New, expanded capacities return US, Canada to global lead

OGJ subscribers can download, free of charge, the 2014 Worldwide Gas Processing Survey tables at www.ogjonline.com: Scroll to "Surveys and Statistics." Click on OGJ Subscriber Surveys, then Worldwide Gas Processing, and choose from the list below June 2, 2014. To purchase spreadsheets of the survey data, please go to http://www.ogj.com/resourcecenter/orc_survey.cfm or email [email protected]. |

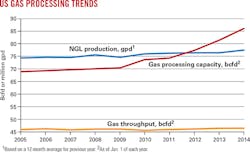

New US gas processing and fractionation projects that were in the pipe for the 18-24 months before Jan. 1, 2014, began showing results in 2013 as Oil & Gas Journal's plant-by-plant survey of global gas processing on that date reflects nearly a 6% growth in US processing capacity. More than 3 bcfd of this was new capacity, OGJ data show; the rest were plant expansions and data new to OGJ's database.

As exploration and production companies continued developing US shale plays, US gas plant operators continued planning and installing new capacity. And, since much of this development targets wet shale-gas plays, the need for additional fractionation is being met by a crowd of new and expanded fractionators, especially in Southeast Texas.

OGJ data show US gas processing capacity advanced in 2013 by nearly 5 bcfd, pushing up total global capacity by more than 1 bcfd. For 2012, US capacity had increased by nearly 4 bcfd.

Overall, global natural gas production in 2013 gained over production in 2012 (OGJ, Mar. 10, 2014, p. 31), up by more than 1 tcf and led by the US, Africa, and Middle East countries.

For 2013, the US produced more than 21% of global natural gas. But that level was about flat with that for 2012 after a large leap in 2011 of more than 7% compared with growth in 2010.

US gas processing capacity growth in 2013 kept North American production (including Mexico) ahead of the rest of the world. And that US growth even helped push the share held by US and Canada ahead of the rest of the world for the first time since 2005. In 2013, the two countries' share of global gas processing capacity increased to nearly 51% from slightly less than 50% in 2012.

Global natural gas production will likely continue to grow robustly not only in North America, of course, but also in the Middle East and Asia. As the US wrestles with whether and how much natural gas to export as LNG, it's become increasingly clear that Asia will be the target market for any such exports.

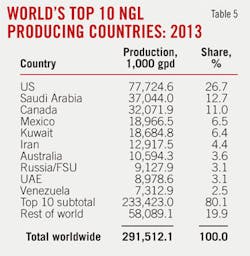

Table 2 presents a snapshot of global gas plant construction; Table 3, a review of global natural gas reserves; Table 4, a list of the world's leading gas producing countries; and Table 5, the leading NGL-producing countries. Two additional tables on pp. 78-80 display projects and their statuses as of OGJ press time.

Sources

Oil & Gas Journal's exclusive, plant-by-plant, worldwide gas processing survey and its international survey of petroleum-derived sulfur recovery provide industry activity figures.

Canadian data are based on information from Alberta's Energy and Utilities Board (EUB) that reflect actual figures for gas that moved through the province's plants and are reported monthly to the EUB. For 2000 for the first time, OGJ took these data for all of Alberta and compiled annual figures and thereby created a new baseline for data comparisons from that point.

Effective Jan. 1, 2008, the province realigned the EUB into two separate regulatory bodies: the Energy Resources Conservation Board to regulate the oil and gas industry and the Alberta Utilities Commission to regulate utilities.

Then, at mid-2013, the ERCB became the Alberta Energy Regulator (www.aer.ca).

In addition to EUB figures for Alberta and to operators' responses to its annual survey, OGJ has supplemented its Canadian data with information from British Columbia's Ministry of Energy, Mines and Petroleum Resources and Saskatchewan's Ministry of Energy & Resources.

Activity

The following sections look at selected individual projects by global region and, in the case of North America, by play to illustrate some of the activity for the past 12-18 months.

Texas-Oklahoma

In May last year, Enbridge Energy Partners LP, Houston, announced plans to build a 150-MMcfd cryogenic natural gas processing plant near the East Texas town of Beckville in Panola County, estimating the cost of the project at $140 million (OGJ Online, May 1, 2013). Construction began later in the year and is to be completed for start-up by early 2015.

