Companies slash capital budgets as oil price drop cuts cash flows

Bob Tippee

Editor

Conglin Xu

Senior Editor-Economics

Oil and gas companies, whose basic commodity has lost more than half its value in half a year, have slashed budgets in an effort to pull spending back within sharply diminished cash flow. Many companies won't soon meet this financial goal. Some companies won't survive the rapid and deep industry contraction.

In its annual assessment of capital spending, Oil & Gas Journal estimates spending on US projects will sag 26.8% this year to a total of $261.99 billion. The percentage decline is smaller than those of many other published spending projections because OGJ's forecast includes outlays for refining and marketing, pipelines, and other categories not hit as hard as exploration and production (E&P) by the budget cuts. Most other forecasts concentrate on E&P, always the industry's largest target for investment.

For US E&P only, OGJ projects spending in 2015 of $203.24 billion, down 32% from last year. That percentage decline is about what other sources forecast. It's also roughly the cost cuts that analysts suggest operators want from service and supply firms.

Spending at the level OGJ estimates for this year would take investment in US oil and gas projects back to the low point following the recession of 2008-09: $260.1 billion in 2010. Spending growth in 2010-14, 37.5%, is close to the 39.3% by which the annual average US Bureau of Labor Statistics producer price index for drilling oil and gas wells increased over the same period.

Early PPI data indicate cost-cutting has begun. Preliminary estimates were 428.7 for January and 427.2 for February, down from an annual average 454.1 for all of 2014, also preliminary, and a monthly high last year of 457.2 in March.

OGJ forecast

OGJ based its E&P spending forecast on company data and a rig count projection that assumed the crude price would remain below $60/bbl.

Integrated and top 20 US E&P companies indicated spending cuts of $50 billion, about 25%, from 2014 spending. OGJ increased the percentage to account for larger cuts being announced by smaller companies and for the chance that large companies will make further cuts if oil prices stay low.

OGJ assumed sharply lower bidding in the two Outer Continental Shelf oil and gas lease sales this year. The first, OCS Sale 235 of leases in the Central Gulf of Mexico, drew apparent high bids totaling $539 million-down from $850 million in last year's central gulf Sale 231 offering about the same total acreage but still higher than OGJ expected.

Investment in US refining and marketing will increase by 2% this year to $13.35 billion. Although some of the integrated companies plan to trim spending in this area because of reduced cash flows, independent refiners are maintaining or increasing their budgets.

Spending on US petrochemical projects also is expected to grow this year-by 8.3% to $6.5 billion. The availability of low-cost ethane has stimulated construction and expansion. The consultancy Accenture points out, "During low oil price times, petrochemical segment profits are more prominent in portfolios, and, consequently, those segments become targets for capital allocation, boosting expansions and possibly acquisitions."

OGJ based its estimate for 2015 spending on US pipeline projects on data from last year's Pipeline Economics report and this year's Worldwide Pipeline Construction special (OGJ, Sept. 1, 2014, p. 114; Feb. 2, 2015, p. 72). The construction outlook is for a 30% decline in overall US pipeline construction from expectations of 2014. OGJ projects spending on crude and product pipelines will decline 3.1% to $23 billion while outlays for natural gas pipelines rise 2.6% to $9 billion.

Spending on Canadian oil and gas project this year will decline 23.3% to $68.745 billion (Can.), as sector changes follow the US pattern with E&P spending down 30.4% to $32 billion. Spending on oil sand projects will fall 21.2% to $26 billion. Refining and marketing investment in Canada will slip 1.7% to $2.95 billion while petrochemical outlays jump 6.7% to $1.28 billion.

As in the US, pipeline spending will be mixed in Canada. The outlay for crude and products pipelines will fall 11.4% to $3.1 billion, according to OGJ. For natural gas pipelines, spending will jump 37.5% to $2.2 billion.

Size, financial strength

Analysis by Moody's Investors Service indicates a relationship between the size of budget cuts and the size and financial strength of companies making them.

