OGJ Newsletter

GENERAL INTEREST — Quick Takes

US House approves bill aimed at increasing LNG exports

The US House of Representatives passed a bill aimed at increasing US LNG exports by requiring the Department of Energy to determine whether a project is in the national interest once its federal environmental reviews were complete.

Their Jan. 28 action came a day before the US Senate Energy and Natural Resources Committee planned to hold its own hearing on LNG exports.

Forty-one Democrats joined 236 Republicans in approving HR 351, which Energy and Commerce Committee member Bill Johnson (R-Ohio) introduced on Jan. 14. One Republican, Chris Gibson (NY), and 132 Democrats voted against it.

The American Petroleum Institute applauded the bill's passage. "This is a top priority for the new Congress because LNG exports represent a clear-cut, bipartisan opportunity to increase domestic energy production, create more American jobs, and protect the security of the US and its allies," said Erik Milito, API industry and operations director.

"We're optimistic that House and Senate leaders will be able to quickly come together behind legislation that will benefit the US while helping bolster our allies abroad," he said.

OGUK: Push to ban fracing in UK 'ill-informed'

The House of Commons' Environmental Audit Committee's proposed amendment to the infrastructure bill that would introduce a moratorium on hydraulic fracturing in the UK is "ill-informed" and would derail industry and cross-party efforts to maximize economic recovery of oil and gas from the North Sea, Oil & Gas UK said on Jan. 26.

"If this amendment is successful, the future of the North Sea will be put into serious jeopardy, placing at risk our indigenous energy supply and leaving us more reliant on imports," stated Malcolm Webb, OGUK's chief executive.

"Hundreds of thousands of UK jobs and the country's place as a global leader in offshore engineering and technology would then also be in peril," said Webb.

He emphasized the numerous challenges presented by the aging North Sea, including falling oil prices, and urged the implementation of Sir Ian Wood's 2013 report on the UKCS, a "blueprint for maximizing economic recovery of the North Sea's oil and gas (OGJ Online, Nov. 11, 2013)."

Said Webb, "I therefore urge MPs from all parties to preserve the cross party support that the Wood Report has so far enjoyed and to ensure that the infrastructure bill is approved on Monday."

IMF: Most oil exporters facing deficits

Most oil exporting countries will run fiscal deficits this year if the crude price averages $57/bbl as currently indicated by markets, according to the International Monetary Fund.

The main exception is Kuwait, IMF said in an update to its Regional Economic Outlook, which projects fiscal balances as percentages of each country's gross domestic product. Kuwait's fiscal surplus this year will fall to 11.1% of GDP from 21.9% last year, according to IMF.

The only other oil exporters not expected to show deficits this year in IMF's analysis are Turkmenistan and Uzbekistan.

Among major oil exporters, Saudi Arabia faces a deficit of 10.1% of GDP in 2015 after a surplus of 1.1% in 2014.

For other major exporters, IMF projects deficits this year relative to GDP of 3.7% for the United Arab Emirates, 3.4% for Iran, 6.1% for Iraq, 37.1% for Libya, 1.5% for Qatar, 15.1% for Algeria, 14.5% for Azerbaijan, and 2.3% for Kazakhstan.

IMF projects total oil export revenue losses this year of $300 billion among Gulf Cooperation Council (GCC) countries: Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the UAE.

Among non-GCC exporters Algeria, Iran, Iraq, Libya, and Yemen, 2015 revenue losses will total about $90 billion.

And Caucasus and Central Asian exporters Azerbaijan, Kazakhstan, Turkmenistan, and Uzbekistan will have revenue losses totaling $35 billion, IMF projects.

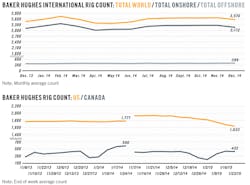

Western Canada due output, spending cuts

The Canadian Association of Petroleum Producers has cut its expectations for oil-production growth and said it expects sharply lower capital spending by the oil industry in western Canada this year.