Adding the Beckville plant will expand the company's processing capacity in the Cotton Valley and Haynesville shales to about 820 MMcfd, said Enbridge, and connect with existing NGL infrastructure in the area.

In April of this year in the Haynesville in San Augustine County (also in East Texas), Azure Midstream Energy LLC, Houston, started up its 10-MMcfd Fairway gas plant.

It recovers NGLs from associated gas produced from the James Lime formation and returns the residue gas into Azure's East Texas gathering system for delivery into interconnections with Gulf South's 42-in. pipeline, CenterPoint Energy Gas Transmission's 42-in. line near Carthage, Gulf South's 30-in. pipeline at Milam, and Azure's interconnection with Natural Gas Pipeline Co. of America in Nacogdoches County.

Recovered NGLs move by truck to fractionation in East Texas, South Louisiana, or Mont Belvieu, Tex., said the company.

On May 1, 2013, Enable Midstream Partners LP, Oklahoma City, formed to own and operate the midstream businesses of OGE Energy and CenterPoint. The resulting company has natural gas gathering and processing in four states and serves natural gas production from shale developments in the Anadarko, Arkoma, and Ark-La-Tex basins.

At yearend 2013, Enable's energy infrastructure included about 11,000 miles of gathering pipelines, 12 processing plants with about 2.1 bcfd in total processing capacity, 7,900 miles of interstate pipelines, 2,300 miles of intrastate pipelines, and 8 storage caverns containing 86.5 bcf of capacity.

The company said its expansion capital expenditures will approach $450 million for the 12 months ending Mar. 31, 2015.

Enable has made investments to expand the super-header system, including its newest plant in Custer County, Okla. The 200-MMcfd McClure plant started operations in December 2013. It increased Enable's gas processing capacity in the basin by more than 15%.

Enable expects to expand capacity of the super-header system by adding another 200-MMcfd cryogenic processing plant and gathering pipelines in Grady County, Okla. The Bradley plant is to be completed in first-quarter 2015.

In April this year, Oneok Partners LP, Tulsa, completed its 200-MMcfd gas processing plant. Cost for the Canadian Valley plant and related infrastructure in the Cana-Woodford shale in Oklahoma was about $340-360 million, said the announcement.

The plant increases the company's processing capacity in Oklahoma to about 700 MMcfd and is now its largest natural gas plant in the state.

Permian basin, environs

Also in April this year in far West Texas, Nuevo Midstream LLC, Houston, increased its processing capacity in the Delaware basin to 300 MMcfd by starting up its new 200-MMcfd Ramsey III cryogenic plant in Reeves County, Tex.

The Ramsey system also includes amine-treating capacity of 1,800 gpm, more than 270 miles of low and high-pressure gathering lines, four field compressor stations, and interconnections into the El Paso Natural Gas and DCP Sandhills pipelines.

Nuevo's operations are primarily focused on production from the Bone Spring and Wolfcamp formations and the Avalon shale trend in southeastern New Mexico and in West Texas.

The company also said that customer demand for additional processing and treating has prompted it to begin engineering its next two plant expansions, the Ramsey IV and Ramsey V.

Ramsey IV will add 200 MMcfd of cryogenic processing and a new 1,000-gpm amine plant. Nuevo expects to bring Ramsey IV online in third-quarter 2015, raising total cryogenic processing capacity to 500 MMcfd and amine treating capacity to 2,800 gpm.

Ramsey V expansion will be operating in summer 2016 and include adding 400 MMcfd cryogenic processing capacity and 1,000-gpm amine treating, bringing Nuevo's cryogenic processing capacity to 900 MMcfd and total amine treating capacity to 3,800 gpm.

Expansion plans include two new compressor stations and more than 75 miles of additional high-pressure gathering in operation by yearend 2016.

In March this year in New Mexico, DCP Midstream Partners LP, Denver, announced it would build a 200-MMcfd sour natural gas processing plant in Lea County to meet demand from growing Permian basin production. Included in the project will be associated gathering system expansions for southeast New Mexico and West Texas.

In addition to the Zia II plant are front-end treating for sour gas, two acid-gas injection wells, a 50-mile, 20-in. high-pressure trunk line to intersect DCP Midstream's existing New Mexico gathering system, and new high-pressure pipelines and compression in West Texas.

