Western Europe leads global refining contraction

Robert Brelsford

Downstream Technology Editor

Warren R. True

Chief Technology Editor-LNG/Gas Processing

Leena Koottungal

Survey Editor/News Writer

Motiva Enterprise LLC's Port Arthur, Tex., refinery became the largest refinery in North America last year when the company completed a 325,000-b/d expansion to 600,000 b/d. Motiva is a refining and marketing joint venture owned by affiliates of Royal Dutch Shell PLC and Saudi Aramco. Photo from Shell.

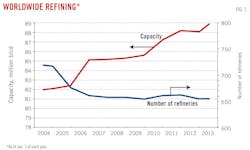

Global crude oil refining capacity in 2013 fell from the high it had attained in 2012 (OGJ, Dec. 3, 2012, p. 32) so that capacity growth since 2010 appears to be flattening, according to the latest OGJ Refinery Survey.

Only the Middle East reported an increase in capacity, but of less than 2%, for a region that reports slightly less than 7.4 million b/d. African capacity crept higher as well.

Western Europe, which with more than 13.5 million b/cd ranks third in total capacity behind Asia and North America, led the general decline in capacity, dropping more than 3% from 2012. Even Asia, which had seen robust growth to nearly 25.3 million b/cd, experienced essentially no growth in 2013.

The world's three largest regions for crude oil refining—Asia, North America, and Western Europe—comprise more than 68% of global refining capacity.

For 2013, OGJ's survey data show total global capacity at slightly more than 88 million b/cd with a drop in both number of plants—by 10—and capacity—by more than 900,000 b/cd—mostly in Western Europe and Asia.

The 2012 figures represented a peak in global refining capacity of more than 88.9 million b/cd. For 2010, capacity had fallen by 175,000 b/d from 88.23 million b/cd; the number of refineries by seven. For 2009, global capacity stood at 87.2 million b/cd for 661 refineries.

Fig. 1 shows trends in operating refineries and worldwide capacity.

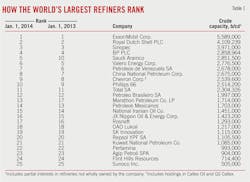

Largest refining companies

Table 1 lists the top 25 refining companies that own most worldwide capacity. Table 2 lists companies whose plants total more than 200,000 b/cd of capacity in Asia, the US, and Western Europe. Capacities from Tables 1 and 2 include partial interests in refineries that the companies do not wholly own.

Major changes in Table 1 positions since Jan. 1, 2013, are few: Saudi Aramco replaced Valero by opening its Jubail operation; Marathon Petroleum replaced Pemex with its purchase of BP PLC's Texas City, Tex., refinery. Other changes in capacity that appear in Tables 1 and 2 result from adjustments in declared capacity.

Table 2 shows refineries by region with 200,000 b/d capacity or greater. Table 3 lists the world's largest refineries with a minimum capacity of 400,000 b/cd. OGJ data reflect the closing and conversion to a terminal of the 350,000 b/d refinery by Hovensa LLC, a joint venture of Hess Corp. and Petroleo de Venezuela SA, at St. Croix, Virgin Islands (OGJ Online, Jan. 29, 2013).

Table 4 lists regional process capabilities as of Jan. 1, 2014.

Asia-Pacific trims

Refining capacity declined in Asia-Pacific during 2013 alongside a slowdown in economic growth early in the year. But refiners continued with plans for additional expansions aimed at processing more diversified crude slates.

Reductions in regional refining capacity largely resulted from ongoing closures in Japan. In October, the US Energy Information Administration (EIA) issued its country review for Japan. It said the Japanese government's move to promote operational efficiency in refining may lead to further closures.

In 2010, Japan's Ministry of Economy, Trade, and Industry (METI) enacted an ordinance to raise refiners' mandatory cracking-to-crude distillation capacity ratio to 13% or higher from 10% by March 2014 (OGJ, Dec. 3, 2012, p. 32). EIA expects refinery closures in Japan already announced, along with the METI rule, to lower refining capacity by nearly 1 million b/d more between April 2010 and April 2014, reducing Japan's total capacity to about 3.9 million b/d.

