GENERAL INTEREST — Quick Takes

Total to divest $10 billion in assets during 2015-17

Total SA plans to divest $10 billion in assets during 2015-17 in an effort to improve cash flow and enforce stricter financial discipline.

The announcement follows the realization of the company's goal to divest $15-20 billion in assets during 2012-14, including the recent sale of 10% interest in Azerbaijan's Shah Deniz field and the South Caucasus pipeline to Turkish Petroleum Corp. for $1.5 billion (OGJ Online, May 30, 2014).

Earlier this month, Total received an offer from French specialty chemical company Arkema to acquire global adhesives affiliate Bostik for $2.25 billion.

Organic investment within the company is expected to decrease to $26 billion this year from $28 billion in 2013. By 2017, it hopes to reduce investment to $25 billion.

Total is targeting $15 billion in free cash flow for 2017, which it believes will be aided by the launch of 15 major projects expected to boost production to 2.8 million boe/d that year.

The company also reported the appointment of Kevin McLachlan to the position of senior vice-president, exploration, to take effect in early 2015. He's currently working with Total's exploration teams to define a new exploration strategy for next year and beyond.

Total, which late last year named Arnaud Breuillac as its E&P president, is seeking better overall exploration success (OGJ Online, Nov. 4, 2013).

EOR to boost US tight oil output by 1.5-3 million b/d

Additional volumes from enhanced oil recovery (EOR) slated to come on stream after 2020 could boost tight oil production in the US by 1.5-3 million b/d by 2030, up to 25% more oil than is being forecasted today, according to analysis from Wood Mackenzie.

"Growth in US tight oil continues to impress as development technology and techniques have yet to mature beyond adolescence," explained Phani Gadde, WoodMac senior North America upstream analyst.

WoodMac notes that these technologies are in early test phases and not yet commercial, but indicators suggest up to a 100% increase in recovery rates. Pilot tests are being conducted by operators such as EOG Resources Inc. in the Eagle Ford shale (OGJ Online, Apr. 8, 2010).

"This is going to happen, like horizontal drilling and [hydraulic fracturing], leading to another step-change in production technology," noted Skip York, WoodMac principal analyst, Americas downstream, midstream and chemicals.

The crude oil export ban, however, could delay such advancement, York warns. Excessive production could drive down US crude oil prices by more than $30/bbl compared with their international benchmarks, stranding barrels in reservoirs and leading to no net change in US tight oil volumes.

Policymakers could lift the export ban to preserve current investment levels if US crude prices fall compared with international benchmarks, resulting in improved US tight oil wellhead margins by $5/bbl.

The margin improvement would then attract additional investment, yielding another 350,000-450,000 b/d, WoodMac says. This environment would attract more capital-where every $5 billion invested could yield additional production of 400,000 b/d over 5 years.

Ann-Louise Hittle, WoodMac head of macro oils, added, "The fact these additional volumes are poised to have an impact after 2020 means the increased US tight oil production above our current forecast is likely to be absorbed without a strong effect on Brent oil prices. This is particularly the case because of potential long-term political risk in key future sources of supply such as Iraq's."

Higher Permian output hikes WTI oil-hub spreads

Crude oil prices in the Permian basin at Midland, Tex., have been falling below similar crude priced at Cushing, Okla., due to increasing production in the area and insufficient pipeline systems to move the crude to refineries, according to an analysis of the US Energy Information Administration.

"While the price difference between Midland and Cushing has been increasing for almost a year, recent refinery outages in the region caused it to widen substantially," EIA said.

EIA's latest Drilling Productivity Report (DPR) estimates that August Permian basin oil production will be almost 1.7 million b/d, 0.3 million b/d more than a year ago. A series of recent outages at refineries in or near the Permian, and along the US Gulf Coast caused the West Texas Intermediate price at Midland to fall $17.50/bbl below the price at Cushing, a record difference.

The previous record was set in late 2012 at a time when production also exceeded pipeline takeaway capacity. The price gas closed in 2013 when Magellan Midstream Partners reversed and repurposed part of its Longhorn Pipeline to move crude from the Permian to Houston, with a capacity of 225,000 b/d. In addition, the first expansions on the Sunoco Logistics Partners' Permian Express pipelines and other portions of Sunoco's pipeline system also came online in 2013.

"However, the increase in crude oil production has now outgrown these expansions, and additional pipeline expansions are under construction," EIA said.

With several projects that will allow more crude to flow from the Permian to the Gulf Coast coming online soon, this price difference is expected to narrow.

Magellan's 300,000-b/d BridgeTex Pipeline, which will move crude from West Texas to refining centers in Houston, Texas City, and Galveston, is expected to begin operating soon. Beginning in early 2015, the Cactus Pipeline, with an expected capacity of 200,000 b/d, will move Permian crude south to connect with an expanded Eagle Ford Pipeline that will deliver crude to Corpus Christi, Tex.

