OGJ Newsletter

GENERAL INTEREST — Quick Takes

Progress acquires Montney acreage

Progress Energy Canada Ltd., a wholly owned subsidiary of Malaysia's Petronas, has acquired acreage in northeast British Columbia's Montney basin from Talisman Energy Inc. for $1.5 billion (Can.).

In an existing agreement with Talisman, partner Sasol would have been able match the Progress bid within 30 days of the notice from Talisman, but Sasol opted not to exercise its right of first refusal.

Progress and Sasol now will work as partners in the development of shale gas in the Montney.

The deal, first reported in November, includes 127,000 net acres of Montney lands in two Montney-related partnerships from Talisman, producing 11,000 b/d of oil equivalent as of Oct. 1 (OGJ Online, Nov. 11, 2013).

Resource work seen helping First Nations

Aboriginal peoples in Canada, known as First Nations, have a "unique opportunity" to benefit from the country's booming resource development, according to a study from the Fraser Institute, a nonpartisan Canadian research group.

The study, by Ravina Bains, associate director of aboriginal policy studies in the institute's Vancouver, BC, office, says each of 600 major resource projects planned in Canada during the next decade affects at least one First Nations community. The projects represent investment of an estimated $650 billion.

First Nations groups exert strong and growing influence over governmental approvals of big oil and gas projects—some supporting projects and others opposing them. For example, First Nations support will be vital to approval of two pipeline projects proposed between Alberta and Canada's Pacific Coast and opposed by environmental groups.

In British Columbia, 28% of First Nations communities can benefit from seven major oil and gas projects now proposed, Bains said in her study. In Alberta, five proposed projects would benefit 44% of First Nations communities. In Saskatchewan the numbers are two projects and 23%.

In 2010, more than 1,700 aboriginal people worked directly in oil sands operations. Over the past 12 years, aboriginal-owned businesses have received contracts related to oil sands work worth more than $5 billion, Bains said.

While the median age of First Nations groups is 26, compared with 41 for other Canadians, the First Nation on-reservation unemployment rate is higher than the national average: 23% vs. 7.1%.

NGSA president announces retirement

Natural Gas Supply Association Pres. R. Skip Horvath announced he will retire during first-half 2014 after 15 years at the trade association's helm. A search is under way for his successor.

Horvath became NGSA president in 1999. He previously was the Interstate Natural Gas Association of America's executive vice-president and chief operating officer.

Horvath's work in the gas industry has spanned the terms of 13 of the 15 chairmen that the US Federal Energy Regulatory Commission has had in its history, according to NGSA. It said he also helped establish and lead the Natural Gas Council, a forum for gas industry leaders to discuss common concerns, and was instrumental in determining its operating principles.

He also founded the Distributed Power Coalition of America and served as one of four individuals tasked with setting up the Gas Industry Standards Board (now known as NAESB, the North American Energy Standards Board) and the Center for Liquefied Natural Gas, NGSA said.

Exploration & Development — Quick Takes

Gazprom presses work on East Russian gas

Gazprom said it will complete drilling of 14 exploratory wells and acquisition of 1,200 sq km of 3D seismic data this year in Chayandinskoye field and begin exploratory drilling in Kovyktinskoye field next year.

The fields will anchor gas production centers in the developing Eastern Gas Program of East Siberia and the Russian Far East.

Gazprom expects oil production to begin at Chayandinskoye field in 2014 and gas production to start in 2017. The field will feed a production center in Yakutia.

Drilling in Kovyktinskoye field will follow 3D seismic surveys. Gazprom also is working on a pilot unit in Kovyktinskoye, which will be tied to the Irkutsk gas production center, for testing membrane technology for in-field helium extraction. Data will be used in a similar unit planned at Chayandinskoye field.

Development of the fields is synchronized with construction of the Power of Siberia gas transmission system and gas treatment facilities near Belogorsk in the Amur region.

Gazprom made the final investment decision for the predevelopment of Chayandinskoye, construction of Power of Siberia, and Belogorsk processing facilities in October 2012 (OGJ Online, Nov. 1, 2012).

Statoil makes another gas find off Tanzania

Statoil ASA and ExxonMobil Corp. have made their fifth natural gas discovery on Block 2 offshore Tanzania amounting to an additional 2-3 tcf.