OGJ subscribers can now download, free of charge, the text version of the OGJ Worldwide Refining Report 2013 tables from www.ogjonline.com. Scroll down to "Surveys & Statistics," click "OGJ Subscriber Surveys," then "Worldwide Refining." This link also features the previous editions of this report as well as a collection of other OGJ Surveys from previous years. Subscribers and nonsubscribers may purchase Excel spreadsheets of the survey data by sending an email to [email protected] or calling (800) 345-4618. For further information, please email [email protected], or call Leena Koottungal, OGJ Survey Editor/News Writer (713) 963-6239. |

OGJ's survey data show Japanese refining capacity at 4.4 million b/d, down from nearly 4.8 million b/d in 2012, with three refinery closures on the year.

But Chinese refining capacity held steady from 2012. In its October Short-Term Energy and Winter Fuels Outlook, EIA estimated that liquid fuels consumption in China will increase by 420,000 b/d in 2013 and a further 430,000 b/d in 2014, compared with average growth of about 510,000 b/d/year 2003-12.

Noting that China's steady growth in oil demand has made it the world's largest net oil importer, exceeding the US in September 2013, EIA forecast this trend to continue through 2014.

But much of China's fresh capacity over the past year came late in 2012, with most added during fourth quarter, according to the International Energy Agency's Medium-Term Oil Market Report 2013 released in May.

By early November 2012, state-owned China Petroleum & Chemical Corp (Sinopec) had completed a 200,000-b/d crude distillation unit (CDU) to boost sour crude processing at its Maoming refinery in the southeast Guandong Province. After the unit's December 2012 commissioning, the refinery was processing around 350,000 b/d by Jan. 20, according to Sinopec.

The addition of the CDU at Maoming will boost refinery output to more than 400,000 b/d, Sinopec said.

But as 2013 began, China's refining industry faced sluggish global economic recovery, slowdown of the country's economic growth, and weak demand in oil and petrochemical markets.

In May, Reuters reported that PetroChina—the publicly listed arm of state-owned China National Petroleum Corp. (CNPC)—delayed plans for doubling capacity at its 100,000-b/d Huabei refinery in Hebei Province, initially slated to be operating at 200,000 b/d by yearend 2012. The company now expects to complete the expansion by late 2014, with commissioning in early 2015.

In September, China's Ministry of Environmental Protection shelved all proposals for upcoming refining projects by Sinopec and CNPC, the country's two largest state-owned refiners. The sanction came as a result of both companies' failure to meet targeted emissions levels.

The government freeze on refiners' activities included stalling PetroChina's joint venture with Royal Dutch Shell PLC and Qatar Petroleum for a 400,000-b/d refinery and petrochemical complex in Taizhou, in eastern Zhejiang Province (OGJ, Dec. 5, 2011, p. 30).

Also in September, PetroChina delayed commissioning its 200,000-b/d Pengzhou refinery in China's southwestern province of Sichuan following an investigation into accusations of corruption against former company officials. Pengzhou is to be Sichuan's first major refinery and will process crude from northwest China and Kazakhstan.

Despite the economic downturn during the first three quarters of 2013, recovery later in the year encouraged refiners to move forward with plans for adding capacity.

Ongoing commitment to investment in downstream operations came amid increased profits stemming from reforms to petroleum products pricing instituted in March by China's National Development and Reform Commission (NDRC).

In late March, NDRC revamped its system of setting domestic oil product prices more closely to reflect the international pricing of imported crudes from which the products are made, increasing refiners' profitability.

In late June, PetroChina released an environmental impact assessment for the Kunming refinery in southwest Yunnan Province. The refinery is to have a 200,000-b/d processing capacity and open in 2014.

In October, CNPC signed an agreement with Rosneft for the commissioning schedule and oil supply for the 260,000-b/d refinery in the eastern port city of Tianjin, first announced in 2010 (OGJ Online, Sept. 2, 2010).

Under the detailed work schedule signed between CNCP and Rosneft, a joint final investment decision on implementation of the Tianjin refinery is to be made in 2017, with the refinery to be commissioned before yearend 2020.

