OGJ Newsletter

GENERAL INTEREST — Quick Takes

EPA cuts 2013 cellulosic-ethanol mandate

The US Environmental Protection Agency lowered the amount of cellulosic ethanol required in 2013 to the amount actually produced, relieving refiners and importers of the need to buy credits to cover shortfalls against the earlier mandate.

The adjusted volume is 810,185 ethanol-equivalent gal. The earlier requirement, published on Aug. 15, 2013, was 6 million gal.

EPA made the change in response to petitions for reconsideration from the American Petroleum Institute and American Fuel & Petrochemical Manufacturers.

AFPM welcomed the move. "I expect EPA to use the same rational thinking to revise its proposed 2014 ethanol and biodiesel requirements, which are already long overdue," said AFPM Pres. Charles T. Drevna.

He said EPA has proposed a mandate of 17 million gal of cellulosic ethanol for 2014 and noted production of the material in the first quarter totaled less than 75,000 gal.

Because commercialization of cellulosic ethanol has been slow to develop, EPA is using regulatory discretion to set mandates below statutory levels. The Energy Independence and Security Act of 2007 set the requirement for cellulosic ethanol in 2014 at 1.75 billion gal.

Roc, Horizon Oil to join in 'merger of equals'

Roc Oil Co. Ltd. and Horizon Oil Ltd., both of Sydney, have proposed a merger to create a significant Asian exploration and production company.

Calling it an all-scrip merger of equals, the two companies announced they have entered into a merger implementation deed whereby they will merge via a Horizon scheme of arrangement.

Horizon shareholders will receive 0.724 of a Roc share for each Horizon share held. The figure is based on the exchange ratio implied by the 10-day VWAP of Horizon and Roc shares ending on Apr. 24—the last day of trading prior to the announcement.

Following completion of the merger Roc shareholders will own about 42% of the merged entity while Horizon shareholders will have 58%.

The merger proposal has support of both Roc and Horizon boards.

When implemented, the merger will create a company with a market capitalization of $800 million (Aus.), net 2P reserves of 36.9 million bbl of oil equivalent (95% liquids), and net 2C contingent resources of 120.7 million boe.

The combined portfolios include assets across China, Papua New Guinea, Malaysia, Myanmar, Australia, and New Zealand along with a strong cash flow and numerous growth options through appraisal and exploration prospects.

Current Horizon Chief Executive Officer Bent Emmet will become chief executive officer and managing director of the merged entity. The senior management team will be drawn from the two companies' existing teams. Mike Harding, current Roc chairman, will chair the new entity. Horizon Chairman Fraser Ainsworth, meanwhile, will be appointed a nonexecutive director of the new group.

The timetable for implementation of the merger begins with the first court hearing to approve the scheme booklet in June followed by circulation of the booklet to Horizon shareholders later the same month. A scheme meeting of Horizon shareholders will take place in late July followed by a second court hearing to approve the scheme in August. Merger implementation is expected to take place by the end of August.

Encana to sell assets in East Texas for $530 million

Encana Oil & Gas Inc., a wholly owned subsidiary of Encana Corp., has reached an agreement with an undisclosed buyer to sell certain properties primarily in Leon and Robertson counties in East Texas for $530 million, effective Apr. 1. The deal is expected to close in the second quarter.

The combined areas make up 90,000 net acres with average production in 2013 of 100 MMcfd of natural gas and 1,200 b/d of total liquids. The properties' yearend 2013 total estimated proved reserves were just more than 200 bcf of gas equivalent, 97% of which was natural gas.

Noble to appoint CEO

Noble Energy Inc. reported that Charles D. Davidson, chairman and chief executive officer, plans to retire and leave the company's board effecitve May 1.

The board will propose the election of David L. Stover, Noble's president and chief operating officer since 2009 (OGJ Online, Dec. 16, 2002; Aug. 1, 2006; May 1, 2009), as a director at its Apr. 22 organizational meeting following the annual meeting, and intends to appoint him as chief executive officer in October.

Davidson, who has been chief executive officer and director since joining Noble in 2000, will serve as the company's chairman until the 2015 annual meeting.

