Fourth-quarter earnings hit by dropping crude oil prices

Conglin Xu

Senior Editor-Economics

Laura Bell

Statistics Editor

The plunge in crude oil prices eroded North American oil and gas companies' earnings in the last quarter of 2014.

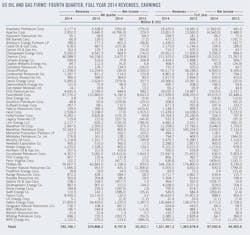

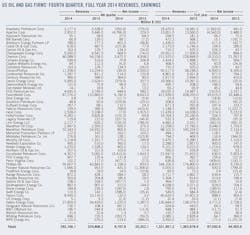

A sample of 56 US-based oil and gas producers and refiners posted combined net earnings of $8.7 billion for fourth-quarter 2014, a decrease of $11.6 billion from year-earlier results. The group's collective net earnings for the 12 months ended Dec. 31, 2014, were $87 billion compared with $95 billion in 2013. Revenues for the fourth quarter and the full year decreased 14% and 2% year-over-year, respectively.

Lower crude oil prices weighed heavily on upstream earnings, despite continued growth in US crude oil production in the fourth quarter. Downstream, fourth-quarter refining margins compressed with the narrowing of the prices of US and West Canadian crudes to Brent and other international crudes. Refinery throughput and average refinery utilization rates remained strong.

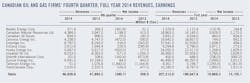

Meanwhile, a sample of 12 oil and gas producers and pipeline companies with headquarters in Canada posted a combined net loss of $390.7 million (Can.) for fourth-quarter 2014 compared with net earnings of $358.5 million (Can.) in the prior year's fourth quarter. However, on a full-year basis, their profits increased to $18.9 billion (Can.) from $13.1 billion (Can.) in 2013.

Commodity prices, refining margins

Crude oil prices fell sharply in fourth-quarter 2014 as robust global production exceeded demand. The average quarterly WTI and Brent marker prices decreased to $73.16/bbl and $76.40/bbl, respectively, for fourth-quarter 2014 from $97.34/bbl and $109.21/bbl, respectively, for fourth-quarter 2013.

The quarterly average composite cost of crude oil for US refiners was $73.7/bbl, down from $96/bbl a year ago, according to the US Energy Information Administration.

Quarterly refining margins in most US regions decreased from a year ago, according to Muse, Stancil & Co. Cash margins in fourth-quarter 2014 averaged $17.98/bbl for Midwest refiners, $12.93/bbl for the West Coast, $6.12/bbl for the Gulf Coast, and $5.08/bbl for the East Coast. In the same quarter of last year, these refining margins were $23.23/bbl, $15.04/bbl, $8.43/bbl, and -11¢/bbl, respectively.

Front-month gas on the New York Mercantile Exchange averaged $3.848/MMbtu in fourth-quarter 2014 compared with $3.857/MMbtu a year earlier. Retail gasoline prices declined 80¢ during the quarter to average $2.55/gal. Diesel fell 30¢ to $3.42/gal.

US operators

ExxonMobil Corp. reported fourth-quarter 2014 earnings of $6.78 billion compared with $8.64 billion for same quarter in 2013, reflecting both lower upstream and downstream earnings. Lower commodity prices in the upstream and higher planned maintenance costs in the downstream were partially offset by improved chemical margins, the company said.

Excluding the impact of the expiry of the Abu Dhabi onshore concession, the company's fourth-quarter 2014 liquids production increased 80,000 b/d from the same period last year, and natural gas output decreased 653 MMcfd.

Chevron Corp. reported $3.5 billion in fourth-quarter 2014 net income compared with $4.9 billion in the same quarter in 2013. Foreign currency effects increased earnings by $432 million in fourth-quarter 2014 compared with an increase of $202 million a year earlier. Full-year 2014 earnings were $19.3 billion compared with 21.6 billion in 2013.

Compared with fourth-quarter 2013, the company's US upstream earnings of $432 million in the fourth quarter 2014 were down $371 million, and international upstream earnings of $2.24 billion decreased $1.81 billion, primarily due to sharply lower oil realizations and higher depreciation expense.

During the fourth quarter Chevron's worldwide net oil production remained unchanged at 2.58 million boe/d compared with the year-ago level as increased production from "project ramp-ups" in the US, Argentina, Brazil, Nigeria, and Bangladesh were offset by normal field declines as well as the effect of asset sales.

EOG Resources Inc. reported fourth-quarter 2014 net income of $444.6 million compared with fourth-quarter 2013 net income of $580 million. In fourth-quarter 2014, EOG increased its US crude oil and condensate production by 28%, while total company crude oil and condensate production rose by 26%, compared to the same prior year period. For the full year, EOG reported net income of $2.9 billion, compared to $2.2 billion for the full year 2013.

ConocoPhillips posted a fourth-quarter 2014 net loss of $39 million compared with fourth-quarter 2013 earnings of $2.5 billion. Revenues in the reported quarter decreased to $11.2 billion from the year-ago level of $13.25 billion. The decrease in earnings was primarily due to lower realized prices, increased dry hole expenses, higher operating costs and depreciation expense associated with increased volumes, partially offset by higher volumes.