Rosneft will be the major oil supplier for the refinery, which will be granted the rights for crude import, oil products export, and product sales by the Chinese government.

Sinochem also plans to commission a 240,000-b/d refinery at Quanzhou in southern Fujian Province by yearend.

China National Offshore Oil Co. (CNOOC), China's third-largest state refiner, continues to advance plans to add 200,000 b/d of capacity at its 240,000-b/d refinery in Huizhou, Guangdong Province, by 2014.

But, as GlobalData of London reported, ongoing corruption probes into state-owned companies as well as the Chinese government's indeterminate freezes on upcoming projects due to environmental restrictions could slow development of other refinery projects planned for 2016-25.

India also remains committed to expanding its refining capability to meet rising demand.

In March in India, Hindustan Petroleum Corp. Ltd. and the state government of Rajasthan signed a memorandum of understanding (MOU) for a refinery and petrochemical complex at Barmer. The project, for which no capacity was announced, would be developed by state-owned HPCL, Rajasthan State Refinery Ltd., and other equity partners (OGJ Online, Mar. 14, 2013).

India's Ministry of Petroleum and Natural Gas (IMPNG) estimates the Barmer project will cost $6.85 billion and take 4 years to construct. The complex would use crudes produced locally and from abroad, making it Rajasthan's first refinery and India's first petrochemical plant designed to process indigenous crude oil, IMPNG said.

In May, the Wall Street Journal reported that Hindustan Petroleum Corp. Ltd. revived its plan to build a refinery and petrochemical complex at Visakhapatnam in the southern state of Andhra Pradesh. The refinery will be able to process 300,000 b/d.

Bharat Petroleum Corp. Ltd., Mumbai, continued to let contracts in 2013 for services related to an expansion and upgrade of its Kochi refinery at Ambalmugal in the state of Kerala. The project will expand crude capacity to 15.5 million tonnes/year (tpy; about 300,000 b/d) from 9.5 million tpy. It will include a CDU, fluid catalytic cracking (FCC) unit, and delayed coker.

In July, Bharat awarded Essar Projects Ltd. a contract in a consortium with GR Engineering of Mumbai for the engineering, procurement, and construction of the reactor regenerator package of a 2.2-million-tpy FCC at the Kochi refinery. The FCC project is to be completed in 24 months.

In August, Chennai Petroleum Corp. Ltd.—a partly owned subsidiary of Indian Oil Corp. Ltd.—let a turnkey contract to Engineers India Ltd. for the addition of a delayed coker at its 10.5-million-tpy Manali refinery in Tamil Nadu, India (OGJ Online, Aug. 14, 2013). According to press reports, the coker will have capacity of 2.2 million tpy. It's part of a project enabling the refinery to upgrade resid and increase distillate yield by about 7%. The Manali project includes the revamp of the refinery's existing hydrocracker.

More immediately, completion of a 300,000-b/d, full-conversion refinery by Indian Oil at Paradip on India's northeastern coast was expected in November, according to IMPNG (OGJ Online, Mar. 13, 2013). In addition to crude and vacuum distillation units, the refinery will have a hydrocracker and delayed coker.

But plans for the start of commercial operations at Nagarjuna Oil Corp. Ltd.'s 120,000-b/d Cuddalore refinery in Tamil Nadu, India, during this year's first half remain delayed following extensive damage from cyclone Thane in 2011. Downstream units of the refinery, slated for start-up during first-half 2014, will include an FCC unit and delayed coker (OGJ, Dec. 3, 2012, p. 32).

While China and India prepared for additional capacity, smaller countries in Asia-Pacific also planned for expanding their downstream sectors.

In January, Cambodian Petrochemical Co. Ltd., through a contractor, let a licensing and engineering services contract to KBR for a hydrocracker at a 5-million-tpy refinery planned in Cambodia (OGJ Online, Jan. 18, 2013). Tianjin Petrochemical Engineering Design Co. Ltd. is engineering, procurement, and construction contractor for the 1.2-million-tpy unit, which will use Veba Combi Cracking technology.

