OGJ Newsletter

GENERAL INTEREST — Quick Takes

BSEE proposes changing regs to reflect advances

The US Bureau of Safety and Environmental Enforcement proposed amendments to its regulations governing offshore oil and gas operations in federal waters. It said the proposed rule, which will appear in the Aug. 22 Federal Register, would revise 30 CFR 250 Subpart H, Oil and Gas Production Safety Systems, in the regulations to address recent technological advances.

"The common-sense changes we are proposing, which will address issues such as production safety systems, subsurface safety devices, and safety device testing, will help regulations keep pace with changing technologies that have enabled the industry to explore and develop resources in deeper waters," BSEE Director James A. Watson said.

"The rule also implements best practices currently being deployed by industry leaders as we continue to strive for safety at all levels, at all times," he added.

In its announcement, the US Department of the Interior agency said the proposed changes involve a section of the regulations that hasn't undergone a major revision since it was first published in 1988.

During that period, the offshore oil and gas industry's use of subsea trees has evolved or become more prevalent, BSEE said.

"These devices and materials include foam firefighting systems; electronic-based emergency shutdown systems; subsea pumping, waterflooding, and gas lift; and new alloys and equipment for high-temperature and high-pressure wells," it noted.

Comments on the proposed changes will be accepted through Oct. 21, BSEE said.

Study outlines benefits of oil, gas on economy

The oil and natural gas industry plays a pivotal role in bringing substantial economic benefits to Colorado, according to a recent economic study released by the Colorado Oil & Gas Association (COGA).

The study, Assessment of Oil & Gas Industry 2012: Industry Economic & Fiscal Contributions in Colorado, conducted by University of Colorado Boulder researchers Brian Lewandowski and Richard Wobbekind, found that in 2012, industry pumped $29.6 billion into the Colorado economy and supported over 110,000 high-paying jobs.

"Collectively, the oil and gas industry contributed nearly $3.8 billion in employee income to Colorado households in 2012, or 2.8% of total Colorado salary and wages," it said.

The study also found that the oil and gas industry is a key source of Colorado's fiscal revenues, contributing nearly $1.6 billion in tax revenues to state and local governments, schools districts, and special districts. "Governments across Colorado depend on the oil and gas industry to pay for much-need public services," said Doug Flanders, COGA director of policy and external affairs.

As oil and gas extraction technology advances in efficiency, permits dropped more than 37% between 2010 and 2012 while oil and gas production increased during the same time period, according to the study.

Concerning the current debate on environmental and societal impacts of oil and gas development in Colorado, the study stated that the economic contributions of the industry should be present in the discussion calling for drilling moratoriums.

The data used by the study is publicly available statewide data concerning employment, wages, property values, royalties, leases, severance taxes, rig and well counts, as well as production and prices.

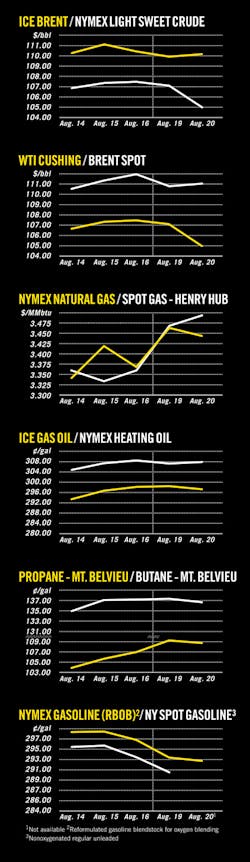

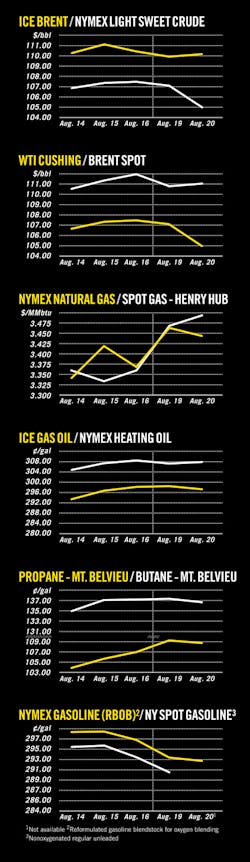

Oil prices continue to be supported in the near term

Oil price risk remains to upside in the short term and natural gas prices are recovering but with capped upside, Barclays said in its most recent Energy Market Outlook, released Aug. 16.

