Rail emerging as long-term North American crude option

Julie M. Carey

Navigant Consulting Inc.

Washington, DC

Initially thought of as a stopgap for transporting North American crude oil production until new pipelines could be built, the relatively short time needed to recover capital costs of rail infrastructure has opened the possibility that rail transportation rates could be reduced enough to keep railroads competitive and profitable even as compared to new pipelines.

Both the US and Canada have the opportunity to reduce their dependence on oil imports and increase their energy security through new domestic supply sources. Global crude markets became out of balance as North American supplies entered the market, demonstrated by the more than $20 premium Brent carried over West Texas Intermediate and its more than $40 premium to Western Canadian Sweet prices.1 Transportation bottlenecks between the new US and Western Canadian supply regions and the consuming regions helped create these differentials.

Differentials have recently narrowed, but this phenomenon appears to be due to short term factors and more transportation will be needed as US unconventional oil resources continue to expand. Pipeline projects such as the Seaway reversal helped move crude more efficiently to refining centers (OGJ Online, Mar. 27, 2012), but a large part of the debottlenecking was also accomplished by increasing use of crude-by-rail transport.

Market penetration

The deepest penetration of railroads as a transporter of crude oil has been in the Bakken shale (North Dakota, Montana, and Saskatchewan). Rail loading facilities have also been built in the Permian and Eagle Ford basins in Texas and the Niobrara and Anadarko basins in the US Midwest (see figure). Bakken crude rail terminal takeaway capacity could exceed 800,000 b/d by end-2013.2

Rail transportation of crude and bitumen has also emerged in the Western Canada oil sands. Southern Pacific Resources Corp. signed a deal to transport its entire bitumen production via Canadian National Railway Co. (CN)3 and MEG Energy Corp. is building a terminal that will allow transportation of its 32,000 b/d production of Canadian bitumen by pipeline, rail, and barge.4 Rail shipments of crude oil from Western Canada are 120,000 b/d and rail loading capacity is expected to grow to 200,000 b/d by yearend 2013.5

New rail unloading terminals have emerged to unload crude from the tank cars to refineries or transload it for waterborne shipment to Gulf Coast refineries. Phillips 66 announced a 5-year commitment to ship 50,000 b/d of North Dakota crude by rail to its New Jersey refinery (OGJ Online, Jan. 9, 2013), essentially making a $1-billion bet that North American crude will remain cheap. PBF Energy is also increasing rail offloading capacity at its Delaware refinery to at least 110,000 b/d from 20,000 b/d to take more Western Canadian and Bakken shale crude oil into Delaware City.

Sunoco's 330,000-b/d Philadelphia refinery is adding rail offloading similarly to accept large quantities of Bakken crude by railroad. The refinery also plans to take advantage of inexpensive Marcellus shale natural gas to feed not only the refinery, but also a new 600-700 Mw power plant and a gas-based hydrogen plant to make cleaner fuels and building blocks for fertilizers.6

Non-price factors

Rail can rapidly enter markets because the primary new infrastructure required is transloading terminals, which typically have short construction lead times of just 12-18 months. Scalable rail operations also have ready access to large fleet resources including locomotives, rail cars, rail crews, additional track, and other facilities that can be put in place quickly and cheaply to handle rapid expansion.

One unit train can carry nearly 70,000 bbl. There are terminals in the Bakken area that can load nearly 140,000 b/d..

Rail carriers have several other non-price advantages over pipelines. They can quickly respond to changing market circumstances and allow variation in crude oil supply sources, the primary reason cited for cancellation of Kinder Morgan's proposed $2-billion Freedom Pipeline project.7

Rail carriers also typically have shorter contract commitment periods than pipelines. They also often have shorter transit times between point-of-origin and final destination. Rail shipments take an estimated 8-10 days from Alberta to the US Gulf Coast compared with 40-50 days by pipeline. These advantages help offset the higher cost-per-barrel of rail transportation per given unit of crude oil.

