Global ethylene capacity poised for major expansion

Global ethylene capacity grew in 2012 at about the same pace as in 2011, and in both years capacity grew more slowly than the prior 3 years, according to the latest Oil & Gas Journal's survey of the industry.

China, the US, and the UAE added almost 2.8 million tonnes/year (tpy) last year, while Japan closed 330,000 tpy. Global capacities as of Jan. 1, 2012, had grown by 2.5 million tpy (OGJ, July 2, 2012, p. 78) after global capacities at the end of 2010 had set a record (OGJ, July 4, 2011, p. 100). That had exceeded capacity added in 2009 (OGJ, July 26, 2010, p. 34) and in 2008 (OGJ, July 27, 2009, p. 49).

Although growth has flattened the last 2 years, it has nonetheless been robust, with Asian and Middle Eastern countries leading the way. And if start-ups set for 2013, according to OGJ data, come online as scheduled, the industry will add record capacity.

Global ethylene production on Jan. 1, 2013, factoring in 2012 additions, was more than 143 million tpy, following capacity at the same point last year of almost 141 million tpy

OGJ data show three new worldscale ethylene plants starting up last year; for 2011, two started up; for 2010, eight new plants started up with combined production capacity of 8.65 million tpy.

Regional view

Table 1 shows rankings of the 10 largest ethylene production complexes in the world. The order for 2012 remains unchanged, according to OGJ survey data, and none on the list reported a change in capacity.

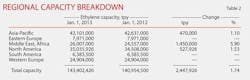

Table 2 ranks ethylene production capacity by region; Table 3 shows changes for individual countries between 2011 and 2012.

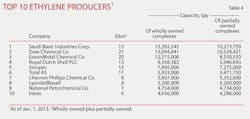

Table 4 lists the top 10 owners of ethylene capacity worldwide. The first column of capacities presents them for assets owned entirely by one company; the second column reflects the total of actual percentages for companies in joint ownership.

The exclusive, plant-by-plant table, based on OGJ's survey, follows this article.

Construction

If all projects under construction remain on announced schedules, 2013 will see capacity added at near-record pace: more than 11 million tpy. That pace will fall off considerably in 2014, to a bit more than 1.2 million tpy.

Beyond 2013, the global construction pace for ethylene and related capacity begin to accelerate again.

Asia-Pacific; Middle East

In October 2012, PetroChina Co. Ltd. started up an 800,000-tpy ethylene unit at its Fushun Petrochemical Co. refining and petrochemical complex in Liaoning Province, as reported by PetroChina parent company China National Petroleum Corp. (OGJ Online, Nov. 5, 2012).

All eight production units at the complex began operating, bringing crude capacity to 11.5 million tpy and ethylene capacity to 1 million tpy.

Also in October, CNPC started up a 600,000-tpy ethylene unit that doubles capacity of Daqing Petrochemical with the country's first ethylene plant based on domestically developed technology (OGJ Online, Oct. 11, 2012).

The project is part of a national push to increase ethylene capacity (OGJ Online, May 19, 2009).

In November, officials for China Petroleum & Chemical Corp. (Sinopec) told international news agency Thomson Reuters it would increase crude refining capacity at its Yangzi Petrochemical unit by 250,000 b/d by mid-2014 and wanted to expand its ethylene capacity by adding an 800,000-tpy unit. No timetable was cited.

In India last year, Reliance Industries Ltd. awarded Technip, Paris, an engineering and procurement services contract for a refinery off-gas cracker (ROGC) plant as part of an expansion at Reliance's Jamnagar refining and petrochemical complex in Gujarat, on the western coast.

The ROGC plant, said the Technip announcement, will be among the largest ethylene crackers in the world. Products from that plant will be used as feedstock for the new downstream petrochemical plants.

Also late last year in Indonesia, state-owned PT Pertamina began the process that will lead to construction and operation of a naphtha cracker. The project is part of a plan to increase its share of the Indonesian petrochemical market (OGJ Online, Dec. 18, 2012).

The cracker will start up at an unspecified site in 2017 to produce 250,000 tpy of ethylene, 400,000 tpy of polyethylene, 350,000 tpy of polypropylene, and 200,000 tpy of polyvinyl chloride (PVC).

Pertamina will complete a feasibility study of the $5 billion project by yearend 2013.

Among the most active spots for ethylene capacity in Asia-Pacific in recent years has been Singapore.

Late last year, Shell announced it would expand its ethylene cracker at its Shell Eastern Petrochemicals Complex on Jurong Island. The expansion will follow from a debottlenecking of the cracker to 1 million tpy of ethylene, propylene, and benzene from then-current 800,000 tpy.

