Deepwater prospects gain momentum off Morocco

Tayvis Dunnahoe

Exploration Editor

Morocco's long-awaited offshore oil and gas development may soon be under way.

The country historically has been a net importer of hydrocarbons. According to the US Energy Information Agency (EIA), Morrocco produced 5,100 b/d of oil in 2013. Domestic natural gas production equaled 2 bcf in 2012. The country consumed 209,000 b/d of oil and 38 bcf of gas, respectively, in 2013.

Though Morocco first drilled for oil in 1890, the first discovery occurred in 1923 with the onshore Ain Hamra oil pool in the Rharb basin. Several smaller discoveries were made through the 1950s, but it was not until the government restructured its oil and gas policies in 2000 that full-fledged exploration began.

To date, Morocco's state-owned Office National des Hydrocarbures et des Mines (ONHYM) has acquired 44,227 km (27,481 miles) of 2D seismic and 1,634 sq km of 3D seismic onshore, coupled with 142,602 km of 2D seismic and 34,970 sq km of 3D seismic shot offshore. Despite more than a century of exploration, the country has seen little drilling, with 270 wells onshore and 34 offshore.

By modern standards, Morocco is underexplored. New seismic interpretation and recent advances in the understanding of resource development in rift basins along the Atlantic margin have attracted many operators.

Morocco's potential is helped by recent discoveries and a flexible fiscal regime for exploration activity.

Atlantic margin

The Moroccan Atlantic margin extends 3,000 km along the shoreline, from Tangier to Lagouira. The width of its shelf is variable-up to 150 km in the areas south of Agadir, with an average of 50 km in the north. The continental slope varies from cliff-like, off the Mazagan (El Jadida) plateau, to gently dipping in the Tarfaya and Dakhla segments.

As illustrated by the presalt basins off Brazil and Angola, exploration efforts in the continental rift have undergone a paradigm shift in the past decade.

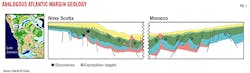

Many operators are entering Morocco in hopes of discovering analogs to the recent finds off Nova Scotia (Fig. 1). The Deep Panuke and Sable Island discoveries have proven 4 tcf of gas and associated liquids. While Nova Scotia's deepwater has not been fully explored, there is evidence in the subsurface that both countries have more to yield.

Morocco is situated where the African continent, the expanding Atlantic Ocean, and the Alpine collision zone meet. The region's petroleum geology is marked by a prolonged extensional period, which resulted in the opening of the Atlantic.

Atlantic margin geology is superimposed upon pre-existing Paleozoic basins that are prolific hydrocarbon producers to the east in Algeria and have proven effective in parts of Morocco. Regional source rocks are recognized in the Jurassic and Cretaceous as well as in the Paleozoic, and hydrocarbon discoveries in Morocco have been tied geochemically to all of these source rock levels.

Recent discoveries

Offshore Morocco has seen 34 exploration wells since 1968, 29 of which were drilled before 2003. The majority of these wells targeted Jurassic carbonate objectives on the shelf.

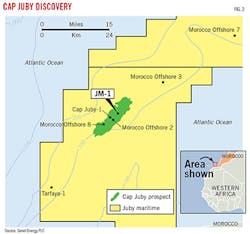

Cap Juby field is the most notable discovery from this period, which began with the MO-2 well when it encountered heavy oil in the Upper Jurassic section in 1968 (Fig. 2). The field remained undeveloped until recently.

In March 2014, Cairn Energy PLC reported its JM-1 well in the Juby Maritime license, which is 2 km from the MO-2 well, had confirmed the presence of heavy oil within a gross interval of 110 m in the same section (OGJ Online, Mar. 17, 2014).

The well was abandoned without testing. Cairn holds a 37.5% interest as operator and is partnered with Genel Energy (37.5%) and ONHYM (25%) in JM-1. Evaluation of the Cap Juby structure is ongoing.

In 2009, Repsol YPF SA drilled its Anchois-1 well 40 km off Morocco on the Tanger-Larache license. The well went to a total depth of 2,435 m and encountered two intervals of high-quality, gas-bearing sands totaling 90 m, with 40 m of net pay (OGJ Online, Mar. 30, 2009).

Repsol is currently exploring two offshore blocks in Morocco. Anchois was the first of several prospects identified with 3D seismic and is suspended for future production. The 3,568-sq-km Tanger-Larache license lies in 380 m of water.