KBR said China Perfect Machinery Industry Corp. Ltd., Shanghai, will build the refinery in the Kampong Som Petrochemical Industrial Zone, with start-up slated for 2015. The refinery will be Cambodia's first since destruction in 1972 of a 10,000-b/d refinery built in 1969.

In April, state-owned Pakistan State Oil signed an MOU with the government of the northwest province Khyber Pakhtunkhwa to build a 40,000-b/d refinery on 400 acres in Kohat district of K-P (OGJ Online, Apr. 12, 2013). The plant will process crude from nearby indigenous sources for production of products conforming to Euro IV standards. The project is to be commissioned by 2016-17, with construction to begin by yearend.

In July, Nghi Son Refinery & Petrochemical LLC let a project management and consultancy services contract to a Foster Wheeler subsidiary for its 200,000-b/d refinery and petrochemical complex in Thanh Hoa Province, Vietnam (OGJ Online, July 30, 2013). The refinery, currently under construction, will process Kuwaiti heavy crude and include an 80,000-b/d FCC unit as well as a 700,000-tpy aromatics complex.

Once completed, the Nghi Son refinery—which is set for start-up in 2017—will fulfill about two thirds of Vietnam's total refined petroleum liquids needs, according to local media.

But Vietnam's rising demand for oil products also prompted the Vietnamese government to approve a license for Thailand's state-owned PTT Public Co. Ltd. to build a $27 billion refinery and petrochemical complex in Binh Dinh Province. Local media reported the project, for which details remain vague, is to be commissioned by 2020.

Elsewhere, Indonesia's state-owned PT Pertamina and UOP LLC agreed in October to develop a feasibility study for modernization of five of Pertamina's Indonesian refineries (OGJ Online, Oct. 7, 2013).

The refineries to be covered in the modernization master plan are at Balikpapan, East Kalimantan; Cilacap, Central Java; Dumai, Riau; Plaju, South Sumatra; and Balongan, West Java. The refineries have capacities totaling slightly more than 1 million b/d, according to Pertamina. The company said the work to be studied includes upgrades to enable the refineries to process heavier, lower-quality crude oil.

But in Australia, refining capacity contracted in 2013, with still further contractions possible next year.

After shuttering its 79,000-b/d Clyde refinery at Sydney last year, Shell Australia in April said it is looking for a buyer for its only other Australian refinery. Sale of the 120,000-b/d Geelong refinery is part of the company's global strategy to concentrate investments on large-scale sites, such as its Pulau Bukom refinery in Singapore (OGJ Online, Apr. 4, 2013).

Shell said if it cannot negotiate a sale of the Geelong plant by 2014, it would consider converting the refinery into an import terminal, as it did with the Clyde refinery (OGJ Online, June 7, 2012).

Middle East expansions, growth

In Kuwait late in 2012, Kuwait National Petroleum Co. awarded a $500 million project management contract to UK-based AMEC to build a 615,000-b/d refinery. The award targets completion in 2018.

In the United Arab Emirates, the $10 billion expansion of Takreer's (Abu Dhabi Oil Refining Co.) Ruwais refinery, some 385 miles west of Abu Dhabi City, will add 417,000 b/d of crude capacity, taking the plant to more than 800,000 b/d capacity. The company expects start-up in first-half 2014.

In September, Dubai signed agreements with China Sonangol to build the second refinery in the country; Emirates National Oil Co. operates the 120,000-b/d Jebel Ali refinery. China Sonangol is owned by Sonangol (30%) and New Bright International (70%), a private Hong Kong company.

In Iraq in October, the country's prime minister signed a $6 billion contract with Swiss company Satarem to build and operate a 150,000-b/d refinery in the southern border province of Maysan.

In April, Qatar Petroleum signed a joint venture agreement with Total and Japan's Idemitsu, Cosmo Oil, Marubeni, and Mitsui to expand its 146,000-b/d Laffan Refinery (LR1) condensate splitter at Ras Laffan (OGJ Online, Aug. 19, 2011; Apr. 22, 2013).

