Weak refining margins rein in third-quarter earnings growth

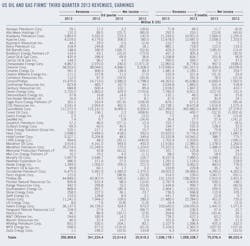

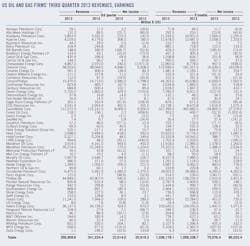

A sample of 59 US-based oil and gas producers and refiners posted a collective increase of 5.2% to $22 billion in earnings in this year's third quarter but a 12.7% decrease to $75 billion in the first 9 months compared with the same periods in 2012.

During the most recent quarter, upstream earnings as a whole increased year over year on higher oil and gas prices and increased production volumes. However, the refining segment continued to report tremendously squeezed earnings due to lower crack spreads, narrowed crude oil differentials, and elevated Renewable Identification Number (RIN) costs compared with third-quarter 2012.

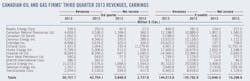

A sample of oil and gas producers and pipeline companies with headquarters in Canada posted a combined increase in net income and revenues for the recent quarter compared with third-quarter 2012.

Prices, refining margins

During this year's third quarter, the front-month futures price of West Texas Intermediate crude on the New York Mercantile Exchange averaged $105.83/bbl, compared with $92.22/bbl in the same quarter in 2012. Front-month NYMEX natural gas futures averaged $3.56/MMbtu in this year's third quarter vs. $2.89/MMbtu a year earlier.

Refining margins in all US regions plunged from a year earlier, according to Muse, Stancil & Co. Cash margins in this year's third quarter averaged $17.78/bbl for Midwest refiners, $13.90/bbl for West Coast refiners, $6.54/bbl for Gulf Coast refiners, and $1.89/bbl for East Coast refiners. In the same quarter of last year, these refining margins were $30.69/bbl, $16.19/bbl, $12.14/bbl, and $8.33/bbl, respectively.

The average composite cost of US and imported crude for US refiners was $105.25/bbl in this year's third quarter, up from $97.5/bbl a year earlier, according to the US Energy Information Administration.

US operators

Fourteen of the companies in the sample recorded a net loss for this year's third quarter, while 27 firms in the group incurred a loss for the 2012 third quarter.

ExxonMobil Corp. posted an 18% decline in earnings to $8.07 billion and a 2.4% decline in revenues to $112.37 billion in the latest quarter from third-quarter 2012. The company's refining and marketing business reported operating earnings plunged 81% to $592 million, as weaker margins, primarily in its refining business, decreased profits by $2.4 billion.

The company's upstream earnings were $6.7 billion in this year's third quarter, up $740 million from third-quarter 2012, primarily because of higher liquids and natural gas realizations. Production increased 1.5% on an oil-equivalent basis.

Chevron Corp. posted $5 billion in third-quarter earnings, down from $5.3 billion a year earlier, primarily because of lower margins for refined products and higher operating expenses reflecting repair and maintenance activities at company refineries. The company's worldwide net oil-equivalent production was 2.59 million b/d in this year's third quarter, compared with 2.52 million b/d in the same quarter in 2012.

ConocoPhillips reported third-quarter net income of $2.48 billion, up 38% from third-quarter 2012 earnings. For the quarter, the company's total liquids production in the Lower 48 and Canada increased 15% compared with the same period in 2012, resulting in the liquids percentage of production increasing to 51% from 46%.

Devon Energy Corp. and Chesapeake Energy Corp. reported profits of $429 million and $240 million, respectively, for this year's third quarter. This compares with third-quarter 2012 respective net losses of $719 million and $1.97 billion.

Devon Energy's oil production averaged 165,000 b/d, a 16% increase compared with third-quarter 2012. The most significant growth came from the company's US operations, where third-quarter oil production increased 38% year-over-year. Chesapeake Energy's third-quarter oil production increased 23% year-over-year to 120,000 b/d.

Refiners

HollyFrontier Corp. reported earnings of $48.5 million in the recent quarter. A year earlier, the Dallas-based company posted $349.6 million in earnings. The year-over-year decrease in third quarter earnings was driven by lower inland refined product margins as a result of contraction in the Brent to WTI differentials, and additionally, higher crude oil prices and increased RIN costs.

Tesoro reported third-quarter net income of $109 million, compared with $280 million for third-quarter 2012. The Tesoro Index for the third quarter was $8.42/bbl, down $8.23/bbl relative to a year ago. "The year-over-year decline in the Tesoro Index can be partially attributed to West Coast refined product margins which were negatively impacted by increased supply of refined products as a result of high refinery utilization rates relative to the significant regional refinery downtime experienced in 2012," the company said.

Marathon Petroleum Corp. reported a $173 million profit in the most recent quarter, down from $1.22 billion in third-quarter 2012. The company's refining and marketing margin in the third quarter decreased by $10.57/bbl from a year earlier, primarily due to narrower crude oil differentials, lower crack spreads, and lower product price realizations compared with the spot market product prices used in the Light Louisiana Sweet (LLS) crack spread calculation.

Phillips 66 posted a third-quarter loss of $2 million in its refining segment compared with earnings of $1.5 billion in third-quarter 2012, due to lower realized refining margins.

Canadian firms

A sample of 13 companies based in Canada, including oil and gas producers and pipeline operators, reported a combined $5.85 billion (Can.) in earnings in this year's third quarter. In the third quarter of 2012, this group's combined earnings were $2.7 billion (Can.). Year-to-date earnings were $12.65 billion (Can.), up 22.8% vs. the same period in 2012.

Canadian Natural Resources Ltd. recorded quarterly earnings of $1.17 billion (Can.), an increase from earnings of $360 million (Can.) for third-quarter 2012. The company's record total production for this year's third quarter averaged 702,938 boe/d, an increase of 5% and 13% from third-quarter 2012 and second-quarter 2013 levels, respectively.

"The quarterly highlights include higher volumes at Horizon as the company achieved safe, steady and reliable production. Additionally, production volumes increased as a result of a high level of activity on primary heavy crude oil assets, strong Pelican Lake performance, growth in light crude oil and NGLs production and the cyclic nature of thermal in situ," the company said.

Talisman Energy Inc. reported a net loss of $55.5 million (Can.) for this year's third quarter. Compared with the same period last year, earnings have increased due to higher impairments recorded in 2012. This year's third-quarter loss was because of lower North American gas prices, mark-to-market hedging losses and foreign exchange losses, partially offset by higher production volumes and liquids pricing and recognition of tax benefits from Vietnam production.

Imperial Oil Ltd.'s earnings in the third quarter were $647 million (Can.), down from $1.7 billion (Can.) from the same quarter in 2012, due to significantly lower industry refining margins.