OGJ Newsletter

GENERAL INTEREST — Quick Takes

API broadens its programs to address scrutiny

Growing public scrutiny of oil and gas operations has forced the American Petroleum Institute to broaden its technical program coverage to suppliers of goods and services, API executives said.

David Miller, director of API's standards and practices department, said his department also is working on a new community engagement program.

Plans are to have a draft ready by midyear with a final version by Dec. 31, Miller said during an API lunch with reporters on May 2.

Meanwhile, John Modine, API's global industry resources director, said API's Global Industry Services Group is conducting refinery and gas processing plant audits.

API has developed Work Safe, an online employee training system that companies can adopt.

"It takes a long time for the results of improved training to infiltrate every company's operations," he said. "Culture can be the toughest thing to move in any organization."

Modine recently attended a Center for Offshore Safety forum where participants said the biggest challenge is making it so employees are rewarded, and not reprimanded, for reporting problems.

"The oil and gas services industry is about eight times the industry's manufacturers, but it was left alone for a long time," Modine said. "We've visited several service companies' headquarters, but the real work gets done when we see their work sites."

API is not ready yet to certify service contractors, but hopes to have its first certification program for them this summer, he added.

About 5,000 certified licenses are on API's composite list, which can be viewed online, Modine said.

HRT to acquire Campos basin shelf oil field

HRT Oil & Gas Ltd., Rio de Janeiro, will acquire BP PLC's 60% interest in Polvo oil field in shallow water in the southern Campos basin offshore Brazil for $135 million cash.

Polvo produces 13,000 b/d of oil. BP expects the deal to close in this year's second half.

BP purchased interests in 10 exploration and production blocks, including Polvo field, from Devon Energy Corp. in 2011 and farmed into four deepwater blocks operated by Petroleo Brasileiro SA a year later.

Guillermo Qintero, BP Brazil president, said, "Over the past 2 years BP has built a significant portfolio of upstream interests in Brazil which offer long term growth potential. We are now actively engaged in exploring this new acreage. The sale of our interest in the Polvo field is part of our ongoing global portfolio optimization as we reposition the company for long-term growth."

Earlier this year BP announced a successful flow test at its operated Itaipu discovery in the Campos basin on one of the blocks acquired from Devon.

Polvo field, in 100 m of water 100 km off Rio de Janeiro, went on commercial production in 2007. BP has operated Polvo since acquiring it from Devon. Maersk Oil holds the other 40% interest in Polvo.

Statoil warns against Norwegian tax move

Statoil says a proposal by the Norwegian government to lower an allowance against the special petroleum tax would hurt the allure of future offshore projects.

The government proposes to lower the rate of the allowance, called uplift, to 5.5% from 7.5%. The special petroleum tax applies at the rate of 50% to profits from petroleum production and pipeline transportation on the Norwegian continental shelf.

It applies in addition to a standard 28% income tax.

"The proposed change in the Norwegian petroleum tax reduces the attractiveness of future projects, particularly marginal fields, and raises questions regarding the predictability and stability of the fiscal framework for long-term investments on the Norwegian continental shelf," said Torgrim Reitan, Statoil chief financial officer.

Exploration & Development — Quick Takes

ExxonMobil starts Julia ultradeepwater project

ExxonMobil Corp. will develop a field with nearly 6 billion bbl of resource in place more than 30,000 ft below the sea floor in more than 7,000 ft of water in the Gulf of Mexico.

An initial development phase will result in production of 34,000 b/d of oil from Julia field starting in 2016. Capital cost for the project is estimated at more than $4 billion, ExxonMobil said.

Julia, in 2007 one of the first large oil discoveries in the gulf's ultradeepwater frontier, comprises Blocks 584, 627, 628, 540, and 583 in the Walker Ridge planning area 265 miles southwest of New Orleans.

The Initial development phase includes six wells with subsea tiebacks to the Chevron Corp.-operated Jack and St. Malo production facility. Julia project front end engineering design has been completed and the engineering, procurement, and construction contracts have been placed.

Neil W. Duffin, president of ExxonMobil Development Co., said, "The development of Julia will provide a new source of domestic energy and well-paying jobs over the next several years. Access to resources such as Julia will contribute to US energy security for many years."

Duffin added, "Enhanced technologies will be deployed to ensure the safe and environmentally responsible development of this important energy resource."

ExxonMobil, the operator, and Statoil Gulf of Mexico LLC each hold a 50% interest in the Julia unit.

ExxonMobil said it has drilled 36 deepwater wells in the gulf 4,000-8,700 ft of water in the past decade.

