the Flat Lake-Hoffer region to the Mistral plant for NGL extraction and sales gas delivery to the TransGas system.

In August, AltaGas Ltd. and Painted Pony Petroleum Ltd., both of Calgary, announced they would develop processing and marketing for natural gas and NGLs for Painted Pony's liquids-rich Montney gas production in northeast BC.

In the first phase, AltaGas will build and operate a 198-MMcfd shallow-cut gas processing plant in the Montney for which Painted Pony will retain rights to a minimum 150 MMcfd of firm capacity.

The Townsend plant will be about 62 miles north of Fort St. John and about 12 miles southeast of AltaGas's Blair Creek plant, through which Painted Pony had already been processing a large portion of its Montney production.

Estimated cost for the Townsend plant is $325-350 million (Can.) to be built and funded by AltaGas. It will start up by yearend 2015, subject to regulatory and other approvals.

The company said that, upon completion of this first phase, further construction of processing infrastructure in northeast BC is possible, with a second phase of Townsend to include a deep-cut system for the enhanced recovery of additional NGLs and fractionation.

In October last year, Pembina Pipeline announced plans for a $170 million (Can.) expansion of its 200-MMcfd Resthaven gas processing plant in west-central Alberta and to build, own, and operate a new gas gathering pipeline to deliver gas into Resthaven. The expansion is underpinned by a long-term, fee-for-service contract with Mosaic Energy Ltd., Calgary.

The gas processing expansion component of the project is to cost about $105 million (Can.) and increase capacity of Resthaven by 100 MMcfd, bringing total capacity to 300 MMcfd. To support the expansion, Pembina will build a $65 million (Can.), 7.5-mile, 12-in. gas gathering pipeline that will connect the Mosaic's condensate recovery plant into Resthaven.

The additional NGLs that will be extracted from the processed gas will be transported on the recently constructed Resthaven lateral. The pipeline was to have been in-service by second-quarter 2015, followed by the gas processing expansion in mid-2016.

With the additional volumes at Resthaven, Pembina has also signed a long-term contract with Mosaic for Phase III pipeline capacity and fractionation capacity at the Redwater fractionation and storage facility, mentioned earlier.

In December, Keyera Corp., Calgary, announced it would pay $65 million (Can.) to buy a 70.79% ownership interest in the Ricinus deep-cut gas plant in west-central Alberta.

The company announcement did not name the seller, but 2014 data from the Alberta Energy Regulator show a Ricinus gas plant of similar capacity owned by Apache Canada Ltd. (OGJ, June 2, 2014, p. 72).

The sweet-gas processing plant, which is about 14 miles south of Keyera's 275-MMcfd Strachan deep-cut gas plant, is able to extract a C3+ mix of NGLs. Current operating capacity is about 124 MMcfd, compared with licensed capacity of 221 MMcfd, because only one of two NGL trains is operating, said the announcement. The plant underwent a turnaround in September 2014.

Keyera will operate the Ricinus plant and plans to restart the second NGL train. Keyera also plans to build a new pipeline connecting the Ricinus and Strachan plants and to invest in associated gas gathering (OGJ Online, Dec. 12, 2014).

In December last year, Pembina Pipeline announced it would build a new shallow-cut gas processing plant and expand existing capacity at Musreau, northwest of Edmonton, by 100 MMcfd. The company estimated the new Musreau III plant would cost $105 million (Can.).

It will be supported by long-term agreements with several area producers, said the company announcement, and involves construction of the new plant adjacent Pembina's existing Musreau processing and the nearly complete Musreau II plant.

Musreau III will have liquids extraction capacity of about 3,000 b/d, subject to gas compositions. Similar to the company's other gas processing, the take-or-pay agreements for Musreau III provide flow through of operating expenses. Pembina anticipates bringing Musreau III on stream in mid-2016.