The discovery was made with the Mronge-1 well, drilled by the Discoverer Americas drillship about 20 km north of the Zafarani discovery in 2,500 m of water.

The Mronge-1 well discovered gas at two separate levels, with the primary accumulation at the same stratigraphic level as proven in the Zafarani-1 well on Block 2, and the secondary accumulation in a separate, younger gas-bearing reservoir in a play that has not been tested on Block 2.

In September, the partners started their Block 2 drilling campaign, which included drilling several prospects and appraisals of previous discoveries. The partners are scheduled to appraise the 2012 Zafarani discovery following Mronge-1.

Statoil said the Mronge-1 discovery was preceded by three "successful, high-impact" gas discoveries in the first drilling phase with Tangawizi-1 (OGJ Online, Mar. 18, 2013), Zafarani-1, and Lavani-1 (OGJ Online, June 14, 2012), and a deeper discovery in a separate reservoir in Lavani-2 (OGJ Online, Dec. 22. 2012).

Statoil now estimates the total Block 2 in-place volumes at 17-20 tcf. Helge Lund, Statoil's chief executive officer, previously said the company is looking into possible LNG projects as a result of its offshore Tanzania discoveries (OGJ Online, Oct. 8, 2013).

Statoil, in Tanzania since 2007, operates the license on Block 2 on behalf of Tanzania Petroleum Development Corp. with 65% working interest. ExxonMobil Exploration & Production Tanzania Ltd. owns the remaining 35% (OGJ Online, Mar. 31, 2010).

OMV due interests in four blocks off Gabon

OMV will help fund drilling of three wells next year on four exploratory blocks offshore Gabon from which it has agreed to acquire interests from operator Ophir Energy PLC, London.

The Austrian company will acquire 10% interests each in the Mbeli and Ntsina blocks and 30% each in the Gnondo and Manga blocks.

Ophir will remain operator and retain 70% interests in the Manga and Gnondo blocks and 40% in the Mbeli and Ntsina blocks, in which Petrobras holds 50% interests.

Work plans for 2014, in addition to the three wells, include 3D seismic surveys on all four blocks, which cover 12,000 sq km.

OMV will pay past costs and a promoted share of the well costs on the Padouck Deep well, a presalt test on the Ntsina Block; the Affanga Deep well in the Ogooue Delta play on the Gnondo Block; and the Okala presalt well on the Mbeli Block. OMV also will pay a promoted share of the cost of two additional wells and of the 3D seismic surveys.

Drilling of the Padouck Deep well is to begin in February.

Colombia shale test flows 1,863 b/d of oil

Canacol Energy Ltd. reported the first flow test result from its Leono 1 exploration well, spudded Nov. 9 on the company's LLA23 contract in Colombia's Llanos basin.

The well encountered 133 ft of net oil pay in four separate reservoirs—C7 (13 ft), Barco (27 ft), Gacheta (69 ft), and Ubaque (24 ft). Average porosity for the four reservoirs ranged to 24% (Ubaque) from 18% (Barco).

The Leono 1 reached a total measured depth of 11,995 ft on Nov. 26. The company perforated the Barco reservoir from 10,584—10,600 ft and flowed at a stable rate of 1,863 b/d of of 35° API gravity oil. The well had an initial watercut of 17% that fell throughout the course, the company said.

Canacol has an 80% operated working interest in the LLA23 contract, with Petromont Colombia SA holding the remaining 20%.

The company is preparing to conduct production testing on the Gacheta reservoir. Once completed, the company has said it will bring the Leono 1 into long-term production subject to approval from Colombia's National Hydrocarbon Agency. In addition, the company has four appraisal wells planned at Leono following completion of Leono 1.

Canacol's LLA23 is one of five contracts that give the company exposure to 334,000 net acres of shale oil potential (OGJ Online, Feb. 27, 2013).

Drilling & Production — Quick Takes

BP lets contract for Shah Deniz stage 2 project

BP Exploration (Shah Deniz) Ltd. has let a contract to KBR for the engineering and procurement support services for the Shah Deniz stage 2 project in the Azerbaijan section of the Caspian Sea.

Earlier this month, the project's consortium partners made a final investment decision for the stage 2 development of the field (OGJ Online, Dec. 17, 2013).

