Uncertainties threaten natgas development

Michael Lynch

Strategic Energy & Economic Research Inc.

Boston

The past decade has seen what is now considered to be a revolution in natural gas production, as the industry has discovered how to produce natural gas economically from tight formations such as shales, which are extremely common.

The US, which was only recently anticipated being a major LNG importer, is now poised to become an LNG exporter instead, and the practice has begun to spread to other parts of the globe, albeit it slowly. This trend has potentially serious implications for international natural gas prices, as well as oil markets.

One of the biggest uncertainties for energy companies is, after all, long-term prices. The various swings (1979, 1986, 1998, and post-2000) have not only caused great shifts in the market, but also generally have taken nearly everyone by surprise. Combined with uncertainty about long-term costs and the lengthy investment lag for big projects, the problem is enormous.

The truth is that natural gas remains abundant. While public attention has focused on the shale gas boom, conventional gas fields continue to be found around the world, including supergiants in the Mediterranean and off East Africa. Robert Hefner's assertion that "the age of gas" has come looks very solid.1

Price dilemma resurrected

But in much of the world, price setting remains a problem.

Policies seem aimed at keeping domestic gas prices low for industry (and other consumers), as well as at preventing producers from getting "excessive" profits, particularly where they are foreign or private companies.

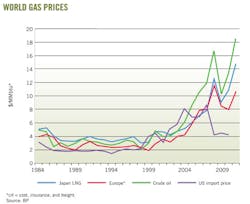

For exporters, price setting is a different problem because there is no functioning market that sets international gas prices. Starting with the use of natural gas to replace crude oil in power generation in Japan 4 decades ago and bolstered by the 1970s' hysteria for replacing insecure crude imports, consumers agreed to pay the same price for imported natural gas as for crude oil imports, converted on a heat-equivalent basis.

This has generally meant that natural gas prices in most of the world have been well above those in North America, the only major market where prices are set by supply and demand (see accompanying figure). This makes as much sense as pricing tea sales based on coffee prices, adjusted for caffeine content.

Enter shale gas

To date, shale gas has made an impact only in the US, but expectations of soaring LNG imports in North America have now been reversed, possibly to the point of the US (and Canada, and conceivably Mexico someday) becoming major gas exporters.

Projects in Qatar and Russia that had been aimed at the US market now find themselves either delayed or casting about for new buyers, and other projects could soon experience the same trouble. What happens if this trend spreads to other importers (current or potential)?

Most notably, the industry has great hopes for China as a market for LNG. But China has an estimated 1,275 tcf of shale gas.2 While it has only recently begun to learn hydraulic fracturing, its companies are certainly capable of large-scale, repetitive drilling operations.

Given that natural gas demand has been increasing by about 500 bcf/year in the past 5 years, shale gas production should soon reach levels that satisfy most demand growth. It took the US about 8 years to reach that level of incremental production, and while China might take a little longer to accomplish that, it doesn't face the same kinds of skepticism and resistance to the viability of shale that the early US drillers have.

Europe is a different story, with much greater—and more effective—resistance from the public to large scale drilling and fracking. Restrictions or outright bans on hydraulic fracturing have been problems in mostly western European countries, but Poland and England appear to be moving ahead with at least some development.

Supply growth does not look likely to be rapid, but European natural gas demand will be anemic for several years, at least, and supplies from North Africa will meet much of Western Europe's incremental needs. Russia's Gazprom will be especially hard hit by anemic demand in markets east and west.

There goes the neighborhood

The advent of fracking has also seen grassroots opposition, complete with Hollywood stars and a pseudo-documentary.3 Fears of the pollution of large watersheds, local drinking water, and increased cancer rates have led to massive protests, local and national restrictions on the practice, and even some actual scientific investigation.

Given the somewhat novel nature of the practice (at least in many locales) and the proprietary attitude drillers have taken to the chemicals used in fracking, it makes a certain sense to examine both what is being done and the possible resulting pollution.

To date, the research has been relatively minimal and has found little or no evidence that pollution is actually occurring—at least from fracking.

Opposition thus seems to belong to that category of irrational fears of technology, bolstered by the foolish equation of any illness or problem with fracking. Based on the experience of past scares about electrical transformers and leukemia or cell phones and brain tumors, it seems likely that rational consideration will win out.

Still, there are those who oppose drilling in their immediate vicinity simply because of the inconvenience. They are unlikely to be satisfied by scientific studies but might be assuaged by financial remuneration.

