US, Canadian oil, gas firms' fourth-quarter 2013 earnings slip

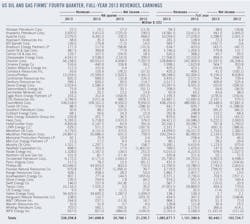

A sample of 53 US-based oil and gas producers and refiners posted a collective decrease of 2% in fourth quarter earnings and an 11% decrease in full year 2013 earnings compared with the same periods in 2012.

Lower refining margins relative to 2012 have played a key role in shrinking downstream earnings for the fourth quarter as well as full year 2013. Upstream output in the fourth quarter was negatively impacted by factors including field decline, asset sales, and higher costs.

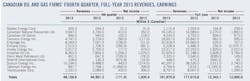

Meanwhile, a group of 13 producers and pipeline operators with headquarters in Canada reported a combined net loss of $171 million (Can.) for fourth-quarter 2013, compared with earnings of $2 billion (Can.) a year ago. The group, however, posted an increase of 3% in earnings for full year 2013 over 2012, mainly reflecting a $3 billion (Can.) loss by EnCana Corp. that occurred in 2012.

Prices, refining margins

In fourth-quarter 2013, crude oil front-month futures prices on the New York Mercantile Exchange averaged $97.45/bbl compared with $88.18/bbl in fourth-quarter 2012. The front-month futures contract on Brent averaged $109.40/bbl in the final quarter of 2013 compared with 110.11/bbl in fourth-quarter 2012.

Front-month NYMEX natural gas futures averaged $3.86/MMbtu in 2013's final quarter compared with $3.54/MMbtu a year earlier. Henry hub natural gas spot prices averaged $3.85/MMbtu in fourth-quarter 2013 compared with $3.40/MMbtu in the comparable quarter in 2012.

US crude oil composite acquisition cost by refiners in the last quarter of 2013 averaged $96/bbl compared with $97.30/bbl a year earlier, according to the US Energy Information Administration.

Cash margins in most refining centers decreased in 2013 from a year ago, according to data from Muse, Stancil & Co. US cash margins for the quarter ended Dec. 31, 2013, averaged $23.23/bbl for the Midwest, $15.04/bbl for the West Coast, $8.43/bbl for the Gulf Coast, and –11¢/bbl for the East Coast. The average cash refining margins in northwestern Europe and Southeast Asia during the quarter were $1.92/bbl and $1.59/bbl, down from respective averages of $6.13/bbl and $3.77/bbl a year earlier.

US producers

In the sample of US oil and gas producers, 16 incurred a net loss for the last 3 months of 2013, and 28 posted a decline in earnings from the final quarter of 2012.

Hess Corp. reported net income of $1.9 billion for the quarter ended Dec. 31, 2013, up from $376 million in fourth-quarter 2012. The company's 2013 full-year earnings were $5 billion, up from $2 billion for the prior year.

For fourth-quarter 2013, the company's oil and gas production was 307,000 boe/d, down from 396,000 boe/d in the same quarter a year before, primarily due to asset sales and extended shutdowns caused by civil unrest in Libya. However, the firm's average worldwide crude oil selling price, including the effect of hedging, was $98.27/bbl, up from $84.46/bbl in the same quarter a year ago. The average worldwide natural gas selling price for the quarter was $6.97/Mcf, compared with $6.60/Mcf from a year ago.

ExxonMobil Corp. reported earnings of $8.35 billion, a 16% decrease from the same period in 2012. The firm's full-year 2013 earnings were $33.4 billion, down from $47.7 billion for 2012.

Upstream earnings from US and non-US operations were $1.18 billion and $5.6 billion for the 2013 fourth quarter, down $418 million and $558 million from the prior year, respectively. Oil-equivalent production for the quarter decreased 1.8% from the fourth quarter of 2012. Natural gas production was 11.9 bcfd, down 654 million bcfd from 2012.

ExxonMobil's worldwide downstream earnings were $916 million, down $852 million from the fourth quarter of 2012, due to weaker margins, mainly in refining. US downstream earnings were $597 million for the fourth quarter 2013, down $100 million from the prior year.

Chevron Corp. reported net income of $4.96 billion for the fourth quarter of 2013 compared with $7.29 billion in the 2012 fourth quarter. Earnings for the full year 2013 were $21.6 billion, down from $26.3 billion for 2012.

The company's worldwide net oil-equivalent production was 2.58 million b/d in the fourth quarter 2013, down from 2.67 million b/d in the 2012 fourth quarter, as production increases from project ramp-ups in the US and Nigeria were more than offset by normal field declines and lower cost recovery volumes.

Chevron's US upstream earnings of $803 million in fourth-quarter 2013 were down $560 million from a year earlier due to lower crude oil production and higher operating, income tax, depreciation, and exploration expenses. International upstream earnings of $4 billion decreased $1.45 billion from fourth-quarter 2012, primarily due to the absence of a gain of $1.4 billion on an asset exchange in Australia and higher exploration expenses.

The company's US downstream earnings of $265 million in fourth-quarter 2013, down from earnings of $331 million a year earlier, mainly due to higher operating expenses reflecting repair and maintenance activity and lower refining margins. International downstream operation earnings were also down $469 million between quarters, as a result of lower gains on asset sales, lower margins, an unfavorable change in price effects on derivative instruments, and higher income taxes.

