Subsea gas compression increases chance of deepwater development

Gioia Falcone

Clausthal University of Technology, Clausthal-Zellerfield, Germany

Bob Harrison

Soluzioni Idrocarburi SRL, Rome

Much of future offshore oil and gas production will come from complex reservoirs in deep water with ever-longer tiebacks, Providing subsea technologies the opportunity to replace traditional surface infrastructure in field development.

This article looks at global market trends for deepwater subsea development. It uses current subsea hardware industry data as a barometer for one specific technology, subsea gas compressors, and determines if these could replace traditional offshore compression.

Subsea development remains technologically complex and expensive. There is, however, a spread in the breakeven oil price for comerciality. It can be $80/bbl for the Arctic, $70/bbl for West Africa, $60/bbl for the Gulf of Mexico and North Sea, $50/bbl for Brazil presalt, and as low as $30/bbl for the Caspian Sea1 2 Even in today's low-price environment many subsea projects will still be sanctioned.

The natural gas market continues to grow and prices outside the US are rising. The way natural gas is transported is shaping this growth. In 2013 about 711 billion cu m (bcm) of natural gas was transported by pipeline, and the equivalent of about 325 bcm by carrier.3

Besides having to develop resources in deeper, more remote locations and more extreme metaocean conditions, reserves are also smaller and more scattered.

Greater use of subsea technology for separation, multi-phase pumping, and gas compression-as an alternative to fixed processing platforms-could help unlock fields that are inaccessible with existing hardware. Fig.1 shows the growing importance of offshore production over the past 4 decades and forecasts where trends are headed. Deepwater and ultradeepwater (UDW) reservoirs are on the rise. North America deepwater projects have long lifecycles that are less susceptible to short-term price fluctuations. Subsea hardware development can play an important role in bringing these resources to production by reducing the cost of separation, boosting, and compression.

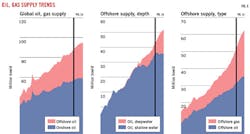

Fig. 2 shows the trend of increasing water depth and tieback distance. With increasing step-out capability, a subsea compression plant with very long reach could enable Arctic production by 2020.1

Subsea hardware market

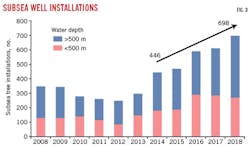

The subsea hardware sector presents a long-term growth opportunity, particularly in Africa, Asia-Pacific, and Brazil. New markets are also developing in the eastern Mediterranean and East Africa. Subsea well installations will grow at a compound rate of 11%/year through 2019.3 Subsea tree awards, a key industry barometer, will increase as well (Fig. 3).

Deepwater and UDW exploration will be one of the biggest growth areas of global E&P spending over the next 5 years, primarily in West Africa and Brazil, followed by the North Sea and the Gulf of Mexico, and then Asia-Pacific.2 Difficulties, however, remain.

In Brazil, which accounts for 14% of forecast subsea capital expenditure, Petroleo Brasileiro SA (Petrobras) is having trouble executing deepwater projects. Contractual requirements and a shortage of engineers puts pressure on the supply chain, inflates costs, and delays delivery of production systems. This impacts the timing of subsea installations. Analysts have removed about 60% of slated subsea projects from forecasts due to these constraints.

There are technology and cost barriers to market entry. This helps the top players who control more than 80% of the market maintain high margins.

There also are only a handful of national oil companies (NOCs) and international oil companies (IOCs) with experience in subsea project execution. Table 1 lists the key subsea markets geographically, including major operators and subsea development contractors.

With limited availability of subsea equipment, some IOCs and NOCs must consider forward integration or joint ventures to strengthen their project-development abilities and overcome industry bottlenecks.