Among the North American E&P companies the credit monitoring firm rates, the total reduction in capital spending this year will be 41%. But cuts by integrated oil companies will average 10% (Fig. 1). Those by companies Moody's rates "investment grade" will average 36% and by "speculative-grade" companies, 47% (Fig. 2).

Last year, the median spending level by speculative-grade companies was about $600 million. The level by investment-grade companies was $5 billion.

"Investment-grade companies have better access to capital markets than speculative-grade companies, even at times of weak commodity prices and have acreage in multiple hydrocarbon basins, allowing them to reallocate their capital budgets towards highest-return assets when necessary," point out Moody's analysts Prateek Yanati Reddy, Dylan G. Duzey, and Steven Wood.

Of the North American E&P companies rated by Moody's, only 6% plan to increase capital spending this year. Meanwhile, 21% of the companies plan to cut budgets by more than 60%, and more than half will reduce capital spending by at least 40%.

The analysts note that some of the companies planning to increase spending are drilling to hold leases or investing in recently acquired acreage. Some of them produce mostly natural gas, prices of which haven't fallen as much as oil prices recently.

"Unless they have hedging programs, E&P companies that concentrate more on producing liquids than on natural gas will experience more-drastic reduction in earnings, unleveraged cash margins, and cash-flow generation than their peers that produce higher proportions of natural gas in 2015," the analysts say. "As a result, liquids-focused E&P companies are reducing their capital spending more than gas-focused companies."

About 40% of the companies in the Moody's group had hedged at least half of their 2015 production. Most speculative-grade companies without hedging programs will try to limit capital spending to their cash flow from operations, although some will outspend cash flow to hold acreage.

"As some hedges start rolling off, some speculative-grade companies will be forced to maintain production even at cyclically low commodity prices in order to service their debt," the Moody's analysts say. "For certain companies, shareholder pressure to monetize hedges will increase cash-flow volatility.

"By contrast, most investment-grade E&P companies are geographically diversified in multiple basins, and during periods of weak commodity prices they can reallocate capital spending and focus on developing acreage that provides the highest returns among all of their assets."

None of the investment-grade companies rated by Moody's announced a spending increase this year. Apache Corp. was the only one cutting capital spending by 60% or more. Trimming budgets by up to 20% in this group are Devon Energy, EnCana, EQT, Hess, Southwestern Energy, and Suncor.

Anadarko, Cenovus, ConocoPhillips, EOG, Husky, Murphy, and Occidental cut budgets by 20-40%. Decreasing announced spending plans by 40-60% were Canadian Natural Resources, Canadian Oil Sands, Continental Resources, Noble Energy, and Pioneer Natural Resources.

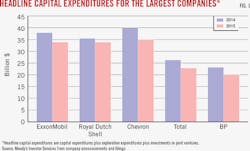

Projected cuts in capital spending by the integrated oil companies Moody's rates are Shell, 4%; ExxonMobil, 11%; and Chevron, Total, and BP, 13% each. The analysts point out that Shell has signaled larger cuts in 2016 and 2017 as it reschedules and defers projects. Shell and ExxonMobil already had entered a period of lowered spending as major projects come on stream.

Large-company plans

A separate report by Moody's analysts Thomas S. Coleman, David G. Staples, Wood, and Elena Nadtotchi predicts integrated oil companies can weather the period of low oil prices but won't cover capital spending with internal cash flow.

"The companies will be borrowing or drawing on large cash positions (and increasing net leverage) to cover dividends and capital spending," the analysts say. The major companies nevertheless have large bases of stable cash flow with which to service debt and ample access to capital.

Although large companies were moderating capital investment before the oil-price decline, most have indicated they'll maintain spending on large projects already in progress. Deferrals and cancellations "will follow the industry risk and cost curve," the Moody's analysts say, targeting projects for which final investment decisions haven't been made. All the companies have discussed "rephasing" projects to allow time for costs to subside and reevaluations to be made before final investment decisions.