DCP said the project is to start up during first-half 2015.

The company's investment in the past 3 years in the Permian totals more than $1.7 billion with the Rawhide plant and the Sand Hills NGL pipeline (OGJ Online, Feb. 15, 2012; Oct. 25, 2012).

In August last year, also to serve Permian production, the company started up its deep-cut, cryogenic 75,000-MMcfd Rawhide plant and its low-pressure gathering and compression system in Glasscock County, Tex.

The plant was part of DCP's expansion for the liquids-rich Permian and included the 720-mile, 20-in., 200,000-b/d Sand Hills pipeline to provide takeaway service from the Permian to fractionation along the Texas Gulf Coast and Mont Belvieu.

With its opening, the Rawhide plant gave DCP Midstream 18 processing plants it owned and operated with a capacity of more than 1.3 bcfd that produced about 120,000 b/d of NGLs, according to company statements at the time.

Crestwood Midstream Partners LP, Houston, is building the 20-MMcfd Willow Lake processing plant in Eddy County, NM, with scheduled completion set for third-quarter 2014. Once this plant is finished, the company will begin on the nearby Delaware Ranch plant, which will have a capacity of 120 MMcfd and be completed in 2015 (OGJ Online, Apr. 1, 2014).

Canyon Midstream Partners LLC, Houston, said in January it was developing a natural gas gathering, processing, and treating system in the Permian basin. The system, said the company, is anchored by a 10-year gathering and processing agreement with "one of the world's largest oil and gas companies," which it declined to identify.

The James Lake system will include a cryogenic gas processing plant in Ector County, Tex., with an initial processing capacity of 70 MMcfd and treating capabilities for natural gas containing H2S and CO2.

To supply the plant, Canyon is developing 40 miles of high-pressure gathering and three compressor stations that will connect to low-pressure field gathering Canyon is building for the anchor customer in Ector County and Andrews County.

In February in the Granite Wash in Hemphill County, Tex., MarkWest Energy Partners LP, Denver, started up the 200-MMcfd Buffalo Creek cryogenic gas plant and associated high-pressure trunk line (OGJ Online, Feb. 7, 2014).

The plant is supported by long-term fee-based agreements with Chesapeake Energy Corp., said the company announcement. As part of a gas processing agreement, Chesapeake dedicated 130,000 acres throughout the Anadarko basin.

Completion of the Buffalo Creek plant increased MarkWest's total processing capacity in the Anadarko basin to 435 MMcfd at two complexes: Buffalo Creek and the 235-MMcfd Arapahoe processing complex in western Oklahoma. The plants are connected through MarkWest's rich-gas gathering system, which can gather 575 MMcfd.

In March, PennTex Midstream Partners LLC, Houston, announced it had completed two midstream transactions to build gathering and processing in the Permian basin and northern Louisiana.

PennTex formed PennTex North Louisiana LLC in a joint venture with producers in north Louisiana to develop infrastructure in the area. The initial phase will consist of building a 200-MMcfd cryogenic processing plant and associated residue gas and NGL pipelines in Lincoln Parish, said the company announcement.

PennTex NLA expects this initial system to start up in first-quarter 2015.

In February, PennTex closed on its purchase of a majority interest in Atlantic Midstream LLC, renaming it PennTex Permian LLC. The new venture is building gathering and compression to handle production in the Delaware basin, primarily in Reeves, Pecos, and Ward counties in West Texas. First phase of operations were to have been in service by Apr. 1.

In July, PennTex Permian will complete and place in service a 60-MMcfd cryogenic natural gas processing plant in Reeves County, along with an NGL pipeline.

Near the end of April, a PennTex spokesperson told OGJ, most of the pipelines had been completed and placed into service, with first flow on Mar. 17.

Temporary treating has been put in place to allow system operations to continue. Full system operations will begin when the processing plant is completed and available for service in late June or early July, he said.

Earlier this year, Howard Energy Partners LLC, San Antonio, completed its 200-MMcfd Reveille plant in Webb County, Tex. (OGJ Online, Feb. 8, 2013). Around the same time, DCP Midstream commissioned a new 200-MMcfd plant in Goliad County.

