Chinese political transition makes change possible in energy approach

Xiaofei (Sarah) Li

York College of Pennsylvania

York, Pa.

The composition of China's new Politburo and its members' views about large, state-owned enterprises (SOEs) have profound implications for the country's socioeconomic trajectory in general and for the energy industry in particular. The new leaders will govern the country for most of this decade and beyond.

Moreover, the transition to new leadership raises questions about changes possibly in store for China's national oil companies (NOCs) and for energy policy in general.

Three groups

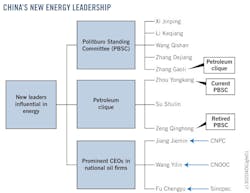

Each new Politburo member important to energy in China can be viewed as belonging to one of three groups: the Politburo Standing Committee (PBSC), a supreme leadership body atop China's official hierarchy; a group of politicians who achieved political status through careers in the oil and gas industry known as the "petroleum clique"; and the prominent chief executive officers of China's large oil companies (see figure).

The PBSC

Leading the PBSC is Xi Jinping, who succeeded Hu Jintao as president of People's Republic of China (PRC) after the 18th Party Congress in November 2012. He has long been known for his market-friendly approach to economic development, yet he has also displayed strong support for China's flagship SOEs, including the large energy firms. The SOEs thus may continue to monopolize many major industries under his tutelage. Moreover, Xi's views concerning China's political reforms appear to be remarkably conservative, seemingly in line with old-fashioned Marxist doctrines.

Li Keqiang will succeed Wen Jiabao as premier of the State Council, a position for which he is perceived by some to be too weak. Considered an economic reformer, Li gave a talk recently that signaled with unusual clarity his endorsement of renewed market-oriented reforms. Li likely will continue to pursue policy issues such as promoting innovation in clean-energy technology. In addition, he will succeed Wen as head of the National Energy Administration, China's top energy regulatory agency.

Wang Qishan, who helped transform China's state-dominated economy a decade ago, was discussed this summer as possibly leapfrogging Li Keqiang to take the premier's seat but instead became anticorruption chief. Known as a troubleshooter and considered strongly proreform, he has strong ties to major SOEs. But it is unclear whether he will favor public ownership of petroleum companies or promote private investment. In his new role, his influence over the Chinese economy and petroleum industry will be greatly diminished.

Another PBSC member, Zhang Dejiang, an economist trained in North Korea, is considered a hardliner with deep affection for China's often inefficient state enterprises. He may continue to promote policies in favor of state dominance, economic protectionism, and the development of SOEs, among which NOCs are the most profitable in China.

Another member of the new PBSC, Zhang Gaoli, is an economic thinker who advanced early in his career within the oil industry. Although he has extensive leadership experience in prosperous coastal areas like Shenzhen, Guangdong, and Tianjin and is considered instrumental in their economic development, he takes a low-profile approach. His attitude toward development of the NOCs is, therefore, unclear. He and others in China's official elite have risen to the top in part because of their ability to hide personal quirks. In general, Zhang is known for his promarket economic policy orientation.

An examination of the policy preferences of this PBSC group indicates that the top Chinese leaders for the next decade will help PRC flagship companies become leading global enterprises. This does not exclude economic mercantilism and protectionism. China's national flagship companies' monopolies and overseas expansion are seen as the most crucial factors in the next phase of China's rise.

Petroleum clique

A prominent member of the petroleum clique, Zhou Yongkang, is a former member of the PBSC who spent much of his career in the oil and gas industry. A former vice-minister of the petroleum industry and president of China National Petroleum Corp., Zhou remains influential in the oil business. However, his political impact has been tarnished by his step-down from the 18th Party Congress and by his support for Bo Xilai, a once-promising Chinese politician who was expelled from the Communist Party last year amid scandal. Zhou lost his right to select his own successor when he retired from the PBSC last November.

Zeng Qinghong, another former PBSC member, is the chief of the petroleum clique. Zeng spent his early years in the petroleum industry before rising to national leadership by then-President Jiang Zemin, who made him a trusted adviser. When Zeng was in place, most clique members swore loyalty to him. Now, however, Zeng's influence is ebbing as Jiang's faction is gradually phasing out the political platform.