Husky lets White Rose satellite contracts

Husky Oil Operations Ltd. has let two contracts to Technip for work related to the South White Rose Extension (SWRX) tieback to White Rose oil field offshore Newfoundland and Labrador.

The project will develop the Early Cretaceous Ben Nevis/Avalon formation of the South Avalon and SWRX satellite pools. Wells completed subsea will be tied back to the SeaRose floating production, storage, and offloading vessel on the main field, which lies in 120 m of water 350 km southeast of St. John's.

Husky, operator, plans to drill two horizontal production wells, one deviated gas injector, and one water injector to develop the SWRX pool, in which it holds a 68.875% working interest with partners Suncor Energy, 26.125%, and Nalcor Energy-Oil & Gas, 5%.

To develop the South Avalon pool, it plans one horizontal infill producer and one highly deviated gas injector. Interests in that pool are Husky 72.5% and Suncor 27.5%.

With an assumed end of field life at 2030, Husky estimates cumulative oil recoveries from the SWRX drill center of 24 million bbl from the SWRX pool and 9 million bbl from the South Avalon pool.

Technip's contracts cover the supply and installation of gas-injection flowlines, umbilicals, and subsea structures.

East Java Sea Lengo gas field may be commercial

A group led by a subsidiary of KrisEnergy Ltd., Singapore, has tested gas at the Lengo-2 appraisal well on the Bulu PSC in the East Java Sea offshore Indonesia.

Gas flowed at a maximum rate of 4.6 MMscfd on a drillstem test of the Kujung formation at 2,415-85 ft, prompting partner AWE Ltd., Sydney, to state that "subject to a successful evaluation of the composition of the gas, plans remain on track for the well to confirm the accumulation as suitable for a future commercial development."

The well is projected to continue drilling to 2,726 ft to tag basement.

Bruce Clement, AWE managing director, said "The results to date are in line with predrill expectations and are providing us with valuable data that will help us progress the Lengo field to a commercial development decision."

The KrisEnergy-operated well was at 2,485 ft measured depth running in hole with a core assembly in preparation for cutting a second 90-ft of core in the primary objective Kujung 1 carbonate reservoir.

To date, AWE said, a single core has been cut 2,425-85 ft, recovering an estimated 58 ft of carbonate Kujung 1 reservoir formation.

The results of the DST confirm that the previously untested upper part of the primary objective at Lengo-1 has reservoir quality sufficient to contribute potential future production at the Lengo-2 location.

After cutting the second 90-ft core, the plan is to run wireline logs and a second DST that will evaluate the entire Kujung 1 formation intersected, drilling to TD, running final wireline logs, and plugging the well as intended.

Interests in the Bulu PSC are KrisEnergy Satria Ltd. and AWE via subsidiaries 42.5% each, PT Satria Energindo 10%, and PT Satria Wijaya Kusuma 5%.

Drilling & Production — Quick Takes

Canada firm to redevelop East Java oil field

Rift Basin Resources Corp., Vancouver, BC, has signed a memorandum of understanding with PT Sinergi Wijaya Kusumah to evaluate and redevelop an onshore multireservoir oil field known as the Dandangilo & Beji block in Bojonegoro, East Java, Indonesia.

PT Sinergi has the rights under a renewable 5-year cooperation agreement with KUD Sumber Pangan to produce oil from existing shut-in oil wells in the 80 sq km area. Six wells are producing 1,500 b/d of oil. The area contains 110 wells.

KUD is a district-level cooperative with the rights, under a petroleum production contract with PT Pertamina, to lift and raise oil from relinquished and mature fields and deliver to an agreed point as approved by the Ministry of Natural Resources.

Pertamina has recorded 20 million stb bbl of production during 1963-80 from original oil in place of 112 million stb.

Rift Basin entered into a separate MoU under which Rift Basin and Portvest International Sdn. Bhd., through a newly established Indonesian foreign investment company, will jointly hold 70% of PT Sinergi, which in turn holds the rights to exploit the field. Portvest will be the operator and responsible for funding initial service and enhancement work required to establish initial production cash flow and attract a project lending facility.

The MOUs do not create obligations other than giving Rift Basin the opportunity to negotiate and enter into definitive agreements and in the case of the PT Sinergi MOU, to establish enhanced oil recovery and production. Rift Basin expects that PT Sinergy, Portvest, and related parties may introduce other fields to Rift Basin for joint development and benefit in due course.

Flow starts from Gulf of Mexico discovery

Energy Resource Technology GOM LLC (ERT) has started production from its Green Canyon 237 No. 5 discovery in 2,200 ft of water in Phoenix oil field in the Gulf of Mexico.

