OGJ Newsletter

GENERAL INTEREST — Quick Takes

EU axes national renewable-energy goals

The European Union will abandon national mandates for renewable-energy use after 2020 under a framework on climate and energy for 2030 proposed Jan. 22 by the European Commission.

Binding national renewable-energy targets now in effect are widely blamed for soaring energy costs in Europe. The EU imposed the targets in 2009 in an effort to raise the renewable share of total EU energy consumption to 20% by 2020.

The renewable-energy mandates supported an EU goal of lowering emissions of greenhouse gases by 20% from 1990 levels by 2020.

In the new framework, which extends the effort through 2030, the EC raises the legally binding target for GHG emission cuts to 40%, to be met through domestic measures.

The new framework raises the target for renewable energy to 27% of total energy by 2030 but doesn't provide for translation of the target into national targets through EU legislation.

US appeals court won't allow rehearing of LCFS lawsuit

A federal appeals court in California refused to accept a petition to rehear a challenge to the state's low-carbon fuel standard (LCFS), which three of the court's judges dismissed last year. The ruling could be appealed to the US Supreme Court.

A majority of the 9th US Circuit Court of Appeals said it would not let the case, in which ethanol producers and the American Fuel & Petrochemical Manufacturers argued the requirements discriminate against out-of-state ethanol producers, be argued before a larger panel of judges.

"Although the LCFS clearly discriminates against fuels produced in other states and violates the Commerce Clause of the US Constitution, the 9th Circuit chose to deny our petition and uphold this biased law," AFPM General Counsel Richard Moskowitz said in response to the court's Jan. 22 denial of rehearing.

"The broad reach and intended scope of the California LCFS mean that the 9th Circuit's decision will have adverse consequences throughout the nation's fuel supply chain far beyond California's borders, and ultimately a negative impact on consumers," he continued.

"AFPM agrees with the seven dissenting judges who would have granted further review because the original decision ‘contravenes black letter law' and is ‘inconsistent with Supreme Court precedent,'" Moskowitz said. The trade association will evaluate options regarding further court proceedings in coming weeks, he added.

Old onshore concession ends in Abu Dhabi

Abu Dhabi National Oil Co. (ADNOC) has become the sole shareholder of Abu Dhabi Co. for Onshore Oil Operations (ADCO) after the expiration this month of a 75-year-old concession involving participation by international oil companies.

Previously, ADNOC held a 60% interest in its onshore operating subsidiary. Other interests were BP, ExxonMobil, Shell, and Total, 9.5% each, and Partex, 2%.

The international companies participated under production-sharing terms that, according to the US Energy Information Administration, valued crude oil at $1/bbl.

In a country profile issued last month, EIA estimated that in 2012 ADCO produced oil from its main fields at rates of 430,000 b/d from Asab, Sahil, and Shah (SAS); 360,000 from Bab; 550,000 b/d from Bu Hasa; and 100,000 b/d from Dabbiya, Rumaitha, and Shanayel (Northeast Bab).

ADCO has projects under way to raise production from Bu Hasa, Bab, and the SAS fields by 200,000 b/d. Its concession covers shallow offshore as well as onshore fields.

The International Energy Agency said in its January Oil Market Report that ADNOC has invited 10 companies to seek new onshore contracts. The companies include the former partners as well as Rosneft, Eni, Statoil, Korea National Oil Corp., and China National Petroleum Corp.

Shell, Mubadala swap Malaysian interests

Mubadala Petroleum, Abu Dhabi, has agreed with Shell to swap equity interests in two exploration blocks offshore Malaysia.

Mubadala acquires a 20% interest in deepwater Block 2B from Shell, and Shell acquires a 20% interest in Block SK320 from Mubadala. State owned Petronas Carigali participates in both blocks.

On Block SK320, operator Mubadala recently made a third natural gas discovery with the Sintok-1 well (OGJ Online, Dec. 17, 2013). Mubadala said it will plug that well and drill another prospect, Sirih, nearby. Other discoveries on the block are named Pegaga and M5.

Shell operates Block 2B, which is adjacent to Block SK320.

Exploration & Development — Quick Takes

Norway makes offers for 65 licenses in APA 2013

Offers will be sent to 48 companies for 65 new oil and gas production licenses on the Norwegian continental shelf, according to the Norwegian Petroleum Directorate. The offers are being issued after the authorities have evaluated applications from 50 companies in the Awards in Pre-defined Areas 2013 (APA 2013).

The greatest interest by companies was shown for the northern part of the North Sea and central part of the Norwegian Sea, NPD noted. Of the 65 production licenses, 38 are in the North Sea, 19 in the Norwegian Sea, and 8 in the Barents Sea. Seventeen of the production licenses are additional acreage to existing production licenses. Ten of the licenses are divided stratigraphically and only apply to levels below and above a defined stratigraphic boundary.