The trade group cut its forecast for oil production growth in western Canada by about 65,000 b/d, now expecting an increase over 2014 levels of 150,000 b/d to an average of 3.6 million b/d for 2015. CAPP said it expects a similar increase next year, 120,000 b/d below its earlier growth projection for 2016.

In 2015, conventional oil production will remain at 1.3 million b/d, and oil sands output will increase to 2.3 million b/d as projects come on stream from prior-year investments, CAPP said. The group expects capital spending in western Canada to drop 33% to $46 billion this year.

The spending forecast includes a decline in the oil sands to $25 billion from $33 billion last year. In conventional oil and gas, CAPP projected, spending will drop to $21 billion from $36 billion. CAPP predicted a 30% decline in drilling in western Canada to 7,350 total wells.

Exploration & Development — Quick Takes

CNPC completes Keshen-902 appraisal well

China National Petroleum Corp. (CNPC) has completed the Keshen-902 appraisal well in Tarim oil field at a depth of 8,038 m, 15 m deeper than the Keshen-7 well drilled on the same structural belt 4.3 km away in 2011.

CNPC says Keshen-902 is "by far" the deepest onshore well drilled in China, represents the largest completion depth in a 333.4 mm borehole, and represents the largest setting depth with 273 mm casings.

The well, which lies on the southwest wing of the Keshen-9 structural high in the Kelasu structural belt, was drilled over a period of 368 days, 380 fewer days than that of Keshen-7, CNPC says.

Keshen-902 was drilled by the 90002 Drilling Crew of CNPC Chuanqing Drilling Engineering Co. Ltd. using a domestically developed 9,000 m electrical drilling rig.

Eni has strike in Egypt's Western Desert

Eni SPA has started production from an oil and gas discovery at the West Melehia deep exploration prospect in the Western Desert of Egypt, 300 km west of Alexandria.

The Melehia West Deep 1X, drilled to 4,175 m, cut 20 m of light oil pay in the Lower Cretaceous Alam El Bueib formation. The well also encountered gas and condensate in Upper Jurassic Safa.

Production began at a rate of 2,100 b/d of 40° gravity oil, to be treated at nearby Melehia field.

Drilling of delineation and development wells is planned. Eni estimates production to reach 8,000 b/d by yearend.

The company holds a 76% interest in the Melehia license through a subsidiary, International Egyptian Oil Co. Lukoil holds 24%. The operator is Agiba, equally held by IEOC and Egyptian General Petroleum Corp.

In some communications, Eni has spelled the area name "Meleiha."

Reliance expects to sign Myanmar PSC this quarter

Reliance Industries Ltd., Mumbai, said it expects to sign a production-sharing contract (PSC) this quarter with Myanma Oil & Gas Enterprise (MOGE) for shallow-water Blocks M17 and M18 offshore Myanmar.

Reliance was awarded two of the Myanmar offshore blocks that were auctioned in 2013 (OGJ Online, Mar. 26, 2014).

In its earnings statement for the quarter through Dec. 31, Reliance also said it has three international blocks in its portfolio: two in Yemen and one in Peru.

In India, Reliance said deepwater KG-D6 field off the east coast produced 500,000 bbl of crude, 100,000 bbl of condensate, and 38.5 bcf of gas during the quarter. In a third appraisal of the D55 discovery, the MJ-A3 encountered a hydrocarbon zone "thinner than expected" (OGJ Online, July 30, 2013).

Panna-Mukta fields off the west coast produced 1.8 million bbl of crude and 18.5 bcf of gas during the quarter.

Production from the Tapti fields declined significantly, and the company said "cessation of production" is likely to occur in 2015.

Development continues in two coalbed methane blocks in east-central India, Sohagpur East and Sohagpur West. Phase I is expected to have more than 200 wells. Four rigs are operating. Reliance said India's new policy for natural gas has a price of $5.05/MMbtu on a gross calorific value basis through Mar. 31. The price will be revised every 6 months, it said.