Another major petroleum clique member, Su Shulin, has many years of experience in Chinese oil and gas. He spent most of his time as leader of China Petrochemical Corp. (Sinopec). One of the important accomplishments of Sinopec under Su's leadership was its environmental focus. Also under him, the company actively explored renewable energy sources. Since 2011, Su has served as governor of Fujian Province. With his diverse governing experience and youth, Su is likely to continue to rise politically after the new Chinese leaders assume power.

Like Su, others in this second group of petroleum CEOs-turned political leaders made successful transfers from the oil industry to the political realm. Not top-tier yet, they are making their way to the generation of leadership that will follow Xi. As the CEOs-turned politicians have further enhanced their presence at the 18th Central Committee in 2012, the oil industry is expected to be well-represented in the future.

NOC CEOs

Prominent CEOs of NOCs include Jiang Jiemin, Fu Chengyu, and Wang Yilin. Jiang is a long-term leader of CNPC and a key figure in China's determined expansion of energy activity overseas. Fu is a former chairman of China National Offshore Oil Corp. since 2003 who became chairman of Sinopec in 2011. However, both Jiang and Fu have never made their jumps from the energy business to politics, and both are approaching retirement age.

Fu failed to be elected as an SOE delegate to the 18th Party Congress, and Jiang became only an alternate member of the Central Committee. The decline of Jiang's political fortune is further portended by his receipt of a warning for his responsibility in a pipeline explosion in Dalian over a year ago, as well as by a recent investigation against him by the Central Discipline Commission regarding his handling of a sensitive car accident early last year. The political careers of current NOC leaders such as Jiang and Fu might depend upon the patronage of Zeng and Zhou.

Despite the lack of political say, the energy companies' financial clout and technical expertise provide them with considerable influence over energy projects and policies in China. Their increasing importance in China's political life has been illustrated by the threefold increase in the number of SOE delegates to the 18th Party Congress over that of the 16th Party Congress in 2002, when SOEs first formed a separate group. In addition, a quarter of the delegates from SOEs are from the energy industry. This group of business elites is well aware of the problems faced by the NOCs, and therefore probably are more in favor of a market approach and price reforms.

Biographies of the new leaders indicate the group will continue to support the effort to help the NOCs to achieve global leadership. The large Chinese oil companies probably will continue to enjoy monopoly advantages and government assistance with overseas expansion. However, the internal conflict over price control vs. market pricing might push the new administration to make adjustments in the NOCs.

NOC directions

Many China observers wonder what directions China's NOCs might take with new Chinese leaders now in office. Will these energy giants be privatized or continue to be sponsored by the state? Generally, there are two views regarding the status of the NOCs in the society: one supportive and one not.

NOC supporters

Many domestic groups support the existence of large NOCs in China. They do not oppose state subsidy or monopoly; in fact, they embrace control of prices of energy products. The NOC supporters prefer to keep the current regulatory model to guarantee low prices of oil and gas products in the interest of social and economic stability.

The NOC supporters believe state-owned companies enjoy tremendous policy preferences, financial supports, monopolistic advantages, cheap funds from national banks, tax benefits, and political clout in government. In this view, the NOCs receive these benefits in exchange for social responsibilities in difficult time. To NOC supporters, control of energy prices moderates prices of goods and services purchased by households. The government thus supports these corporate giants for the purposes of providing convenient services for the people, serving the Communist Party's needs, and promoting social harmony and stability in the long term.

However, China's recent natural gas shortage indicates the performances of the energy majors are disappointing. Reluctance by CNPC and Sinopec to expand gas supply during a time of shortage is a defiant act in the eyes of NOC supporters. According to them, by shirking their duties, the NOCs are trying to take advantage of both market and state: Under the banner of the SOEs, they grab public resources and engage in monopoly practices, and in the name of transitioning to the market, they also try to raise energy prices. The NOC supporters' concern is that by taking future measures to reform NOCs, the new leaders might allow oil prices to rise and cause social instability.

NOC opponents

Many other groups in China oppose the current status of NOCs. They believe the NOCs, like other SOEs, suffer from ineradicable problems such as bureaucratism, mismanagement, and lack of innovation. Fortune Magazine indicates that, although CNPC and Sinopec are near the top in its Global 500 Companies, their efficiency is only 1⁄23 that of ExxonMobil Corp. Moreover, 99% of SOEs in China have no patents, and 80% of their profits come from monopoly advantage. In addition, the value of PetroChina stock, since its initial issuance in 2007, has consistently dropped from ¥48/share to less than ¥10/share and thus been decried as one of the worst cases of equity fraud. The incomes of some NOC executives are "secret." Like top executives of western multinational companies, however, NOC executives are known to have high salaries and large equity holdings in their companies.