Future exploration

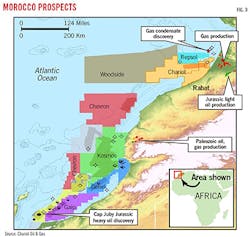

Close to Repsol's acreage, Chariot Oil & Gas Ltd. holds the Loukos, Rabat Deep, and Mohammedia Reconnaissance blocks in the Doukkala basin (Fig. 3). The three blocks are situated up to 50 km off northern Morocco and cover a combined area of more than 16,500 sq km.

Chariot completed 3D seismic acquisition on its Rabat Deep license in March 2014 and interpretation is under way.

"The JP-1 has potential in the Jurassic play fairway," Chariot CEO Larry Bottomley told OGJ. Chariot expects to complete processing and interpretation of 1,700 sq km of 3D seismic data by mid-2015. The company's plan to drill is subject to finding a partner, according to Bottomley.

Last year, Woodside Petroleum Ltd. finalized a farm-in agreement with Chariot, taking an initial 25% participating interest in six permits in the Rabat Deep region (OGJ Online, July 7, 2014). Woodside has an option to increase its share to 50% and take on operatorship for a capped well-carry obligation. Drilling options for Chariot's Rabat Deep license are still under consideration, the company said. ONHYM holds 25% interest in the prospect. Chariot holds 50% as operator.

The six permits are undrilled and cover an area of 10,782 sq km. Water depths vary at 150-3,600 m. Woodside has existing interests in the Canary Islands nearby.

Chariot has identified Jurassic structures similar to Genel's JM-1 discovery. The company has estimated its JP-1 well will cost $60 million and could contain up to 618 million bbl of oil.

The JP-1 is a four-way dip faulted Jurassic carbonate prospect covering 149 sq km. A second prospect, JP-2, is half the size at around 75 sq km. In all, Chariot holds six Jurassic leads in its Rabat Deep license with 208-1,041 million bbl of oil.

"Much of Morocco's onshore production is from Jurassic, and we believe these reservoirs are continuous offshore," Bottomley said.

Most recently, further south from Chariot's Rabat Deep acreage, Freeport-McMoRan Oil & Gas LLC was scheduled to spud an exploration well last month in the Mazagan license. The 10,900-sq-km block lies 100 km off Morroco in 1,000-2,100 m of water.

Originally acquired by Pura Vida Energy NL in 2011, the block was farmed out to Freeport-McMoRan (52% as operator) with Pura Vida maintaining a 23% interest and ONHYM a 25% interest. The MZ-1 well will target the Ouanoukrim prospect, which has total gross unrisked mean prospective resources of 1.4 billion bbl of oil, with a high case of more than 3 billion bbl.

According to Pura Vida, the prospectivity of the Mazagan permit features three independent trends containing multiple prospects and leads mapped with 2D and 3D seismic data.

MZ-1 is in 2,176 m (7,139 ft) of water and has a firm total vertical depth of 5,600 m. The vertical well will test four stacked targets with a contingent fifth target if the well is drilled to 6,150 m. MZ-1 will explore a range of play types including Cretaceous structural four-way dip closures and Jurassic fans.

The ultra-deepwater Atwood Achiever was sheduled to drill MZ-1 at an estimated cost of $136.6 million (including contingencies). Pending results of MZ-1, the joint-venture partners are planning a two-well campaign with a second drilling location to be determined.

Economics

Morocco has some of the most competitive fiscal terms in the world, supported by a robust regulatory framework and ONHYM, a highly regarded state oil company.

Morocco levies a 30% corporate tax on oil production with royalties of 7-10% on oil and 3.5-5% on gas. The standard working interest for ONHYM is 25% in all offshore projects. Due to the lack of widespread exploration, Morocco also provides a 10-year tax holiday on discoveries.

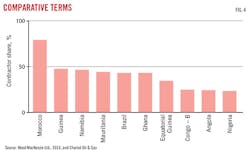

Morocco's Hydrocarbon Law was amended in 1992 and again in 2000 to encourage foreign investment, resulting in attractive fiscal terms compared with those for many exploration areas in the region (Fig. 4).

Morocco has seen a surge in transactional activity over the past 2 years. Major operators such as Chevron and BP have taken large offshore acreage positions in Morocco (Fig. 3). Other operators in the country include Kosmos Energy, Tangiers Petroleum, and Petroleos de Portugal-Petrogal SA.

These acquisitions have in turn led to an unprecedented level of drilling activity and introduced the possibility that Morocco's offshore development may soon expand.