Drilling & Production — Quick Takes

Eni lets $2.54-billion contract for Ghana FPSO

Eni SPA unit Eni Ghana Exploration & Production Ltd. has let a $2.54-billion contract to Malaysia's Yinson Holdings Bhd. for the chartering, operation, and maintenance of a floating production, storage, and offloading vessel to process oil and gas from the Offshore Cape Three Points (OCTP) block in the Tano basin, 60 km offshore Ghana.

The contract is for a firm charter period of 15 years with 5 yearly extension options exercisable by Eni Ghana. Should Eni exercise all of the extensions, the estimated total aggregate value of the contract would reach $3.26 billion.

The FPSO will be based on the conversion of the Yinson Genesis, a recently acquired very large crude carrier. The FPSO will have an available storage capacity of 1.7 million bbl, an oil processing capacity of 58,000 b/d, a gas injection capacity of 150 MMscfd, and a maximum future gas-export capacity of 210 MMscfd. The FPSO will be spread-moored in an average 1,000 m of water with a total topsides weight of almost 15,000 tonnes.

"We have been working with Eni on the front-end engineering design competition for this project for over a year and are therefore confident that we will be able to deliver the FPSO in accordance with the schedule, achieving first oil by mid-2017," said Eirik Barclay, Yinson's chief executive, FPSO division.

Peak production from OCTP is expected to reach 80,000 boe/d in 2019. The project comprises oil and nonassociated gas fields and will access 1.45 tcf of gas and 500 million bbl of oil in place.

Yinson's wholly owned subsidiary and joint venture company Yinson Production (West Africa) Pte. Ltd. is the FPSO chartering company, and Yinson Production West Africa Ltd. is engaged in the operation and maintenance of the FPSO.

Eni and its partners on Jan. 27 signed an agreement with the Ghana's president and minister of petroleum to proceed with the OCTP project. "The sanction of this significant project comes after less than 2 years from the completion of a successful exploration campaign (OGJ Online, Sept. 20, 2012)," said Claudio Descalzi, Eni chief executive officer.

Eni Ghana operates OCTP with 47.22% interest. Partners are Vitol 37.77% and Ghana National Petroleum Corp. 15%.

Gas-turbines head to Vostochno-Messoyakhskoye

JSC Gazprom Neft reported that six gas-turbine power units are in transit to Vostochno-Messoyakhskoye field in the Yamalo-Nenetsk Autonomous Region.

The 13-Mw units are expected to be in operation in 2016, and will provide power supply to the Messoyakhskoye group of fields, the northernmost onshore fields in Russia.

Operator Gazprom Neft said construction of systems for full development is expected to continue throughout 2015, including roads and an oil gathering system, along with installation of well pads and the beginning of full-scale production drilling.

Laying of a 100-km oil pipeline from the fields to the Zapolyarye Purpe trunk pipeline began last year, and facilities with 45,000 cu m capacity have been installed for treatment and storage of oil and water.

The Messoyakhskoye fields were discovered in the 1980s. They are in the Tazovsky district on the Gydan Peninsula, some 340 km north of Novy Urengoy. First oil from Vostochno-Messoyakhskoye was produced in 2012 (OGJ Online, Oct. 17, 2012). Licenses for exploration and development of the fields are held by Messoyakhaneftegaz, jointly owned by Gazprom Neft and OAO Rosneft.

Stone lets pipe supply contracts for Amethyst field

Stone Energy Corp., Lafayette, La., has let flexible pipe supply and installation contracts to Technip SA for Amethyst field on Mississippi Canyon Block 26 in the Gulf of Mexico.

The first contract includes the engineering, procurement, fabrication, assembly, and testing of a 5-in., 9-km production static riser and all associated hardware.

The second covers the installation of flexible pipe as a tieback to the Pompano fixed platform in 395 m of water. The pipe will be manufactured at Technip's Asiaflex products plant in Tanjung Langsat, Malaysia, and installed using the Deep Blue pipelay vessel. The project is scheduled to be completed during this year's second half.