Exploration & Development — Quick Takes

Eni reports second major oil find in as many days

Eni SPA has made an oil discovery with the Oglan-2 exploration well on Ecuador's Block 10, 260 km southeast of Quito.

As with its discovery offshore Angola reported on Sept. 17, the company estimates the Oglan discovery may hold 300 million bbl of oil in place (OGJ Online, Sept. 17, 2014).

Drilled to a total depth of 6,450 ft, the well encountered a 236-ft net crude oil column of 16° gravity, and flowed 1,100 b/d of oil during a production test constrained by surface facilities. Data acquired in the well indicate up to 2,000 b/d of oil in production capacity per well.

Eni says commercial studies on the discovery will commence immediately. Processing facilities serving Villano field, also inside Block 10, lie 7 km from Oglan and produce 12,500 b/d (OGJ Online, Nov. 29, 2010).

The Oglan discovery is part of Eni's exploration campaign to develop Block 10 under a service contract signed with the Ecuadorian government in 2010. Eni has operated Block 10 since February 2000 through affiliate Agip Oil Ecuador.

AWE makes gas discovery under existing Senecio field

AWE Ltd., Sydney, has increased the worth of its Senecio gas field in permits L1/L2 in the onshore Perth basin of Western Australia with a discovery underlying the Senecio reservoir.

The find, originally called Senecio Deep, but now dubbed Waitsia, represents a new play with significant upside potential for the Perth basin.

The deeper horizons (Kingia and High Cliff sandstones) were penetrated by the continued drilling in the Senecio-3 well that appraised and confirmed the Senecio discovery earlier this month. These deep reservoirs have never been drilled in this part of the basin.

AWE says the presence of a significant quantity of potentially moveable hydrocarbons at Waitsia is indicated by strong gas shows, petrophysical analysis, and pressure data.

Further evaluation and appraisal will be needed to accurately define the size and lateral extent of the Waitsia accumulation, but initial estimates for 2C resources are 260 bcf.

Putting the two fields together, AWE believes the Senecio-Waitsia discovery could represent the largest onshore conventional gas find in Western Australia since the Dongara gas field in the 1960s.

Initial evaluation has identified 360 bcf of contingent resources.

There is substantial upside in that AWE is also looking at unconventional gas potential identified in the Carynginia shale and Irwin River Coal Measures during the drilling of Senecio-3.

AWE will flow test Senecio-3 in the coming weeks to establish commercial viability and the potential for early, low-cost development via existing plant and pipeline infrastructure that lies just 7 km west at the Dongara field.

A Waitsia appraisal well is also under consideration for drilling in early 2015.

EGPC awards two Gulf of Suez concessions to RWE Dea

Egyptian General Petroleum Corp. (EGPC) has awarded two concessions in the Gulf of Suez to RWE Dea AG, which said the awards stem from International Bid Round 2013.

RWE Dea will operate and hold 100% in East Ras Fanar Offshore and 50% in Northwest El Amal, with Edison International SPA holding 50%. RWE Dea's operated licenses in Egypt will increase to eight from six.

East Ras Fanar Offshore covers 187 sq km in the central gulf near the Ras Fanar field, and Northwest El Amal covers 365 sq km in the southern gulf between the July and Amal fields.

The work program includes seismic reprocessing, two exploratory wells in East Ras Fanar, and one in Northwest El Amal.

"Both blocks provide promising opportunities in an area where we know the geological conditions very well," said Maximilian Fellner, general manager of RWE Dea Egypt (OGJ Online, Aug. 27, 2014).

Drilling & Production — Quick Takes

Fort Hills lets contract for oil sands project

The Fort Hills Energy LP consortium has let a $1.3 billion engineering, procurement, fabrication, and construction contract to Fluor Corp. for the utilities scope of the Fort Hills oil sands mining project, 90 km north of Fort McMurray, Alta., in the Athabasca region.

The Fort Hills project will be developed as an open-pit truck and shovel mine. Production is expected to launch in fourth-quarter 2017 and eventually yield 180,000 b/d of bitumen (OGJ Online, Oct. 31, 2013).

Fort Hills Energy is owned by Suncor Energy Inc., developer and operator of the Fort Hills project, with 40.8% interest; Total E&P Canada 39.2%; and Teck Resources Ltd. 20%.

BSEE proposes safety rules for fixed offshore platforms

The US Bureau of Safety and Environmental Enforcement is seeking public comments on a proposed rule aimed at improving safety of helideck and aviation fuel operations on fixed offshore facilities.