In December, ExxonMobil Corp. finished building one of the world's largest ethylene steam crackers, according to the company announcement (OGJ Online, Dec. 28, 2012).

The multibillion dollar project adds 2.6 million tpy of finished product capacity, doubling the company's capacity at Singapore. The expansion includes two polyethylene plants, a polypropylene plant, a metallocene elastomers unit, an oxo-alcohol unit, and an aromatics expansion. Ethylene was to start later in 2013.

And in late May of this year, ExxonMobil Corp. began producing ethylene from the second steam cracker (OGJ Online, May 30, 2013).

Also late last year, Korea Petrochemical Industry Co. awarded Toyo Engineering Korea Ltd. a contract to build an ethylene oxide and ethylene glycol plant in the Ulsan petrochemical complex in South Korea.

Toyo Engineering Korea is providing engineering, procurement, and construction management; the plant is to be completed in May 2014.

Running against the region's capacity-expansion trends, however, were two announcements from Japan in mid-2012 and early in 2013.

In June 2012, international news agency Reuters reported that Mitsubishi Chemical Holdings Corp. was closing one of two ethylene plants in its Kashima complex in eastern Japan to reduce fixed costs at the complex by $50 million/year.

In 2014, Mitsubishi will close the plant's No. 1 ethylene unit with a capacity of 390,000 tpy. This year, however, it is boosting capacity of the plant's No. 2 unit by 50,000 tpy, raising it to 540,000 tpy.

Earlier this year, Sumitomo Chemical announced plans to close an ethylene plant at its petrochemical plant at Chiba works. The closing will take place on or before September 2015.

After shutdown of the ethylene plant, Sumitomo Chemical will obtain needed ethylene and other petchem feedstock by buying more from Keiyo Ethylene Co., a joint venture among Maruzen Petrochemical Co., Mitsui Chemicals Inc., and Sumitomo Chemical.

In the Middle East last year, Qatar Petroleum and RoyalDutch Shell were moving toward final investment decision for a large petrochemical complex at Ras Laffan (OGJ, July 2, 2012, p. 78).

The plant would have capacity to produce 1.5 million tpy of monoethylene glycol and would be held by Qatar Petroleum (80%) and Shell (20%).

In October of last year, Saudi Polymers Co. announced it had begun commercial production at its petrochemical complex in Jubail, Saudi Arabia.

The complex has capacities of 1.22 million tpy of ethylene, 440,000 tpy of propylene, 1.1 million tpy of polyethylene, 400,000 tpy of polypropylene, 200,000 tpy of polystyrene, and 100,000 tpy of 1-hexene.

Saudi Polymers is owned 65% by National Petrochemical Co., a Saudi joint-stock company, and 35% by Arabian Chevron Phillips Petrochemical Co., a wholly owned subsidiary of Chevron Phillips Chemical (OGJ Online, Oct. 2, 2012).

North America

In Canada late last year, Platts reported that Williams Energy would apply to Alberta's Energy Resources Conservation Board (ERCB) to build NGL and olefins processing in the province.

The company aims to use gas produced from oil sands upgraders to build an extraction plant at Canadian Natural Resources Inc.'s Horizon oil sands upgrader near Fort McMurray, install a 45-mile expansion of the Boreal NGL pipeline, and debottleneck Williams's fractionator at Redwater.

Williams expects to invest $500-600 million and start up the facilities by mid-2015. Ultimate production of ethane, propane, ethylene, and propylene could reach 15,000 b/d.

This spring, Nova Chemicals Corp. awarded a contract to Technip to expand Nova Chemicals' polyethylene project at Joffre, near Read Deer, Alta.

The project includes installation of a 450,000-tpy single-train linear low-density polyethylene unit, expanding its Joffre polyethylene capacity by 40%.

Work began at yearend 2012; start-up is targeted for late 2015.

In Mexico last year, Braskem Idesa SAPI, Philadelphia, hired a joint venture consisting of ICA Fluor, Empresas ICA, and Odebrecht to provide engineering, procurement, and construction to build the $3 billion Etileno XXI petrochemical complex in the Coatzacoalcos-Nanchital region of the Mexican state of Veracruz.

The complex will include a 1-million-tpy ethylene cracker and two high-density polyethylene plants. It will start up in June 2015.

According to Technip, the complex will also include:

• A low-density polyethylene plant.

• Storage, waste treatment, and utilities, including a 150-Mw combined-cycle power and steam cogeneration plant.