Atlas Pipeline Partners LP, Philadelphia, is constructing the Edward gas processing plant in West Texas. An initial capacity of 100 MMcfd will be available, and in second-half 2014 the capacity will be increased to 200 MMcfd (OGJ Online, July 16, 2013).

Earlier this year, Outrigger Energy LLC, Denver, said it was developing a gathering system in Loving and Winkler counties, Tex., and that the project will include a 60-MMcfd processing plant.

Marcellus, Utica

Utica East Ohio Midstream LLC (UEO) last year let a $5 million engineering and procurement support contract to ENGlobal Corp., Houston, for cryogenic gas processing in Leesville in southwestern Carroll County, Ohio (OGJ Online, July 24, 2013).

ENGlobal's scope was to consist of engineering and procurement support for a control room, condensate stabilization unit, site grading, and design integration for the 200-MMcfd unit. The work was to have been completed by mid-2014, but the company's website at press time provided no update.

UEO is a joint venture of M3 Ohio Gathering LLC, Access Midstream Partners LP, and EV Energy Partners LP and operates UEO Buckeye, a large midstream complex in eastern Ohio that includes plants at Kensington and Leesville (OGJ Online, Feb. 18, 2013). At mid-2013, the complex included 800 MMcfd of natural gas processing and associated NGL fractionation, loading, and terminal.

The Leesville plant was to be the second in the UEO Buckeye complex that will recover NGLs in the liquids-rich Utica shale play.

In November last year, MarkWest Energy Partners and producer Antero Resources, both of Denver, reached agreements that support construction of a fifth 200-MMcfd cryogenic gas plant at MarkWest's Sherwood complex in Doddridge County, W.Va. (OGJ Online, Nov. 8, 2013). Sherwood V will start up later this year.

In fourth-quarter 2013, the company started up the third 200-MMcfd plant at Sherwood, augmenting the two 200-MMcfd plants already operating at nearly full utilization, said MarkWest. The fourth plant, Sherwood IV, is to start up in third or fourth quarter this year.

And last month, MarkWest announced yet another 200-MMcfd plant—Sherwood VI—that will start up by second-quarter 2015 and bring the complex's capacity to 1.2 bcfd (OGJ Online, May 7, 2014).

Also in fourth quarter at MarkWest's Majorsville complex in Marshal County, W.Va., the company started up its 200-MMcfd Majorsville V plant to handle production from Chesapeake Energy Corp. and Statoil ASA.

And in the same time frame, MarkWest started up the 200-MMcfd Mobley III plant in Wetzel County, W.Va., bringing total capacity there to 520 MMcfd. The plant is handling production from EQT Corp. and Magnum Hunter Resources Corp. MarkWest will begin operations at the 200-MMcfd Mobley IV in fourth-quarter this year (OGJ Online, Aug. 19, 2013).

And last month, the company said it will increase total processing capacity at the Wetzel County site to 920 MMcfd with construction of yet another 200-MMcfd cryogenic plant—Mobley V—to handle production from EQT Corp. Plans target in service by second-quarter 2015 (OGJ Online, May 7, 2014).

Mobley currently consists of three plants with total 520 MMcfd of processing capacity. The complex processes production from Marcellus rich-gas production from EQT, Magnum Hunter Resources Corp., Stone Energy Corp., Consol Energy Inc., and Noble Energy Inc.

In August last year, MarkWest announced plans for processing and transportation projects to support production in both the Marcellus and Utica shales. It will build yet another processing complex, this time in Tuscarawa County, Ohio, beginning with a 200-MMcfd gas plant and installing a 150,000-b/d pipeline to move C2+ to Mont Belvieu.

Also in Ohio in November, the company began operations at the 200-MMcfd Seneca I plant in Noble County, Ohio, supporting production from Antero Resources, Gulfport Energy Corp., Rex Energy Corp., and PDC Energy, among others.

MarkWest announced start-up of the 200-MMcfd Seneca II earlier this year.

Also earlier this year, Pennant Midstream announced its 200-MMcfd Hickory Bend cryogenic natural gas processing plant in the Utica shale at New Middletown, Ohio, had been commissioned (OGJ Newsletter, Jan. 13, 2014).

The plant's gathering system includes about 55 miles of 20 and 24-in. OD wet-gas gathering pipelines that support delivery of more than 600 MMcfd. This will allow expansion if demand warrants, said the company, and it was preparing sites for two additional plants at Hickory Bend.