Rail transportation has also expanded in the Bakken and Western Canadian crude oil production areas in recent years through delivery of equipment and supplies to the production sites, complementing the shipment of crude and supporting on site rail personnel.

While tanker car availability presents a potential bottleneck to increasing rail movements, Navigant believes sufficient access to tanker rail cars will be available. Phillips 66 purchased 2,000 rail cars to transport crude oil from the Bakken to its refineries throughout the country, and noted in its press announcement that the purchase would help the manufacturer underpin new production.

Price factors

Cost advantages unique to rail exist because rail moves bidirectionally and can carry product back to the origin market. Such carry-back options include diluent for use in pipelines. Rail's relatively small incremental cost of hauling diluent from crude destination back to origin reduces per unit delivery costs.

Interest in shipping bitumen by rail from Canada to the US has increased in recent years. An additional factor keeping the cost of shipping crude oil by rail closer to that of shipping via pipeline is that much less diluent is required when shipping bitumen by rail, making a greater quantity of undiluted bitumen deliverable per rail car, with only small additional expenses incurred in delivering diluent to the bitumen production area.

About 30%/bbl more bitumen can be shipped when diluents are not added, reducing the per-barrel cost of rail-delivered bitumen accordingly. While rail transportation of bitumen is still in its infancy, the economics of transporting bitumen by rail are superior to those of transporting bitumen blends, as greater quantities can be shipped with only small additional costs stemming from the return shipment of diluents.

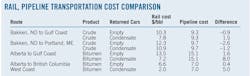

The accompanying table compares rail and pipeline transportation costs for crude oil movements originating in the Bakken and Western Canada. Adjustments were made, compensating for costs shippers incur associated with securing diluent supplies and blending it with bitumen. Adjustments were also made for the time values of money, reflecting the greater speed at which crude travels by rail. Further adjustments were made to rail rates to include the costs of leasing and loading tank cars.

Rail transportation is a cost effective competitor to pipelines for the transportation of crude oil and bitumen, particularly when railroads backhaul diluents to the origin market. Estimated rail transportation rates are based on sample rates from unit trains reported in the Surface Transportation Board waybill sample dataset, along with estimated cost of the rail movement plus a return component.

Rail rates used 180% of variable cost of the rail move as a forward-looking estimate of levels achievable with competitive pressures. This figure is referred to as the "jurisdictional threshold," since a US shipper cannot dispute the reasonableness of the rail transportation rate with the regulatory agency for a movement unless the rate exceeds 180% of the variable cost of that rail movement.

The reduced rail transportation rate for bitumen reflects the higher relative quantity of bitumen railroads can move because it doesn't need to be diluted. The pipeline costs reflect the added cost incurred (relative to railroads) associated mixing diluent into the bitumen.

References

1. http://northdakotapipelines.com/oil-transportation-table/

2. "Drilling Down On Crude Oil Price Differentials," TD Economics, Mar. 14, 2013.

3. "Crude On The Rails: In For The Long Haul," Financial Post, Aug. 24, 2012.

4. Van Loon, J., and Penty, R., "MEG's Bitumen-by-Barge Winning Over Investors: Corporate," Bloomberg, Feb. 4, 2013.

5. "Outlook for Rail Crude Oil Transport," Rail Energy Transportation Advisory Committee, Surface Transportation Board, Mar. 14, 2013.

6. "Carlyle Group, Sunoco, and Politicians' Joint Venture to Rescue Philadelphia Refinery," Washington Post, Dec. 21, 2012.

7. "Kinder Morgan Cancels $2 Billion Pipeline Plan," Wall Street Journal, May 31, 2013

The author

Julie M. Carey ([email protected]) is a director with Navigant Consulting. She is an economist with a focus on energy and regulatory economics and antitrust analyses involving electricity, oil and gas, pipelines, coal, renewables, and railroad industries. She has provided expert testimony in US federal and state courts, arbitrations, and US and Canadian regulatory agencies.