Ukraine's gas upstream sector: focus on international investment

Roman Opimakh

Economic Reforms Coordination Center

Kiev, Ukraine

Ukraine depends to a large extent on natural gas imports, which are mainly met by one external supply source.

To enhance energy security and develop market competition, the Ukrainian government has taken measures to increase the indigenous gas production and liberalize the domestic gas business. Achieving these goals requires large-scale investments in the upstream sector.

To attract these investments requires systemic reforms in the areas of tax regime, access to hydrocarbon reserves, and pricing to develop an attractive, stable, and transparent business environment.

The past year has shown a positive trend in this direction, which is supported by the decisive actions of the Ukrainian government in 2013.

Natural gas resource base

Natural gas forms the largest share in the structure of primary energy consumption in Ukraine–about 40%, which is one of the highest in the world.

In the past 13 years, gross gas production ranged from 18 to 21 bcm/year that helped fill about one third of domestic demand (basically household needs). The lack of domestic production is covered by import, mostly from Russia. In 2012 Ukraine consumed around 55 bcm of gas, including 33 bcm of imported gas, 99% of which Gazprom supplied.

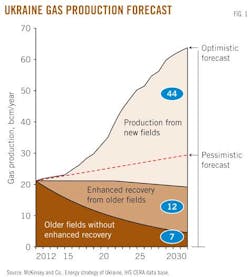

According to various predictions, domestic gas production by 2030 could grow to 30 bcm/year in a pessimistic scenario to as much as 65 bcm/year in an optimistic one (Fig. 1). The long-term industry goal is to satisfy overall domestic demand with indigenous gas production.

The forecasts are based on two pillars: the country's resource potential and the assumption that in the nearest future will be created a climate favorable development of conventional and unconventional gas deposits.

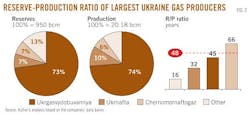

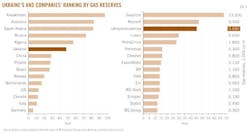

With regard to the hydrocarbon resource base, Ukraine has sizable conventional and unconventional gas deposits. Ukraine has 1.1 trillion cu m of proved conventional gas reserves plus 5.1 trillion cu m potential conventional gas resources.

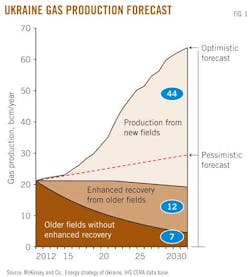

At current production levels, proved reserves are sufficient for nearly 50 years, among the longest in the world (Figs. 2 and 3).

However, a detailed analysis of the data indicates that almost all of the existing and prospective conventional fields have been developed, the share of drilled deposits accounts for 80% of the reserves, and the main large fields are in decline due to their continuous operation.

At the same time, new deposits are mainly located in border zones, deeper pools of older fields, and in traps that are difficult to drill. For example, 63% of proved reserves fall into the category of hard-extractive, the development of which requires huge capital investment and raises production costs. Thus less than 40% of the proved reserves of the largest state-run gas producer, Ukrgasvydobuvannya, could be extracted without further investments.

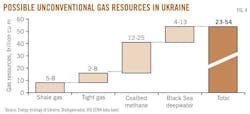

According to preliminary estimates, Ukraine also holds huge untapped unconventional gas resources, including Black Sea deepwater hydrocarbons, the potential of which totals 20 to 50 tcm (Fig. 4).

Current production could be stabilized or increased by 2020 by exploring deeper horizons in existing fields, applying enhanced recovery methods, and adding compressor stations.

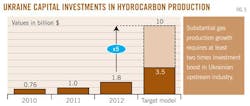

However, to achieve the production growth target by 2030 also requires development of the more challenging resources and the introduction of capital-intensive advanced methods of horizontal drilling and hydraulic fracturing. Therefore, to triple Ukraine's gas production will require at least a doubling of upstream investment to $3.5-10 billion/year (Fig. 5).

Achieving such a gas production target depends directly on the Ukrainian government's ability to insure a predictable long-term framework that provides a sound and stable investment climate.