Residue gas supplies local residential and commercial demand, while NGLs move through a 12-in. OD, 38-mile pipeline and existing infrastructure to Utica East Ohio's Harrison County, Ohio, fractionator (OGJ Online, Sept. 30, 2013).

Hickory Bend processes rich-gas production from Hilcorp Energy Co. and other producers in the area. NiSource Midstream Services LLC operates Pennant Midstream, which is jointly owned by Harvest Pipeline (an affiliate of Hilcorp Energy Co.) and NiSource Midstream Services.

Earlier this year, Blue Racer Midstream LLC, Dallas, started up its 200-MMcfd Natrium II expansion to its Natrium gas plant in Marshall County, W.Va. The expansion brings overall nameplate processing capacity at Natrium to 400 MMcfd (OGJ Online, Aug. 5, 2011).

In addition, Blue Racer is continuing to build out its Berne processing complex in Monroe County, Ohio. The site can accommodate three 200-MMcfd cryogenic processing units, says the company. It expects to commission the first 200-MMcfd plant by the end of third quarter. Together, Natrium and Berne will allow Blue Racer to process 1 bcfd.

North Dakota; DJ basin

In February of this year, Hess Corp. started up its Tioga, ND, gas plant, following an expansion to 250 MMcfd from 110 MMcfd and additional capacity to recover ethane and other NGLs.

The expansion was expected to contribute to a reduction in widespread natural gas flaring in the state because of inadequate gas processing capacity and takeaway pipelines.

Oneok Partners is building Garden Creek II, a $160 million project that will increase capacity at the complex to 200 MMcfd from 100 MMcfd. The expansion is to be completed in third-quarter this year. Garden Creek III will add another 100 MMcfd by early 2015 (OGJ Online, Apr. 10, 2013).

Oneok is also seeking approval from the North Dakota Public Service Commission to build the 200-MMcfd Lonesome Creek plant in McKenzie County. Tentative in-service date is fourth-quarter 2015 (OGJ Online, Nov. 20, 2013).

In Mountrail County, ND, Whiting Petroleum Corp. plans to expand the Robinson Lake plant to 110 MMcfd from 60 MMcfd by fourth-quarter 2015.

In October last year, DCP Midstream started up its 110-MMcfd O'Connor cryogenic gas plant near Kersey, Colo., in the Niobrara shale of the Denver-Julesburg basin.

The O'Connor plant, said the company at the time, is part of an eight-plant system owned and operated by DCP, with total inlet-gas capacity of about 600 MMcfd. An expansion of the new plant to 160 MMcfd was completed earlier this year.

In first-quarter 2014, Summit Midstream Partners LP, Dallas, placed into service the new 20-MMcfd gas plant at DeBeque, Mesa County, Colo. The project was originally developed by Beartracker Energy and acquired by Summit and handles production from the Mancos shale.

In Weld County, Colo., DCP Midstream plans to place the 230-MMcfd Lucerne II plant into service in second quarter next year. Near Lucerne II, DCP plans to build "Plant 10," which will have a capacity of 200 MMcfd (OGJ Online, Aug. 20, 2012).

Crestwood Midstream with co-owner Access Midstream is expanding the Jackalope gathering system in eastern Wyoming and building the 120-MMcfd Bucking Horse cryogenic gas processing plant to serve Niobrara shale production, including volumes from Chesapeake and RKI Exploration & Production LLC.

In December last year, the Wyoming Department of Environmental Quality approved the new plant's air pollution permit required for construction to begin. Jackalope will begin processing there in fourth-quarter 2014, according to Crestwood Midstream's 10K annual report to the US Securities and Exchange Commission (SEC).

The company expects the plant to produce more than 9,000 b/d of NGLs at full capacity and Jackalope to spend about $237 million on system build out that will reach total design capacity of 150 MMcfd by third quarter this year.

North American fractionation

In Canada, Keyera Corp. announced earlier this year expansion at NGL fractionation and storage in Fort Saskatchewan, Alta., more than doubled C3+ capacity to 65,000 b/d from 30,000 b/d (OGJ, Newsletter, Jan. 13, 2014).

The project also includes new product receipt, operational storage, and pipeline interconnections. Detailed engineering should be complete by first-quarter 2016.