KBR will provide engineering design and procurement support services for an offshore complex consisting of two bridge-linked fixed jacket platforms as well as an onshore gas processing facility. The onshore facility consists of two gas processing trains, each with 900 MMscfd capacity, and condensate processing facilities with about 105 million b/d capacity adjacent to the existing Shah Deniz stage 1 facilities at Sangachal terminal. This work will start in January and run through to 2018.

US drilling rig count dips to 1,757 units

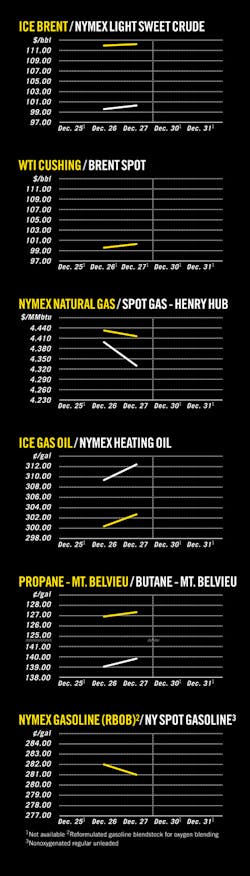

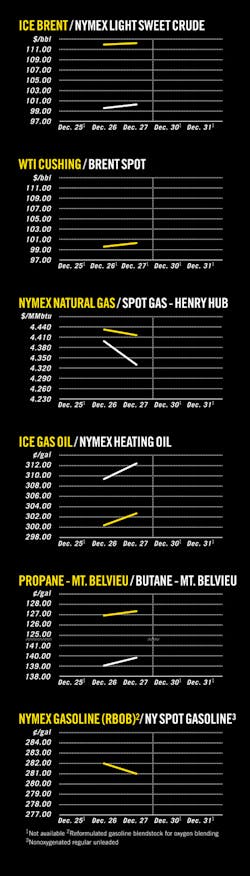

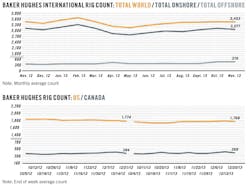

Rigs drilling on land and for oil took the biggest hit in the latest US drilling rig count report, released by Baker Hughes Inc. The rig count lost 11 units to settle at 1,757 rigs working in the week ended Dec. 27, 2013, Baker Hughes reported.

All of that loss was seen in rigs drilling on land, which reached 1,676 units, down 11 from last week. Offshore drilling and drilling in inland waters, at respective counts of 61 and 20, were unchanged from a week ago.

Rigs targeting oil declined 13 units to reach 1,382. Those rigs drilling for gas reached 374 units, up 2 rigs. Rigs considered unclassified were unchanged at 1 unit.

Horizontal drilling rigs climbed 6 units to reach 1,146, while directional drilling ticked up 1 unit to 224 rigs working.

Rigs drilling in Canada fell to 263 units, down 135 from a week ago, but 59 units more than the same week last year. Rigs drilling for oil in Canada fell 96 units to 131, while those targeting gas reached 132 units, down 39.

API notes 23.1% rise in drilling outlays

Oil and gas producers spent an estimated $153.7 billion to drill US wells in 2012, 23.1% more than in 2011, the American Petroleum Institute said in its latest Joint Association Survey of Drilling Costs.

"The US oil and natural gas revolution is gathering momentum, as companies invest more into domestic production and expand our ability to supply America's energy needs," API Statistics Director Hazem Arafa said. "Companies are opening more oil and gas wells, with a rising share of new investment devoted to exploration and production of oil, both onshore and offshore."

He said the total number of new wells increased by 5.8% to 46,736 from 2011 levels. Expenditures on oil represented 61.1% of all drilling costs in 2012, up from 49.3% in 2011. Gas well spending accounted for 30.7% of costs, down from 44.2% the previous year, he added.

"Gas production remains at historic highs, but we're seeing that new production is following the market, where the demand for oil is driving growth," Arafa observed.

The report also showed that expenditures on shale drilling represented 34.6% of total costs, down from 52.5% in 2011. Most of the decline was in gas well drilling, while the number of new shale oil wells rose from 3,414 in 2011 to 3,619 in 2012.