In subsea hardware, leading players FMC Technologies Inc., and Aker Solutions have added capacity, particularly in Asia, Brazil, and Europe. Capacity additions have been prompted by large-frame equipment-supply agreements; Aker's new plant in Brazil follows a NOK 4.6 billion (about US $600 million) frame agreement for subsea hardware from Petrobras. First-quarter 2013 subsea hardware orders were among the strongest ever. Aker led the way, with 118 trees ordered, and Cameron also posted record sales. Orders will wane in 2015 before picking up again in 2016.

Subsea gas compression

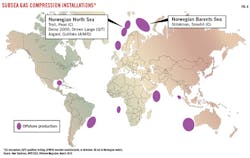

This growth in general subsea equipment orders extends to the subsea gas compression market. Aker estimated it could win 20-30 subsea compression contracts by 2020.5 Fig. 4 shows the potential global markets and the status of existing and planned subsea gas compression installations.

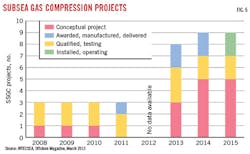

Subsea gas compression was firstconceived in 1985. This original concept, which required the separation of liquid and gas phases is being employed in Statoil's Aasgard field. Framo Engineering (now a part of OneSubsea) developed a solution for subsea wet-gas compression without prior phase separation that is to be deployed in Gullfaks field. Progress has been slow but steady, typical of technologies entering the subsea market and accepted by the industry.

Subsea gas compression's advantages include:6

• Boosting gas flow as reservoir pressure depletes.

• Increasing and accelerating gas production and ultimate recovery through proximity to the well.

• Reducing capital and operating expenses by eliminating the need for an offshore platform or onshore compression.

• Limiting CO2 emissions through lower energy consumption and has a smaller carbon footprint as there are no emissions or disposals into the sea.

• Increasing safety through unmanned operations.

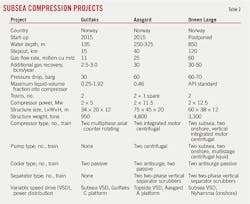

Despite these benefits, project development has been limited. Aker's dry-gas subsea compression project in Asgard field in 300 m of water is estimated to have cost $2.3 billion. OneSubsea's smaller and simpler wet-gas compression system in Gullfaks field, in 135 m of water, may cost $385 million. While these two sytems are planned to be installed, hooked up, and in operation sometime this year, the third Norwegian subsea gas compression project, Shell's Ormen Lange in 800 m of water, was planned for 2016 but has been shelved due to economics.

Table 2 outlines the key parameters of these projects.7 Table 3 shows that only a handful of these systems has been tested in the field, and that the first subsea wet-gas application is yet to be implemented. Deploying succesfully and operating trouble free will be key for industry acceptance.

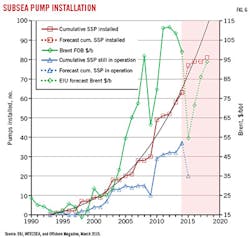

Looking at the development of the established subsea-pumping market may provide insight into how subsea gas compression could evolve. Plotting annual subsea-pumping data reveals an underlying correlation with the Brent crude oil price (Fig. 6).

The plot implies that gaining market acceptance for new technology in the sector is a long road and that Aker's projection of winning 20-30 subsea-compression packages by 2020 may be optimistic.

References

1. "Global Subsea Outlook: Trends and Opportunities," Infield Systems Ltd., Norwegian Centers of Expertise (NCE) Subsea, May 2013.

2. "Global Offshore Prospects," Douglas-Westwood Ltd., Energy Institute, September 2013.

3. "Statistical Review of World Energy," BP PLC, June 2014.

4. "World Subsea Hardware Market Forecast 2013-17," Douglas-Westwood Ltd., 2013.

5. Mikali, S., "Subsea Technology," Subsea Asia Conference, Kuala Lumpur, June 5, 2013.

6. Thomas, M., "Subsea gas compression to boost recovery rates," E&P Magazine, August 3, 2012.

7. Perez Aguilera, L.C., "Subsea Wet Gas Compressor Dynamics," MA thesis, Norwegian University of Science & Technology, Department of Energy & Process Engineering, June 2013.

The authors