The fractionator will handle a C3+ NGL mixed stream. This incremental C3+ mixed fractionation capacity is in addition to the de-ethanizer currently under construction at Fort Saskatchewan (OGJ Online, Sept. 11, 2012), which will allow Keyera to fractionate roughly 30,000 b/d of C2+.

Keyera last year proposed a 12-in. OD condensate pipeline connecting its Alberta diluent terminal in Edmonton to its Fort Saskatchewan Pipeline System (OGJ Online, Aug. 2, 2013).

At Mont Belvieu last year, Enterprise Products Partners LP (EPP) expanded its NGL fractionation capacity to 655,000 b/d by starting up two new 85,000-b/d units, the seventh and eighth on the site east of Houston. Only 3 years earlier, the company operated 400,000 b/d (OGJ Online, Nov. 19, 2013; Sept. 18, 2013).

EPP said the eighth fractionator would accommodate increasing NGL production from domestic shale plays, including the Eagle Ford in South Texas, and other basins in the Rocky Mountains and Midcontinent.

System wide at yearend 2013, EPP said it had more than 1 million b/d NGL fractionation capacity.

In November last year, Lone Star NGL LLC, a joint venture of Energy Transfer Partners LP (ETP) and Regency Energy Partners LP, both of Dallas, placed into service its 100,000-b/d Lone Star Frac II fractionator at Mont Belvieu. This follows start-up in January of Lone Star Frac I, also with 100,000 b/d in capacity (OGJ, May 7, 2012, p. 88; OGJ Online, Nov. 4, 2013).

Both fractionators receive NGLs from several sources, including Lone Star's West Texas NGL pipelines and ETP's Justice NGL pipeline.

And in April this year, the US Environmental Protection Agency issued a final greenhouse gas (GHG) prevention of significant deterioration (PSD) construction permit to Lone Star for a third 100,000-b/d NGL fractionator at Mont Belvieu

In December 2013, Kinder Morgan Energy Partners LP and Targa Resources Partners LP announced they would form a joint venture to build new NGL fractionation at Mont Belvieu to serve producers in the Utica and Marcellus shales in Ohio, West Virginia, and Pennsylvania (OGJ Online, Dec. 20, 2013).

To allow producers and shippers time to assess their Gulf Coast fractionation and pipeline needs, Kinder Morgan and Targa extended until Feb. 28, 2014, a binding open season already under way for the Utica Marcellus Texas Pipeline (UMTP), a proposed joint venture between MarkWest Utica EMG LLC and Kinder Morgan.

Pending approval by the US Federal Energy Regulatory Commission, UMTP will involve abandonment and conversion to liquid service of more than 1,000 miles of Kinder Morgan's existing Tennessee Gas Pipeline natural gas system from Mercer, Pa., to Natchitoches, La., and construction of about 200 miles of new pipeline from Natchitoches to Mont Belvieu.

The new fractionation, to sit adjacent to Targa's existing capacity at Mont Belvieu, will provide fractionation for shippers on UMTP of up to 150,000 b/d and potentially serve up to 400,000 b/d of maximum pipeline capacity.

In April this year, Oneok announced completion of a $46 million, 40,000-b/d C2-C3 splitter at its Mont Belvieu NGL storage site to serve area petrochemical producers (OGJ Online, Apr. 23, 2014; Aug. 12, 2012). The splitter can produce 32,000 b/d of purity ethane and 8,000 b/d of propane.

In addition to its previously announced $6.0-6.4 billion capital-growth program through 2016, Oneok said at the time it had a $2-3 billion-plus backlog of unannounced growth projects that it continues to develop.

Oneok confirmed in a yearend 2013 filing with the SEC that it expects a second 75,000-b/d NGL fractionator, MB-3, to be completed during fourth-quarter 2014. At an estimated cost of $525-575 million, the project is to meet growing demand from petrochemical companies for ethane and propane feedstocks and will include related infrastructure and storage capacity.

Also this spring, Phillips 66 is expected to reach final investment decision for a proposed 100,000-b/d fractionator at Sweeny, Old Ocean, Tex. If the company decides to proceed, the project it would be finished in second-half 2015 (OGJ Online, Feb. 7, 2014).