Projects at risk, according to the Moody's analysis, include:

• New Canadian oil sands projects and potential expansion phases requiring the price of crude to exceed $70/bbl to break even.

• Large and costly greenfield integrated LNG projects.

• Frontier development in areas such as the Arctic.

• Deepwater projects in early stages lacking clear tie-ins to existing equipment.

• Mature areas subject to high taxation, such as the North Sea.

• High-cost North American shale plays outside sweet spots.

• Enhanced oil recovery projects.

• Alternative energy.

Following oil prices

Oil companies generally approached 2015 planning to lower capital spending in response to flagging oil prices then cut even further as prices continued downward.

In January, Barclays said its December survey of 225 companies indicated an 8.8% overall cut in global exploration and production spending, noting the decline was only the seventh in the 30-year history of the survey. By the end of February, reported Barclays analysts J. David Anderson, William Thompson, and Edward Kim, budgets announced by 45% of the surveyed companies reflected a cut of 23%. The December survey results had been based on a Brent crude price in 2015 of $70/bbl. By the end of January, the price had fallen below $50/bbl.

In the February Barclays report, planned North American spending on exploration and production by the companies reporting budget revisions was down 30%. Budget declines were 37% for large E&P companies, 40% for small and midsize producers, and 18% for US integrated oil companies.

International spending, 9% in the January report, was down an aggregate 19% in the February report for companies reporting changes.

Also in February, Anderson, Thompson, and Kim in a separate report addressed the question whether budget-cutting operators would extract enough price concessions from service and supply firms to structurally lower the costs of developing unconventional resources.

The analysts noted E&P companies are seeking overall concessions of 20-30% in North America, which they called "staggering." Cuts that deep are possible in the long term but are much less so immediately, they said.

"Most service-product lines don't have anywhere close to 20-30% pricing to give back before entering cash break-even, at which point rational behavior would result in equipment being stacked and crews being furloughed, which has already begun in earnest," the analysts said. Barclays E&P analyst Tom Driscoll has reported operators are budgeting service-price reductions of about 10% but appealing for a further 15%.

Service and supply companies eventually will pass cost cuts through their supply chains, the Barclays analysts said, "but this will take quarters, not weeks, as vendors come to terms with current activity levels."

The US rig-count decline has been the fastest of any in the past 20 years, the analysts noted in their report dated Feb. 24.

At that time, they said, "If the rig count stays on its current trajectory for another 2 months, that would imply US upstream spending would be down more than 50%, even assuming a 15% reduction in well costs". "In other words, either the rig count is going to flatten out in the coming weeks or spending declines are considerably worse than the E&Ps are letting on."

They said, "It's also possible that E&Ps are expecting up to 30% pricing and cost concessions from service companies, which would mean the rig count could overshoot on the way down and then rebound to an equilibrium (1,000 rigs?) once costs come down-if they can come down that much, of course."

Lead-time distinction

In a Mar. 23 report, Raymond James & Associates Inc. analysts Pavel Molchanov and Carlos Newall point to the distinction between short-cycle and long-lead-time drilling and conclude the investment slump is hitting the US hardest.

"The areas where drilling activity-and thus spending-tend to respond the fastest to lower commodity prices are not necessarily the ones with the highest cost structure," they write. "Rather, it is where the operators have the most near-term flexibility to adjust their activity levels."

Multibillion-dollar, multiyear ventures already under construction, such as deepwater, oil-sands, and LNG projects, tend to proceed regardless of price changes. Short-cycle activity such as shale and conventional onshore drilling can be adjusted within a few months.

The US Lower 48, therefore, "clearly stands out as an area where capital spending in 2015 is experiencing an utter collapse," Molchanov and Newall say. Evidence is clear, they say, that the spending drop is steeper in the US than it is elsewhere, just as the US increase was steeper while investment was expanding.

Middle-size and small companies with only US assets have cut 2015 budgets by 35-60%, with a few cutting by 80%. Companies with assets weighted toward oil are cutting spending more than those weighted toward gas, the analysts note.