The NOC opponents further see a correlation between public ownership and corruption. This seems to be evidenced by the conviction of the former chairman of Sinopec, Chen Tonghai, who was sentenced to death in what is believed to be the country's biggest bribery case. The NOC opponents also cite connections between the state companies and excessive spending. An example often cited is Sinopec's spectacular headquarters building, which the company spent $40 million to renovate. The lobby is over 10 stories high, overhung by a chandelier worth more than $2 million. In another case, a manager of Sinopec in Guangdong was reported to have spent $280,000 on a bottle of Chinese wine at dinner with company money in April 2011.

Fundamentally, the public opposes the NOCs on the grounds that most of them are dominated by the adult children of high-ranking officials. The NOCs thus have fostered powerful vested-interest groups, stripping state assets to their own use. To these opponents, the introduction of private capital by ordering the NOCs to issue stock is the only way of reforming and transforming China's energy industry.

New approaches

As the Hu-Wen administration gives way to the next generation of leadership, many observers may wonder what approaches the new leaders may take. It is this analyst's view that the two forces—supporting and opposing NOCs—will continue to exist, interact, and drive the future development of China's energy giants. Nevertheless, given the ideologies of the Politburo members, especially their confidence in the SOEs, as well as given their high priority of maintaining social stability, the Chinese government probably will continue to support its flagship firms, namely China's big three energy companies. In particular, China's new leaders, believing in NOCs' leading position in meeting the country's future energy needs, might insist that public ownership remain dominant in the economy, thus ruling out fast privatization. This is consistent with the original party center's policy—"Grasp the large, and let go of the small," that is, to sell off small SOEs while investing in big ones.

At the same time, the new policy-makers might advance the gradual reforms to reconcile internal conflicts in the NOCs. The reformist measures include incrementally liberalizing prices of oil and gas products, optimizing company structure, and improving corporate governance. Policies likely to be issued will fight corruptions, curb the power of senior executives, and establish independent boards. However, these reform efforts do not necessarily mean the new leaders will leave NOCs completely up to the market. To the contrary, achieving these goals may require government agencies to assert their control over the NOCs. This is illustrated by the State-owned Assets Supervision and Administration Commission's (SASAC) strengthening of its regulations of subordinate central enterprises and the possibility of setting up a Super Energy Ministry. All in all, in the next administration, changes of the NOCs are likely to be limited and gradual, undertaken in the context of continuity of the energy sector.

Changes in prospect

As China just finished its 18th Party Congress and prepares for the start of the 12th National People's Congress in March, the political alignment creates the opportunity and impetus for energy-policy change. The power transition is occurring not just at the apex of political power but also throughout every level of Chinese institutions. In economic-management agencies, the turnover is generational; in essence, a generation of managers is stepping down. It includes individuals who went to university during the 1960s, worked through the Cultural Revolution, and assumed leadership roles during the 1990s. The outgoing generation includes China's "energy czar," Zhang Guobao, who retired in 2011, and the chairman of the SASAC, Li Rongrong, who retired in 2010.

At the same time, the holdovers from the 17th Party Congress will see political continuity with past policies in the new Politburo under Xi Jinping. For the Central Committee (371 members), the turnover rate at the 18th Party Congress is 64%. In the State Council, about 70% of the total members will be replaced, mainly due to their ages. In the new administration, China will continue to be governed by an oligarchy similar to the Jiang and Hu eras and a growing difficulty in establishing consensus among the leaders.

The change-in-the-context-of-continuity dynamics driven by the Chinese leadership shift will profoundly affect various aspects of the oil and gas industry. Likely areas of change include:

• Oil-product pricing reform. China's oil-product pricing reform targets reasonable profit margins of around 5% for Chinese refiners. Beginning Dec. 16, 2011, China took a small step toward natural gas price reform by implementing a trial in the southern Guangdong and Guangxi provinces. The implementation of permanent pricing reform could be opportune in that the sustained period of lower oil prices helps restrain inflation. However, the odds of a pricing reform in the first half of 2013 are believed to be low given the political environment. The National Development and Reform Commission (NDRC) nevertheless has acted, and a nationwide roll-out to fully liberalize wellhead prices can be expected before 2015.