In Louisiana in November last year, Crosstex Energy companies Crosstex Energy LP and Crosstex Energy Inc. completed Phase I of the Cajun-Sibon NGL expansion, connecting the partnership's Eunice, La., fractionator to Mont Belvieu supply pipelines in East Texas.

Pipeline operations were completed in October and deliveries of NGLs to the Eunice, Riverside, and Plaquemine fractionators began shortly thereafter. The Eunice fractionator began operations on Nov. 6 at 15,000 b/d of NGLs. At the time, the pipeline was delivering 25,000-30,000 b/d into various Louisiana delivery points and was expected to be moving about 70,000 b/d by yearend.

The companies said the second phase of the expansion was on schedule to begin operations in second-half 2014 and includes expanding the Cajun-Sibon pipeline capacity by 50,000 b/d to a total of 120,000 b/d; installing a 100,000-b/d fractionator adjacent to the partnership's existing Plaquemine natural gas processing complex; modifying the Riverside fractionator; and building several natural gas and NGL pipelines to expand the partnership's capabilities and market connectivity.

The expansions are supported by a 10-year supply agreement with Dow Hydrocarbons and Resources LLC and a 5-year supply agreement with Williams Olefins LLC.

In December last year in Texas' Eagle Ford shale, Plains All American Pipeline LP, Houston, announced plans to build new NGL fractionation and expand existing condensate stabilization.

The 15,000-b/d fractionator, expanded condensate stabilization, and enhanced related infrastructure will cost about $120 million and come into service in second-quarter 2015.

The fractionator will be near existing Plains assets in Gardendale, La Salle County, Tex., and include condensate stabilization and rail and truck loading and unloading. It will handle NGL Y-grade and treat and fractionate off-spec Y-grade from Plains' South Texas gathering system and throughout the Eagle Ford.

Purity products to be produced include international refrigerant specification-grade propane, US Environmental Protection Agency non-commercial-grade butane, and international specification natural gasoline. These products can be transported from Plains' adjacent rail and truck site.

Plains is also adding a third condensate stabilization train that will provide about 40,000 b/d of incremental capacity to the existing condensate stabilizer, bringing total capacity to about 120,000 b/d.

In the Marcellus in July last year, MarkWest began operations at its Houston complex in Washington County, Pa., starting up a 38,000-b/d fractionator producing purity ethane from Marcellus production.

The stream is initially to fill the Mariner West C2 purity line being developed by MarkWest and Sunoco Logistics Partners LP. Later, said MarkWest, it will fill Enterprise Products' 1,230-mile Appalachia-to-Texas pipeline (ATEX) and MarkWest's own joint venture's Mariner East pipelines.

In August, the company announced plans to develop more fractionation to serve Marcellus production. It will install de-ethanization and depropanization totaling 20,000 b/d of capacity at its Keystone complex in Butler County, Pa.

MarkWest also said it would install a 38,000-b/d de-C2 plant at its Sherwood complex in West Virginia and another C2 unit at the Seneca complex in Ohio. No target completion date for either, however, has been announced.

Late last year, MarkWest doubled purity C2 fractional capacity in the Marcellus to 76,000 b/d with the start-up of a second de-C2 unit at Majorsville. At the same time, the company said it had started up its Liberty C2 pipeline taking C2 from Majorsville.

In January, MarkWest Utica EMZG and MarkWest Energy Partners began operations at the 60,000-b/d Hopedale fractionator and marketing complex in Harrison County, Ohio, to remove C3+.

Current fractionation capacity at Blue Racer's Natrium site in West Virginia is 46,000 b/d and will accommodate gas processing expansions at Natrium and the first 200-MMcfd of processed volumes at the Berne gas plant in Monroe County, Ohio.

Fractionation capacity at Natrium will be expanded to 126,000 b/d by March 2015, the company has said, providing increased ethane recovery and accommodating future NGLs from an expansion of processing capacity at Berne.

A 30-mile Y-grade pipeline will carry liquids from the Berne complex to Natrium for fractionation.

Middle East, Asia, Africa

In Iraq a year ago, Basra Gas Co. awarded a front-end engineering design contract for NGL processing in Iraq to Technip, in partnership with China HuanQiu Contracting & Engineering Corp.