Wealthy, developed areas such as New York and Paris are hardly likely to allow drillers and frackers access any time soon. Given that shales are typically huge, however, finding places where jobs and royalties are more welcome than large trucks feared, or countries such as China that will not bend to moderate public pressure should mean that the global shale business will not be significantly deterred by public opposition.

Increased shale gas production

Because shale gas wells are expensive and less productive than wells in such areas as East Africa offshore, eastern Siberia, or Australia, the implication is that shale gas will prosper when it is found near consuming areas, such as in the US or China, as transport costs will be minimal. (The differential is heightened by price-setting clauses described above.) Thus, investment will be done locally and reduce imports in many nations, as already in the U.S.

The outlook, then, is for much slower growth in the international trade of natural gas, especially LNG. Such major exporters as Russia and Australia will find that markets are largely closed to them and that they must compete fiercely for small volumes of new sales. And with the growing number of players in the market, it seems highly likely that the oligopoly will break down and some exporters will try to expand market share by discounting prices relative to crude oil equivalence. That would take the industry back to the 1960s, when the Dutch created a European market by pricing Groningen gas to compete with coal and residual fuel oil in the power sector.

Of course, there will be strong resistance from existing exporters who will hardly welcome revisions to existing, high-priced contracts, and only when there is enough pressure will the practice break down.

The tipping point will be when shale gas is recognized as ubiquitous and cheap enough to compete with oil price-linked imports and when exporters scramble to lock in contracts and avoid being locked out of markets. This could be similar to 1986, when such exporters as Statoil decided to abandon efforts to achieve ever-higher prices in order to cope with lower-price competition.

Already, there are some signs that price indexes are changing, as it is reported that Kansai Electric in Japan has signed a contract tied to Henry Hub prices with BP (although it is not clear what multiplier is used) and Statoil is offering a contract to Wintershall with prices linked to European spot prices.4 These amounts are small but could signal just the beginning of broader shift.

An important implication would be for exporters to be forced to choose between price-cutting and having their gas "stranded" especially if oil prices retreat from current elevated levels. One option that would then present itself is to utilize it domestically, essentially on site where low production costs could be translated into low fuel or feedstock prices.

Increasing use of gas for power generation should certainly be pursued in many of these places, but one interesting alternative is as feedstock for gas-to-liquids (GTL) plants.

Prospects for GTL

Gas-to-liquids is in an interesting position where it should, theoretically, be quite attractive economically and yet actual investment has been minor. Qatar hosts the biggest plant, but there is ongoing interest in the US, now a source of low-priced natural gas, including Alaska with its stranded gas reserves. Other areas, such as East Africa and Australia that would seem prospective have yet to attract investment.

The technology is well established but suffers from the expense involved, although in 1996 when Syntroleum announced progress in reducing costs, most of the majors showed interest. Capital costs were said to be $20,000-30,000/b/d a decade ago but now are estimated to be up to ten times as much.5 Shell's Pearl project in Qatar experienced a huge escalation in capital costs, and the proposed Exxon Qatari plant was abandoned.

It could be argued, however, that Pearl's cost inflation reflected cyclical pressures on the engineering industry, including the run-up in steel prices at the time, and would not recur, or at least not to that extent.

But, it could equally be that some of the cost inflation was due to excessive optimism about capital costs that often infects big projects and their promoters.

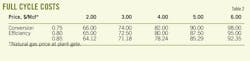

Future capital costs should be about $45/bbl, assuming construction one sixth lower than Pearl and favorable interest rates, up to $55/bbl if costs are equivalent to Pearl. (This assumes a discount rate of 15% plus maintenance costs of 3% of the capital costs.) Also, not every project is likely to have the liquids offset—NGLs and condensate—that the Pearl plant has.

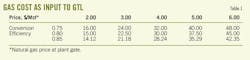

Table 1 shows the gas input cost, assuming different gas prices and efficiencies; the Pearl plant reportedly has an efficiency of 75%. In Table 2, capital and maintenance costs are estimated at $50/bbl, yielding costs ranging from $64-98/bbl. A discount of $20/bbl for the ultra-clean nature of the products is reasonable, at least at $100/bbl crude prices, and seems unlikely to fall below $10/bbl.

The implication is that, with Brent prices above $100/bbl, even an expensive plant with high-cost gas ($6/Mcf) would be profitable, which should mean that even a US plant, under pessimistic assumptions about shale gas economics, should thrive. If oil prices fall to less than $70/bbl, however, plants without cheap natural gas ($2-3/Mcf) would have difficulties. Cheap natural gas, potentially available in Russia, Australia, or Qatar, would make a GTL project much less risky than one in the US.