The well is producing at sustained rates of 4,200 b/d of crude oil and 6.3 MMcfd of natural gas with no water into the Helix HP-1 floating production unit.

ERT, operator, is a wholly owned subsidiary of privately held Talos Energy LLC.

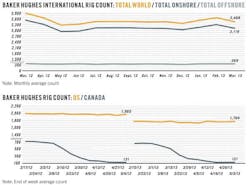

US drilling rig count gains 10 units to 1,764

The US drilling rig count gained 10 units during the week ended May 3 to a total of 1,764 rotary rigs working, Baker Hughes Inc. reported. That compared with 1,965 rigs working in the comparable week last year.

Most of the gains were seen in land-based drilling activity, which increased 9 units from a week ago to 1,690 rigs working. The offshore count rose by 2 units to reach 51, while inland water drilling dropped by 1 unit to 23. Of the rigs drilling offshore, 48 were in the Gulf of Mexico, up 1 unit from a week ago.

Rigs targeting oil climbed by 22 units to 1,403, while those targeting gas decreased by 12 to 354. There were 7 rigs considered unclassified, unchanged from a week ago.

Rigs drilling horizontally were reported at 1,092, up 8 units from a week ago and 66 fewer than the comparable week last year. Rigs drilling directionally fell 2 units to 197. This compared with 234 rigs working horizontally in the comparable week a year ago.

Of the major oil and gas producing states, Oklahoma and Alaska, at respective counts of 188 and 8, each gained 5 units. Four states gained 1 rig each: North Dakota, 174; Pennsylvania, 60; Wyoming, 41; and Ohio, 32. Four states were unchanged from a week ago, namely Colorado, 63; California, 41; West Virginia, 24; and Arkansas, 15. Louisiana, at 108, and New Mexico, at 78, were down 1 unit each. Texas lost 3 units to reach 831.

PROCESSING — Quick Takes

Gazpromneft to upgrade Moscow refinery

Gazpromneft has let a front-end engineering and design contract to a Foster Wheeler AG subsidiary for an upgrade of its Moscow refinery.

The work will increase design capacity of the refinery to 18.15 million tonnes/year (tpy) from 12.15 million tpy.

A project Gazpromneft calls Combined Oil Refinery Unit includes crude distillation and vacuum distillation units, a continuous catalytic reforming unit with naphtha hydrotreatment and hydrogen recovery by pressure-swing adsorption, a diesel hydrotreater including a dewaxing section, a gas plant with an LPG sweetening unit, and common utilities.

Foster Wheeler's Global Engineering & Construction Group is to submit design documentation in the first quarter of 2014.

OMV boosts butadiene output at refineries

OMV is investing €230 million to add a butadiene plant at its 73,000-b/d refinery at Berghausen, Germany, and to upgrade a butadiene plant at its 193,000-b/d refinery at Schwechat, Austria.

The company didn't disclose capacities but said the combined capacities would represent 6% of European butadiene production.

The extended Schwechat plant is to start production in June 2014. The new Berghausen plant is to start up in the second quarter of 2015.

Dow lets contract for Oyster Creek expansion

Dow Chemical Co. let an engineering, procurement, and construction (EPC) contract to Fluor Corp. for a propane dehydrogenation unit, an ethane cracker, and associated power, utilities, and infrastructure upgrades at its Oyster Creek complex in Freeport, Tex. The upgrades are focused on processing hydrocarbons from domestic shale formations, the companies said.

In April 2012, Dow reported it would build an ethylene plant at Oyster Creek, Light Hydrocarbon 9 (LHC 9). The company's greenhouse gas permit application with the US Environmental Protection Agency estimated LHC 9's maximum ethylene output at 1.95 million tonnes/year. Dow expects the unit to enter service in 2017.

Oyster Creek is part of Dow's integrated Texas Operations site in Freeport, along with Plant A, Plant B, and Salt Dome. Dow's Texas Operations produce more than 21% of the company's global sales volumes. Dow is adding a propylene plant to Texas Operations which it expects to begin operations in 2015. Dow licensed UOP LLC's C3 Oleflex process technology for manufacturing on-purpose propylene from propane for the project.

Fluor's office in Sugar Land, Tex., will lead the EPC and self-perform construction phases of the project with additional support provided by its Asia Pacific operations. Fluor booked the undisclosed contract value into backlog in this year's first quarter.

TRANSPORTATION — Quick Takes

Woodside looks at Shell floating LNG technology

Woodside Petroleum Ltd. has made an agreement with Royal Dutch Shell PLC to investigate the possibility of using Shell's floating LNG (FLNG) technology for the Browse LNG project offshore Western Australia.