It specifically would like comments on whether to incorporate in its regulations certain industry and international standards for design, construction, and maintenance of offshore helidecks, as well as standards for aviation fuel quality, storage, and handling, BSEE said in an advanced notice of possible rulemaking.

BSEE also asked whether it should incorporate existing standards, with modifications, for helideck and aviation fuel systems, or develop new regulations. As an alternative, it is seeking comments on whether to require submissions on past accidents or other incidents involving helidecks, helicopters, or aviation fuel on or near fixed OCS facilities, it said.

"We know that transportation accidents account for the majority of fatalities on the OCS, and that helicopter-related accidents are a significant concern," BSEE Director Brian Salerno said. "We are looking at our regulations to ensure that the aviation related areas over which we have jurisdiction have the benefit of rigorous safety standards."

Statoil installs compressors to extend fields' lives

Faced with falling reservoir pressures, Statoil ASA is installing compressors in the Norwegian North Sea to extend field lifetimes and produce an extra 1.2 billion boe.

The company began operating a compressor Sept. 17 at the Kvitebjorn gas-condensate field, which is expected to add 8 years through 2035 and increase production by 220 million boe. Kvitebjorn lies on Block 34/11, east of Gullfaks.

Statoil began operating a compressor at Kristin earlier this year and plans one soon for Heidrun. Compressor startups are planned later for Gullfaks, Asgard, and Troll fields. Statoil said Troll will add two compressors to increase recovery by 522 million boe and extend field life 18 years to 2063.

"Many people don't realize that these relatively small modules are able to contribute as much or more value as new fields and that they cost much less to develop because the platform is already in place," said Terese Kvinge, senior vice-president for brownfield projects.

PROCESSING — Quick Takes

Husky lets contract for Ohio refinery upgrade

Lima Refining Co. (LRC), a subsidiary of Husky Energy Inc., has entered an integrated supply contract with a subsidiary of Linde Group as part of a planned upgrade and modernization project at its 160,000-b/d refinery at Lima, Ohio.

Under the integrated supply agreement, New Jersey-based Linde North America will supply hydrogen and steam utilities to the refinery as LRC implements a crude oil feedstock flexibility project at the site, Linde said.

"LRC will use the additional hydrogen to hydrotreat product streams containing sulfur and other components," said Raghu Menon, Linde's vice-president of tonnage business development in the Americas.

In addition to investing in upgrades that will increase production capacity and operational flexibility at its two existing hydrogen plants in the region, Linde also will build a steam methane reforming (SMR) hydrogen plant designed to help meet overall regional demand from other refining and petrochemical operators in the regional cluster, Menon said.

While Menon said Linde expects to invest about $100 million overall for related enhancements to its regional hydrogen production operations, a value of the integrated supply contract with LRC was not disclosed.

The new SMR plant, Linde Lima 3, should be on stream during first-quarter 2016 and will be operated with Linde's other two plants as a single installation having a combined hydrogen production capacity of more than 60 MMcfd, the company said.

As of late July, front-end engineering design on the Lima refinery's feedstock flexibility project was about 95% complete, according to Husky Energy's latest quarterly earnings report.

The project, intended to provide LRC the flexibility to process up to 40,000 b/d of Western Canadian heavy crude, will not change the refinery's overall nameplate capacity, Husky Energy said.

Petron lets contract for coker at Bataan refinery

Petron Corp., Mandaluyong City, Philippines, has let a contract to a subsidiary of Foster Wheeler's global engineering and construction group for work related to a new delayed coking unit at Petron's 180,000 b/d refinery in Limay, Bataan, about 150 km southwest of Manila.

Foster Wheeler will provide operator training, commissioning, and start-up assistance services for the unit, the company said.

The unit, based on Foster Wheeler's proprietary SYDEC delayed coking technology, also includes a Foster Wheeler delayed coker heater, the company said.

Foster Wheeler's scope of work is scheduled to be completed by yearend, the company said. A value of the contract was not disclosed.

Petron previously let a contract to Foster Wheeler for detailed engineering and procurement services for the coker (OGJ Online, Jan. 17, 2012).

In 2011, Petron embarked on a refinery expansion project (RMP-2) designed to boost Bataan's production capacities and make the plant more competitive in the Asia-Pacific region, according to Petron's web site.

As of March, RMP-2 was 98% completed, with target commercial operation of the expansion scheduled for this year's fourth quarter, Petron said in its latest presentation to investors, dated May 12.

Total lets contract for Antwerp refinery expansion

France's Total SA, through a contractor, has let a contract to GE Oil & Gas, Houston, part of General Electric Co., for work related to the expansion of its 338,000-b/d refining and petrochemical complex in Antwerp, Belgium.