Quarterly production averaged 1.56 million boe/d, an increase of 96,000 boe/d compared with the same year-ago period. The company's total realized price was $52.88/boe vs. $65.41/boe in fourth-quarter 2013, reflecting lower averaged realized prices across all commodities.

Occidental Petroleum Corp. reported a fourth-quarter 2014 net loss of $3.4 billion compared with net income of $1.6 billion for fourth-quarter 2013. During fourth-quarter 2014, the company completed the spin-off of California Resources Corp. and its financial and operational results have been classified as discontinued operations.

Refiners

Marathon Petroleum Corp. reported fourth-quarter 2014 net earnings of $805 million and full-year net earnings of $2.55 billion. The firm's refining and marketing segment income from operations was $1.02 billion in fourth-quarter 2014 and $3.61 billion for full-year 2014 compared with $971 million and $3.21 billion in fourth-quarter 2013 and full-year 2013, respectively.

The increase in R&M segment income for fourth-quarter 2014 compared with the same year-ago quarter was primarily due to more favorable net product price realizations and a favorable effect from valuing yearend inventories using the last-in, first-out (LIFO) method of accounting, which was partially offset by a lower blended crack spread and a narrower sweet-sour crude oil differential.

Tesoro Corp. reported fourth-quarter 2014 net earnings of $132 million compared with last year's $3 million, reflecting strong R&M and logistics performance.

The Tesoro index was $9.45/bbl for the quarter, up $1.80/bbl relative to a year ago. Overall gross margin for the quarter was $11.08/bbl compared with $9.45/bbl of the index last year. Total refinery throughput for the quarter was 808,000 b/d, or 95% utilization.

Valero Energy Corp. posted net income of $1.22 billion in fourth-quarter 2014 compared with $1.28 billion in fourth-quarter 2013. Operating income in the refining segment was flat in fourth-quarter 2014 vs. fourth-quarter 2013, as stronger gasoline, distillate, and other product margins relative to Brent crude oil as well as higher refining throughput volumes were offset by lower discounts for sweet and sour crude oils relative to Brent crude oil.

Refining throughput volumes during the quarter averaged 2.8 million b/d, an increase of 41,000 bbl from fourth-quarter 2013. Valero's refineries operated at 98% throughput capacity utilization in fourth-quarter 2014.

Canadian firms

All financial figures in this section are presented in Canadian dollars unless noted otherwise.

Suncor Energy Inc. posted net earnings of $84 million for fourth-quarter 2014, down from $443 million for last year's corresponding quarter. The company's operating earnings and cash flow from operations fell 60% and 36%, respectively, from the prior year's same quarter, reflecting significantly lower upstream benchmark prices and a less favorable downstream business environment, partially offset by favorable foreign exchange rates.

The company's total upstream output was 557,600 boe/d during fourth-quarter 2014, consistent with 558,100 boe/d in the same year-ago quarter, as increased maintenance in oil sands operations was offset by higher production in exploration and production.

During fourth-quarter 2014, Suncor's R&M segment completed planned maintenance at its refineries at Montreal, Sarnia, and Edmonton. Despite this maintenance, average refinery utilization remained strong at 95% for the quarter vs. 91% in the prior year's fourth quarter.

Imperial Oil Ltd. announced fourth-quarter 2014 earnings of $671 million, down 36% from the corresponding 2013 period. Full year 2014 earnings were $3.78 billion-second highest in the company's history.

The company's fourth-quarter 2014 production averaged 315,000 boe/d, down 14,000 bbl from 2013. Excluding the impact of conventional assets divested earlier in 2014, total production was up 4,000 b/d. Production for the full year average 310,000 boe/d, up 12% from 2013, excluding divestments.

Quarterly refinery throughput averaged 373,000 b/d, down 14,000 bbl from the same period in 2013. In the quarter, refinery capacity utilization averaged 96%, excluding planned maintenance at the Sarnia and Nanticoke refineries. Annual refinery capacity utilization reached a record high of 94%. Chemical achieved record annual earnings of $229 million on the strength of high polyethylene margins.

Canadian Natural Resources Ltd. reported net earnings from operations of $1.2 billion for fourth-quarter 2014 compared with net earnings of $413 million in the same quarter last year, reflecting higher sales volumes in North America, higher realized risk management gains, and a weaker Canadian dollar relative to the US dollar.

During the quarter, the company's total crude oil and NGL production was 572,000 b/d, an increase of 20% from the year-ago level, resulting largely from increased production volumes across all business divisions. Total gas production was 1.7 bcfd, an increase of 45%, largely due to acquisitions completed in the first half of the year and the concentrated liquids-rich Montney natural gas drilling program at Septimus.

Husky Energy Inc. reported a fourth-quarter 2014 net loss of $603 million compared with net earnings of $177 million in the same period of 2013. Excluding one-time charges for asset impairments and a provision of $128 million after tax, net earnings were $147 million.

Enbridge Inc. returned to profit in fourth-quarter 2014 as new projects entered service. The company reported net income of $316 million for the quarter after suffering a loss of $243 million in same year-ago quarter.