A record number of companies applied for available acreage this year.

"It is clear that the oil companies still consider it interesting to explore for oil and gas in mature areas," said Sissel Eriksen, NPD exploration director.

She believes the interest stems from familiar geology, and notes that several of these areas have a time-critical infrastructure. Exploring the nearby areas in order to realize the resource potential is therefore urgent.

Of the companies that applied, 48 will receive offers of ownership interests in at least one production license. Twenty-nine companies will be offered operatorship. Petoro will participate as a licensee and will manage the state's direct financial interest in 12 production licenses.

Eleven areas require the acquisition of new seismic, and a firm well must be drilled in the southern North Sea. For the other production licenses there are "drill or drop" conditions. This means that the licensees have 1-3 years to decide whether they want to drill an exploration well. If they do not wish to drill an exploration well, the production license lapses, NPD said.

From the first APA round in 2003, the APA area has been expanded several times. APA 2013 comprised a total of 199,054 sq km, an increase of 860 sq km from APA 2012.

Premier Oil outlines Indonesian drilling plans

Premier Oil PLC reported plans to drill 13 wells in 2014—6 exploration, 2 appraisal, and 5 near-field—that will target more than 160 million boe of net unrisked prospective oil and gas resources.

The company said it will explore further the Lama play on Natuna Sea Block A offshore Indonesia where, in early 2012, it reported flow of 17 MMscfd of gas from fractured Eocene-Oligocene Lama sanstones in Anoa oil and gas field (OGJ Online, Mar. 5, 2012). The first well, to be drilled in this year's first quarter, will test the Ratu Gajah prospect with a gross prospective resource of as much as 700 bcf of gas. Premier Oil also will appraise the Anoa Deep discovery in the fourth quarter.

Elsewhere in Indonesia, the firm plans to spud the Kuda-Singa Laut well in the first quarter. The well will initially test the Kuda Laut segment and then sidetrack to test the adjacent Singa Laut segment, the company said.

India to assess 26 sedimentary basins in 30 months

India plans to assess all 26 sedimentary basins covering 3.14 million sq km in the next 30 months, according to the government's press information bureau.

The last exercise was carried out in 15 basins about 20 years ago. A full-scale revision is warranted because of the vast amount of data collected since then. There also is an urgent need for estimation in the 11 other basins as no hydrocarbon resources have been estimated thus far.

M. Veerappa Moily, minister of petroleum and natural gas, approved creation of a multiorganization team for the task. The Keshav Dev Malviya Institute of Petroleum Engineering (KDMIPE) will act as leader. The director of exploration of Oil & Natural Gas Corp. (ONGC) will serve as chairman and the director of exploration and development of Oil India Ltd. (OIL) co-chairman.

Work teams will prioritize and draw timelines for the completion schedule for each basin. Comprehensive documentation in the form of reports and maps will be generated. Manpower will be drawn from KDMIPE, ONGC, OIL, and professional bodies and consultants.

Lundin Petroleum updates reserves

Lundin Petroleum AB, Stockholm, has reported that its net proved and probable working interest reserves are 194.1 million boe as of Dec. 31, 2013. The company forecasts production of 30,000-35,000 boe/d for 2014.

Lundin's best estimate for contingent resources is 342 million boe—excluding the Johan Sverdrup field, which contains gross 2C of 1,800-2,900 million boe as disclosed by pre-unit operator Statoil. The company forecasts 50,000 boe/d production in 2015. This estimate includes full production from the Brynhild field and the start-up of the Boyla, Bertam, and Edvard Grieg fields in 2015.

Drilling & Production — Quick Takes

SAFE: More oil production doesn't guarantee US security

More US oil production potentially could provide real security benefits, but the nation will continue to be affected by global events, Securing America's Future Energy (SAFE) said in a recent report.

The study, "Oil Security 2025: US National Security Policy in an Era of Oil Abundance," was the first to analyze the US production boom in the national security context, SAFE said. The report was released Jan. 15 in New York by SAFE's energy and geopolitics commission.

"The United States will only experience the full benefits of the domestic oil boom by working to help improve stability in the global oil market and decrease the nation's exposure to it," the committee's co-chairmen—Dennis Blair, a former US National Intelligence Director, and Michael W. Hagee, a former US Marine Corps Commandant—said in a joint statement issued with the study.

"Our political leaders should prioritize long-term political stability in major oil-producing regions, enhance the international community's capability to respond to oil supply crises that will inevitably occur, and diversify energy sources in the transportation sector away from oil to electricity and natural gas," they suggested.

Camac secures long-term FPSO contract

Camac Energy Inc. said it has signed a letter of intent regarding terms and conditions of a long-term agreement for the Armada Perdana floating production, storage, and offloading vessel.