BG Group chief executive resigns

BG Group's board has accepted Chris Finlayson's resignation as chief executive and executive director, effectively immediately. Andrew Gould, BG nonexecutive chairman, will take over as interim executive chairman until a permanent replacement is appointed, the company said.

A recruitment process to find an external successor to Finlayson is under way. Gould will return to his role as nonexecutive chairman once the company finds a new chief executive.

The company has withdrawn the resolution to reelect Finlayson as a director at this year's annual general meeting.

Exploration & Development — Quick Takes

Stone discovers oil in deepwater Cardona South well

Stone Energy Corp., Lafayette, La., encountered more than 275 ft of net oil pay in three separate sections of the deepwater Cardona South well on Mississippi Canyon Block 29 in the Gulf of Mexico.

Stone said the Cardona South success extends the productive zone of the MC Block 29 TB-9 well to the adjacent fault block to the south and sets up a potential second and third well in the fault block.

The company plans to flow the Cardona South well along with the Cardona discovery to the Stone-owned and operated Pompano platform contracted from Ensco PLC in April 2013 (OGJ Online, Apr. 9, 2013).

"The success of the Cardona South well and the previously announced Cardona well allows us to move forward with our accelerated development program," said David H. Welch, Stone chairman, president, and chief executive officer.

"We expect to begin production early in 2015, less than 1 year after spudding the first Cardona well, and we expect volumes from these two wells to more than double our deepwater oil production. These two successful wells, combined with the Amethyst and Tomcat discoveries in February, have provided a great start to our 2014 exploration and development drilling program," Welch said.

Production casing has been set and cemented in the Cardona South well and subsea tree equipment will be put in place. The rig will then move back to the original Cardona well to commence completion operations before returning to complete the Cardona South well.

The original Cardona well was previously estimated to have 84 ft of net oil pay, but Stone indicated that further evaluation has brought the estimated net oil pay to 96 ft (OGJ Online, Feb. 25, 2014).

Stone operates and owns the Cardona South well with 65% interest, which was acquired from BP PLC in 2011 (OGJ Online, Nov. 21, 2011).

Statoil drills, cases Southern Georgina basin well

Statoil Australia Theta BV has successfully drilled and cased the OzAlpha-1 well in exploration permit 104 in the Southern Georgina basin of Australia's Northern Territory.

All open hole well evaluation activities have been completed and are now being analyzed. A total of 196 m of core were recovered in a continuous coring process, which penetrated the Lower Arthur Creek and Thorntonia formations.

However, partner PetroFrontier Corp. specified that it's too early to tell if the well will be selected for completion and testing, as that decision has to consider the continuing evaluation work and the results of future wells not yet drilled.

PetroFrontier previously reported encouraging oil and gas indications at EP 104 and two other horizontal wells in southern Georgina (OGJ Online, Sept. 5, 2012). A 2D proprietary seismic program consisting of 385 line-km on exploration permits 103, 104, 127, and 128 was commenced in July 2013 (OGJ Online, July 22, 2013).

Operator Statoil plans to drill as many as five wells and complete and test as many as three wells this year.

The company has moved the rig to the former Owen-3H location to abandon that well in accordance with Australian regulations. The rig will subsequently be moved to OzBeta-1, the second well location of the five-well program, in EP 127.

PetroFrontier holds 100% interest in EP 103/104 and EPA 213/252, and 75% in EP 127-128 (OGJ Online, June 12, 2013).

Tullow drills dry hole offshore Mauritania

Tullow Oil PLC reported it did not find hydrocarbons with its Tapendar-1 exploration well drilled in the C-10 license offshore Mauritania. Tullow said it will plug and abandon the well.

The objective of Tapendar-1 was to test two targets of Miocene and Upper Cretaceous age. At the Miocene interval a major undrilled turbidite fairway was penetrated and encountered excellent quality, well developed reservoir sands. However, these sands were water-bearing at this location, Tullow said.

The deeper Upper Cretaceous target tested a salt flank play, which did not encounter sands at this location. The well reached total depth of 3,752 m. After the well is plugged and abandoned, the Stena DrillMax drillship will leave Mauritania.