In total, once Musreau III is complete, the Cutbank complex will have about 570 MMcfd of shallow-cut processing capacity and 205 MMcfd of deep-cut capacity and will produce roughly 25,000 b/d of liquids for transportation on Pembina's conventional pipelines, said Stuart Taylor, Pembina senior vice-president for NGL and natural gas.

US-Marcellus, Utica

In May last year, MarkWest Energy Partners LP, Denver, announced plans to expand Marcellus shale processing at two sites in West Virginia.

At its Sherwood complex in Doddridge County, MarkWest is adding 200 MMcfd of processing to accommodate production from Antero Resources Corp., based on a long-term, fee-based contract (OGJ Online, June 7, 2014; Nov. 8, 2013).

By the end of this quarter, the new plant will expand total capacity at Sherwood to 1.2 bcfd.

At its Mobley complex in Wetzel County, W.Va., MarkWest is increasing total processing capacity to 920 MMcfd with construction of an additional 200-MMcfd plant-Mobley V-to handle production from EQT Corp. Original plans targeted in service by second-quarter 2015.

Mobley had consisted of three plants with total 520 MMcfd of processing capacity. In late 2014, MarkWest started up Mobley IV, increasing capacity to 720 MMcfd (OGJ Online, Aug. 19, 2013). The complex processes production from Marcellus rich-gas production from EQT, Magnum Hunter Resources Corp., Stone Energy Corp., Consol Energy Inc., and Noble Energy Inc.

MarkWest said in 2014, it will complete 11 projects, bringing its total US Northeast processing and fractionation capacity to 4 bcfd and 250,000 b/d, respectively.

In June 2014, Ergon Inc., Jackson, Miss., announced plans to expand processing capabilities of its subsidiaries' operations in the Appalachian basin to support growing condensate and NGL production from the Marcellus and Utica shales.

The plans included a total of 20,000 b/d in regional condensate stabilization capacity. The company planned to start up 10,000 b/d of stabilization capacity at its Marietta, Ohio, river terminal during fourth quarter, with another 10,000 b/d to be added to its Newell, W.Va., operations this year.

In August last year, MarkWest said it would add 600 MMcfd of natural gas processing capacity and 110,000 b/d of NGL fractionation capacity to projects in West Virginia, Pennsylvania, and Ohio (OGJ Online, Aug. 7, 2014).

In the second quarter of the year, the company placed into service two natural gas processing plants with 320 MMcfd of capacity in the Marcellus shale, a 200-MMcfd plant in the Utica, a 20,000-b/d ethane and heavier fractionation in the Marcellus, and 40,000-b/d of de-ethanization capacity in the Utica.

The company is building a seventh 200-MMcfd processing plant at its Sherwood complex in Doddridge County, W.Va., to handle production from Antero Resources. The new plant will expand total capacity at Sherwood to 1.4 bcfd by third-quarter this year.

In late August, MarkWest started up the Sherwood IV plant, also supported by production by Antero.

And MarkWest is building a sixth processing complex in the Marcellus-the Hillman complex-in Washington County, Pa., based on rich-gas production by Range. The new complex will initially consist of Hillman I, a 200-MMcfd processing plant with associated de-ethanization. It is to start up during first-quarter 2016.

Propane and heavier NGLs recovered at Hillman will move by a new pipeline to the nearby Houston, Pa., complex for fractionation.

The plans follow announcements earlier this year regarding capacity additions at the Mobley complex in Wetzel County and the Majorsville plant in Marshall County, W.Va. (OGJ Online, May 7, 2014; OGJ, June 2, 2014, p. 72) and the Bluestone II plant in Butler County, Pa. (OGJ, June 2, 2014, p. 72).

In the Utica, in nearby Harrison County, Ohio, MarkWest Utica EMG is developing Cadiz III, a 200-MMcfd processing plant that was expected to begin operations early this year. It would increase total processing capacity at Cadiz to 525 MMcfd.

At the time of the announcement, the complex consisted of a 125-MMcfd cryogenic processing plant. During September, MarkWest Utica EMG was to have started up the 200-MMcfd Cadiz II plant to handle rich-gas production from Gulfport Energy and other producers (OGJ Online, June 5, 2014).