The contract is for Ar Ratawi NGL Train 1 at North Rumaila, Basra Province. Basra Gas is a joint venture among the Iraq South Gas Co. (51%), Shell (44%), and Mitsubishi (5%).

According to the Technip announcement, the project is the first of new greenfield associated gas processing that will reduce gas flaring in Iraq and make more energy available for power and domestic use. The NGL train will have a nominal feed capacity of 530 MMcfd and produce LPG, NGL, and condensate for domestic markets (OGJ Online, Apr. 10, 2013).

In May last year, Saudi Aramco awarded India's Larsen & Toubro (L&T) a $300 million construction contract that included a 75-MMcfd gas processing plant for its Midyan gas field, according to area media. The reports pegged condensate production at 4,500 b/d.

In July, Saudi Aramco announced plans to build a 1-bcfd gas plant at al-Fadhili oilfield. The new plant will be able to handle streams from Khursaniyah and Hasbah fields. Gas from Hasbah is known to have high levels of H2S, CO2, and nitrogen.

Scheduled for start-up in 2018, the plant would deliver 520 MMscfd residue gas to area markets.

On the Red Sea coast at Duba, Aramco plans a large gas plant to handle production from Ahmar-1 non-associated gas field off Saudi Arabia's northwestern Tabuk Province.

In December last year, Saudi Aramco awarded subsidiaries of Foster Wheeler's global engineering and construction group contracts for engineering and project management for developing the Fadhili gas program in the eastern province of Saudi Arabia (OGJ Online, Dec. 20, 2013).

Foster Wheeler is executing front-end engineering and design for the 1.5-bcfd grassroots Fadhili plant to handle nonassociated natural gas. In addition to the plant, Foster Wheeler's scope will include the onshore Khursaniyah upstream facilities, the Fadhili downstream pipelines, a residential camp, and industrial support at the new plant.

The new Fadhili gas plant will be about 19 miles southwest of the existing Khursaniyah gas plant (OGJ Online, June 26, 2007; Apr. 25, 2012).

In India last year, Oil and Natural Gas Corp. announced plans to spend $1.7 billion to build an integrated gas processing plant in the state of Maharashtra. It will be built near the Kelwa-Mahim area with a processing capacity of about 35 MMcfd. The project will also have a 30-Mw power plant.

The new plant was designed to process gas from C-24 field and B-12 fields in Tapti Daman Block of the western offshore basin.

In Pakistan earlier this year, Pakistan Oilfields Ltd. commissioned the Makori gas processing plant. The plant was gradually ramping up and as of March was handling 23-25 MMcfd and producing 4,500-5,500 b/d of crude oil and condensate. In addition, production of around 200 tonnes/day of LPG was added to the production inventory since Mar. 3.

Earlier this year, Angola LNG announced it had sold its first LPG cargo to Angola's state oil and gas company Sonangol. All LPG and condensate products have been committed for sale to the shareholder affiliates of Angola LNG, said the company.

The sale followed the commissioning of an LPG and condensate jetty; a second jetty for pressurized butane will serve local Angolan markets.

In Egypt in February this year, Dana Gas conducted major maintenance and tie-in work at its El Wastani gas plant.

The work involved equipment upgrade to allow an increase of inlet-gas capacity to 200 MMscfd from 160 MMcfd. The additional capacity was to allow increased gas production from Salama-Tulip, Faraskur, and South Abu El Naga fields with a new pipeline tie-in, said the company announcement.

Expected sales from the plant, company officials told OGJ, will be about 5,300 b/d of condensate and 300 tonnes/day of LPG, depending on

The scheduled maintenance also includes modifications, modernization, and debottlenecking at the plant.

Finally, in March of this year, Ghana National Petroleum Corp. was to reach mechanical completion on the $750-million onshore Atuabo gas plant to process natural gas production from Jubiliee field offshore.

Reuters cited in March the state oil company Ghana National Petroleum Corp. as saying the 150-MMcfd gas plant, in the Ellembele District in the western region, will start up in September.

Tullow Ghana Ltd. operates the field in partnership with GNPC, Kosmos, Anadarko Corp., and Petro SA, formerly Sabre Oil.

Correction

The photograph in "ExxonMobil publishes assay for Kearl oil sands diluted bitumen" (OGJ, May 5, 2014, p. 106) was provided by ExxonMobil Corp.