Tapendar-1 is the second exploration well in Tullow's Mauritania exploration campaign, following the Fregate-1 well, which was drilled in February.

Tullow, which has a significant exploration position offshore Mauritania, stated that a variety of exploration prospects and plays in the area, independent of the Tapendar and Fregate results, remain highly prospective.

Data from the Fregate-1 and Tapendar-1 wells will now be analyzed and integrated into the seismic data previously acquired across Tullow's Mauritania acreage before the next well locations and timings are confirmed. Seismic acquisition in Blocks C-3 and C-18 will also continue this year.

Tullow operates the C-10 license with 59.1% interest, partnering with Premier Oil PLC 6.23%, Kuwait Foreign Petroleum Exploration Co. 11.12%, Petronas 13.5%, and SMHPM 10%.

Lukoil starts 2D seismic survey on Block 10 in Iraq

OAO Lukoil has started a 2D seismic survey on Block 10 in southern Iraq that is expected to cover 2,000 km within 16 months. BGP Inc. is the seismic contractor.

Block 10 is in Dhi Qar and Mutanna provinces, 120 km west of Basra. Lukoil Overseas has a 60% share of the block and Inpex Corp. has 40%. The contract holder is Iraq's state-run South Oil Co.

Lukoil was granted exploration and production rights in Block 10 during a licensing round in June 2012.

In addition to the seismic survey, the Mandatory Geologic Exploration Program includes drilling one exploration well.

Drilling & Production — Quick Takes

Bakken production surpasses 1 billion bbl mark

Continental Resources Inc., Oklahoma City, Okla., cited data from IHS indicating that the Bakken field surpassed 1 billion bbl of light, sweet crude oil produced during the first quarter.

Two-thirds of the total was produced in the last three years, Continental pointed out.

The company is the largest producer, driller, and leaseholder in the field, with more than 1.2 million acres, the largest remaining reserves, and the most advanced delineation program in the deeper Three Forks benches (OGJ Online, Apr. 2, 2014).

Continental in 2013 estimated 32 billion bbl of oil to be recoverable at a 3.5% recovery factor, 36 billion bbl at 4%, and 45 billion bbl at 5%. USGS said a mean of 8 billion bbl of oil and natural gas liquids remains to be discovered (OGJ, May 20, 2013, p. 19).

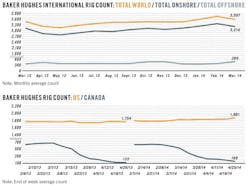

Baker Hughes: US drilling rig count leaps to 1,861

The US drilling rig count jumped 30 units to reach a total of 1,861 rigs working during the week ended Apr. 25, Baker Hughes Inc. reported. The US now has 107 more rigs working compared with this week a year ago.

Land-based rigs accounted for most of the gain, collecting 28 units to 1,793. The other 2 were offshore rigs, which now total 54. Rigs drilling in inland waters, at 14, were unchanged from a week ago.

Oil rigs were up 24 units to 1,534; gas rigs, meanwhile, increased 7 units to 323. Rigs considered unclassified dropped 1 unit to settle at 4.

Horizontal drilling rigs shot up 21 units to 1,245. Directional drilling rigs rose 2 units to 218.

Canada's rig count took a 31-unit hit, leaving that country's total at 168—still 46 more than this week a year ago. The total was almost evenly split between oil rigs, which dropped 16 units to 69, and gas rigs, which fell 15 units to 99.

The largest increase of the major oil- and gas-producing states again came in Texas, where 10 more units came online to bring the state's total to 894. Neighboring Oklahoma gained 5 units to 192. West Virginia rose 4 units to 27. Kansas tallied 3 units to 31. Louisiana, New Mexico, Colorado, and Pennsylvania each were up 2 units to 112, 91, 64, and 61, respectively. North Dakota, Wyoming, and California each collected 1 unit to reach respective totals of 179, 50, and 41.

Three states were unchanged from a week ago: Utah at 27, Arkansas at 12, and Alaska at 9. Ohio, which now has 35 units, was the only state to lose a rig.