Market impacts

A combination of lower gas prices and higher production should be expected, the best of both worlds for some but a problem for others. Lower gas prices would mean more fuel substitution in the short run and greater creation of pipeline systems in the long run, with Latin America, West Africa, and South Asia all candidates for extensive pipeline networks. Power generation would become cheaper and more reliable in many areas, as small gas turbines would be preferable in most instances to renewable installations.

There is also a distinct possibility that NGL production will increase sharply, as is already being seen in parts of the US. Prices for propane, for example, have fallen by about 40%, compared with historical levels vis-à-vis oil prices, even more relative to Brent, and are likely to remain so as infrastructure struggles to keep up with rising supply.

This raises the potential for propane markets to expand into new areas, especially where people lack access to commercial cooking fuels. While some displacement of kerosine or heating oil could occur in countries such as India and Japan, it would be hoped that people using biomass will become the new consumer, rather as whale oil was replaced by kerosine for lighting in the 19th century.

The losers would be those LNG exporters that hold out for high prices and find there is no market for them. This could particularly affect high-cost supplies in such places as eastern Siberia, the American Arctic, and the Shtokman deposit off northwest Russia. Others, such as new discoveries in East Africa and Australia, with lower production costs but no market, might attempt to develop local consumers, such as in power generation, petrochemical plants, or conversion to liquids through GTL. Recall, after all, that the petrochemical industry has generally migrated to areas with surplus natural gas, beginning with the 19th Century in Appalachia.

Of course, aside from the question of oil equivalence in pricing, the possibility that oil prices will fall could affect natural gas trade as well. If oil prices remain high, then discounted LNG prices could lead to greater market share for gas in many Asian countries, especially the historical LNG importers that still use large amounts of residual fuel oil for power generation. Lower oil prices, say $60/bbl, could discourage high-cost LNG producers, such as the US, from exporting at a discount, meaning lower cost producers like Australia and Russia would again have an advantage.

Thus, the oil market over the next decade faces a triple storm: higher conventional oil production, competition from shale gas and its attendant NGLs, and rising shale or tight oil supply. This will almost certainly lead to lower prices, but we can hope it will also mean cleaner energy: more natural gas instead of coal for power generation and commercial energy such as propane for the energy impoverished.

On the other hand, there is a high probability of a major expansion of natural gas use, including substitution for coal in South Asia and China and for heavy fuel oil in East Asia, as well as the creation of major systems supplying utilities in other less developed countries, notably in Africa. The rise in NGL production would allow LPG markets to grow, serving those not on any pipeline system, and improve the lot of the energy impoverished substantially.

Timing of the spread of the shale gas revolution might be uncertain, but there is no doubt it will prove transformative to world energy systems, and the industry should be prepared to cope with these changes.

References

1. Hefner, Robert A., III, The Grand Energy Transition: The Rise of Energy Gases,Sustainable Life and Growth, and the Next Great Economic Expansion, Hoboken, NJ: John Wiley and Sons, 2009.

2. Kuuskraa, Vello, et. al., World Shale Gas Resources: An Initial Assessment of 14 Regions Outside the United States, US Energy Information Administration, Apr. 5, 2011.

3. "Gasland" received a lot of attention and an Academy Award nomination, but a casual viewing shows it to be misleading in some respects, and various authorities have criticized factual misstatements. See for example the webpage of American Natural Gas Alliance http://www.anga.us/TruthAboutGasland and my own comments at http://www.usnews.com/opinion/blogs/on-energy/2012/07/30/alec-baldwin-and-fracking-opponents-need-to-check-the-facts.

4. International Oil Daily, Nov. 21, 2012.

5. Gas-to-Liquids Conversion, Arno De Klerk, http://arpa-e.energy.gov/Portals/0/Documents/ConferencesAndEvents/PastWorkshops/De_Klerk_Nat_Gas_Conv_Pres_1_13_12.pdf. January 2012.

The author

Michael Lynch is president and director of global petroleum service for Strategic Energy & Economic Research Inc., Boston, and a lecturer at Vienna University. He has performed a variety of studies related to international energy matters, including forecasting of the world oil market, energy and security and corporate strategy in the energy industries, as well as analysis of oil and gas supply. Lynch is a former chief energy economist at DRI-WEFA Inc. and a past president of the United States Association for Energy Economics. He was a senior fellow for the USAEE. He holds combined SB-SM degrees in political science from the Massachusetts Institute of Technology, Cambridge.