The agreement encompasses an initial term of 5 years beginning Jan. 1, with an automatic extension for an additional 2 years unless terminated by Camac with prior notice. The parties are working toward executing a definitive agreement on or before Jan. 31.

The Armada Perdana FPSO can process as much as 40,000 b/d of oil and has a storage capacity of 1 million bbl. It currently supports production of 2,000 b/d of oil and 40 MMcfd of natural gas from the Oyo field offshore Nigeria in OML 120.

Camac has proceeded with the roadshow presentation to institutional investors for the proposed $300 million bond offering that will provide the company with the capital to complete Oyo-7 and drill and complete Oyo-8 and 9. Pro forma closing of the Allied Energy PLC transaction, these three wells will bring online a total of 21,000 b/d of oil net.

The Oyo-7 well encountered oil and gas in the producing Pliocene reservoir in October (OGJ Online, Oct. 16, 2013), and in November confirmed the presence of oil in Miocene (OGJ Online, Nov. 13, 2013).

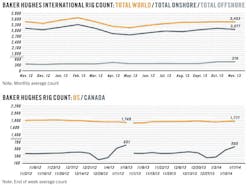

Baker Hughes: US drilling rig count jumps to 1,777

Land rigs accounted entirely for the sharp 23-unit increase in the US drilling rig count during the week ended Jan. 17, Baker Hughes Inc. reported. The US now has 1,777 rigs working.

Rigs drilling offshore and in inland waters each were unchanged from a week ago, remaining at respective totals of 57 and 20.

Oil rigs grew by 15 units to 1,408 while gas rigs gained 8 units to 365. Rigs considered unclassified remained at 4 total, unchanged from last week.

Horizontal drilling rigs claimed 15 more units to reach 1,173 as directional drilling rigs relinquished 5 units to settle at 219.

For the second consecutive week, Canada experienced a large rise in its rig count, leaping 88 units to 565. A vast majority of those units were oil rigs, which rose 79 units to 379. Gas rigs increased 9 units to 186. Canada now has 36 fewer rigs working compared with this week a year ago.

The state with by far the most rigs reported the most activity for the week, as Texas's count spiked 16 units to reach a total of 841. Oklahoma, with a 3-rig gain to 186, showed the next-biggest rise this week. Colorado collected 2 more units to reach 61. Pennsylvania, Ohio, Utah, Arkansas, and Alaska each edged up a unit to respective totals of 56, 36, 26, 12, and 11. Unchanged from a week ago were North Dakota at 168, Louisiana at 110, and West Virginia and California, each with 34. Of the three states that lost rigs, Wyoming and Kansas fell by 1 unit each to respective counts of 53 and 29, and New Mexico declined 4 units to 77.

Reflecting the movement of their respective states, the Permian basin boasted a 7-unit rise to 478 as the Barnett suffered a 4-unit loss to 28. Also up was the DJ-Niobrara, collecting 4 units to 55.

PROCESSING — Quick Takes

Suriname refinery expansion progresses

Staatsolie, the state oil company of Suriname, has let a services-related contract to Honeywell as part of a major expansion and efficiency project to double crude capacity at the Tout Lui Faut refining complex, about 12 miles south of Suriname's capital city of Paramaribo (OGJ Online, Sept. 9, 2009).

As part of the contract, Honeywell will provide the refinery its manufacturing execution system (MES) to help the plant better manage its production, operations and process visualization, according to a Jan. 21 release from Honeywell.

"With the Honeywell MES solution, our refinery expects to achieve significantly improved operational readiness," according to Rudolf Elias, Staatsolie's project and acting director for refining and marketing.

Once completed, Staatsolie's expansion project—which began in February 2012 and was designed to reduce the country's dependence on imported fuel products—will more than double the refinery's capacity to 15,000 b/d from a current 7,000 b/d to produce high-quality diesel, gasoline and fuel oil (OGJ Online, July 28, 2011).

Commissioning of the expanded refinery, originally slated for 2013, now is scheduled for October 2014, according to Staatsolie and Honeywell.

VRP lets contract for refinery project

Vung Ro Petroleum Ltd. (VRP) has let a services-related contract to Ineos for a 900,000-tonne/year polypropylene project at its grassroots refinery complex in Hoa Tam Commune in the Dong Hoa district of Phu Yen Province, Vietnam.

Under the contract's terms, Ineos will provide its Innovene PP process to the plant for the manufacture of homopolymers, random copolymers and impact copolymers to plant, according to Ineos.

The project, which will allow the plant to produce a wide range of polypropylene grades, is designed to serve growing demand in the Asian market.