The Marcellus was the only major US basin to experience significant movement, rising 6 units to 87.

PROCESSING — Quick Takes

Pemex lets contracts for two refineries

Pemex Refining, a division of Mexico's Petroleos Mexicanos, has let contracts to a joint venture of Foster Wheeler and partner Altair Strickland LLC for work at two of the company's Mexican refineries.

Under the contracts, the joint venture will provide engineering, design, procurement, construction, commissioning, and start-up of slide valve systems on delayed coker units at the 275,000-b/d Hector R. Lara Sosa refinery in Cadereyta, Nueva Leon, and the 190,000-b/d Francisco I. Madero refinery in Ciudad Madero, Tamaulipas.

Both projects are scheduled to be completed during refinery turnarounds in 2015, said Foster Wheeler.

While specific contract values were not disclosed, Foster Wheeler did include them in its fourth-quarter 2013 bookings, the company said.

Contract let for Chinese isobutane unit

Shandong Chengtai Chemical Industry Co. Ltd. has let a contract to CB&I for the license and engineering design of a grassroots isobutane dehydrogenation unit to be built in Changyi, Shandong Province, China.

Under the contract, CB&I will equip the unit with Clariant International Ltd.'s CATOFIN dehydrogenation technology and CATOFIN catalyst to process isobutane feed for the production of 114,000 tonnes/year of isobutylene, the company said.

Isobutylene will be used as a building block to produce methyl tertiary butyl ether and other downstream products, according to CB&I.

Takreer lets contract for Ruwais refining complex

Abu Dhabi Oil Refinery Co. (Takreer), through a contractor, has let a contract to Metso Corp. to supply valve technology to its 350,000-b/d Ruwais refining complex about 385 miles west of Abu Dhabi City in the United Arab Emirates.

As part of the contract, Metso will deliver its Neles Globe control and on-off valves, most of which are equipped with technology aimed at performance follow-up and predictive maintenance to boost process efficiency and uptime, Metso said.

The valves will be installed in a carbon black and delayed coking plant currently under construction at the Ruwais complex, according to the company.

A value of the valve-supply contract was not disclosed.

Scheduled for completion in December 2015, the plant will process 30,000 b/d of crude and produce 40,000-tonnes/year of carbon black, Metso said.

Samsung Engineering of South Korea will provide project management services for the engineering, procurement, construction, and commissioning processes for the project on a turnkey basis, Metso added.

Takreer previously announced a $10 billion expansion of the Ruwais refinery that will add 417,000 b/d of crude capacity, taking the plant to more than 800,000 b/d capacity. The company expects start-up in first-half 2014 (OGJ Online, Dec. 2, 2013).

Neste inks hydrogen contract for Porvoo refinery

Neste Oil Corp. has let a contract to Linde Group, Munich, for long-term hydrogen supply at the 205,000-b/d Porvoo, Finland, refinery.

Under the agreement, Linde will invest in and be responsible for the construction of a hydrogen production plant at the refinery, while Neste Oil will build all necessary piping to connect the plant to the refinery, the companies said.

While the Porvoo refinery already has two hydrogen production units, Neste Oil's plan is to replace hydrogen output from the oldest of these units with production from the new, more efficient unit, the companies said.

Construction work on the $139 million project will start immediately, with the unit scheduled to be commissioned in summer 2016, according to Neste Oil.

AGA, a subsidiary of Linde, will act as the plant's operator.

New Zealand refinery extends maintenance

Bad weather and additional repairs have led to a delay in planned maintenance that began in March at New Zealand Refining Co. Ltd.'s (NZRC) 107,000-b/d Marsden Point refinery at Northland on the North Island's east coast (OGJ Online, Mar. 4, 2014).

While work on a number of key units related to the shutdown is already finished, inclement weather and the need for additional repair work has delayed completion of the scheduled maintenance on the refinery's hydrocracker and associated units until this week, NZRC said.

The company previously had expected the planned maintenance project, which included work to improve yields from the hydrocracker, to be completed in early April (OGJ Online, Mar. 4, 2014).

During the extended shutdown period, NZRC said it has been working closely with customers on supply planning and will continue to do so for the duration of the shutdown.