GE will provide a variety of compressors for a refinery off-gas (ROG) expansion project, which is part of Total's $1.3 billion overall investment to expand and enhance processing capabilities at the Antwerp complex, GE said.

The compression equipment to be delivered to the Antwerp refinery will convert low-value refinery ROG into a low-cost petrochemical feedstock for Total's adjacent ethylene production plant by recovering large amounts of valuable hydrocarbons that otherwise would be burned as fuel, GE said.

Total will process the recovered hydrocarbons as feed streams in the complex's existing naphtha cracker, replacing the need for expensive oil-based naphtha feeds, according to GE.

The $33 million contract includes multiple trains of motor-driven ethylene and propylene refrigeration, saturated and unsaturated off-gas compressors, and a turboexpander-driven compressor together with GE's project management, parts, and installation services, the service provider said.

GE's equipment is scheduled for delivery to the refinery during third-quarter 2015 to support the startup of Total's expanded ROG installation, which due to be commissioned in early 2017.

Total's ROG project at Antwerp follows the recent move by European refiners and petrochemical producers to lower their cost of production and improve overall operating efficiency by modernizing and improving existing complexes rather than developing new plant sites, GE said.

Total previously let a contract to a subsidiary of Maire Tecnimont SPA, Milan, to provide engineering, procurement, and construction services for the Antwerp ROG project (OGJ Online, Apr. 3, 2014).

TRANSPORTATION — Quick Takes

Odisha to become eastern India's energy gateway

India's state of Odisha will implement oil and gas projects within the next 5 years that amount to about 1 trillion rupees ($16.4 billion) in investments, positioning the state to become the energy gateway for eastern India, according to the country's Ministry of Petroleum and Natural Gas.

These investments will be allocated to multiple projects already under way in the state in the areas of petrochemicals, oil-and-gas pipelines, LNG and LPG terminals, as well as strategic oil reserves, said India's Minister of Petroleum and Natural Gas Shri Dharmendra Pradhan in an Sept. 12 release following a meeting with meeting with Shri Naveen Patnaik, Odisha's chief minister.

The purpose of the meeting was to seek the cooperation of Odisha's state government in facilitating land acquisition, environmental clearances, and other necessary statutory approvals to ensure the smooth implementation of the upcoming projects, the ministry said.

The total 5-year investment into state projects includes 34,000 rupees ($5.5 billion) that already have been invested into Indian Oil Corp. Ltd's (IOC) 15 million-tonnes/year refinery at Paradip (OGJ Online, Nov. 16, 2011), which is now scheduled to be commissioned by early 2015, according to Pradhan.

Pradhan also added that Odisha will be one of the few Indian states that will have gas supplies from three sources, which include imported LNG, domestic natural gas, and coal bed methane.

Configured to process heavy and high-sulfur crude oil and to produce Euro 5-standard fuels, the Paradip refinery previously was scheduled for commissioning in November 2013 (OGJ Online, Mar. 13, 2013).

In August, Indian Oil Corp. Ltd. (IOC) told investors it expected to complete commissioning activities at Paradip by December (OGJ Online, Aug. 14, 2014).

Niobrara-to-Cushing line open season launched

Magellan Midstream Partners LP has launched an open season to assess customer interest in transporting various grades of crude oil from the Niobrara shale to its storage site in Cushing, Okla., via its proposed 600-mile, 20-in. OD Saddlehorn pipeline.

Saddlehorn would carry as much as 400,000 b/d from Platteville, Colo., to Cushing, using existing right-of-way for what Magellan describes as a significant portion of its route.

Subject to sufficient commitments from shippers and regulatory approvals, Saddlehorn could be operational during second-quarter 2016.

Magellan is already in discussions with two major producers who have expressed interest in committing to the project, and Magellan intends to proceed with the project if commitments are received at currently negotiated levels from these producers. All potential customers will have an equal opportunity to obtain capacity in the open season, Magellan said. It closes Oct. 22.

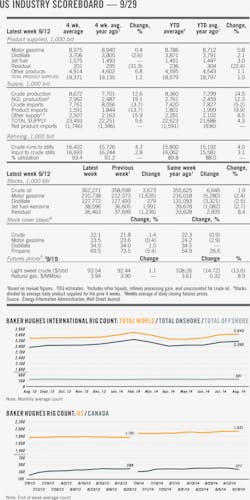

Baker Hughes Inc. reported a 5 unit increase in drilling rigs operating in the DJ-Niobrara region for the week ending Aug. 15 (OGJ Online, Aug. 15, 2014). PwC US Energy Practice reported three merger and acquisition deals totaling $432 million in the Niobrara shale for the 3 months ending June 30 (OGJ Online, July 30, 2014).