The expansion (LR2), to be operated by Qatargas Operating Co. Ltd., will process untreated condensate from supergiant North gas field, producing as much as 60,000 b/d of naphtha, 53,000 b/d of jet fuel, 24,000 b/d of gas oil, and 9,000 b/d of LPG. Construction of the $1.5 billion facility is to be complete in second-half 2016.

A diesel hydrotreater to be commissioned second-quarter 2014 will be able to process all light gas oil from LR1 and LR2, yielding ultralow-sulfur diesel.

Ownership under the joint venture agreement is QP, 84%; Total, 10%; Idemitsu and Cosmo, 2% each; and Marubeni and Mitsui, 1% each.

In October, Qatargas awarded Qatar Kentz WLL, a unit of Kentz Corp. Ltd., a manpower services contract for LR2 (OGJ Online, Oct. 9, 2013).

In September, Malaysia's news agency cited Iranian sources that Sinopec and a South Korean firm had completed arrangements for a $1.5 million revamp of Iran's Esfahan refinery. The project is to boost the refinery's gasoline and diesel production.

Also in September in Saudi Arabia, Saudi Aramco Total Refinery & Petrochemicals Co. (Satorp) began shipping refined products from its 400,000 b/d full-conversion refinery at Jubail (OGJ Online, Apr. 25, 2013; Sept. 26, 2013).

Construction on Jubail started in April 2010, and all units are slated to be operating by yearend. The $14 billion refinery will process Arab heavy crude from nearby Safaniya and Manifa fields and yield petrochemicals as well as high-quality fuels. It will be Saudi Arabia's first producer of petroleum coke and paraxylene.

Satrop is a joint venture of Saudi Aramco (62.5%) and Total SA (37.5%).

North American growth, ownership

In Canada in September, officials gathered for groundbreaking for the first major new refinery in North America in nearly 30 years. The $5.7 billion (Can.) 150,000-b/d refinery north of Edmonton in Sturgeon County will process bitumen and produce diesel, diluent naphtha, low-sulfur vacuum gas oil and light ends—butane, propane, and ethane.

The North West Redwater Partnership is a 50-50 joint venture of North West Upgrading Inc. and Canadian Natural Resources Ltd. (OGJ Online, Nov. 13, 2012). The first 50,000-b/d phase is to be operating by late 2016.

In the US in late 2012, Koch Industries' unit Flint Hills Resources, Wichita, Kan., sought approval from the Minnesota Pollution Control Agency to amend its air-quality permit to allow a $400 million upgrade to the company's Pine Bend refinery at Rosemount, Minn., about 20 miles south of St. Paul.

Improvements would allow the refinery to handle crude oil feed closer to its 320,000-b/d processing capacity and to reduce emissions of nitrogen oxide and sulfur dioxide.

The upgrade, a company spokesperson told OGJ, will start up in early 2014. It will be the largest at the refinery since it completed a $350 million project in 2006 to produce low-sulfur diesel.

Construction began earlier this year on North Dakota's second refinery.

The 20,000-b/d Dakota Prairie plant will sit on 318 acres west of Dickinson, Stark County, in southwestern North Dakota. It will produce diesel and kerosine to meet trucking and commercial demand rising in response to oil production boom in the Bakken area in the northwestern part of the state.

The refinery will be operated by Dakota Prairie Refining LLC and is being built by MDU Resources Group Inc., Bismarck, through its unit WBI Energy Inc., and by Calumet Specialty Products Partners LP, Indianapolis. Westcon is general contractor with Ventech Engineering providing primary equipment and technology, according to area media reports.

North Dakota's only operating refinery, the 58,000-b/d Tesoro Mandan refinery near Bismarck, also produces diesel fuel, jet fuel, heavy fuel oils, and LPG.

In May, North Dakota's Three Affiliated Tribes broke ground for the $450 million, 20,000-b/d Thunder Butte refinery about 2.5 miles west of Makoti and about 30 miles southwest of Minot. Products of the refinery will be diesel, propane, and naphtha.

Three Affiliated Tribes include the Mandan, Kidatsa, and Arikara tribes, which jointly govern the MHA Nation, according to its web site.

Another refinery, the 20,000-b/d Trenton diesel refinery to be owned by Dakota Oil Processing, received an air-quality permit from the North Dakota Department of Health in early 2012, according to EIA. No further progress toward construction has been announced.