The refinery continues to produce fuel products through key processing units that have not been affected by the shutdown, NZRC said.

The extended shutdown of the refinery's hydrocracker will result in an undisclosed impact on NZRC's margin, as the ability to upgrade lower-cost feedstock into high-value products remains limited with the unit still off line, the company said.

TRANSPORTATION — Quick Takes

El Paso to buy gas assets from KMI for $2 billion

El Paso Pipeline Partners LP, a Kinder Morgan Inc. subsidiary, has agreed to acquire 50% interest in Ruby Pipeline, 50% interest in Gulf LNG, and 47.5% interest in Young Gas Storage from Kinder Morgan for $2 billion, effective Apr. 30.

The transaction, expected to close in May, includes $1.012 billion of proportionate debt at Ruby and Gulf LNG, resulting in an equity purchase price of $972 million.

The 680-mile, 42-in. Ruby system extends from Wyoming to Oregon, providing gas supplies from the major Rocky Mountain basins to California, Nevada, and the Pacific Northwest.

The Gulf LNG terminal in Pascagoula, Miss., contains 6.6 bcfd of storage capacity and 1.5 bcfd of peak vaporization send-out capacity. It's in the process of developing the proposed Gulf LNG Liquefaction Project, which will add liquefaction and export capabilities at the existing terminal.

Young Gas Storage is in Morgan County, Colo., and has a working gas storage capacity of 6 bcf.

"As mentioned on our first quarter earnings call, a recent study (Wood Mackenzie) calls for US natural gas demand to increase by over 30% in the next 10 years to approximately 94.5 bcfd," said Richard D. Kinder, El Paso chairman and chief executive officer.

El Paso, acquired by Kinder Morgan in 2011, owns an interest in or operates 13,000 miles of interstate natural gas transportation pipelines in the Rockies and the Southeast, natural gas storage facilities with a capacity of nearly 100 bcf, and LNG assets in Georgia (OGJ Online, Oct. 17, 2011).

Gazprom: South Stream gas line construction on schedule

OAO Gazprom says the South Stream gas pipeline project is "progressing in strict compliance with the schedule."

From Russia, South Stream gas pipeline will cross the Black Sea to southern and central Europe.

"Only South Stream may offer now extra guarantees of energy security to Europe," said Alexey Miller, chairman of Gazprom's management committee.

Gas production will be delivered starting in late 2015. The pipeline is expected to reach full capacity of 63 billion cu m in 2018.

Gazprom said 8,500 jobs would be created in Bulgaria, Serbia, Hungary, Slovenia, and Croatia in building and operating South Stream.

Gazprom said Bulgaria is expected to sign contracts "soon" for equipment procurement, installation, personnel training, and commissioning of a pipeline section. Similar activities are being carried out in Serbia.

Main construction operations in Bulgaria and Serbia are scheduled for this summer.

In Hungary, front-end engineering and design work is under way, along with spatial planning and environmental impact assessment (EIA) activities.

Spatial planning and EIA also are in progress in Slovenia. Bids to design the Slovenian section will be announced before the beginning of summer.

In Croatia, a draft contract and scope of work for devising project documentation are being negotiated.

The investment concept is being developed for constructing a gas branch to Macedonia.

Gazprom has also started examining the possibility of creating a gas pipeline section in Austria simultaneously with the Slovenian section (OGJ Online, Apr. 24, 2014).

The offshore pipeline laying will begin this autumn.

The Russkaya main compressor station, South Stream's starting point, will have installed capacity of 448 Mw. Work on the station will be completed this year.

Large-scale construction continues on the Southern Corridor gas trunkline system to feed gas to South Stream.

Opal gas processing plant shut down after explosion

Williams Partners LP and Williams reported an explosion and fire at about 2 p.m. MST on Apr. 23 affecting the TXP-3 cryogenic processing train at their natural gas processing plant in Lincoln County, Wyo., near the town of Opal. There were no reported injuries or damage to property outside the plant. TXP-3 is one of five cryogenic trains at the plant.