Overall investment in offshore production also increased from 6.5% of all US oil and gas production expenditures in 2011 to 7.1% in 2012, Arafa said.

Statoil restarts production at Statfjord A after leak

Statoil ASA resumed production from its Statfjord A platform in the North Sea on Dec. 29, 2013, after an oil and gas leak was reported on Dec. 28.

Statoil depressurized and shut down Statfjord A (OGJ Online, Nov. 15, 2013) and found the site of the leak.

About half of the 168 personnel on board were moved to nearby installations and later returned to Statfjord A after the leakage had been stopped. Statoil said there were no injuries during the incident.

PROCESSING — Quick Takes

Shell opts out of US Gulf Coast GTL project

Royal Dutch Shell PLC reported that it will not move ahead with a proposed 140,000 b/d Gulf Coast gas-to-liquids project in Louisiana and will suspend any further work.

Shell in September had set its sights on Louisiana for the proposed $12.5 billion, world-class facility (OGJ Online, Sept. 24, 2013).

Shell, an industry leader in GTL technology, said it "carefully evaluated a number of development options for GTL on the US Gulf Coast, using natural gas feedstocks." It said, "Despite the ample supplies of natural gas in the area, the company has taken the decision that GTL is not a viable option for Shell in North America, at this time, due to the likely development cost of such a project, uncertainties on long-term oil and gas prices and differentials, and Shell's strict capital discipline."

CCRL refinery repairs to take months

Repairs following a Dec. 24, 2013, explosion and subsequent fire at Consumers' Cooperative Refineries Ltd.'s (CCRL) 145,000-b/d refining complex in Regina, Sask., will take months, owner Federated Cooperatives Ltd. has confirmed (OGJ Online, Dec. 27, 2013).

The company will be cooperating with Regina Fire & Protective Services to determine a cause of the explosion, but an investigation could take weeks, with repairs slated to take several months, FCL said in a Dec. 27, 2013, release.

While FCL expected an exhaustive investigation to begin over the next couple of days, the company has determined that the explosion occurred in a unit used to manufacture gasoline from propane and butane, according to the release.

In an acknowledgment that a series of fire-related events at the refinery over the past 2 years "are concerning," FCL also said it will evaluate whether a comprehensive Process Safety Management system scheduled for implementation in 2014 requires further changes once the cause of this latest incident has been established.

But impacts to the refinery's current production capacity as a result of the Dec. 24, 2013, fire remained unavailable.

Elba Island terminal announces Phase 2 liquefaction

El Paso Pipeline Partners LP, Houston, has announced that Shell US Gas & Power LLC, a Royal Dutch Shell PLC subsidiary, has given notice to Elba Liquefaction Co. LLC to move ahead on Phase 2 of the jointly owned natural gas liquefaction project at Southern LNG Co.'s Elba Island LNG terminal, near Savannah, Ga.

El Paso's Southern Liquefaction Co. owns 51% of Elba Liquefaction Co.

Phase 2 will add 70-140 MMcfd (0.5-1.0 million tonnes/year) of capacity at an estimated $500 million at the maximum volume of 140 MMcfd, said the announcement.

The planned six trains of Phase 1 will provide about 210 MMcfd of export capacity at start-up in late 2016 or early 2017 (OGJ Online, Aug. 16, 2013). Phase 2 will add two trains and start up in 2017-18. If the maximum volume for Phase 2 is elected, the Elba liquefaction project will have total capacity of about 350 MMcfd (2.5 million tpy) of LNG.

The liquefaction project will cost about $1.5 billion, according to Kimberly S. Watson, president of natural gas pipelines east region for Kinder Morgan.

The project was initially announced in early 2013 and will use Shell's small-scale liquefaction units, which will be integrated with the existing Elba Island terminal and, said the announcement, enable rapid construction when compared with traditional large-scale plants (OGJ Online, Jan. 28, 2013).

Saudi Aramco awards Fadhili gas plant contract

Saudi Aramco has awarded subsidiaries of Foster Wheeler's global engineering and construction group contracts for engineering and project management for developing the Fadhili gas program in the eastern province of Saudi Arabia. Foster Wheeler did not disclose the contract's value.