With a cost estimated at $200 million, it will have an atmospheric distillation column, hydrotreater, naphtha stabilizer, and associated process equipment. According to Dakota Oil Processing's web site, the primary product from the refinery will be light gas oil.

Other products will be naphtha, which may be used to produce petrochemicals or mixed as diluent into heavy crude oil; kerosine, which the refinery plans to blend into the distillate pool to maximize distillate yield; atmospheric gas oil; and heavy fuel oil, which can be sold in the bunker fuel market, according to EIA.

Bakken crude isn't the only production prompting upgrading to Lower 48 refineries.

In September, Husky Energy Co. sought approval from Ohio for a $300 million upgrade to its Lima refinery specifically to process heavier crudes from Alberta.

Husky has initiated design work on a crude oil flexibility project that would allow the Lima refinery to process as much as 40,000 b/d of heavy crude, according to a Husky spokesperson.

"The project would not expand the refinery's capacity," but would give Husky greater flexibility to switch between lighter and heavier blends. It would give the refiner "the ability to process a small amount of bitumen, but would primarily give us the capability to process heavy oil," the Husky spokesperson said.

Earlier this year, the joint venture BP-Husky Refining LLC announced it had commissioned a 42,000-b/d naphtha reformer at the joint venture's 160,000-b/d Toledo refinery at Oregon, Ohio.

The $400 million project replaced two older catalytic reformers and a hydrogen plant also to provide the flexibility to handle heavier crude (OGJ Online, Mar. 12, 2013).

In July, BP PLC started up a 250,000-b/d crude unit at its Whiting, Ind., refinery, a step that returned the refinery to its 413,000-b/d nameplate processing capacity. It also allowed for remaining upgrades of new coking and hydrotreating units (OGJ Online, Feb. 1, 2011; July 1, 2013).

A BP spokesperson told OGJ the project remains on schedule with the final new unit—the 102,000-b/d coker—coming online before yearend.

When all units are online, the reconfigured refinery will have the flexibility to increase heavy, sour crude processing to about 80% of its overall crude run.

Construction of the Whiting refinery upgrade is more than 95% complete, said the company, which has commissioned a 105,000-b/d gas oil hydrotreater and other associated units.

In late 2012, Calumet Specialty Products said it will double production at its Great Falls, Mont., refinery over 2013-14 with an expansion to its 20,000-b/d crude unit.

Calumet planned to invest $275 million with improvements expected to be completed by mid-2015.

In late 2012, Calumet agreed to pay $100 million for the 14,500-b/d refinery at San Antonio from NuStar Refining LLC and NuStar Logistics LP, both units of NuStar Energy LP, San Antonio.

The refinery produces ultralow-sulfur diesel, jet fuel, specialty solvents, reformates, naphtha, and vacuum gas oil. At the site is about 200,000 bbl of storage capacity along with about 200,000 bbl of crude oil storage capacity at a crude oil terminal in Elmendorf, Tex. Crude oil feedstocks are from South Texas, primarily the Eagle Ford shale.

In February, Marathon Petroleum Corp. closed on the purchase of BP's 451,000-b/cd Texas City, Tex., refinery, renaming it the Galveston Bay refinery.

The transaction also includes a 1,040-Mw cogeneration plant, four light product terminals located in the US Southeast, retail marketing contract assignments for about 1,200 branded sites representing about 61,000 b/d of gasoline sales, three operating intrastate NGL pipelines originating at the refinery, and a 50,000-b/d allocation of BP's Colonial Pipeline Co. shipper history.

Base purchase price is about $598 million, plus inventories valued at about $1.1 billion.

Also in February, Hess Corp. completed the closing of its 70,000-b/d Port Reading, NJ, refinery, as it had announced it would in January (OGJ Online, Jan. 29, 2013).

The adjacent 6-million-bbl storage terminal was put on the market and, in October, Hess announced agreement with Buckeye Partners LP to sell its US East Coast and St. Lucia terminal network for $850 million in cash.