PROCESSING — Quick Takes

Vietnam advances Dung Quat refinery expansion

Binh Son Refining & Petrochemical Co. Ltd. (BSR), a subsidiary of state-owned Vietnam National Oil & Gas Group (PetroVietnam), has unveiled further details on plans for the upgrade and expansion of its Dung Quat refinery in Quang Ngai Province, Vietnam (OGJ Online, Aug. 13, 2010).

The $1.82 billion expansion and upgrade project, which received federal and provincial government investment approvals in December 2014, will boost crude oil processing capacity at the refinery to 8.5 million tonnes/year from its current 6.5 million tpy, BSR and PetroVietnam said.

Bidding and implementation of the overall front-end engineering and design contract is scheduled to be completed in this year's second quarter, with construction on the project due to run from fourth-quarter 2017 to third-quarter 2021, according to the companies.

The fully upgraded and expanded refinery is scheduled to be commissioned before 2022.

The Dung Quat project investment includes the addition of refining units, work to increase capacities of existing units, revamping of auxiliary units, construction of additional oil storage and product tanks, and the addition of a single-point mooring terminal capable of accommodating vessels up to 300,000 dwt, the companies said.

In addition to enabling the plant's flexibility to process a wider variety of crudes, the expansion and upgrade project also will equip the refinery's production to conform to Euro 5 quality standards and increase its competitiveness in the global market, as well as reduce Vietnam's dependence on imported petroleum products, according to BSR and PetroVietnam (OGJ Online, Aug. 26, 2014).

While the newly revealed plan confirms a reduction in a previously announced capacity expansion target, Russia's Gazprom Neft remains on board to become a stakeholder in the refinery, the companies said (OGJ Online, Nov. 12, 2013).

Sasol delays Louisiana GTL plant investment

South Africa's Sasol Ltd. says it will delay the final investment decision on a large-scale, gas-to-liquids (GTL) plant in Louisiana as part of the company's plan to conserve cash in response to lower international oil prices. The timing of the decision will take into consideration progress made with the execution of Sasol's ethane cracker and derivatives complex in Westlake, La., prevailing market conditions, and other strategic investment opportunities, the company says.

"Albeit at a much slower pace, we will continue to progress the US GTL facility," said David Constable, Sasol's president and chief executive officer. "This will allow us to evaluate the possibility of phasing in the project in the most pragmatic and effective manner. North America and our home base in Southern Africa remain strategic investment destinations for Sasol."

The company in late 2013 chose Technip as the primary contractor for the front-end engineering and design phase of the facility (OGJ Online, Nov. 25, 2013).

Sasol is proceeding with construction of its ethane cracker and derivatives complex, for which a $4-billion credit facility was secured in December (OGJ Online, Dec. 23, 2014).

The company says it's confident that, given "robust project economics," the facility is the first step in developing the site near Lake Charles into an integrated hub.

Geismar plant begins first methanol production

Methanex Corp., Vancouver, BC, has completed the first production of methanol from its newly commissioned 1 million-tonne/year plant in Geismar, La. (OGJ Online, Aug. 14, 2012).

Methanex achieved first methanol production from the Geismar 1 plant, which was relocated from its operations site in Punta Arenas, Chile, on Jan. 24, the company said on Jan. 26.

The plant is due to ramp up to full production rates over the coming weeks, according to John Floren, Methanex president and chief executive officer.

Construction also continues to progress on the 1 million-typ Geismar 2 plant, which remains on schedule to begin methanol production late in first-quarter 2016, Floren said.

The new plants follow the company's 2013 commitment to grow its methanol operating capacity by 3 million tpy over 3 years, Floren added.

The cost of completion for both Geismar plants remains at about $1.4 billion, the company said.

Methanex previously announced it would relocate two of its methanol plants from Chile to Geismar, a move intended to provide capital savings as well as a reduced project timeframe for bringing production online (OGJ Online, Apr. 4, 2014).

TRANSPORTATION — Quick Takes

New Russia-Turkey gas pipeline route approved

OAO Gazprom reported selection of a route for a gas pipeline across the Black Sea from Russia to Turkey.

Some 660 km of the pipeline will be laid within a corridor designed for the cancelled South Stream pipeline (OGJ Online, Dec. 2, 2014). Another 250 km will be in a new corridor toward the European part of Turkey.