Anadarko Petroleum Corp. reported a net loss of $725 million for the fourth quarter of 2013 compared with earnings of $190 million for the same quarter in 2012. The company said that the results "included certain items typically excluded by the investment community in published estimates." It said, "In total, these items, which include a Tronox-related loss accrual, decreased net income by approximately $1.15 billion on an aftertax basis." These items have also affected the full-year result. For the year ended Dec 31, 2013, Anadarko reported net income of $941 million, down from $2.4 billion in 2012.

Anadarko's onshore operating areas in the US achieved a 25% increase in oil volumes for full-year 2013 relative to 2012, driven by record-high production in several major growth plays, including the Wattenberg field, Eagle Ford shale, and East Texas/North Louisiana horizontal play. The company's full-year sales volumes of natural gas, oil, and gas liquids totaled 781,000 boe/d, up 7% from 2012.

Refiners

Most independent refiners across the US posted lower fourth-quarter and full-year 2013 earnings compared with the same periods in 2012, primarily due to lower refining margins.

HollyFontier Corp. reported fourth-quarter 2013 earnings of $62.9 million, down from $391.6 million for the quarter ended Dec. 31, 2012, principally reflecting lower fourth quarter refining margins. Refinery gross margins for fourth-quarter 2013 were $10.96/bbl, a 54% decrease from a year ago. For all of 2013, the company's net income totaled $767.8 million, down from $1.76 billion in 2012.

Valero Energy Corp. reported net income of $1.3 billion for the last quarter of 2013 compared with $1 billion for fourth-quarter 2012. Its fourth-quarter 2013 results include a nontaxable gain of $325 million related to the disposition of retained interest in CST Brands Inc. For the year ended Dec. 31, 2013, the company's net income was $2.7 billion, up from $2.1 billion in 2012.

The company's refining segment operating income decreased from fourth-quarter 2012 to fourth-quarter 2013, mainly due to an increase in depreciation and amortization expense, an increase in operating expenses due largely to higher energy costs, and a decrease in throughput margins.

Meanwhile, Valero's ethanol segment earned operating income of $269 million in fourth-quarter 2013 compared with $12 million in fourth-quarter 2012. The increase in operating income was attributed to significantly higher gross margins caused by a decrease in corn prices and low industry ethanol inventories, combined with record high quarterly production volumes. In 2013, the ethanol segment earned $491 million in operating income vs. a loss of $47 million in 2012.

Marathon Petroleum Corp. posted fourth-quarter 2013 earnings of $631 million compared with $759 million in fourth-quarter 2012. Full-year 2013 earnings were $2.1 billion compared with $3.4 billion for all of 2012.

Refining and marketing segment income from operations was $971 million in fourth-quarter 2013 and $3.2 billion for full-year 2013, respectively, compared with $1.14 billion and $5.1 billion in the corresponding periods of 2012. The decrease in refining and marketing segment income for the year 2013 compared with 2012 was primarily due to narrower crude oil differentials and lower net product price realizations, partially offset by higher sales volumes.

Canadian producers

Talisman Energy Inc. recorded a net loss of $1 billion (Can.) for fourth-quarter 2013 compared with earnings of $400 million in the comparable period in 2012, primarily due to impairments. Lower volumes from the UK and lower netbacks in southeast Asia also generated a loss of $116 million from operations, the company said.

The company reported a net loss of $1.2 billion in 2013 compared with a net income of $140 million in 2012. Lower production from the North Sea as a result of the sale of 49% of Talisman's UK business, higher royalties, and lower capitalized interest costs were only partially offset by higher liquids production in the Eagle Ford and Vietnam, lower impairments, and expenses. In addition, 2012 net income reflected gains of more than $1 billion on asset sale and revaluation.

EnCana Corp. reported a fourth-quarter 2013 net loss of $267 million, reflecting the result of the change in EnCana's unrealized hedging position, a foreign exchange loss as well as higher administrative expense associated with the company's organizational restructuring.

Suncor Energy Inc. reported fourth-quarter 2013 earnings of $443 million compared with a net loss of $574 million for fourth-quarter 2012. Net earnings for the prior year's quarter were impacted by aftertax impairments, net of reversals, of $1.48 billion.

In fourth-quarter 2013, the company continued to set quarterly production records in the oil sands segment, with average production volumes of 409,600 b/d compared with 342,800 b/d in the prior year's quarter. The production increase from oil sands operations more than offset the reduced production from the sale of the company's conventional natural gas businesses.

In response to the decline in inland crude prices, Suncor's margins in the refining and marketing segment rose, offsetting a decrease in benchmark crack spreads.

Imperial Oil Ltd. reported fourth-quarter 2013 earnings of $1 billion, roughly flat from same period a year earlier. Due to relatively lower earnings in the first three quarters, the company's full-year 2013 earnings were $2.8 billion, down 25% from 2012.

Imperial Oil's upstream net income in the fourth quarter was $411 million vs. $488 million in the same period of 2012, primarily due to lower liquids realizations and the company's share of higher Syncrude royalty costs. With the Kearl project start-up and Celtic acquisition, fourth-quarter gross production averaged 329,000 boe/d, up from 285,000 boe/d in 2012.

As a result of the Dartmouth refinery closure in the third quarter and planned maintenance activities at the Nanticoke refinery, the company's refinery throughput averaged 387,000 b/d in the quarter, down from 468,000 b/d in 2012. In the meantime, downstream earnings were $625 million—the highest downstream quarter in company history, thanks to higher marketing margins of about $70 million.

TransCanada announced earnings of $420 million for fourth-quarter 2013, up 37% from the prior year, as higher earnings from the Canadian Mainline, the NGTL System, Keystone, and Bruce Power were partially offset by lower contributions from US Natural Gas Pipelines and Western Power.