In July 2014, MarkWest Utica EMG completed the 200-MMcfd Seneca III processing plant in Noble County, Ohio. The new plant processes production from Antero Resources under a long-term, fee-based contract and has expanded total processing capacity of the Seneca complex to 600 MMcfd.

Responding to "continued growth of Antero Resources and other producers," MarkWest Utica EMG expected to complete the Seneca IV 200-MMcfd plant in second-quarter this year.

Also in July last year, MarkWest Utica EMG completed a 40,000-b/d de-ethanization plant at Cadiz. Purity ethane produced at the new Cadiz facility is delivered into the ATEX pipeline (OGJ Online, Dec. 6, 2013).

Also in August last year, MarkWest announced plans to expand midstream infrastructure at its Keystone complex in Butler County, Pa., to handle growing rich-gas production from the Marcellus shale and Upper Devonian formations.

New processing agreements with Rex Energy Corp. and EdgeMarc Energy are underwriting the expansion. As part of these agreements, MarkWest is building Bluestone III and IV, each of which to handle 200 MMcfd and begin operations in fourth-quarter this year and second-quarter 2016, respectively.

MarkWest is also building 40,000 b/d of additional de-ethanization and more than 20,000 b/d of additional propane and heavier NGL fractionation capacity.

US-Bakken

In August, Oneok Partners announced that its 100-MMcfd Garden Creek II natural gas processing plant in eastern McKenzie County, ND, had started up.

The company's plans at the time called for about 1.1 bcfd of increased capacity by third-quarter 2016 following completion of additional natural gas infrastructure in the Williston:

• Garden Creek III: a 100-MMcfd plant, expected to start up in late 2014 or early 2015.

• Lonesome Creek: a 200-MMcfd plant, expected to be completed in fourth-quarter this year.

• Demicks Lake: a 200-MMcfd plant, expected to be completed in third-quarter 2016.

• Construction of additional gas compression to take advantage of additional natural gas processing capacity at the existing and planned Garden Creek and Stateline processing plants by a total of 100 MMcfd, expected to be completed in fourth-quarter 2015.

In October last year, Targa Resources Partners LP, Houston, approved the purchase of a 200-MMcfd cryogenic plant to be located in McKenzie County, ND, in the Williston basin. When combined with the current 40-MMcfd expansion to be operating at yearend 2014, this new capacity will increase Targa's effective processing capacity when all facilities are debottlenecked to 300 MMcfd to handle production from the Bakken and Three Forks shale plays.

The additional Badlands plant is to be operating as early as yearend 2015.

US-Permian

Lucid Energy Group LLC, Dallas, is installing a 200-MMcfd cryogenic gas plant about 10 miles southeast of Big Lake in Reagan County, Tex., a site the company says is in the "heart of the Permian's Midland basin."

Manufactured by UOP Russell, Tulsa, the plant will bring Lucid's total processing capacity in the Midland basin to 320 MMcfd. It operates a combined 120 MMcfd of processing at its Silver and Munson plants, in Sterling and Irion counties, respectively.

The Big Lake plant will connect to Lucid's 450-mile pipeline system and process gas produced from the Wolfcamp shale in Irion, Reagan, and Crockett counties. Construction was to have been completed at the plant in first-quarter 2015.

In September last year, EnLink Midstream Partners LP, Dallas, completed the Bearkat natural gas processing plant and rich-gas gathering system in West Texas.

The first phase of the West Texas expansion included building the new 60-MMcfd Bearkat gas plant in Glasscock County along with 65 miles of high-pressure gas gathering pipeline and a portion of a gathering system, which includes 30 miles of pipeline that provides gas takeaway capacity for producers in Glasscock and Reagan counties.

Additional 35 miles to provide further gathering capacity for the Bearkat complex was nearing completion at yearend. The new pipeline will have initial capacity of 100 MMcfd and provide takeaway for constrained producers in Howard, Martin, and Glasscock counties.