The approval came during a Jan. 27 working meeting in Ankara involving Alexey Miller, chairman of the Gazprom management committee, and Taner Yildiz, Turkish minister of energy and natural resources.

Four strings of pipeline will have a total capacity of 63 billion cu m (bcm)/year. The first string's capacity of 15.75 bcm/year will be "exclusively intended for Turkish consumers," Gazprom said. First gas is planned for yearend 2016.

Priorities for the project include determining the location of landfall facilities, gas delivery points for Turkish consumers, and border crossings between Turkey and Greece.

Gazprom will be responsible for construction of the offshore section. Turkish gas transportation facilities will be built jointly by Gazprom and Botas Petroleum Pipeline Corp., which is approved to represent Turkey.

Eaglebine-Woodbine crude pipeline advances

Knight Warrior LLC has reached agreements to build its 160-mile, 100,000-b/d pipeline linking the East Texas Eaglebine-Woodbine crude oil play to Houston refining and export markets. Knight Warrior awarded Hatch Mott MacDonald LLC the project's engineering and design contract, with Contract Land Staff LLC performing land management and Apex Titan environmental services.

The 16-in. OD Knight Warrior East Texas project will start in Madison County, Tex., continuing south through Walker, Grimes, Montgomery, and Harris counties. Initial loading stations will be near North Zulch, Tex., and Madisonville, Tex., with a third planned near Roans Prairie, Tex., to accommodate anticipated production growth. The pipeline will be expandable to 200,000 b/d and be able to segregate and batch its crude shipments.

The company expects the pipeline to begin operations second-quarter 2016. Shipper commitments, including Vitol and SEI Energy LLC, support the project. Knight Warrior East Texas will cost roughly $300 million.

Knight Warrior LLC is owned by Blueknight Energy Partners LP, a joint venture of Vitol, which also owns 50% of its general partner, and SEI. It was initially targeting March 2016 completion (OGJ Online, Aug. 8, 2014).

Gazprom's Baltic LNG project to be built in Ust-Luga

OAO Gazprom has determined that its 10-million-ton Baltic LNG plant will be built near the seaport of Ust-Luga, Leningrad Oblast, Russia. The project is now preparing for the investment stage.

The plant, expandable to 15 million tons, will be supplied with gas from the Unified Gas Supply System (UGSS) of Russia, which also may be expanded.

"The Baltic LNG project will provide Gazprom with additional competitive advantages, enhance its presence in the dynamic LNG market, and open up new supply regions for the company," said Alexey Miller, chairman of Gazprom's management committee.

Lithuania, Latvia, and Estonia have recently either opened or advanced plans to build Baltic LNG terminals, which will provide an alternative to imports from Russia (OGJ, Aug. 11, 2014, p. 26).

Gorgon LNG project signs LNG supply deal

The Chevron Australia-led Gorgon LNG project offshore Western Australia has signed a binding sales and purchase agreement to supply 4.15 million tonnes/year of LNG to SK Group's SK LNG Trading Pte. Ltd. of South Korea for 5 years starting in 2017.

The agreement covers 27% of the project's targeted nameplate capacity of 15.6 million tpy. Chevron says that in excess of 75% of its equity LNG from Gorgon has now been committed to customers in Asia.

The Gorgon project combines the development of Gorgon field and nearby Jansz-Io field. The three-train project on Barrow Island is scheduled to come on stream in mid-2015.

Interest holders are Chevron 47.3%, ExxonMobil Corp. 25%, Royal Dutch Shell PLC 25%, and Osaka Gas 1.25%, Tokyo Gas 1%, and Chubu Electric Power 0.417%.

US industry scoreboard - 2/2

4 wk. 4 wk. avg. Change, YTD YTD avg. Change,

Latest week 1/16 average year ago1 % average1 year ago1 %

Product supplied, 1,000 b/d

Latest Previous Same week Change,

Latest week 1/16 week week1 Change year ago1 Change %

Stocks, 1,000 bbl

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com