Considering the most typical challenges to investment growth–mainly tax system unpredictability, changeable legal framework on access to hydrocarbon reserves, and distorted system of gas pricing–this article describes legislative improvements implemented in the past year and further reforms planned for 2013.

The reforms are based on recommendations of Ukraine's Energy Strategy, advices from IHS CERA, the International Energy Agency, World Bank, McKinsey & Co., and direct consultations with gas producer companies in Ukraine.

New hydrocarbon fiscal regime

The tax system for hydrocarbons in Ukraine corresponds largely to worldwide practice but including several local peculiarities (particularly a two-level gas tariff system).

Starting from 2013 the rates of royalty payment are calculated as a percentage of the value of extracted hydrocarbons and based on its cost linked to state-regulated prices for residential consumers or referenced import parity prices for industrial consumers.

A regular fiscal approach includes a combination of corporate income tax (19%, starting from 2014–16%) and charges for subsoil use (kind of a royalty tax). Ukraine doesn't have any special tax on excess profit or windfall profit. The fee for special permit for subsoil use is a kind of one-time bonus payment.

Under this regular license operation the export of hydrocarbons is subject to special licensing, annual volumes quotation, and customs duties.

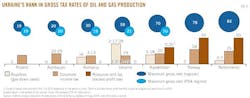

The fiscal system fixes the flexible royalties for produced gas (11-25%), differentiating the rates according to geological conditions (depth and location of deposits) and consumer category (residential or commercial end-users), also it provides a opportunity to operate on not-regular terms of the Production sharing agreement (PSA) under which royalty for natural gas is 1.25%.

To encourage the development of exhausted and hard-extractive resources the government also is going to intensify the existing beneficial tax mechanism in the manner of applying in practice the incentive royalty fixed on 2% for hydrocarbons produced from hard-extractive deposits and depleted fields (Table 1).

Therefore nowadays Ukraine's fiscal system for hydrocarbons is competitive and quite attractive at the international level, especially under PSA terms (Fig. 6).

Access to hydrocarbon reserves

The legal terms (Fig. 6). The PSAs holders are only the subject to: CIT (19% currently, 16% in 2014); royalty (fixed at 1.25% for gas and 2% for oil); VAT (20% currently, 17% starting from 2014), VAT zero-rate for export operations. No other taxes will apply to PSA investors.

They are (1) the regular license-granting mechanism under which special permits (referred to as the license) are awarded at auctions or directly and (2) the production sharing agreement (PSA) regime.

Under the PSA an investor is obliged to invest a fixed sum in pilot exploration (nowadays during a 5 or 7-year period for land and offshore areas, respectively), and the investor's production costs shall not exceed 70%, while the government captures a share of profit oil that varies from 25% to 60% (depending from a volume of production and a level of commodities prices) and revenue from a limited number of payable taxes and other payments (bonuses, social investments).

In the process of preparation for concluding PSAs with Shell, Chevron, and ExxonMobil, the Ukrainian PSA regime in 2012 underwent crucial tax and legal improvements that made it the most attractive and safeguard for strategic investors aiming to operate in Ukrainian upstream sector.

The favorable legal framework even prompted DTEK, a member of the financial-industrial group of SCM and the shareholder of Vanco Prykerchenska, to engage actively seeking solutions to a long-standing dispute around Ukraine's first PSA contract to develop the Black Sea Prykerchenska block. At present the PSA is in force (confirmed by the Ukrainian government resolution and international court decision), and DTEK is looking for skilled international partner for launch the project development.

Much work remains in order to mobilize the capital investments under a regular licensing regime and expedite the procedure of land plot acquisition for oil and gas operations. Thus this year Subsoil Code will be significantly updated in line with European Directive 94/22/EC and related to best international practice (Table 2), as well as essential positive amendments to the Land Code will be adopted (as of March 2013, both laws had already been drafted).

As stated, the implemented and upcoming improvements in the fiscal, legal, and contractual framework have already allowed Ukraine's upstream industry to welcome such international major players as Shell, ENI, ExxonMobil, and Chevron as successful bidders for unconventional and deepwater hydrocarbon blocks (Fig. 7).