The VRP grassroots refinery project—a $4 billion refinery, petrochemical, and seaport development fully financed by foreign investors—will have an 8 million tpy capacity for processing VRP Blend and Arabian Light crudes into products satisfying both Vietnamese and international specifications and standards, according to VRP's web site.

The planned product slate includes gasoline and diesel meeting Euro 5 standards as well as jet fuel, LPG, and fuel oil. In addition to polypropylene, the petrochemical portion of the complex will produce benzene, toluene, and mixed xylene, VRP said.

VRP expects to commission the refinery in 2018.

RIL advances Jamnagar refinery expansion

Reliance Industries Ltd. (RIL), Mumbai, has let a contract to French firm Alstom T&D's Indian division to provide power transformer packages for the continued expansion of the 1.24 million-b/d Jamnagar refining and petrochemical complex in Gujarat, India (OGJ Online, July 6, 2012; May 3, 2012).

Under the scope of the new contract, Alstom will design, engineer, manufacture, supply, supervise construction of, and commission 14 gasification service transformers and three generator step-up transformer packages as part of the third phase of RIL's ongoing expansion of the Jamnagar complex, Alstom said.

In this third phase, or J3, the company will provide transformers to receive power at high voltages, and lower them to acceptable levels for distribution to newly expanded complexes, which include gasification plants, an ethylene cracker complex, and a paraxylene plant, Alstom said.

The contract is valued at 1.06 billion rupees (€13 million), according to Alstom.

TRANSPORTATION — Quick Takes

TransCanada begins Gulf Coast Project shipments

TransCanada Corp. has begun crude oil shipments between Cushing, Okla., and Nederland, Tex., on its Gulf Coast Project pipeline. The 36-in. OD, 485-mile pipeline has an initial design capacity of 700,000 b/d, expandable to 830,000 b/d. Deliveries on the pipeline will be used in the Beaumont-Port Arthur refining center.

The $2.3-billion Gulf Coast Project, which included that addition of 2.25-million bbl of storage at Cushing, would serve as the southern leg of an eventual Keystone XL pipeline. TransCanada last year pushed its in-service date for Keystone XL to second-half 2015 due to continued delays in the project's approval by the US government (OGJ Online, May 6, 2013).

The company is also building the 47-mile, 36-in. OD Houston Lateral to transport crude shipped on the Gulf Coast Project to Houston refineries, and expect to have it complete by this year's fourth quarter. Houston Lateral will cross Liberty, Chambers, and Harris counties and increase refining capacity reachable via the Gulf Coast Project to more than 4 million b/d.

Price Gregory International, a Quanta Services Inc. company, is installing the Houston Lateral.

Enbridge suffers leak on Alberta Clipper line

Enbridge Inc. shut down and isolated a section of its 450,000-b/d Line 67 (Alberta Clipper) crude oil pipeline south of Regina, Sask., Jan. 19 after a 125-bbl release from piping within the Rowatt pumping station. The 36-in. OD pipeline between Hardisty, Alta., and Superior, Wisc., is part of the Enbridge Mainline system.

An initial investigation determined that all free product was contained on site. High winds blew some spray onto the snow of an adjacent farm field, which the company picked up. All regulatory and provincial officials, including emergency response officials, were notified and the source of the release promptly contained.

Enbridge restarted Line 67 about 10½ hours after shutting it down. An investigation into the incident by Enbridge and regulators is under way. There was no impact to the public, wildlife, or waterways, according to Enbridge. The company expects cleanup to be completed this weekend.

Enbridge received approval from Canada's National Energy Board in February 2013 to expand Line 67's capacity to 570,000 b/d. The expansion project includes installing a new pump at eight existing stations, adding four new pumps and an electrical substation at Metiskow Station, and adding a metering terminal and booster pump at Hardisty. Work on the expansion began late-June 2013 and is expected to be completed by July.

W. Australia line to link Dampier-Bunbury trunkline

A $178 million (Aus.) natural gas pipeline is planned in Western Australia to connect the main Dampier-Bunbury trunkline with the Solomon Power Station in the Pilbara region.

The proposed 270-km line will be constructed by a joint venture of the DUET Group (57%) and TransAlta Corp. (43%). TransAlta is the owner-operator of the power station, which it bought from Fortescue Metals Group (FMG) for $357 million (Aus.) in 2012.

Currently, the power station runs on diesel. The plant will be converted to gas with this development.

Solomon supplies power to FMG's operations in the region and the conversion to gas is expected to reduce the company's operating costs by $22.45 million (Aus.)/year.

FMG has secured foundation shipper rights under the gas transport agreement that includes the flexibility to increase gas volumes.

The initial contract for gas supply has been written for 20 years, and the pipeline is slated to come on stream in early 2015. Construction will begin in July.

The development also involves engineering firm Monadelphous, which has signed a $100 million contract with the DUET-TransAlta group to help with the line construction.