• The SASAC's corporate governance reforms. The SASAC has begun to exert increasing influence over the large SOEs, including the NOCs. For the next few years, SASAC efforts probably will reduce corruption. The power of leaders of the oil firms might be curbed to prevent the formation of corporate fiefdoms. The likely establishment of independent boards will promote profitability and operational efficiency of the NOCs.

• Super Energy Ministry. The creation of a Super Energy Ministry is expected in 2013 with the objective of consolidating the energy-related responsibilities of the NDRC, National Energy Administration, SASAC, and various other local, provincial, and state agencies. However, the two most important controls—pricing set-up and investment approval authorities—are said to remain in the NDRC for the time being. Without these two commands, the true effectiveness of the prospective Super Energy Ministry will remain in question. In addition, establishing a full ministry not only requires numerous subordinating agencies and staff nationwide but also needs legal validity. China's Energy Law has never been released, although drafting was begun by Premier Wen Jiabao in 2005, and the actual documents came into form in 2008. Furthermore, the formation of the Super Energy Ministry is said to evoke objections from NOCs and other interest-vested organizations because of the likely decline in their influence. All this indicates that establishing a Super Energy Ministry is an important and challenging task for the new generation of Chinese leaders, and it may take as long as 10 years to fulfill the mission.

• Natural gas and pipeline construction. China has recently begun construction of the third West-East Gas Pipeline, which will carry mainly Central Asian natural gas from Xinjiang and Fujian Province in Southeast China. A fourth pipeline has been planned, while discussions to build the fifth are under way. PetroChina may begin the construction of a third cross-border gas pipeline in 2013, and the project may take 2-3 years to complete. In addition, China hopes to double the share of natural gas in its overall energy mix to 8% by 2015. China has recently encouraged shale-gas development and will continue to do so in the future. On Mar. 16, 2012, China's National Energy Administration published a shale gas development plan with ambitious production targets of 6.5 billion cu m/year by 2015 and 60-100 billion cu m/year by 2020. Moreover, in December 2011, China issued the 12th Five-Year Plan for coalbed methane development and utilization. Promoting clean-energy technology based on natural gas will be a priority of the new administration.

• Undergoing an economic slowdown. China faces an economic slowdown. This results partially from economic conditions in Europe, the biggest single contributor to a slowdown in Chinese exports. A more fundamental reason is China itself, which is moving out of a long period of high growth. China's labor-force growth has slowed dramatically and in a few years will become contraction.

To prevent an abrupt transition to slower growth, the government is likely to continue sponsoring or funding large investments in oil and gas projects. At the same time, China's leaders understand that they need to be flexible in order to handle the challenges they face. Changes in oil and gas policy now unexpected may become possible. In addition, unprecedented economic circumstances may increase pressure on incoming leaders to seek ways to break with business as usual. This may open up opportunities for energy reformers.

• Business elites in the party leadership. The CEOs of large NOCs become more ambitious in their jockeying for power in the leadership of the Chinese Communist Party. The remarkable presence of senior NOC executives among the top national leaders reflects an important trend in elite recruitment in present-day China. The political transition in 2012 is an important test for the future importance of business interests in Chinese politics, perhaps foreshadowing a new phase of transformation of state-business relations in this rapidly changing country.

Policy initiatives

An increase in energy-related policy initiatives is likely during the 12th Five-Year Plan of 2011-15 despite a leadership turnover, and the 13th Five-Year Plan is likely to fine-tune the provision of energy to the growth of Chinese economy.

In the second half of 2011, China launched key changes to the taxation system, such as a resources tax and a special oil-gain levy, and changes to pricing of natural gas. Tax adjustments and pricing liberalization probably will continue throughout 2013-14. Major changes in energy policy are less likely before the new leadership in State Council takes office. Economic issues will only gradually move toward resolution in the fall of 2013, when the 18th Central Committee is scheduled to hold its Third Plenum. Traditionally, the Third Plenum has been the venue at which a new administration, having consolidated its power and worked out its program, presents ambitious new economic policies, including those for oil and gas.

The author

Xiaofei (Sarah) Li is an assistant professor of political science at York College of Pennsylvania. She received her PhD in political science from Catholic University in May 2008. Born in China, she received degrees in economics, international finance, and English from Xi'an Foreign Languages University and Beijing University of Chemical Technology. Her research interests include comparative politics in Asia and topics related to China.