Developing a competitive domestic gas market

The injection of foreign investment into the upstream industry is closely connected with positive changes in midstream and downstream gas segments–success of domestic market liberalization process.

In particular, the current two-level pricing system, which sets the price for domestic gas below cost recovering and not reflecting imported gas prices, discourages indigenous gas production, diminishes incentives for energy savings, and weakens the financial position of the state-owned enterprises.

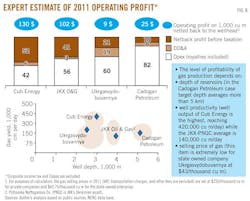

The analysis of Ukrainian assets of the four biggest domestic gas producer companies showed a significant difference in the operating profit from gas sales (gas netbacks) depending on the geological conditions and pricing model for private producers and state-owned Ukrgasvydobuvannya (Fig. 8).

The ongoing efforts to liberalize the gas market in line with Ukraine's Energy Community commitments are extremely important. Today the most expected market reforms are progressively implemented–thus the equal nondiscriminatory third-party access to the gas transmission infrastructure was adopted under the independent energy regulator control, the government has already taken several steps to prepare the unbundling of state-run company Naftogaz into separate legal entities by key gas business segments (the reorganization program is under elaboration by Ernst & Young), with the objective to finalize this process by this year.

Furthermore it should be admitted that the elimination of a Naftogaz-dominant position under the current circumstances (90% of gas sold for the commercial and heating sector has Russian origin) will not create the environment necessary for a free gas selection on the most attractive prices.

Therefore, Ukraine's gas market reform must be accompanied by the creation of technical capabilities for supply the gas from several alternative sources.

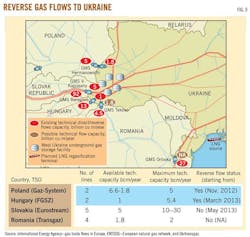

Nowadays there is no restriction on import gas inside Ukraine for every gas supplier, the LNG regasification terminal project is under development (feasibility study was approved as feasible from the technical point of view, viable and economically sound project), the first gas flow as of May 2013, up to 291 million cu m, has already been shipped from Poland, Hungary, and Slovakia via the existing cross-border gas infrastructure used in reverse mode (Fig. 9).

According to the framework agreement between Naftogaz and RWE Supply & Trading of May 2012, the contracted supply volume amounts around 1.5 bcm/year with a possible increase to 5 bcm/year.

Moreover the reversing of gas flows opens for Ukraine the promising opportunity to join to European natural gas spot trading. For this purpose it's reasonable to use Ukraine's underground gas storage facilities on the western border with total working capacity on 24 bcm/year by European gas suppliers and in the long run establish a so-called Eastern European gas hub.

Acknowledgments

This article references the global data and great expertise of IHS CERA, Ernst & Young, CMS Cameron McKenna, and McKinsey & Co.

The author

Roman Opimakh ([email protected]) is oil and gas reform coordinator at the Economic Reforms Coordination Center mandated by the president of Ukraine. He coordinates and monitors the oil and gas reform implementation process in Ukraine according to the 2011, 2012, and 2013 national action plans. For the 2 years he was involved in various roles in realization of the LNG regasification facility project in Ukraine, updating Ukraine's energy strategy through 2030, improving the country's hydrocarbon fiscal regime and legal framework, stimulating competition in the petroleum fuels market, liberalizing the domestic gas market, and restructuring Naftogaz. He was graduated from the International Relations Institute in Kyiv with a masters in international relations and policy affairs and is pursuing a PhD in economics.

Manuscripts welcomeOil & Gas Journal welcomes for publication consideration manuscripts about exploration and development, drilling, production, pipelines, LNG, and processing (refining, petrochemicals, and gas processing). These may be highly technical or they may be more analytical by way of examining oil and natural gas supply, demand, and markets. OGJ accepts exclusive articles as well as manuscripts adapted from oral and poster presentations. An Author Guide is available at www.ogj.com, click "home" then "Submit an article." Or, contact the Chief Technology Editor ([email protected]; 713/963-6230; or, fax 713/963-6282), Oil & Gas Journal, 1455 West Loop South, Suite 400, Houston TX 77027 USA. |