Factors for softness in crude markets include record-high net speculative length, tepid demand growth due to refinery maintenance in September and October, incremental supplies from US shale oil, better Canadian supply, and even the possibility of some new production from Iraq, Barclays analysts said.

While facing countervailing pressures, oil prices are unlikely to be weakened due to high supply-side losses, they said. Strong upward pressure on prices, meanwhile, is being supplied by intensifying conflict in the Middle East, exacerbated supply disruptions from members of the Organization of Petroleum Exporting Countries, upstream field maintenance, and prestocking requirements from new refinery capacity, Barclays analysts said.

"Overall, we see oil price risk skewed to the upside," Barclays said.

US natural gas prices are moderately recovering, with the prompt contract currently trading at about $3.40/MMbtu. The recovery was attributed to storage increase and favorable weather expectations, including stirring tropics. However, Barclays believes the upside remains capped by continued gas production growth.

Exploration & Development — Quick Takes

Total hits Gabon's first deepwater presalt find

Total Gabon's Diaman-1B exploratory well is the first discovery drilled in the deepwater portion of the presalt play off Gabon.

The well confirms the existence of a working petroleum system, and preliminary analysis suggests that the hydrocarbons are natural gas with condensate pending further log analysis.

Partner Marathon Oil Corp. said the well cut 160-180 net ft of hydrocarbon pay in the presalt. The well went to a total depth of 18,323 ft in 5,673 ft of water on the Diaba license G4-223. The wellsite is more than 60 miles from the nearest presalt commercial discovery.

The operator and partners are evaluating the well results and incorporating them into an overall evaluation of the discovery. The well will be temporarily abandoned pending further analysis of the data.

License interests are Total Gabon 42.5%, Marathon and Cobalt International Energy LP 21.25% each, and the Gabonese republic 15%.

Statoil makes discovery with Smorbukk North well

Statoil and partners in production license 479 made a gas-condensate discovery in the Smorbukk North prospect at Haltenbanken in the Norwegian Sea.

Exploration well 6506/9-3, drilled by the Transocean Leader drilling rig, has proven a 40-m gas-condensate column in a down-to situation in the Garn formation of mid-Jurassic age, Statoil said.

In addition, a thin gas-condensate column was proven deeper in the mid-Jurassic Ile formation. The reservoir properties of the Garn formation are good, while somewhat poorer than expected in the Ile formation, the company said.

Statoil pegs the discovery's preliminary reserves volume at 25-47 million boe recoverable.

Smorbukk North, says Statoil, is a typical example of timely near-field exploration, which is an important element in the firm's sharpened exploration strategy for the NCS.

"Being located directly north of the Asgard field, the Smorbukk North discovery could be developed quickly and efficiently through a tie-in to existing infrastructure, providing fast resources and potentially extending the production life of the Asgard production facilities," said Astrid Jorgenvag, vice-president, operations, for Asgard.

Statoil holds 40.95% interest in the project. Partners are Eni Norge AS 19.6%, Petoro AS 14.95%, ExxonMobil Exploration & Production Norway AS 14.7%, and Total E&P Norge AS 9.8%.

BLM posts EA for proposed seismic work

The US Bureau of Land Management has posted an environmental assessment for proposed seismic work on a lease Houston-based Noble Energy Inc. holds south of Elko, Nev., the US Department of the Interior agency announced.

Noble plans to run 3D seismic surveys this fall on 63,000 acres of leases it holds on public and private land 21 miles south of Elko, BLM's Elko district office said in an Aug. 15 notice.

The holdings are in the Huntington Valley area of Elko County, it indicated. Noble expects the work to take about 60 days once it obtains the necessary permits, the notice said. Comments will be accepted through Aug. 30, it added.