Because US planning is fluid, they add, "we do not see these initial spending plans as something that is set in stone."

Outside the US, spending is down in most places, "though it is much more of a mixed bag." Petrobras in Brazil and Ecopetrol in Columbia each cut 2015 spending by 20%, the analysts say. In Argentina, however, YPF's spending is stable.

Of 34 top-tier operators from around the world in the Raymond James survey, none plans to increase spending this year.

"We project an average spending cut of 20-25%, wiping out all the past increases since 2010, Molchanov and Newall say.

Cash-flow pressure

A recent study focusing on natural gas illustrates the cash-flow pressure on US exploration and production companies.

The study, by the Center for Energy Economics (CEE), part of the Bureau of Economic Geology of the University of Texas at Austin, covers 15 publicly traded companies representing 68% of the top-40 gas producers and 33% of US marketed natural gas production.

Because "cash costs remain substantial and stubborn," the study says, the gas price needed to cover full-cycle costs and generate a 10% return was nearly $8/MMbtu in 2013. The average Henry Hub spot price in 2013, according to the US Energy Information Administration, was $3.73/MMbtu.

A 10% return in 2013, moreover, wouldn't fully recover the year's total capital expenditure.

CEE draws its conclusions from analysis of finding and development (FD) costs, defined as capital spending for exploration and development, and cash cost, including lease operating expense, general and administrative costs, marketing outlays, taxes, and interest payments on debt. It uses 3-year rolling total FD spending against 3-year net reserve additions to determine FD per barrel of oil equivalent for each year during 2009-13. To those values it adds each year's total cash cost divided by current production.

Total production by the analysis group of companies increased by 20% during 2010-13 to 2.434 billion boe. The gas share of production peaked in 2011 at 62% but remained at 58% in 2013.

"In boe terms, on average as of 2013 the full-cycle cost for our sample is close to $50/boe with a 10% return assumed," CEE says. "However, a 10% return does not provide sufficient recovery of capital spent in a current year."

CEE therefore uses, instead of 10%, a return equal to capital expenditure spent in a year against that year's production, again adding the return to per-unit FD and cash costs. On that basis, the minimum full-cycle cost is $70-80/boe.

"We believe this suggests an oil price signal of at least $80[/bbl] is needed to sustain activity for our sample and the industry," CEE says.

The industry, it says, remains "predominantly cash-flow negative," as companies spend capital well above cash flow from operations to replace production and build leasehold.

"With lower oil prices," CEE points out, "companies are working to adjust capital spending to fall within cash flows."

Spending and confidence

Plans for capital spending largely reflect the confidence of oil industry decision-makers, which was shattered by the price slump of late 2014 and 2015. The effect figures strongly in an annual survey of industry sentiment conducted by Longitude Research for the technical advisory firm DNV GL.

The results indicate the industry was not surprised by the price drop but rather by the speed and depth of the decline. Of 367 senior industry professionals and executives surveyed in January, 28% expressed confidence about the business in 2015. That's down from 88% in the 2014 survey and 89% in 2013.

In the new survey, only 32% of respondents expected to meet revenue targets this year, and 30% expected to reach profit goals. The top three barriers to growth identified by survey respondents this year, in descending order, are low oil prices, a weak global economy, and low gas prices. In last year's survey oil and gas prices were not among the top three identified barriers to growth.

While low commodity prices and economic weakness were high on the worry list this year, respondents also pointed to risks involving sustained cost increases, a shortage of skilled professionals, and tougher competition, DNV GL said, pointing out companies must decide whether to respond to long-term goals or short-term pressures.

"Firms are reacting to uncertainty by cutting staff and investment," points out Elisabeth Torstad, chief executive officer of DNV GL's Oil & Gas business area. "While the strong correlation between oil price and confidence is expected, a certain proportion of firms need to work beyond the cycle this year. It is bad for the long-term health of the industry to see behavior so tightly bound to oil-price fluctuations."