• A logistics platform for shipment of 1 million tpy of polyethylene via rail, truck, or bagged.

• Administrative, maintenance, control room, and other buildings (OGJ Online, Oct. 5, 2012).

In the US late last year, Westlake Chemical Corp., Houston, announced plans to convert the feed to its Calvert City, Ky., ethylene plant to ethane from propane and to increase ethylene production capacity to about 286,000 tpy from about 204 million tpy.

At the same time, Westlake said it would expand its existing PVC plant in Calvert City to add about 91,000 tpy of capacity to the existing 1.1 billion lb/year capacity. This expansion allows Westlake, it said, to take advantage of increased ethylene production at the site and provide additional PVC resin to growing global demand.

Estimated construction costs for the projects are $210-240 million. The ethylene expansion and feedstock conversion will start up in second-quarter 2014; the PVC expansion in late 2014 (OGJ Online, Oct. 2, 2012).

Early in 2013, Westlake let a contract to Technip for the expansion and modernization of the cracking furnaces and recovery section of its Calvert City plant (OGJ Online, Jan. 29, 2013).

In first quarter this year, Westlake performed planned maintenance and expanded the Petro 2 ethylene unit at its Lake Charles, La., plant. This expansion was to increase ethane-based ethylene capacity by 104,000-109,000 tpy (OGJ Online, Sept. 25, 2012).

Late last year, Dow Chemical Co. announced a number of ethylene-related projects along the US Gulf Coast to take advantage of low-cost feedstocks derived from US shale gas production.

Among the projects were:

• Restarting an ethylene cracker near Hahnville, La., by yearend 2012.

• Improving ethane feedstock flexibility for an ethylene cracker in Plaquemine, La. in 2015.

• Constructing a new ethylene plant in the US Gulf Coast to start up by 2017.

• Building a new propylene plant at Dow's Texas operations for start-up in 2015.

The Taft 2 ethylene plant near Hahnville, La. began producing on-spec ethylene on Dec. 25, 2012 (OGJ Online, Jan. 14, 2013).

Recently, Dow Chemical let an engineering, procurement, and construction (EPC) contract to Fluor Corp. for a propane dehydrogenation unit, an ethane cracker, and associated power, utilities, and infrastructure upgrades at its Oyster Creek complex in Freeport, Tex. The upgrades are focused on processing hydrocarbons from domestic shale formations, the companies said (OGJ Online, May 2, 2013).

In April 2012, Dow reported it would build an ethylene plant at Oyster Creek, Light Hydrocarbon 9 (LHC 9). The company's greenhouse gas permit application with the US Environmental Protection Agency estimated LHC 9's maximum ethylene output at 1.95 million tpy. Dow expects the unit to enter service in 2017.

Only a few weeks ago, BASF Total Petrochemicals LLC completed a revamp of its steam cracker in Port Arthur, Tex., enabling the 1-million-tpy plant to process ethane. The company is considering construction of another steam cracker at the site.

The existing cracker, adjacent the 174,000-b/d Port Arthur refinery and operated by Total Petrochemicals & Refining USA Inc., was commissioned in 2001 to process naphtha.

After the revamp, the Port Arthur cracker can produce as much as 40% of its ethylene from ethane and another 40% from butane and propane.

BASF Total is building a tenth ethane-cracking furnace at the facility. Scheduled to come on stream in second-quarter 2014, the furnace will increase cracking capacity by nearly 15% (OGJ Online, May 23, 2013).

In March of this year, ExxonMobil Chemical said it had filed permits for a multibillion-dollar expansion at its Baytown, Tex., integrated refining-chemical producing sites.

The project would convert ethylene from a new steam cracker to premium polyethylene products for world markets. Plans call for construction of a 1.5-million-tpy ethane cracker at the complex as well as two 650,000-tpy polyethylene production lines near its plastics plant in Mont Belvieu, Tex. (OGJ Online, June 5, 2012).

In March this year, LyondellBasell announced it was beginning construction on the first of several projects to expand its US ethylene capacity.

Starting in 2014, the company will expand its Corpus Christi, Tex., cracker by about 363,000 tpy with start-up targeted for 2015. Construction associated with the La Porte, Tex., expansion was to begin in March of this year, adding about 363,000 tpy upon completion next year.

A third project will add about 113,000 tpy of ethylene at Channelview, Tex., in 2015.

The company said that, as of first-quarter 2013, it had six US crackers capable of producing about 4.4 million tpy. It said it was configuring its US olefins capacities to run 100% domestically produced feedstocks, with up to 90% being NGLs, such as ethane.