The agreement sets out the key principles that would apply in the project was developed using an FLNG vessel. It also provides a framework for the Browse joint venture to go down the FLNG route as a development concept.

Woodside will now discuss this and other development concepts with other Browse partners PetroChina and Japan Australia LNG (MIMI) Pty. Ltd.

A pipeline to the Burrup Peninsula is another option as is a smaller-than-first conceived land-based LNG plant at James Price Point in Kimberley. However the agreement with Shell points strongly to FLNG with Woodside managing director Peter Coleman saying he is enthusiastic about this technology.

Early last month, Woodside caused a stir by pulling the pin on the original version of James Price Point LNG plant, saying a development switch would provide significant savings (OGJ Online, Apr. 12, 2013). The James Price Point option as it stood was too expensive for Browse LNG.

Not surprisingly Western Australian Premier Colin Barnett was less than pleased. He said FLNG was technology that had yet to be built and yet to be tried anywhere in the world, let alone the cyclone zone off the Kimberley coast.

TransCanada to build Alberta crude line

TransCanada Corp. has reached binding long-term shipping agreements to build, own, and operate the proposed Alberta-based Heartland Pipeline and TC Terminals projects. The projects will include a 200-km, 900,000 b/d pipeline connecting the Edmonton region to Hardisty, Alta., and a crude terminal with 1.9 million bbl of storage in the Heartland industrial area north of Edmonton. TransCanada expects the projects to enter service in second-half 2015.

The company described the project as geared toward helping move an expected 3 million b/d increase in Alberta oil production over the next 15 years to Eastern Canada and the US.

TransCanada intends to file a regulatory application for the terminal in this spring, followed by a separate application for the pipeline in the fall. It expects the projects' combined cost to total $900 million.

TransCanada last year announced the Grand Rapids Pipeline project, a 500-km pipeline system to transport crude oil and diluent between the producing area northwest of Fort McMurray and the Edmonton-Heartland region. The system will deliver 900,000 b/d of crude and 330,000 b/d of diluent by early 2017 (OGJ Online, Oct. 29, 2012).

NET Midstream adds Eagle Ford gas shippers

NET Midstream's wholly owned subsidiary Eagle Ford Midstream LP (EFM) has secured firm transportation agreements from Eagle Ford shale producers including Talisman Energy USA and Statoil Natural Gas LLC. EFM is a 150-mile, predominantly 30-in. OD intrastate natural gas pipeline supplying Western Gas Partners' Brasada processing plant in LaSalle County, Tex., and transporting pipeline-quality gas to the Agua Dulce hub.

EFM previously announced a 10-year firm transportation agreement with Anadarko Energy Services (OGJ Online, Mar. 23, 2012) and a 100,000-acre production dedication from Murphy Exploration & Production supporting the pipeline. The company plans to expand its gathering system in McMullen County, Tex.

NET Midstream is also developing the NET Mexico Pipeline, a 124-mile, 42-in. OD pipeline from the Agua Dulce hub to the Texas-Mexico border, supplying a Pemex subsidiary under terms of a 2.1 bcfd firm transportation contract. NET Mexico will enter service December 2014 (OGJ Online, Feb. 22, 2013).

The company already operates two other pipelines in the Eagle Ford shale. LaSalle Pipeline is a 52-mile, 16-in. OD pipeline providing the full gas supply requirements for a 200 Mw power plant in Pearsall, Tex. South Shore Pipeline is a 30-mile pipeline serving the City of Corpus Christi under a long-term gas supply and transportation contract.

EPP to add 4 million bbl crude storage to ECHO

Enterprise Products Partners LP plans to add 4-million bbl of crude oil storage to its Enterprise Crude Oil Houston (ECHO) and Bertron sites and about 55 miles of 24-in. and 36-in. OD pipeline connecting ECHO to southeast Texas refineries. The expansion will bring ECHO's total capacity to more than 6 million bbl, with the pipeline also providing access to EPP's marine terminal at Morgan's Point on the Houston Ship Channel.

EPP described the plans as designed to facilitate the use of increased US crude production by southeastern Texas refiners. It expects to perform the expansion in phases, to be complete by fourth-quarter 2014.

ECHO Phase 1—750,000 bbl divided between three tanks—entered service late last year (OGJ Online, Nov. 2, 2012). EPP expects to complete ECHO's 900,000-b/d Phase 2 by first-quarter 2014.

KW Express LLC is building 210,000 b/d crude oil rail and barge terminal on the Houston Ship Channel (OGJ Online, Feb. 22, 2013).