Drilling & Production — Quick Takes

Andora Sawn Lake SAGD pilot getting under way

Production from a steam-assisted gravity drainage oil sands project at Sawn Lake in Alberta's Peace River area should begin in early 2014, and joint venture partners have elected to participate and are attempting to raise funds, said Pan Orient Energy Corp., Calgary.

The Sawn Lake project is operated by Andora Energy Corp., Pan Orient's 71.8% owned subsidiary.

Andora holds working interests in 88 continuous sections of undeveloped heavy oil sands leases. The Sawn Lake area has established infrastructure and year-round access.

Andora is operator with 100% interest in the 16-section South block, operator with a 50% interest in the 12-section Central block (and holds an additional 3% gross overriding royalty on a nonowned 40% working interest), operator with a 10% interest in 9 sections in the North block, and holds 10% in 51 nonoperated sections of the North block.

Consulting engineers estimate that using SAGD the Blue Sky zone has a contigent resource of 214 million bbl of bitumen attributable to Andora's working interests, or 154 million bbl attributed to Pan Orient's interest in Andora, largely in the South and Central blocks where Andora is operator. That includes 138 million bbl in the Central block, 74 million bbl in the South block, and 2 million bbl in the North block.

The demonstration project is in the Central block. Geological studies of the Blue Sky zone indicate that this location has the thickest pay zones, at greater than 20 m, with high horizontal and vertical permeability. Project goal is to determine the steam-oil ratio and oil production productivity at this location.

The demonstration project at 7-30-91-12w5m will start with a 2013 phase consisting of one SAGD well pair, a facility for steam generation, water handling and oil treating, and water source and disposal facilities with an estimated cost of $24.1 million. The wells will have a 750-m horizontal length at 650 m true vertical depth.

Site preparation is under way, and it is expected that the horizontal well pair will be drilling in the second half of September, steam operations will commence in early December 2013, and oil production will begin in the first quarter of 2014.

Andora is allowing joint venture partners to repurchase the 3% gross overriding royalty on their 40% working interest in the 12 sections of the Central Block for $2.8 million under certain terms and conditions.

The demonstration project will proceed with Andora as operator with a 50% working interest and a 50% working interest held by nonoperators. Additional investment in the demonstration project in 2014 depends on the results of the first SAGD well pair.

Black Elk platform explosion caused by contractors

A third-party investigator concluded that a failure by contractors to follow standard safety practices caused the November 2012 explosion and fire on an oil production platform operated by Black Elk Energy Offshore Operations LLC in the Gulf of Mexico (OGJ Online Nov. 16, 2012). The platform was on West Delta Block 32 about 17 miles southeast of Grand Isle, La.

An 8-month investigation by ABSG Consulting found that, while production was shut in, workers welded on piping that was connected to a tank containing crude oil and flammable oil vapors without following Black Elk's safety practices. The piping leading to the tank had not been isolated and made safe for welding activities as required by Black Elk safe work practices. The flammable vapors in the piping ignited and within seconds reached the first oil tank and then two connected tanks.

Black Elk contracted with Grand Isle Shipyard to perform the construction work. Although Grand Isle committed in its contract to not use subcontractors on Black Elk projects, all of the workers performing the welding involved in the incident were employed by DNR Offshore & Crewing Services, a subcontractor of Grand Isle. ABSG determined that use of the DNR Offshore subcontractor without notifying Black Elk was one of several causes of the incident.

ABSG also determined other causes were that Grand Isle and DNR Offshore employees failed to adequately follow safe work practices for performing welding and failed to stop work when unsafe conditions existed. The workers involved in the incident were from the Philippines. "Filipino offshore oil workers have a deserved reputation for competence and professionalism," said John Hoffman, Black Elk's president and chief executive officer. "A serious issue in this case was Grand Isle's apparent failure to provide proper safety training and appropriate supervision."

ABSG was retained by Black Elk to investigate the Nov. 16, 2012, incident that resulted in the deaths of three workers and injuries to others. ABSG performed an extensive investigation to determine the causes of the accident, coordinated its investigation with the US Bureau of Safety and Environmental Enforcement, and provided recommendations to prevent a similar incident in the future.