The terminal network along the East Coast has a total of 28 million bbl of storage capacity at 19 terminals, 12 of which have deepwater access. Also included was Hess's St. Lucia oil storage terminal in the Caribbean with 10 million bbl of capacity.

In June, Tesoro Corp. closed on its purchase of BP PLC's 266,000-b/d Carson refinery near Los Angeles for a little more than $1 billion for refining and marketing assets and $1.35 billion for inventory and other working capital (OGJ Online, June 3, 2013; May 17, 2013).

Media reports in late 2012 said Petroleo Brasileiro SA (Petrobras) was to sell its 100,000-b/d refinery in Pasadena, Tex., operated by Pasadena Refining Systems Inc. Proceeds from such a sale were to help underwrite more drilling off Brazil.

Petrobras paid almost $1.2 billion in total when it bought first a 50% ownership from Astra Oil Co. Inc., a subsidiary of Transcor, in 2006, then the remaining 50% later.

In March, however, regional media reported Petrobras had taken the refinery off the market in favor of selling its Argentine unit. Repeated calls by OGJ to Pasadena Refining's Pasadena, Tex., offices and messages to Petrobras's main offices in Rio de Janeiro were not returned or answered.

In September, Hawaii Pacific Energy LLC, a subsidiary of Houston-based Par Petroleum Corp., completed the $75 million purchase of Tesoro Hawaii LLC from Tesoro Corp. (OGJ Online, June 19, 2013; Sept. 27, 2013).

Included were the 94,000-b/d Kapolei refinery; storage capacity for 2.4 million bbl of oil and 2.5 million bbl of refined products; and related logistics assets, including five product terminals, 27 miles of pipelines, and a single-point mooring terminal.

The Kapolei refinery produces gasoline, jet fuel, high-sulfur diesel, and high and low-sulfur fuel oil. It also is a major supplier of ultralow-sulfur diesel to the Hawaiian Islands.

Major process units include crude distillation, vacuum distillation, hydrocracking, naphtha hydrotreating, reforming, and visbreaking. The refinery is in the Campbell Industrial Park in Kapolei, 20 miles west of Honolulu.

European woes

In its analysis for 2013 through third quarter, the UK research and consulting firm GlobalData noted that global refinery throughputs suffered rapid decline throughout this year's third quarter, with Europe and Asia-Pacific faring the worst. Dismal refining margins and maintenance programs were hurting profitability.

Europe has been suffering more than any other region in the world from reductions in refining margins. This results from its over-capacity and sliding demand amid a lingering economic recession, which had "destroyed companies' hopes of profitability," GlobalData said.

Furthermore, maintenance during this year's third quarter removed about 1.2 million b/d of the region's atmospheric distillation unit capacity, with many plant turnarounds expected to extend into fourth quarter.

Imports of gasoline, gas oil-diesel, jet kerosene, and all other hydrocarbon products, however, were readily available from the US, Middle East, India, and Russia. Thus, the report saw "little urgency" to bring these plants back on stream even after the planned work.

Several of Europe's refineries are up for sale, and those that remain unsold are under threat of being transformed into terminals by their owners, thereby taking this capacity off the market forever, said GlobalData.

Heavy maintenance in North America threatened to take offline 1 million b/d of atmospheric distillation capacity, as refiners changed over to heating oil production from gasoline production in preparation for winter heating demand.

A further 500,000 b/d of crude capacity, said the analysis, was under maintenance in Asia-Pacific in third quarter, with some of this work planned to continue into the fourth quarter.

In 2012, TotalErg—a joint venture of Total (49%) and Italian refiner Erg (51%)—closed its 86,000-b/d Rome refinery at the end of third quarter, converting it to a storage terminal.

Another Italian refinery, the 52,000 b/d Mantua refinery operated by Hungary's MOL, will cease operations at yearend 2013 and be converted into a product storage terminal.

In April this year, a French court's decision rejecting two offers for France's Petroplus Holdings AG's Petit-Couronne refinery effectively doomed the plant, for which OGJ data shows a nameplate capacity of 154,000 b/d; press accounts of the court's decision gave capacity as 161,800 b/d. Operations there ceased in 2012.