Williams reports immediately shutting down the Opal plant and activating emergency procedures. First-responders evacuated an area including the town of Opal and closed Highway 30 near the plant. Williams is making accommodations for the displaced residents.

Natural gas gathering from surrounding producing areas is temporarily suspended as a result of the incident. Williams is evaluating alternatives that would allow restoration of gas production as soon as possible.

The Opal plant processes gas gathered from wells in the area and produces NGL. It has an inlet capacity of 1.5 bcfd. Recent volumes have been roughly 1 bcfd, Williams said.

Gas pipeline data from Genscape Inc. show five nomination points that actively receive gas from Opal processing plants in the past 2 weeks. The aggregate flow of these five points in the week before the explosion was 992 MMcfd. Since the explosion happened in the middle of the gas day, nominations dropped by 477 MMcf on Apr. 23 to 516 MMcf. Nominations dropped to zero for today. The data compiled nominations on Kern River Gas Transmission, Colorado Interstate Gas, Northwest Pipeline, Ruby Pipeline, and Rockies Express to derive an output for Opal.

Williams is still evaluating the extent of damage to the facility and does not have a timeline yet for return to service. The company said it will conduct a thorough investigation into the cause of the incident in cooperation with regulators.

ExxonMobil starts production at PNG LNG project

ExxonMobil Corp. affiliate ExxonMobil PNG Ltd. reported the early start of LNG production from the $19 billion Papua New Guinea LNG project's first train. The project, which is expected to produce more than 9 tcf of gas over an estimated 30 years of operations, remains on target to send out its first LNG cargo to Asia before midyear, ExxonMobil said.

Work on the second train is progressing, ExxonMobil said, and LNG production from that unit is expected to start in the next several weeks.

The project is an integrated development that includes gas production and processing facilities in the Southern Highlands, Hela, Western, Gulf, and Central provinces of Papua New Guinea. About 435 miles of pipeline connect the facilities, which include a gas conditioning plant and liquefaction and storage facilities with capacity of 6.9 million tonnes/year of LNG.

ExxonMobil expects Asian LNG demand to rise by 165%—to 370 million tpy—between 2010 and 2025.

Williams to supply Sabine Pass LNG via Gulf Trace

Williams Partners LP and its wholly owned subsidiary Transcontinental Gas Pipe Line Co. LLC (Transco) plan to build Gulf Trace, a 1.2-million dekatherm/day (1.16 bcfd) expansion of the Transco pipeline system to serve Cheniere Energy Partners LP's Sabine Pass Liquefaction project being developed in Cameron Parish, La. Sabine Pass Liquefaction LC will be Gulf Trace's anchor shipper. Williams will hold a binding open season, scheduled to end May 8, to gauge additional market interest in the expansion.

The Gulf Trace project will make Transco's production-area mainline and southwest Louisiana lateral systems bidirectional from Station 65 in St. Helena Parish, La. to Cameron Parish, La. In addition to the pipeline reversal, Williams plans to add an 8-mile, 36-in. OD lateral pipeline and two compressor stations to provide firm transportation service to Sabine Pass LNG.

Williams estimates Gulf Trace will cost about $300 million, with a target in-service date of early 2017, subject to approvals.

The Sabine Pass LNG export plant is under construction and scheduled to be completed in phases starting as early as fourth-quarter 2015. Once complete, the Sabine Pass LNG terminal will be the first large-scale LNG export site operating in the US. Sabine Pass Liquefaction's project is supported by long-term contacts with several LNG off-take shippers, including GAIL (India) Ltd., BG Group, and Gas Natural Fenosa (OGJ Online, Dec. 12, 2011).

Unrelated to Gulf Trace, Williams said it is pursuing several other large-volume projects to serve growing domestic demand for natural gas. By yearend 2017, Williams Partners expects to add roughly 3.4 million dekatherms (3.3 bcfd) of natural gas transportation capacity delivering northeast supplies via expansions including the Dalton Expansion Project (OGJ Online, June 1, 2012), Atlantic Sunrise (OGJ Online, Feb. 21, 2014), Leidy Southeast (OGJ Online, Aug. 3, 2012), Virginia Southside (OGJ Online, Nov. 22, 2013), and others.