In conducting its investigation, ABSG reviewed thousands of pages of documents and records; collected and preserved physical evidence from the platform; performed fire and explosion modeling of the incident; and utilized industry-accepted causal analysis methodologies to determine the causes of the incident.

Sunshine signs oil sands JV, slows West Ells work

Sunshine Oilsands Ltd., Calgary, signed a framework agreement with an undisclosed international third party to pursue a joint venture involving its Muskwa and Godin area oilsands leases in the Athabasca area of Alberta.

The agreement provides for a 50-50 joint venture pursuant to which the third party will be responsible for investing as much as $250 million and contribute a thermal enhanced recovery technology to achieve production of 5,000 b/d from the oilsands leases. After this production threshold is achieved, the joint venture parties will contribute in proportion to their ownership positions.

Meanwhile, Sunshine said that some work on the West Ells project site near Fort McMurray has been temporarily slowed. Work is expected to ramp up again once confirmation is received that additional funding has been committed. Sunshine is maintaining staff at site to continue with reduced work activities and to ensure safety of the worksite.

Sunshine, since incorporating in early 2007, has secured more than 1 million acres of oil sands leases or about 7% of all granted leases in the Athabasca area. The company's principal operating regions are West Ells, Thickwood, Legend Lake, Harper, Muskwa, Goffer, Pelican, and Portage.

PROCESSING — Quick Takes

Essar's refining margins up in India, down in UK

Essar Energy PLC said its gross refining margins were up in India during the quarter that ended June 30, but down in the UK.

Margins for Essar's 405,000-b/d Vadinar refinery at Gujarat averaged $7.01/bbl, up 49% from a year earlier. Throughput was 36.34 million bbl, up from 32.65 million the previous year.

Essar's 296,000-b/d Stanlow, UK, refinery averaged $4.86/bbl, down from $7.53/bbl. Throughput was 19.27 million bbl, down from 19.65 million bbl.

Essar completed refinery expansion and optimization projects at Vadinar in 2012. During the most recent quarter, Vadinar's crude mix was 92% lower cost heavy and ultra-heavy, compared with 89% in the same quarter a year earlier. On the production side, the proportion of higher value middle and light distillates was 84%, up from 82%.

Essar said margins at Stanlow were impacted by generally lower industry margins, weaker diesel and jet prices relative to gasoline, and higher resid production related to revised refinery configuration after the closing of the lubes plant in February.

Essar is planning a turnaround at Stanlow, including a 25-year "re-lifing" of the residue catalytic cracking unit.

Several 'incidents' reduce capacity at refinery

Two separate "incidents" that resulted in small fires at two separate, unspecified units at Motiva Enterprices LLC's Port Arthur, Tex., refinery complex will result in the 600,000-b/d nameplate capacity facility being run at a reduced capacity for an indefinite period of time, a spokeswoman for Royal Dutch Shell PLC confirmed for OGJ. Motiva is a refining and marketing joint venture owned by affiliates of Shell and Saudi Aramco.

The spokeswoman told OGJ that there were two separate incidents, one on Aug. 12 and another on Aug. 17. Both incidents are under investigation to determine the cause. One unit remains shut down following the incident.

"I can confirm that the Motiva Port Arthur refinery initiated a safe and orderly shutdown on of one of its units on Aug. 17 following an operational issue, which resulted in a small fire," the spokeswoman said. "There were no injuries, and the fire was extinguished, with no offsite impact," she added.

"While repairs are being made to this unit," the spokeswoman said, "operating rates on the other units in the site will be adjusted to optimize the overall site."

She added, "In keeping with our disclosure policy, we do not provide details with respect to specific units or how long the units will be down."

Motiva completed a 325,000-b/d expansion of the Port Arthur refinery in 2012 which made it the largest US refinery (OGJ Online, May 31, 2012).

The expanded refinery can process a wide variety of crudes, ranging from relatively light to heavy. It also has the flexibility to switch between primarily producing gasoline and diesel to adapt to varying market conditions, the company said.