The second phase of the expansion includes a new 120-MMcfd gas processing plant, multiple low-pressure gathering pipelines, and a new 23-mile high-pressure gathering pipeline that will tie into the Bearkat gas gathering system.

The new Ajax processing plant will lie to the north of the Bearkat plant and increase total transportation capacity of the Bearkat gathering system to more than 400 MMcfd.

The new pipelines were to be operating in first-quarter 2015, and the Ajax plant is to come online in second-half 2015.

EnLink Midstream formed in early 2014 when Devon Energy combined most of its midstream assets with Crosstex Energy.

In September last year in New Mexico's Delaware basin, Enterprise Products Partners LP, Houston, announced it would build a new cryogenic natural gas processing plant in Eddy County, along with associated-gas and NGL pipelines to handle growing production of NGL-rich natural gas in the basin.

The plant and pipelines will come online in first-quarter 2016. The South Eddy gas plant will have an initial capacity of 200 MMcfd, with the potential for expansions. Completing the plant will bring Enterprise's total gas processing capacity in the Delaware basin to 400 MMcfd.

In October last year, Targa announced it would buy and install a new 300-MMcfd cryogenic gas plant, a header pipeline originating at the new plant into the southern portion of the Delaware basin, and related gathering and compression.

The new plant will be in Winkler County, Tex., west of Targa's existing Sand Hills gas plant, to provide additional services to producers on the western side of the Permian basin. Along with the recent start-up of the 200-MMcfd High Plains plant at the San Angelo Operating Unit, the Winkler County plant will increase Targa's Permian basin capacity by 500 MMcfd to a total gross capacity of nearly 1.1 bcfd.

The new processing plant is to be operational at the end of first-quarter 2016.

US-Okla., Haynesville

In July, Oneok Partners LP, Tulsa, announced it would spend $365-470 million by yearend 2016 to build a new 200-MMcfd gas plant and related infrastructure in Grady and Stephens counties, Okla. (OGJ Online, July 24, 2014).

The Knox plant will increase Oneok's Oklahoma processing capacity to 900 MMcfd. It and the related infrastructure, including expansions and upgrades to the company's existing gas gathering and compression, are to be completed during fourth-quarter 2016.

Estimated costs include $175-240 million to build the plant and $190-230 million to build related natural gas infrastructure, including gas gathering pipelines and compression.

Oneok's announcement said it plans total investments of $6.4-6.8 billion through 2016 for acquisitions and infrastructure projects related to gas gathering and processing and NGLs, including the Knox plant and gathering.

In April 2014, MarkWest's Centrahoma joint venture started up its 120-MMcfd Stonewall processing plant in the Woodford shale in southwest Oklahoma. Completion of the Stonewall plant increases Centrahoma's total processing capacity to 220 MMcfd (OGJ Online, Aug. 7, 2014; Dec. 5, 2012).

Regency Energy Partners LP, Dallas, last year announced plans for a new processing plant and NGL pipeline at Dubberly in North Louisiana.

The project includes addition of new 200-MMcfd cryogenic processing, filled by gas from Regency's Dubberly gathering trunkline. Residue gas from this plant will flow into Regency's intrastate system.

In addition, the company is building a new, 160-mile, 8 and 10-in. NGL pipeline from Dubberly for delivery to fractionation. The pipeline will have initial capacity of 25,000 b/d, expandable with additional pump stations.

Combined, the projects are to cost about $260 million, said the Regency announcement, and both the new plant and the NGL pipeline were to be completed in mid-2015.

In East Texas, MarkWest is building a fourth processing plant at its complex in Carthage, Panola County, to handle rich-gas production from the Haynesville shale and Cotton Valley formation.

The new plant, with an initial capacity of 120 MMcfd, was to begin operations in first-quarter this year. Once completed, total processing capacity at the East Texas site will increase to 520 MMcfd (OGJ Online, Aug. 7, 2014).