Foster Wheeler will execute the front-end engineering and design contract for the 1.5-bcfd grassroots Fadhili gas plant to handle nonassociated natural gas. In addition to the plant, Foster Wheeler's scope will include the onshore Khursaniyah upstream facilities, the Fadhili downstream pipelines, a residential camp, and industrial support at the new plant.

The new Fadhili gas plant will be about 19 miles southwest of the existing Khursaniyah gas plant (OGJ Online, June 26, 2007; Apr. 25, 2012).

TRANSPORTATION — Quick Takes

Imperial, KMEP form Edmonton crude rail terminal JV

Kinder Morgan Energy Partners LP and Imperial Oil have formed a 50-50 joint venture to build a crude oil rail-loading terminal in Strathcona County, Alta., called the Edmonton Rail Terminal. The JV will build the terminal on heavy industrial-zoned land about 0.5 km southwest of KMEP's Edmonton storage terminal, on land adjacent to Imperial's Strathcona refinery. Terminal design calls for a crude oil loading terminal capable of loading 1-3 unit trains/day for a combined 100,000 b/d at start up, with the potential to expand to 250,000 b/d.

KMEP's Edmonton storage will supply the rail terminal for delivery on both Canadian National and Canadian Pacific mainlines. Imperial will be the base load customer and has subscribed for the start-up capacity through a long-term contract. The company said it will use the terminal for current and future production from the Kearl Oil Sands project, including the expansion phase scheduled for late-2015 start-up.

The partners are now actively marketing possible expansion capacity to potential third-party customers. The rail terminal will cost $170 million. KMEP will also spend about $100 million on pipeline connections and two new staging tanks to be built at its storage facility. Construction is under way, with completion slated for December.

Anadarko to move crude on KMCC-Double Eagle line

Anadarko Petroleum Corp. has signed a long-term agreement with Kinder Morgan Crude & Condensate LLC and Double Eagle Pipeline LLC, a 50/50-joint venture of Magellan Midstream Partners LP and Kinder Morgan Energy Partners LP, to transport Anadarko's Eagle Ford shale production from Gardendale, Tex., in LaSalle County, to the Houston Ship Channel via the KMCC Pipeline. Double Eagle will build 160,000 bbl of storage and a pump station at Gardendale and a roughly 10-mile pipeline to connect the Double Eagle Pipeline and the KMCC Pipeline in Karnes County, Tex.

Double Eagle will transport production from its new Gardendale station to the KMCC Helena station in Karnes County. KMCC will build 240,000 bbl of storage at its Helena Station to move crude and condensate from the Double Eagle Pipeline to KMCC delivery points. Double Eagle and KMCC expect to complete construction in early 2015.

The Double Eagle Pipeline includes 140 miles of 12-in. OD pipeline connecting to a 50-mile, 14- and 16-in. pipeline segment owned by KMEP extending from Three Rivers, Tex., to Magellan's marine and storage terminal in Corpus Christi, Tex. The initial capacity of the pipeline is 100,000 b/d, but can be expanded with additional pumps. Double Eagle began condensate shipments on the 50-mile segment earlier this year (OGJ Online, May 14, 2013).

Santos covers all bases with Gladstone LNG

Santos Ltd., Adelaide, has covered all bases in its Gladstone LNG (GLNG) project in Queensland by securing a diverse gas feedstock portfolio for its LNG plant on Curtis Island. In the latest move the Santos-led GLNG participants have executed a second agreement with Origin Energy Ltd. of Syndey for the purchase of 100 petajoules of gas to supply the project.

The gas will be supplied at the Wallumbilla gas hub in the Surat basin near Roma over 5 years starting in January 2016. Pricing will be based on an oil-linked formula. Under agreement terms, Origin can supply additional volumes of as much as 94 petajoules during the same 5-year period.

The GLNG consortium's supply now consists of a mix of its own coal seam gas fields, conventional gas from Santos' portfolio, underground storage gas, and third-party supply sources.

Previously GLNG signed agreements with Santos for 750 petajoules of portfolio gas over 15 years and an earlier agreement with origin for the supply of 365 petajoules over 10 years.

Santos has 30% and operatorship of GLNG with Petronas holding 27.5%, Total SA 27.5%, and Kogas 15%.

The GLNG project is now 72% complete and remains on schedule for start-up in 2015.