TRANSPORTATION — Quick Takes

Woodside will use FLNG scheme to develop fields

Woodside Energy Ltd., Perth, will recommend a floating LNG (FLNG) scheme to develop the three Browse gas fields Torosa, Brecknock, and Calliance, which lie off Western Australia about 264 miles north of Broome. The company said the concept will use Royal Dutch Shell PLC's FLNG technology.

Selection of FLNG as the development concept requires approval of the Browse JV participants before moving to the design phase. Browse participants include Woodside as operator, Shell Development (Australia) Pty. Ltd., BP Developments Australia Pty. Ltd., Japan Australia LNG (MIMI Browse) Pty. Ltd., and PetroChina International Investment (Australia) Pty.

Woodside said its decision follows evaluation of "alternative development concepts" for Browse after announcement in April not to proceed with the onshore gas processing development at James Price Point (OGJ Online, May 3, 2013).

Coincidental with the company's announcement was the decision handed down on Aug. 19 by Western Australia's chief justice invalidating three of the state environmental approvals for the planned James Price Point natural gas processing hub.

El Paso moves ahead with Elba Express expansion

The Elba Express Co. LLC (EEC) and Southern Natural Gas Co. LLC (SNG), both units of Kinder Morgan's El Paso Pipeline Partners LP, completed successful open seasons for almost 600 MMcfd of incremental, long-term gas transportation supplying the southeast US and the Elba Liquefaction export project.

The open seasons also attracted interest in further expanding capacity by as much as 400 MMcfd, bringing the total expansion to as much as 1 bcfd.

Shell US Gas & Power LLC and Southern Liquefaction Co. LLC, a Kinder Morgan company and also unit of El Paso Pipeline Partners, announced previous plans to form a limited liability company to develop an LNG export plant in two phases at Southern LNG Co. LLC's existing Elba Island LNG terminal near Savannah, Ga.

The project will have a total liquefaction capacity of about 2.5 million tonnes/year (OGJ Online, Jan. 28, 2013). In June 2012, the Elba Island terminal received approval from the US Department of Energy to export as much as 4 million tpy of LNG to free trade agreement countries.

EEC expects the north-to-south expansion of its system, including interconnects and delivery points with SNG and other pipelines and shippers, to become available in phases, with 600-MMcfd Phase 1 service beginning as early as June 2016 and all phases in service by April 2019.

The EEC open season ended Aug. 7. The SNG open season, which supported deliveries and capacity held on the Elba Express Pipeline, ended July 31. The Phase 1 expansion, which is pending regulatory approvals, is expected to cost $200 million.

Saskatchewan crude-by-rail terminal planned

TORQ Transloading Inc., Calgary, plans a unit-train terminal in southwestern Saskatchewan that will accommodate rail movement of as much as 168,000 b/d of heavy oil and conventional crude. The company is negotiating pipeline connections to the planned terminal in the Kerrobert area.

The $100 million terminal served by Canadian Pacific Railway would be able to handle two, 120-car unit trains/day.

The terminal also would handle crude delivered by truck. It will have as much as 500,000 bbl of storage, including heated tanks for undiluted heavy crude.

According to government reports, Canadian National Railway Co. and Canadian Pacific recently were transporting about 120,000 b/d of Western Canadian crude oil, increasingly bitumen produced in Alberta, which must be diluted with light hydrocarbons.

The TORQ terminal will be able to handle undiluted heavy oil produced in the Lloydminister and Kerrobert areas.

"Kerrobert, Sask., is geographically as close to the heavy crude's natural destination markets as possible by rail, minimizing transportation costs relative to similar crude types to be shipped by rail originating further north and west in Alberta," said TORQ Chief Executive Officer Jarrett Zielinski.

"Our estimation is that the Kerrobert Rail Terminal could offer transportation savings to the US Gulf Coast and East Coast upwards of $5/bbl compared with shipping similar crudes by rail out of certain locations in Alberta."

TORQ operates six crude-by-rail transload terminals in Alberta and Saskatchewan.