In June, Phillips 66 said it would sell Ireland's only refinery, the 71,000-b/d Whitegate plant at Cork.

A Phillips 66 spokesperson told OGJ the company had retained Deutsche Bank to market its business in Ireland, which includes the refinery and associated wholesale marketing business and a crude oil and refined products storage terminal in Bantry Bay.

"Several parties have expressed interest. We are currently evaluating the bids," he said. A decision on whether to go ahead with a sale will be made by yearend.

Why anyone would want a small, outmoded refinery in such a market as Ireland is the subject of both industry and general debate.

But the biggest news from Western European refining has come from Scotland where in October Ineos Group Holdings SA announced it was shutting the 210,000-b/d Grangemouth refinery and petrochemical plant before a strike that could interrupt nearly half of UK crude production.

Ineos cited many of the same woes that have dragged down other European refiners, mainly slimmer margins due to more expensive feedstocks.

The Grangemouth refinery receives feed from BP's Kinneil terminal, part of the Forties system, and from the Finnart Ocean terminal about 62 miles to the west (OGJ Online, Oct. 23, 2013).

Petroineos, a joint venture of Ineos Group Holdings SA and PetroChina International (London) Co. Ltd., operates the refinery and petrochemical plant.

By the end of October, the strike had been settled under an agreement that will keep the refinery open for 3 years.

Ineos and Petrochina pledged to build an LNG regasification terminal at the refinery to accept shipments of US natural gas. This element alleviates the refinery's dependence on more expensive North Sea-produced natural gas and residual fuel oil for plant power.

In Eastern Europe in May, Russian oil producer Gazprom Neft announced plans to invest about $1.5 billion to upgrade its Moscow refinery over 2013-15.

Plans are to upgrade the plant to produce better grades of products, increase the oil conversion rate, enhance energy efficiency, and reduce the plant's effect on the environment.

Gazprom will commission a light-naphtha isomerization unit and a catalytic cracking gasoline hydrotreater this year and complete the second stage of a diesel fuel hydrotreater.

The program will also build a combined refining unit with a capacity of about 118,000 b/d and introduce advanced technologies.

Africa edges up

Some fresh capacity came online in Africa in 2013, but details emerged across the year for additional capacity expansions.

In late December 2012, Angola's state-owned Sonangol began construction on its Sonaref refinery in Lobito, in Benguela Province. The refinery, estimated to cost $8 billion, will process Angolan crude oil to produce unleaded gasoline, diesel, jet fuel, kerosene, LPG, and small amounts of sulfur, local media reported. The refinery is to start up in late 2015 or early 2016 and will eventually reach a capacity of 200,000 b/d, the company said.

In April, Sinopec said it reached a cooperation framework agreement with Petroleum Oil & Gas Corp. of South Africa (PetroSA) that enabled the companies to advance the 400,000-b/d Mthombo refinery project in Port Elizabeth's Coega Industrial Development Zone. PetroSA originally scheduled a final investment decision for the Mthombo refinery for 2010 (OGJ Online, Dec. 8, 2008).

In May, Reuters reported that Algeria's state-owned Sonatrach increased output at the country's largest refinery at Skikda following a series of delays during maintenance to upgrade two CDUs. Work on the 300,000-b/d refinery began in July 2012, leaving operations at half-capacity during the upgrading.

In late August, Sonatrach, through a contractor, awarded a contract to OCI Construction Group for both greenfield and brownfield work at the company's 60,000-b/d Algiers refinery in Sidi Arcine near the port of Algiers. Under the contract, OCI will execute some of the civil works, paving works, underground piping, and related brownfield construction work as part of the rehabilitation and adaptation of the refinery.

In October, Uganda's Ministry of Energy and Mineral Development (MEMD) released a request for qualifications (RFQ) to identify a lead investor-operator for a 60,000-b/d refinery and related downstream infrastructure.

The refinery would be Uganda's first and would serve a growing demand for refined petroleum products, which is estimated to reach 232,000 b/d by 2020, MEMD said. The RFQ follows a feasibility study on a refinery in Uganda that MEMD commissioned in 2010 (OGJ Online, Feb. 2, 2010).